iHeartMedia 2002 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2002 iHeartMedia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

price at the signing of the merger agreement, the historical cost of the Ackerley shares we held prior to the merger date and the fair value of the

employee stock options at the merger date. In addition, we assumed all of Ackerley’s outstanding debt, which had a fair value of $319.0 million

at the merger date. We refinanced Ackerley’s credit facility and made a tender offer for Ackerley’s public debt concurrent with the merger. The

tender offer was finalized on July 3, 2002 at a price of $1,129 per $1,000 tendered, resulting in the repurchase of substantially all of Ackerley’s

public debt. This merger resulted in the recognition of approximately $361.0 million of goodwill. This purchase price allocation is preliminary

pending completion of third-party appraisals and other fair value analysis of assets and liabilities. The results of operations of Ackerley have

been included in our financial statements beginning June 14, 2002.

Future Acquisitions and Dispositions

We evaluate strategic opportunities both within and outside our existing lines of business and from time to time enter into letters of intent to

purchase assets. Although we have no definitive agreements with respect to significant acquisitions or dispositions not set forth in this report,

we expect from time to time to pursue additional acquisitions and may decide to dispose of certain businesses. Such acquisitions or dispositions

could be material.

Shelf Registration Statement

On March 29, 2002, we filed a Registration Statement on Form S-3 covering a combined $3.0 billion of debt securities, junior subordinated

debt securities, preferred stock, common stock, warrants, stock purchase contracts and stock purchase units. The shelf registration statement

also covers preferred securities that may be issued from time to time by our three Delaware statutory business trusts and guarantees of such

preferred securities by us. The SEC declared this shelf registration statement effective on April 2, 2002.

Employees

At February 28, 2003, we had approximately 35,000 domestic employees and 6,800 international employees of which approximately 41,000

were in operations and approximately 800 were in corporate related activities. In addition, our live entertainment operations hire approximately

20,000 seasonal employees during peak time periods.

Operating Segments

Clear Channel consists of three reportable operating segments: radio broadcasting, outdoor advertising and live entertainment. The radio

broadcasting segment includes radio stations for which we are the licensee and for which we program and/or sell air time under local marketing

agreements or joint sales agreements. The radio broadcasting segment also operates radio networks. The outdoor advertising segment includes

advertising display faces for which we own or operate under lease management agreements. The live entertainment segment includes venues

that we own or operate, the production of Broadway shows and theater operations.

Information relating to the operating segments of our radio broadcasting, outdoor advertising and live entertainment operations for 2002,

2001 and 2000 is included in “Note M — Segment Data” in the Notes to Consolidated Financial Statements in Item 8 filed herewith.

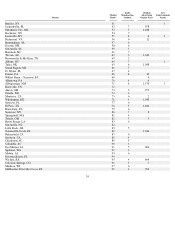

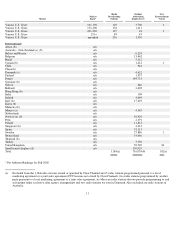

The following table sets forth certain selected information with regard to our radio broadcasting stations, outdoor advertising display faces

and live entertainment venues that we own or operate. At December 31, 2002, we owned 372 AM and 812 FM radio stations. At December 31,

2002, we owned or operated 144,097 domestic display faces and 571,942 international display faces. We also owned or operated 102 live

entertainment venues at December 31, 2002.

8