Walmart 1999 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 1999 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

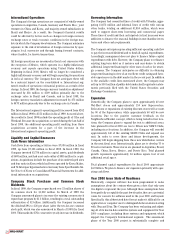

Accounting for derivative instruments and hedging activities

In June 1998, the Financial Accounting Standards Board issued

Statement No. 133, “Accounting for Derivative Instruments and

Hedging Activities.” The Statement will be effective for the Company

beginning February 1, 2000. The new Statement requires all deriva-

tives to be recorded on the balance sheet at fair value and establish-

es accounting treatment for three types of hedges: hedges of changes

in the fair value of assets, liabilities, or firm commitments; hedges of

the variable cash flows of forecasted transactions; and hedges of for-

eign currency exposures of net investments in foreign operations.

The Company is analyzing the implementation requirements and

currently does not anticipate there will be a material impact on the

results of operations or financial position after the adoption of

Statement No. 133.

Net income per share

Basic net income per share is based on the weighted average out-

standing common shares. Dilutive net income per share is based on

the weighted average outstanding shares reduced by the dilutive

effect of stock options.

Foreign currency translation

The assets and liabilities of most foreign subsidiaries are translated

at current exchange rates and any related translation adjustments

are recorded as a component of accumulated comprehensive

income. Operations in Mexico operate in highly inflationary

economies and certain assets are translated at historical exchange

rates and all translation adjustments are reflected in the

Consolidated Statements of Income. Beginning in fiscal 2000, Mexico

will no longer be considered highly inflationary and will begin report-

ing operations in local currency.

Estimates and assumptions

The preparation of consolidated financial statements in conformity

with generally accepted accounting principles requires management

to make estimates and assumptions. These estimates and assump-

tions affect the reported amounts of assets and liabilities and disclo-

sure of contingent assets and liabilities at the date of the consolidat-

ed financial statements and the reported amounts of revenues and

expenses during the reporting period. Actual results could differ

from those estimates.

Reclassifications

Certain reclassifications have been made to prior periods to conform

to current presentations.

2 Defined Contribution Plans

The Company maintains profit sharing plans under which most full-

time and many part-time associates become participants following

one year of employment and a 401(k) plan in which the same asso-

ciates may elect to contribute up to 10% of their earnings.

The Company will make annual contributions to these plans on

behalf of all eligible associates, including those who have not

elected to contribute to the 401(k) plan.

Annual Company contributions are made at the sole discretion of

the Company, and were $388 million, $321 million and

$247 million in 1999, 1998 and 1997, respectively.

3 Commercial Paper and Long-term Debt

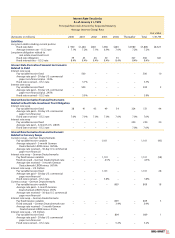

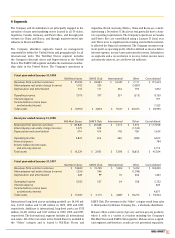

Information on short-term borrowings and interest rates is as follows (dollar amounts in millions):

Fiscal years ended January 31, 1999 1998 1997

Maximum amount outstanding at month-end $ 1,976 $ 1,530 $ 2,209

Average daily short-term borrowings 256 212 1,091

Weighted average interest rate 5.1% 5.6% 5.3%

At January 31, 1999 and 1998, there were no short-term borrowings

outstanding. At January 31, 1999, the Company had committed

lines of credit of $1,872 million with 78 banks and informal lines of

credit with various banks totaling an additional $1,950

million, which were used to support short-term borrowings and

commercial paper. Short-term borrowings under these lines of

credit bear interest at or below the prime rate.

Long-term debt at January 31, consists of (amounts

in millions):