3Ware 2004 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2004 3Ware annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Acquire Complementary Businesses, Products or Technologies

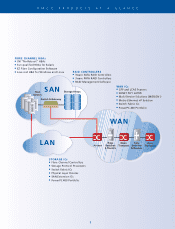

Akey element of our business strategy involves acquiring new businesses, products or technologies that

allow us to reduce the time required to develop and bring to market new technologies and products, complement

our existing product offerings, expand our market coverage, or enhance our technological capabilities. In

September 2003 and January 2004, we purchased assets and licensed intellectual property associated with IBM’s

PowerPRS Switch Fabric product line for approximately $50.0 million in cash to complement our existing switch

fabric product portfolio. In October 2003, we completed the acquisition of all of the outstanding shares of JNI

Corporation, a provider of Fibre Channel hardware and software products that are critical SAN elements, for

approximately $196.4 million in cash. In April 2004, we acquired 3ware, Inc. for approximately $145.0 million

in cash, which expanded our product offerings in the storage market. In May 2004, we purchased assets and

licensed intellectual property associated with IBM’s 400 series of embedded PowerPC standard products for

approximately $227.9 million in cash to complement our existing product portfolio in both the communications

and storage markets. We plan to continue evaluating strategic opportunities as they arise, including business

combinations, strategic relationships, capital infusions and the purchase and sale of assets.

Increase the Number of Products we Provide to Address Specific Protocols and Networking Functions

We focus our new product development efforts and acquisition activities on product lines that are

complementary to our current product portfolio in order to broaden the number of products we provide to address

specific protocols and networking functions. For example, our current product offerings include physical layer

products, overhead processor products, and higher layer products for communications applications, and HBAs

and RAID controllers for enterprise storage applications. Both communications and enterprise storage

applications may use general purpose processors, like the 400 series PowerPC processors acquired from IBM in

May 2004. We believe that we will be able to increase our sales to existing customers and increase our market

share in the communications and storage enterprise markets by taking advantage of product synergies and

integration opportunities.

Increase our Market Share in Non-Solaris Storage Environments

Our HBAs have achieved their greatest market acceptance in computing environments built with high-end

servers from Sun Microsystems due to our products’ interoperability with the Sun Solaris operating system. To

increase our revenues and grow our storage business we are focusing significant marketing and qualification

efforts on building market share with our newer products that interoperate with other operating systems.

Provide a Time-to-Market and Development Cost Advantage to Our Communications Equipment OEMs

Due to the extended downturn in the communications industry, our OEM customers have become more

efficient with their engineering resources and have significantly cut equipment development budgets. Our

strategy is to provide our customers with a complete portfolio of IC products. We believe this comprehensive

solution strategy provides our customers with guaranteed interoperability, pre-designed subsystems, better cost

economics, and system-level expertise. The result for the OEM is faster time-to-market, better performance and

lower development cost. To continue these customer benefits in future generations of products, we are pursuing

an aggressive product integration strategy to provide greater functionality in fewer ICs.

5