ADP 2008 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2008 ADP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

These transactions, along with our cash flows from operating activities, have allowed us to continue to focus on the objective of returning

excess cash to our stockholders through our share buyback program and our cash dividends to stockholders. Subsequent to the completion of

these transactions, the new ADP is a more focused company, which we believe has excellent growth potential for revenue and pretax earnings.

Our financial condition and balance sheet remain solid with cash and marketable securities of $1,660.3 million at June 30, 2008. Our net

cash flows provided by operating activities were $1,772.2 million in fiscal 2008, as compared to $1,298.0 million in fiscal 2007. This increase

exceeded our expectations due to the timing of certain collections of accounts receivable and the timing of payments of certain accruals.

RECLASSIFICATIONS WITHIN CONSOLIDATED BALANCE SHEETS AND STATEMENTS OF CONSOLIDATED CASH

FLOWS

The Company has reclassified funds held for clients and client funds obligations that had been previously presented outside of current

assets and current liabilities, respectively, within the Consolidated Balance Sheets, to current assets and current liabilities, respectively, for all

periods presented. Additionally, the Company has reclassified the net increase (decrease) in client funds obligations in the Statements of

Consolidated Cash Flows from investing activities to financing activities for all periods presented.

RESULTS OF OPERATIONS

ANALYSIS OF CONSOLIDATED OPERATIONS

Fiscal 2008 Compared to Fiscal 2007

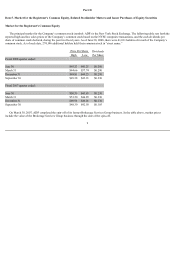

(Dollars in millions, except per share amounts)

15

Years ended June 30, Change

2008 2007 2008 vs 2007

Total revenues $8,776.5 $7,800.0 13%

Costs of revenues:

Operating expenses 3,915.7 3,392.3 15%

Systems development and programming costs 525.9 486.1 8%

Depreciation and amortization 238.5 208.9 14%

Total cost of revenues 4,680.1 4,087.3 15%

Selling, general and administrative expenses 2,370.4 2,206.2 7%

Interest expense 80.5 94.9 (15)%

Total expenses 7,131.0 6,388.4 12%

Other income, net 166.5 211.9 (21)%

Earnings from continuing operations before income taxes $1,812.0 $1,623.5 12%

Margin 21% 21%

Provision for income taxes $650.3 $602.3 8%

Effective tax rate 35.9% 37.1%

N

et earnings from continuing operations $1,161.7 $1,021.2 14%

Diluted earnings per share from continuing operations $2.20 $1.83 20%