iRobot 2010 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2010 iRobot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

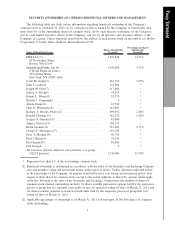

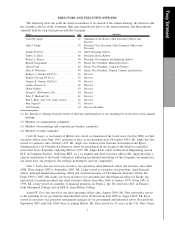

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of the Company’s

common stock as of March 31, 2011: (i) by each person who is known by the Company to beneficially own

more than 5% of the outstanding shares of common stock; (ii) by each director or nominee of the Company;

(iii) by each named executive officer of the Company; and (iv) by all directors and executive officers of the

Company as a group. Unless otherwise noted below, the address of each person listed on the table is c/o iRobot

Corporation, 8 Crosby Drive, Bedford, Massachusetts 01730.

Name of Beneficial Owner

Shares Beneficially

Owned(1)

Percentage of Shares

Beneficially

Owned(2)

FMR LLC(3) .................................... 3,815,844 14.51%

82 Devonshire Street

Boston, MA 02109

OppenheimerFunds, Inc.(4) .......................... 1,500,600 5.71%

2 World Financial Center

225 Liberty Street

New York, NY 10281-1008

Colin M. Angle(5) ................................ 963,712 3.65%

John J. Leahy(6) ................................. 121,384 *

Joseph W. Dyer(7) ................................ 117,404 *

Jeffrey A. Beck(8) ................................ 33,675 *

Robert L. Moses(9) ............................... 32,578 *

Russell J. Campanello ............................. 0 *

Alison Dean(10) .................................. 43,530 *

Glen D. Weinstein(11) ............................. 115,907 *

Rodney A. Brooks, Ph.D.(12) ........................ 599,692 2.28%

Ronald Chwang(13) ............................... 515,235 1.96%

Jacques S. Gansler(14) ............................. 81,400 *

Andrea Geisser(15)................................ 104,153 *

Helen Greiner(16) ................................ 712,683 2.71%

George C. McNamee(17) ........................... 153,129 *

Peter T. Meekin(18) ............................... 60,798 *

Paul J. Kern(19) .................................. 75,534 *

Paul Sagan(20) ................................... 10,266 *

Gail Deegan ..................................... 0 *

All executive officers, directors and nominees as a group

(21)(18 persons) ................................ 3,741,080 13.70%

* Represents less than 1% of the outstanding common stock.

(1) Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commis-

sion and includes voting and investment power with respect to shares. Unless otherwise indicated below,

to the knowledge of the Company, all persons listed below have sole voting and investment power with

respect to their shares of common stock, except to the extent authority is shared by spouses under appli-

cable law. Pursuant to the rules of the Securities and Exchange Commission, the number of shares of

common stock deemed outstanding includes (i) shares issuable pursuant to options held by the respective

person or group that are currently exercisable or may be exercised within 60 days of March 31, 2011 and

(ii) shares issuable pursuant to restricted stock units held by the respective person or group that vest

within 60 days of March 31, 2011.

(2) Applicable percentage of ownership as of March 31, 2011 is based upon 26,301,866 shares of common

stock outstanding.

3

Proxy Statement