ADP 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 ADP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

AUTOMATIC DATA PROCESSING, INC.

(Exact name of registrant as specified in its charter)

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [x] No [ ]

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes [ ] No [x]

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the Registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. Yes [x] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes__ No__

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein and will not be contained, to the best of Registrant’ s

knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [x]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). [ ] Yes [x] No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant as of the last business day of the Registrant’ s most recently completed

second fiscal quarter was approximately $19,826,340,386. On August 21, 2009 there were 502,151,920 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

[X]

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2009

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Commission file number 1-5397

Delaware 22-1467904

(State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.)

One ADP Boulevard, Roseland, New Jerse

y

07068

(Address of principal executive offices) (Zip Code)

Registrant’ s telephone number, including area code: 973-974-5000

Securities registered pursuant to Section 12(b) of the Act:

Name of each exchange on

Title of each class which registered

Common Stock, $.10 Par Value NASDAQ Global Select Market

(

votin

g)

Chica

g

o Stock Exchan

g

e

Large accelerated filer [x] Accelerated filer [ ]

N

on-accelerated filer [ ] Smaller reporting company [ ]

Portions of the Registrant’ s Proxy Statement for its 2009 Annual Meeting of Stockholders. Part III

Table of contents

-

Page 1

...) One ADP Boulevard, Roseland, New Jersey (Address of principal executive offices) Registrant' s telephone number, including area code: 973-974-5000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Common Stock, $.10 Par Value (voting) Securities registered pursuant... -

Page 2

..., ADP delivers stand-alone services such as payroll tax filing, check printing and distribution, year-end tax statements (i.e., Form W-2), wage garnishment services, health and welfare administration and flexible spending account (FSA) administration. In order to address the growing business process... -

Page 3

... 39 million employer payroll tax returns and deposits, and moved over $1 trillion in client funds to taxing authorities and its clients' employees via electronic transfer, direct deposit and ADPCheck. Insurance Services provides a comprehensive Pay-by-Pay workers' compensation payment program and... -

Page 4

... phone system fullyintegrated into the DMS to help dealerships drive sales processes and business development initiatives. Dealer Services also provides its dealership clients computer hardware, hardware maintenance services, software support, system design and network consulting services. Dealer... -

Page 5

... of Dealer Services' solutions are supported by comprehensive training offerings and business process consulting services. ADP' s DMS and other software solutions are available as "on-site" applications installed at the dealership or as application service provider (ASP) managed services solutions... -

Page 6

...and Qualitative Disclosures About Market Risk and the consolidated financial statements and related notes included in this Annual Report on Form 10-K. This discussion includes a number of forward-looking statements. You should refer to the description of the qualifications and limitations on forward... -

Page 7

... their spending on payroll and other outsourcing services or renegotiating their contracts with us. The availability of financing, even to borrowers with the highest credit ratings, may limit our flexibility to access short-term debt markets to meet liquidity needs required by our Employer Services... -

Page 8

... highly skilled and motivated personnel, expected results from our operations may suffer. Item 1B. Unresolved Staff Comments None Item 2. Properties ADP owns 43 of its processing centers, other operational offices, sales offices and its corporate headquarters complex in Roseland, New Jersey, which... -

Page 9

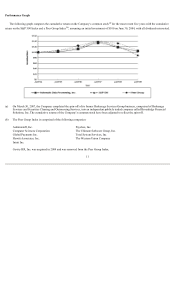

... and Issuer Purchases of Equity Securities Market for the Registrant's Common Equity The principal market for the Company' s common stock (symbol: ADP) is the NASDAQ Global Select Market. The following table sets forth the reported high and low sales prices of the Company' s common stock and the... -

Page 10

... Total (1) Total Number of Shares Purchased (1) 1,206 -5,201 6,407 Average Price Paid per Share $34.61 -$36.50 Pursuant to the terms of the Company' s restricted stock program, the Company made purchases of 1,206 shares during April 2009 and 5,201 shares during June 2009 at the then market value... -

Page 11

...completed the spin-off of its former Brokerage Services Group business, comprised of Brokerage Services and Securities Clearing and Outsourcing Services, into an independent publicly traded company called Broadridge Financial Solutions, Inc. The cumulative returns of the Company' s common stock have... -

Page 12

... and Qualitative Disclosures About Market Risk included in this Annual Report on Form 10-K. (Dollars and shares in millions, except per share amounts) Years ended June 30, Total revenues Total costs of revenues Gross profit Earnings from continuing operations before income taxes Net earnings from... -

Page 13

... and Web-based outsourcing solutions, that assist approximately 540,000 employers in the United States, Canada, Europe, South America (primarily Brazil), Australia and Asia to staff, manage, pay and retain their employees. Employer Services categorizes its services as payroll and payroll tax, and... -

Page 14

...bonuses, lower wage growth, and a decline in pays per control. Our key business metrics for Employer Services showed year-over-year declines in fiscal 2009. "Pays per control," which represents the number of employees on our clients' payrolls as measured on a same-storesales basis utilizing a subset... -

Page 15

... 2008. This decrease in cash flows from fiscal 2008 to fiscal 2009 was due to the timing of collections of accounts receivable and the timing of funding of our employee benefits program, partially offset by a decrease in pension plan contributions as compared to the prior year. RESULTS OF OPERATIONS... -

Page 16

... in our PEO business including those costs associated with providing benefits coverage for worksite employees of $102.7 million and costs associated with workers' compensation and payment of state unemployment taxes for worksite employees of $16.8 million. Our total costs of revenues increased $159... -

Page 17

... fiscal 2009 as a result of a decrease of $40.6 million related to our short-term commercial paper program and a decrease of $6.6 million related to our reverse repurchase program. In the aggregate, interest expense decreased by approximately $68.4 million related to decreases in interest rates and... -

Page 18

...due to the increase in our revenues, higher pass-through costs associated with our PEO business, an increase in our salesforce and implementation personnel, and higher expenses associated with Employer Services' new business sales and implementation. In addition, consolidated expenses increased $142... -

Page 19

... of software and software licenses in fiscal 2008. Selling, general and administrative expenses increased $164.2 million, or 7%, in fiscal 2008 as compared to fiscal 2007, which was attributable to the increase in salesforce personnel to support our new domestic business sales in Employer Services... -

Page 20

... and 40.2 million shares in fiscal 2007. ANALYSIS OF REPORTABLE SEGMENTS Revenues (Dollars in millions) Years ended June 30, 2009 Employer Services PEO Services Dealer Services Other Reconciling items: Foreign exchange Client funds interest Total revenues $ 6,587.7 1,185.8 1,348.6 19.5 (208.2) (66... -

Page 21

...a standard rate for management reasons. Other costs are charged to the reportable segments based on management' s responsibility for the applicable costs. The primary components of the "Other" segment are miscellaneous processing services, such as customer financing transactions, non-recurring gains... -

Page 22

... the number of employees on our clients' payrolls as measured on a same-store-sales basis utilizing a subset of approximately 137,000 payrolls of small to large businesses that are reflective of a broad range of U.S. geographic regions, decreased 2.5% in fiscal 2009. We credit Employer Services with... -

Page 23

...state unemployment taxes for worksite employees that were billed to our clients increased $119.5 million due to the increase in the average number of worksite employees, as well as increases in health care costs. Administrative revenues, which represent the fees for our services and are billed based... -

Page 24

... Customer Relationship Management applications and new network and hosted IP telephony installations. Earnings from Continuing Operations before Income Taxes Dealer Services' earnings from continuing operations before income taxes decreased $9.7 million, or 4%, to $224.1 million in fiscal 2009 due... -

Page 25

...stock purchase plan and exercises of stock options of $157.0 million. Our U.S. short-term funding requirements related to client funds are sometimes obtained through a short-term commercial paper program, which provides for the issuance of up to $6.0 billion in aggregate maturity value of commercial... -

Page 26

... prime rate depending on the notification provided by us to the syndicated financial institutions prior to borrowing. We are also required to pay facility fees on the credit agreements. The primary uses of the credit facilities are to provide liquidity to the commercial paper program and funding for... -

Page 27

...additional operating lease agreements. Purchase obligations primarily relate to purchase and maintenance agreements on our software, equipment and other assets. We made the determination that net cash payments expected to be paid within the next 12 months, related to unrecognized tax benefits of $92... -

Page 28

... market securities and other cash equivalents. At June 30, 2009, approximately 85% of the available-for-sale securities categorized as U.S. Treasury and direct obligations of U.S. government agencies were invested in senior, unsecured, non-callable debt directly issued by the Federal Home Loan Banks... -

Page 29

... maximum maturity at time of purchase for BBB rated securities is 5 years, for single A rated securities is 7 years, and for AA rated and AAA rated securities is 10 years. Commercial paper must be rated A1/P1 and, for time deposits, banks must have a Financial Strength Rating of C or better. Details... -

Page 30

..., if any portion of a decline in fair value below the cost basis of a security is related to credit losses, such amount should be recorded in earnings. Lastly, FSP FAS 115-2 and FAS 124-2 expands and increases the frequency of existing disclosures about other-than-temporary impairments for debt and... -

Page 31

... services (e.g., Employer Services' payroll processing fees) as well as investment income on payroll funds, payroll tax filing funds and other Employer Services' client-related funds. We enter into agreements for a fixed fee per transaction (e.g., number of payees or number of payrolls processed... -

Page 32

... on the fair value of the award on the date of grant. We determine the fair value of stock options issued by using a binominal option-pricing model. The binomial option-pricing model considers a range of assumptions related to volatility, dividend yield, risk-free interest rate and employee exercise... -

Page 33

... the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as... -

Page 34

....7 1.86 0.21 2.07 1.83 0.21 2.04 549.7 557.9 (A) Professional Employer Organization ("PEO") revenues are net of direct pass-through costs, primarily consisting of payroll wages and payroll taxes, of $12,310.4, $11,247.4 and $9,082.5, respectively. See notes to consolidated financial statements. 34 -

Page 35

... equivalents Short-term marketable securities Accounts receivable, net Other current assets Assets held for sale Total current assets before funds held for clients Funds held for clients Total current assets Long-term marketable securities (A) Long-term receivables, net Property, plant and equipment... -

Page 36

... expense Issuances relating to stock compensation plans Tax benefits from stock compensation plans Treasury stock acquired (40.2 shares) Adoption of Staff Accounting Bulletin No. 108, net of tax Brokerage Services Group spin-off Brokerage Services Group dividend Debt conversion (1.1 shares... -

Page 37

... Capital expenditures Additions to intangibles Acquisitions of businesses, net of cash acquired Reclassification from cash and cash equivalents to short-term marketable securities Proceeds from the sale of cost-based investment Dividend received from Broadridge Financial Solutions, Inc., net of $29... -

Page 38

... Employer Services' payroll processing fees) as well as investment income on payroll funds, payroll tax filing funds and other Employer Services' client-related funds. The Company enters into agreements for a fixed fee per transaction (e.g., number of payees or number of payrolls processed). Fees... -

Page 39

... of gross receivables over the sales price of the computer systems financed. Unearned income is amortized using the effective-interest method to maintain a constant rate of return over the term of each contract. The allowance for doubtful accounts on long-term receivables is the Company' s best... -

Page 40

... value of the award on the date of the grant. The Company determines the fair value of stock options issued using a binominal option-pricing model. The binomial option-pricing model considers a range of assumptions related to volatility, dividend yield, risk-free interest rate and employee exercise... -

Page 41

... tax returns by the Internal Revenue Service ("IRS") and other tax authorities. The Company accounts for tax positions taken or expected to be taken in a tax return in accordance with the provisions of Financial Accounting Standards Board ("FASB") Interpretation No. 48 ("FIN 48"), which was adopted... -

Page 42

...-based payment awards that contain nonforfeitable rights to dividends or dividend equivalents (whether paid or unpaid) are participating securities and shall be included in the computation of earnings per share pursuant to the two-class method. FSP EITF 03-6-1 is effective for financial statements... -

Page 43

... accounted for using the cost basis. The Company' s sale of this investment resulted in a gain of $38.6 million. The Company has an outsourcing agreement with Broadridge Financial Solutions, Inc. ("Broadridge") pursuant to which the Company will continue to provide data center outsourcing services... -

Page 44

... Earnings. On March 30, 2007, the Company completed the tax-free spin-off of its former Brokerage Services Group business, comprised of Brokerage Services and Securities Clearing and Outsourcing Services, into an independent publicly traded company. As a result of the spin-off, ADP stockholders... -

Page 45

... received an additional payment of $13.2 million, or $12.6 million after tax, from Solera, Inc., which represented the final purchase price adjustment for the sale of the Claims Services business. The Company reported the final purchase price adjustment within earnings from discontinued operations... -

Page 46

... and funds held for clients at June 30, 2009 and 2008 are as follows: June 30, 2009 Amortized Cost Type of issue: Money market securities and other cash equivalents Available-for-sale securities: U.S. Treasury and direct obligations of U.S. government agencies Corporate bonds Asset-backed securities... -

Page 47

... 30, Corporate investments: Cash and cash equivalents Short-term marketable securities Long-term marketable securities Total corporate investments 2009 $ 2,265.3 30.8 92.4 2,388.5 $ 2008 917.5 666.3 76.5 1,660.3 $ $ Funds held for clients represent assets that, based upon the Company' s intent... -

Page 48

...Canadian securities, Dominion Bond Rating Service. All available-for-sale securities were rated as investment grade at June 30, 2009 with the exception of the Reserve Fund investment discussed below. The amount of collected but not yet remitted funds for the Company' s payroll and payroll tax filing... -

Page 49

... value, and expands the disclosures on fair value measurements. SFAS No. 157 defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction... -

Page 50

... investments and funds held for clients. Level 1 U.S Treasury and direct obligations of U.S. government agencies Corporate bonds Asset-backed securities Canadian government obligations and Canadian government agency obligations Other securities Total available-for-sale securities NOTE 7. RECEIVABLES... -

Page 51

... months ended September 30, 2009. The Company currently expects to complete the sale of the remaining building during fiscal 2010. NOTE 10. GOODWILL AND INTANGIBLE ASSETS, NET Changes in goodwill for the fiscal year ended June 30, 2009 and 2008 are as follows: Employer Services Balance as of June 30... -

Page 52

... June 30, 2009 under the credit agreements. The Company' s U.S. short-term funding requirements related to client funds are sometimes obtained through a short-term commercial paper program, which provides for the issuance of up to $6.0 billion in aggregate maturity value of commercial paper. The... -

Page 53

... Canadian short-term funding requirements related to client funds obligations are sometimes obtained on a secured basis through the use of reverse repurchase agreements, which are collateralized principally by government and government agency securities. These agreements generally have terms ranging... -

Page 54

...EMPLOYEE BENEFIT PLANS A. Stock Plans. The Company accounts for stock-based compensation in accordance with SFAS No. 123R, "Share-Based Payment" ("SFAS No. 123R"), which requires the measurement of stock-based compensation expense to be recognized in net earnings based on the fair value of the award... -

Page 55

As of June 30, 2009, the total remaining unrecognized compensation cost related to non-vested stock options, the employee stock purchase plan and restricted stock awards amounted to $24.8 million, $7.7 million and $39.2 million, respectively, which will be amortized over the weighted average periods... -

Page 56

... Years ended June 30, Risk-free interest rate Dividend yield Weighted average volatility factor Weighted average expected life (in years) Weighted average fair value (in dollars): Stock options Stock purchase plan Performance-based restricted stock 2009 1.8% - 3.1% 2.6% - 3.5% 25.3% - 31.3% 5.0 2008... -

Page 57

... income taxes, in stockholders' equity. The Company' s pension plans funded status as of June 30, 2009 and 2008 is as follows: June 30, Change in plan assets: Fair value of plan assets at beginning of year Actual return on plan assets Employer contributions Benefits paid Fair value of plan assets at... -

Page 58

... The components of net pension expense were as follows: Years ended June 30, Service cost - benefits earned during the period Interest cost on projected benefits Expected return on plan assets Net amortization and deferral 2009 $ 46.2 56.7 (70.3) 1.2 33.8 $ 2008 46.1 50.7 (67.2) 10.4 40.0 $ 2007 42... -

Page 59

...: 2009 United States Fixed Income Securities United States Equity Securities International Equity Securities Total 37% 47% 16% 100% 2008 42% 41% 17% 100% The Company' s pension plans' asset investment strategy is designed to ensure prudent management of assets, consistent with long-term return... -

Page 60

...Company' s pension plans' benefit obligation at June 30, 2009 and includes estimated future employee service. C. Retirement and Savings Plan. The Company has a 401(k) retirement and savings plan, which allows eligible employees to contribute up to 35% of their compensation annually and allows highly... -

Page 61

...Years ended June 30, Provision for taxes at U.S. statutory rate Increase (decrease) in provision from: State taxes, net of federal tax Non-deductible stock-based compensation expense Tax on repatriated earnings Utilization of foreign tax credits Tax settlements Other $ 2009 $ 666.6 % 35.0 $ 2008 634... -

Page 62

... with tax authorities Expiration of the statute of limitations Impact of foreign exchange rate fluctuations Unrecognized tax benefits at June 30, 2008 Unrecognized tax benefits at July 1, 2008 Additions for tax positions of the fiscal year ended June 30, 2009 Reductions for tax positions of... -

Page 63

...examinations currently in progress are as follows: Taxing Jurisdiction U.S. (IRS) California Illinois Minnesota New Jersey France Fiscal Years under Examination 2007 - 2009 2004 - 2005 2004 - 2005 1998 - 2004 2002 - 2006 2006 - 2008 Additionally, Canada has commenced a joint audit with the Province... -

Page 64

...leases require payment of maintenance and real estate taxes and contain escalation provisions based on future adjustments in price indices. As of June 30, 2009, the Company has purchase commitments of approximately $274.1 million relating to software and equipment purchases and maintenance contracts... -

Page 65

...Reportable segments' assets include funds held for clients, but exclude corporate cash, corporate marketable securities and goodwill. Reconciling Items Client Employer Services Year ended June 30, 2009 Revenues from continuing operations Earnings from continuing operations before income taxes Assets... -

Page 66

... short term intercompany amount payable by the Canadian subsidiary to a U.S. subsidiary of the Company. Such amount payable arose as part of the IRS audit settlement and a related agreement with a foreign tax authority, as described in Note 15. The foreign exchange forward contract obligates... -

Page 67

... Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure and (ii) such information is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission' s rules and forms. Management's Report... -

Page 68

... Butler President and Chief Executive Officer /s/ Christopher R. Reidy Christopher R. Reidy Chief Financial Officer Roseland, New Jersey August 28, 2009 Changes in Internal Control over Financial Reporting There were no changes in ADP' s internal control over financial reporting that occurred during... -

Page 69

... executive and principal financial officers, or persons performing similar functions, and effected by the company's board of directors, management, and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements... -

Page 70

... Chief Financial Officer President, Employer Services-Small Business Services Division Corporate Controller and Principal Accounting Officer President, Added Value Services and Chief Strategy Officer Messrs. Benson, Butler and Colotti have each been employed by ADP in senior executive positions for... -

Page 71

... Ownership Reporting Compliance" in the Proxy Statement for the Company' s 2009 Annual Meeting of Stockholders, which information is incorporated herein by reference. Code of Ethics ADP has adopted a code of ethics that applies to its principal executive officer, principal financial officer... -

Page 72

... of Executive Officers" and "Election of Directors - Compensation of Non-Employee Directors" in the Proxy Statement for the Company' s 2009 Annual Meeting of Stockholders, which information is incorporated herein by reference. Item 12. Security Ownership of Certain Beneficial Owners and Management... -

Page 73

...incorporated by reference to Exhibit 3.2 to Company' s Current Report on Form 8-K, dated November 13, 2007 Separation and Distribution Agreement, dated as of March 20, 2007, between Automatic Data Processing, Inc. and Broadridge Financial Solutions, LLC - incorporated by reference to Exhibit 10.1 to... -

Page 74

... Report on Form 8-K, dated June 28, 2006 (Management Contract) Key Employees' Restricted Stock Plan - incorporated by reference to Company' s Registration Statement No. 33-25290 on Form S-8 (Management Compensatory Plan) Amended and Restated Supplemental Officers Retirement Plan - incorporated... -

Page 75

...2008 - incorporated by reference to Exhibit 10.2 to Company' s Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2004 (Management Compensatory Plan) 2000 Stock Option Grant Agreement (Form for Non-Employee Directors) used prior to August 14, 2008 - incorporated by reference to... -

Page 76

...by reference to Exhibit 10.31 to Company' s Quarterly Report on Form 10-Q for the fiscal quarter ended December 31, 2008 (Management Compensatory Plan) Form of Stock Option Grant Agreement under the 2008 Omnibus Award Plan (Form for Non-Employee Directors) used on November 11, 2008 - incorporated by... -

Page 77

...AND SUBSIDIARIES SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS (In thousands) Column B Column A Column C Additions (2) Charged to other accounts Column D Column E Balance at beginning of period Year ended June 30, 2009: Allowance for doubtful accounts: Current Long-term Deferred tax valuation... -

Page 78

...behalf by the undersigned, thereunto duly authorized. AUTOMATIC DATA PROCESSING, INC. (Registrant) August 28, 2009 By /s/ Gary C. Butler Gary C. Butler President and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the... -

Page 79

... ADP Screening and Selection Services, Inc. ADP Tax Services, Inc. ADP Tesoft Automocion Spain ADP TotalSource Group, Inc. ADP Vehicle Information Technology (Shanghai) Co., Ltd Automatic Data Processing Limited Automatic Data Processing Limited (UK) Automotive Directions, Inc. Autosys GmbH Business... -

Page 80

... Benefit Pension and Other Postretirement Plans--an amendment of FASB Statement No. 87, 88, 106, and 132(R)," effective June 30, 2007) appearing in this Annual Report on Form 10-K of Automatic Data Processing, Inc. for the year ended June 30, 2009. /s/ Deloitte & Touche LLP Parsippany, New Jersey... -

Page 81

... financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant' s internal control over financial reporting. Date: August 28, 2009 /s/ Gary C. Butler Gary C. Butler President and Chief Executive Officer -

Page 82

...s ability to record, process, summarize and report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant' s internal control over financial reporting. Date: August 28, 2009 /s/ Christopher R. Reidy... -

Page 83

... CHIEF EXECUTIVE OFFICER CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 In connection with the Annual Report of Automatic Data Processing, Inc. (the "Company") on Form 10-K for the fiscal year ending June 30, 2009 as filed with... -

Page 84

... OFFICER CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 In connection with the Annual Report of Automatic Data Processing, Inc. (the "Company") on Form 10-K for the fiscal year ending June 30, 2009 as filed with the Securities...