World Fuel Services 2004 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2004 World Fuel Services annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

logistics and operational support all feature in our value proposition

to global customers in the supply and purchasing communities.

Aviation Business:

In our aviation segment, 2004 was a year of continued success

across the spectrum. By continuing to diversify our portfolio, we

have continued to diversify our exposure to risk in any one seg-

ment of the market. We achieved growth in each of our key target

markets: passenger, cargo, charter, corporate and military. And in

spite of high oil prices and the much publicized financial woes of

the U.S. flag carriers, many parts of the market remain buoyant

with robust activity in U.N. charters, relief flights, global cargo

movements, military activity and corporate travel. Our largest cen-

ters of activity—the United States, United Kingdom, and

Singapore—all posted strong results and we were pleased to see

better-than-expected results from our smaller satellite offices in

Colombia and Russia. After eight years of developing our position

in China, we opened an office in Beijing on March 1, 2005. The

director of our newest office is the former director of fuel procure-

ment for Air China and is highly regarded in the international avia-

tion community. We have learned from our marine business that

having local representation in China is important to the business

model and we are excited about the prospects for growth in this

enormous emerging market.

On the services and logistics front, we continue to refine and

develop our business model in fuel management and expect

growth in this area in 2005. Our overall volume has grown as we

continue to demonstrate our ability to add value to our supply and

purchasing partners in a growing number of key markets. With the

continuing changes in the industry, our supply partners are work-

ing with us more closely to aggregate demand, de-risk their port-

folios and enhance their global marketing. This has significantly

raised our profile with the purchasing community. In the most

recent Armbrust survey of 71 global airlines, World Fuel Services

was ranked the best regional jet fuel marketer in North America.

Our team achieved high marks for best staff, best organizational

structure, most innovative, best informed and most improved.

This public validation of our service offering is a much deserved trib-

ute to our global team and what they have done to firmly establish

World Fuel Services as a global leader in the fuel services business.

We see tremendous promise in this area and have hired a

well-known industry expert to develop sales and supply

alliances with large fleets.

One of our most exciting areas of growth has been in the corpo-

rate space. We continue to focus on large aircraft and fractional

fleets and in 2004 entered into fuel procurement agreements with

Sentient Jets and Delta Air Elite. Both programs are off to a great

start. Baseops, our flight services business, had its best year ever

and our alliance with Jeppesen has resulted in over 500 new fuel

customers. We have achieved global acceptance of our brand and

firmly established World Fuel Services as the leading fuel solutions

provider for general aviation.

Accounting Changes/Sarbanes-Oxley:

Our greatest challenge in 2004 had nothing to do with our busi-

ness strategy or the commercial operating environment, but

rather with accounting protocol and Section 404 of Sarbanes-

Oxley. In March and May of 2005, we announced that the

Company’s historical financial statements would need to be

restated and that as a result of such restatement management

would conclude that the Company had three material weaknesses

in its internal controls over financial reporting. The restatement

and associated material weaknesses were directly attributable to

three required changes in our accounting. The first of these

changes related to the timing of when we recognize revenue. As a

result of this change, sales and sales-related costs will be recorded

based on the date fuel or related services are delivered, as

opposed to the date related documentation is received from our

third party service providers as had been our prior practice. This

will require us to make estimates going forward. The second

change related to how we account for inventory derivatives.

Under the changed protocol, unrealized gains and losses relating

to inventory derivatives will be recorded in the statements of

income as opposed to the balance sheet. These unrealized gains

or losses will ultimately be offset with the profit or loss on prod-

uct sales in future periods. The third and last change related to the

presentation of borrowings and repayments under our revolving

credit facility in the statement of cash flows. As a result of this

3

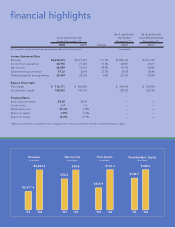

’04

’03

$1,027.0

$2,622.9

Revenue

(in millions)

Income From

Operations

(in millions)

’04

’03

$22.0

$29.1

AVIATION