Whirlpool 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

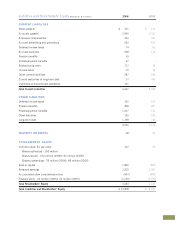

Investing Activities of Continuing Operations The

principal recurring investing activities are property additions,

which were $576 million, $494 million and $511 million in

2006, 2005 and 2004, respectively. These expenditures

are primarily for equipment and tooling, driven by product

innovation initiatives, more efficient production methods

and replacement for normal wear and tear. Expenditures

were also made to support Whirlpool’s global operating

platform footprint initiatives to lower-cost locations as well as

replacement, regulatory and infrastructure changes. During

2006, Whirlpool also increased capital spending to support

the integration of Maytag’s laundry production into our

existing Whirlpool manufacturing facilities.

In each of 2006, 2005 and 2004, Whirlpool entered into

separate sale-leaseback transactions whereby we sold

and leased back certain of our owned properties. In 2006,

proceeds related to the sale-leaseback of four properties,

net of related fees, were approximately $43 million.

Proceeds related to the sale-leaseback of four properties in

2005, net of related fees, were approximately $67 million. In

2004, proceeds related to sale-leasebacks of six properties,

net of related fees, were approximately $66 million.

Cash proceeds from sale of businesses of $36 million

during 2006 resulted from the sale of an equity investment

and non-core business in Brazil. Cash proceeds from sale of

businesses of $48 million in 2005 resulted from the sale of

a non-core business in Latin America.

During 2006, Whirlpool repurchased $53 million of minority

shares related to our operations in Latin America.

In 2006, Whirlpool also received cash proceeds, in total, of

$110 million related to the sale of the Amana commercial

microwave, Dixie-Narco vending systems and Hoover floor-

care businesses. Proceeds related to the sale of the Hoover

floor-care business do not reflect the full proceeds to be

received, as the sale was completed on January 31, 2007.

Cash disbursed in 2006 for the Maytag acquisition, net of

cash acquired, amounted to $797 million. Cash paid in

2005 associated with the Maytag acquisition totaled $77

million, primarily consisting of $40 million to reimburse

Maytag for its payment of a fee to terminate its prior merger

agreement with Triton Acquisition Holding Co. and $37

million of professional fees incurred in connection with

the proposed acquisition. These costs were capitalized

and recognized in the other asset line within Whirlpool’s

Consolidated Condensed Balance Sheet as of December

31, 2005.

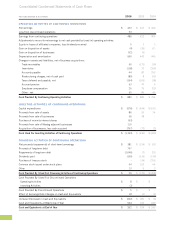

Financing Activities of Continuing Operations Total

borrowings (repayments) of short-term and long-term debt,

net of new borrowings, were $92 million, $(131) million and

$(58) million in 2006, 2005 and 2004, respectively.

During 2006, Whirlpool used available cash and issued

commercial paper to repay the Maytag 6.875% $200 million

principal notes, the 7.875% public interest notes with a

principal amount of $250 million and our Euro-denominated

Eurobonds with a principal amount of 300 million.

On June 19, 2006, Whirlpool received proceeds of $750

million aggregate principal amount of senior notes to

replace commercial paper borrowings used to initially

finance the Maytag acquisition.

Dividends paid to stockholders totaled $130 million,

$116 million and $116 million in 2006, 2005 and 2004,

respectively.

Under its stock repurchase programs in 2005 and 2004,

Whirlpool used $34 million and $251 million to purchase

approximately 0.5 million and 3.7 million shares of

common stock, respectively. No such purchases were

made during 2006.

Whirlpool received proceeds of $54 million in 2006, $102

million in 2005 and $64 million in 2004 related to the

exercise of company stock options.

FINANCIAL CONDITION AND LIQUIDITY

Whirlpool’s objective is to finance its business through

the appropriate mix of long-term and short-term debt. By

diversifying its maturity structure, we avoid concentrations

of debt, reducing liquidity risk. Whirlpool has varying

needs for short-term working capital financing as a result

of the nature of its business. The volume and timing of

refrigeration and air conditioning production impacts our

cash flows and consists of increased production in the first

half of the year to meet increased demand in the summer

months. Whirlpool finances its working capital fluctuations

primarily through the commercial paper markets in the U.S.,

Europe and Canada, which are supported by committed

bank lines. In addition, outside the U.S., short-term funding

is also provided by bank borrowings on uncommitted lines.

Whirlpool has access to long-term funding in the U.S.,

Europe and other public bond markets.