Whole Foods 2007 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2007 Whole Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dear Fellow Stakeholders:

I would like to begin by appreciating our Team

Members for their hard work and dedication

and our customers, suppliers, and shareholders

for their continued support. This year was

another great year of growth for our company

and stakeholders. On a 52-week to 52-week

basis, our sales increased 15% to $6.6 billion

driven by 7% comparable stores sales growth

and 18%* ending square footage growth.

Our average weekly sales for the year were

$632,000* per store, a 7% increase year over year,

translating to sales per square foot of $923*.

We opened a record 21 new stores, a significant

increase over the 13 new store openings we

averaged over the previous five years. Our new

flagship store in London set new opening-day

and first-week company sales records, and

we hope to announce additional sites in the

U.K. in the near future. We also opened our

fourth store in New York City and completely

revitalized our brand image in the Chicago

area with the opening of four new stores.

After a very lengthy and expensive legal battle with

the Federal Trade Commission, we successfully

completed our merger with Wild Oats Markets

in the fourth quarter. One of the exciting benefits

from this merger is that we gained immediate

entry into 15 new markets and five new states.

We quickly sold the Henry’s and Sun Harvest

stores and closed nine Wild Oats stores

not fit our overall brand or real estate strategy.

Over time, we plan to relocate seven smaller

stores to larger stores that we currently have in

development. As a result of the merger, each of

our 11 operating regions added stores, with our

three smallest regions benefiting the most. At

year end, we operated 276 stores totaling 9.3

million square feet with locations in 37 states and

the District of Columbia, Canada and the U.K.

We believe our merger with Wild Oats will create

long-term value for our customers, vendors and

shareholders, as well as exciting opportunities

for our Team Members. Over time, we expect

to recognize significant synergies through G&A

cost reductions, greater purchasing power and

increased utilization of our facilities. Tremendous

strides have already been made operationally and

culturally thanks to the hard work and dedication

of our Team Members, both existing and new.

While the Wild Oats stores on average are older

and smaller than our stores, we believe that

over time we will raise their sales productivity to

levels in line with our stores. Sales at the stores

are already rapidly improving as customers

are enjoying an improved shopping experience

thanks to the expanded product offerings,

particularly on the fresh foods side, as well

as price cuts on over one thousand items.

LETTER TO STAKEHOLDERS

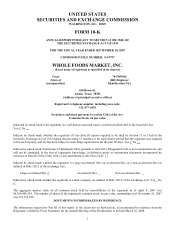

FINANCIAL HIGHLIGHTS

2007 2006 2005 2004 2003

SALES (000s)$6,591,773 $5,607,376 $4,701,289 $3,864,950 $3,148,593

NUMBER OF STORES AT END OF FISCAL YEAR 276 18 6 175 163 145

AVERAGE WEEKLY SALES PER STORE $617,000 $593,000 $537,000 $482,000 $424,000

COMPARABLE STORE SALES GROWTH 7.1 % 11.0% 12.8% 14.9% 8.6%

IDENTICAL STORE SALES GROWTH 5.8% 10.3% 11.5% 14.5% 8.1%

*Excludes acquired Wild Oats stores.

as they

did