3Ware 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 3Ware annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BOARD OF DIRECTORS

Cesar Cesaratto

Chairman of the Board

Independent Director

Compensation Committee

Governance and Nominating

Committee – Chairperson

Kambiz Hooshmand

Technical Advisory Board Committee –

Chairperson

President and Chief Executive Officer

Applied Micro Circuits Corporation

Donald Colvin

Independent Director

Audit Committee

Chief Financial Officer – ON Semiconductor

Fred Shlapak

Independent Director

Compensation Committee

Technical Advisory Board Committee

Former President and Chief Executive Officer

– Motorola Corporation SPS

Niel Ransom

Independent Director

Compensation Committee

Technical Advisory Board Committee

Former Chief Technology Officer – Alcatel

Arthur Stabenow

Independent Director

Audit Committee

Compensation Committee –

Chairperson

Governance and Nominating Committee

Julie Sullivan

Independent Director

Audit Committee – Chairperson

Governance and Nominating

Committee

Vice President and Provost,

University San Diego

EXECUTIVE OFFICERS

Kambiz Hooshmand

President and Chief Executive Officer

Robert Gargus

Senior Vice President and Chief Financial

Officer

Shiva Natarajan

Vice President and Corporate Controller

Mike Major

Vice President, Human Resources

Russell Johnson

Senior Vice President and General Manager,

Storage

Daryn Lau

Senior Vice President, Corporate

Marketing and Strategy

Cynthia Moreland

Vice President, General Counsel

and Secretary

Roger Wendelken

Vice President of World Wide Sales

FINANCIAL HIGHLIGHTS

ANNUAL MEETING

The AMCC 2008 Annual meeting of

Stockholders will be held at 10:00 a.m.,

on August 19, 2008 at the Company’s

headquarters located at 215 Moffett Park

Drive, Sunnyvale, California 94089.

INDEPENDENT AUDITORS

Ernst & Young LLP

303 Almaden Boulevard

San Jose, CA 95110

OUTSIDE COUNSEL

Cooley Godward Kronish LLP

4401 Eastgate Mall

San Diego, CA 92121-1909

TRANSFER AGENT AND REGISTRAR

Computershare Investor Services, LLC

Shareholder Communications Team

2 North LaSalle Street

Chicago, IL 60602

Phone: (312) 588-4143

www.computershare.com

Email: web[email protected]

CORPORATE HEADQUARTERS

Applied Micro Circuits Corporation (AMCC)

215 Moffett Park Drive

Sunnyvale, California 94089

Phone: (408) 542-8600

Fax: (408) 542-8601

INVESTOR INFORMATION

Exchange: Nasdaq Global Select

Stock Market

Symbol: AMCC

COMPANY INQUIRIES

AMCC

Shiva Natarajan

Vice President and Corporate Controller

215 Moffett Park Drive

Sunnyvale, California 94089

Phone: (408) 542-8745

Fax: (408) 542-8820

AMCC and 3ware are registered trademarks and MISSION

is a trademark of Applied Micro Circuits Corporation.

The PowerPC name and logo are registered trademarks

of IBM Corporation and used under license therefrom.

All other trademarks are the property of their respective

holders. Copyright © 2008 Applied Micro Circuits

Corporation. All rights reserved.

Forward Looking Statements

This annual report contains forward-looking statements, including statements concerning the anticipated future direction of the network, storage and other markets that AMCC serves, the resulting opportunities for AMCC, AMCC’s strategy, plans, goals and expectations,

including its targets for revenues and operating margin, and anticipated benefits from AMCC’s initiatives. These forward-looking statements are only predictions based on current information and expectations and are subject to risks and uncertainties, such as those

associated with customer demand for AMCC’s products, which in turn is driven by the demand for AMCC’s customers’ products; the businesses of AMCC’s major customers; the concentration of AMCC’s business on and its revenue with its major customers; reductions,

rescheduling and cancellation of orders by AMCC’s customers; successful and timely development of new products by AMCC and its customers; AMCC’s manufacturing capacity and execution; and general economic conditions in the United States and around the world.

More information about these and other factors that could affect AMCC’s business and financial results is included in the “Risk Factors” set forth in the annual report on Form 10-K and in AMCC’s other filings with the Securities and Exchange Commission from time to time.

As a result of such factors, AMCC’s actual business performance and financial results could differ materially from what is set forth in the forward-looking statements. AMCC undertakes no duty to update the forward-looking statements contained in this annual report.

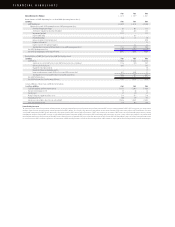

FY06 FY07 FY08

Annual Revenue ($ in Millions) $ 261.8 $ 292.9 $ 246.1

Reconciliation of GAAP Operating Loss to Non-GAAP Operating Income (Loss)

$ in Millions FY06 FY07 FY08

GAAP Operating Loss $ (164.9) $ (37.2) $ (122.0)

Adjustments to reconcile GAAP operating loss to non-GAAP operating income (loss):

Stock-based compensation charges 6.6 10.3 11.3

Amortization / impairments of purchased intangibles 22.2 24.8 23.7

Impairment of goodwill 131.2 - 71.5

In-process R&D charge - 13.3 -

Restructuring charges 12.6 1.3 3.0

Gain on renegotiated design tool agreement - - (0.8)

Litigation settlement, net - - 1.1

Expenses related to stock option investigation - 5.3 1.1

Total adjustments to reconcile GAAP operating loss to non-GAAP operating income (loss) 172.6 55.0 110.9

Non-GAAP Operating Income (Loss) $ 7.7 $ 17.8 $ (11.1)

Non-GAAP Operating Margin as a Percentage of Revenue 2.9% 6.1% -4.5%

Reconciliation of GAAP Net Loss to Non-GAAP Net Income (Loss)

$ in Millions FY06 FY07 FY08

GAAP Net Loss $ (148.4) $ (24.2) $ (115.1)

Adjustments to reconcile GAAP net loss to non-GAAP net income (loss) (see detail above) 172.6 55.0 110.9

Gains on sales of certain assets (0.7) - (4.6)

Impairment of strategic investment - - 3.0

Impairment of long-term marketable securities - - 1.7

Income tax adjustments to reconcile GAAP net loss to non-GAAP net income (loss) (5.7) (0.5) 3.7

Total adjustments to reconcile GAAP net loss to non-GAAP net income (loss) 166.2 54.5 114.7

Non-GAAP Net Income (Loss) $ 17.8 $ 30.3 $ (0.4)

Non-GAAP Net Income (Loss) as a Percentage of Revenue 6.8% 10.3% -0.2%

Selected Balance Sheet Items and Other Information:

$ and Shares in Millions FY06 FY07 FY08

Cash, cash equivalents and short-term investments $ 335.7 $ 284.5 $ 142.9

Days sales outstanding at year end 35 42 36

Inventory turns 5.7 5.0 3.7

Purchase of property, equipment and other assets $7.9 $6.7 $7.0

Headcount at year end 600 619 583

Annual revenue per employee (based on year end headcount) $ 0.436 $ 0.473 $ 0.422

Shares outstanding at year end 73.9 70.7 64.8