ADT 2009 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating income increased $42 million, or 14.8%, during 2008 as compared to 2007 resulting

largely from increased volume and improved margins, primarily in North America, and to a lesser

extent, Asia and EMEA. The increase in operating income during 2008 was partially offset by

$25 million of restructuring, asset impairment and divestiture charges. Also, operating income was

unfavorably impacted by $9 million due to a goodwill impairment in the Latin America reporting unit.

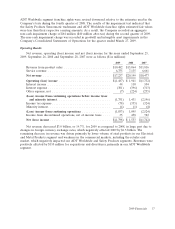

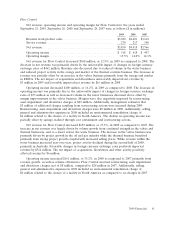

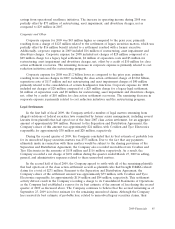

Electrical and Metal Products

Net revenue, goodwill and intangible asset impairments, operating income and operating margin

for Electrical and Metal Products for the years ended September 25, 2009, September 26, 2008 and

September 28, 2007 were as follows ($ in millions):

2009 2008 2007

Revenue from product sales ............................. $1,389 $2,266 $1,970

Service revenue ......................................364

Net revenue ........................................ $1,392 $2,272 $1,974

Goodwill and intangible asset impairments .................. $ 935 $ — $ —

Operating (loss) income ................................ (940) 342 159

Operating margin ..................................... —

(1) 15.1% 8.1%

(1) Certain operating margins have not been presented as management believes such calculations are not meaningful.

Net revenue for Electrical and Metal Products decreased $880 million, or 38.7%, in 2009 as

compared to 2008. The decrease in revenue was primarily due to lower volume and selling prices of

steel products largely resulting from a decline in the commercial market in North America. Lower

volume and selling prices for armored cable products also contributed to the decline. Changes in

foreign currency exchange rates had an unfavorable impact of $52 million. The net impact of

acquisitions and divestitures negatively affected revenue by approximately $31 million.

Operating income decreased $1.3 billion in 2009 as compared to 2008. Based on the sales volume

decrease as well as the significant decline in the price of steel, the Company recorded a goodwill

impairment charge of $935 million during the second quarter of 2009. There was no goodwill

impairment recorded during 2008. The decrease in operating income also related to volume declines as

well as lower spreads for steel products. Spreads for steel products continued to decline as a direct

result of higher raw material costs and lower selling prices. Lower restructuring and divestiture charges

incurred in 2009 as compared to similar charges incurred in 2008 partially offset the decline in

operating income discussed above. Results for 2009 included restructuring and divestiture charges of

$21 million as compared to $43 million for 2008. Additionally, management estimates that $1 million of

additional charges resulting from restructuring actions were incurred during 2009.

Net revenue for Electrical and Metal Products increased $298 million, or 15.1%, in 2008 as

compared to 2007. The increase in net revenue was largely driven by selling price increases for steel

tubular products and to a lesser extent armored cable products partially offset by decreased sales

volume for both products. Changes in foreign currency exchange rates had a favorable impact of

$44 million.

Operating income increased $183 million, or 115.1%, in 2008 as compared to 2007. The increase in

operating income was primarily due to favorable spreads on both steel tubular and armored cable

products. Income generated by higher selling prices for both steel tubular and armored cable products

were partially offset by decreased sales volume for both products. Operational excellence initiatives

resulted in reductions in production cost rates for both steel tubular and armored cable products. The

increase in operating income during 2008 was partially offset by $43 million of restructuring, asset

impairment and divestiture charges, as compared to $7 million in 2007.

2009 Financials 43