Walgreens 2009 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2009 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Results of Operations

and Financial Condition

Restructuring Charges

On October 30, 2008, we announced a series of strategic initiatives, approved by

the Board of Directors, to enhance shareholder value. One of these initiatives was

aprogram designed to reduce cost and improve productivity through strategic

sourcing of indirect spend, reducing corporate overhead and work throughout our

stores, rationalization of inventory categories, realignment of pharmacy operations

and transforming the community pharmacy. In conjunction with these initiatives

approximately $300 million to $400 million of pre-tax costs were anticipated over

fiscal 2009 and 2010.

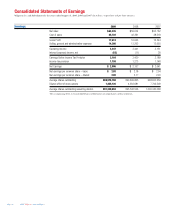

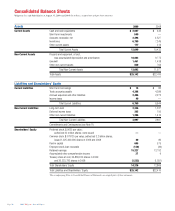

As of August 31, 2009, we have recorded the following pre-tax charges associated

with our restructuring initiatives within the Consolidated Statement of Earnings

(In millions):

Twelve Months Ended August 31, 2009

Severance and other benefits $ 74

Project cancellation settlements 7

Inventory charges 63

Restructuring expense 144

Consulting 76

Restructuring and restructuring related costs $220

Cost of sales $ 63

Selling, general and administrative expense 157

$220

The $74 million of severance and other benefits includes the charges associated

with 432 employees who participated in the voluntaryseparation program and

265 employees who were involuntarily separated from the Company. Prior to their

last dayof service, 143 people who were previouslynotified that their positions

had been eliminated subsequently found open positions within the Company.

All severance and benefits associated with these people have been reversed.

Inventory charges consist of on-hand inventory that has been reduced from cost to

current selling prices and the loss we incurred on the sale of inventorybelow cost.

In addition, as a part of our restructuring efforts we sold an incremental amount of

inventory below traditional retail prices. The dilutive effect of these sales on gross

profit for the year ended August 31, 2009, was $32 million.

Additionally, in conjunction with our Customer Centric Retailing (CCR) initiative, we

are enhancing the store format to ensure we have the proper assortments, better

category layouts and adjacencies, better shelf height and sight lines and better

assortment and brand layout, all of which are designed to positively enhance the

shopper experience and increase customer frequency and purchase size. This format

will be rolled out to approximately 5,000 to 5,500 stores. Fiscal 2009 included

202 stores; we plan to enhance approximately 2,600 stores in fiscal 2010 and the

remaining stores in fiscal 2011. Although we will continue to refine our estimates

as the rollout progresses, based on our current experience with the first 202

stores, we expect the total cost to be $30 thousand to $50 thousand per store.

As of August 31, 2009, we incurred selling, general and administrative expenses

of $5 million related to this program.

Weincurred pre-tax costs of $257 million ($220 million of restructuring and restruc-

turing related costs, $32 million of gross profit dilution and $5 million of CCR store

remodel costs) in fiscal 2009. We anticipate approximately $140 million of pre-tax

restructuring and restructuring related costs and gross profit dilution in fiscal 2010.

Additionally, we anticipate between $78 million and $130 million in pre-tax CCR

store remodel costs in fiscal 2010.

Introduction

Walgreens is principally a retail drugstore chain that sells prescription and non-

prescription drugs and general merchandise. General merchandise includes, among

other things, household items, personal care, convenience foods, beauty care,

photofinishing, candy and seasonal items. Customers can have prescriptions

filled in retail pharmacies, as well as through the mail, by telephone and via the

Internet. As of August 31, 2009, we operated 7,496 locations in 50 states, the

District of Columbia, Guam and Puerto Rico. Total locations do not include 337

convenient care clinics operated by Take Care Health Systems, Inc.

Number of Locations

Location Type 2009 2008 2007

Drugstores 6,997 6,443 5,882

Worksite Facilities 377 364 3

Home Care Facilities 105 115 101

Specialty Pharmacies 15 10 8

Mail Service Facilities 223

Total 7,496 6,934 5,997

The drugstore industry is highly competitive. In addition to other drugstore chains,

independent drugstores and mail order prescription providers, we compete with

various other retailers including grocery stores, convenience stores, mass merchants

and dollar stores.

The long-term outlook for prescription utilization is strong due in part to the aging

population and the continued development of innovative drugs that improve quality

of life and control health care costs. Certain provisions of the Deficit Reduction Act

of 2005 seek to reduce federal spending by altering the Medicaid reimbursement

formula for multi-source (i.e., generic) drugs. These changes are expected to result

in reduced Medicaid reimbursement rates for prescription drugs. Also, in conjunction

with a recently approved class action settlement with two entities that publish

the average wholesale price (AWP) of pharmaceuticals, the methodology used to

calculate the AWP, a pricing reference widely used in the pharmacy industry,

was changed in a way that reduced the AWP for many brand-name prescription

drugs effective September 26, 2009. The Company has reached understandings

with most of its third-party payors to adjust reimbursements to correct for this

change in methodology, but state Medicaid programs thatutilize AWP as a pricing

reference have not taken action to make similar adjustments, which is expected

to result in reduced Medicaid reimbursement levels in fiscal 2010. In addition,

the federal government has been considering proposals to reform the U.S. heath

care system. These proposals may increase government involvement in health

care, increase regulation of pharmacy services, result in changes to pharmacy

reimbursement rates or otherwise change the waywe do business. The effect of

these proposals could have an impact on our results of operations.

Front-end sales have continued to grow due to new store openings and strengthening

core categories, such as over-the-counter non-prescription drugs, household items,

convenience foods and personal care products. Walgreens strong name recognition

continues to drive private brand sales, which are included in these core categories.

Wecontinue to expand into new markets and increase penetration in existing

markets. Tosupport our growth, we are investing in prime locations, technology

and customer service initiatives. Retail organic growth continues to be our primary

growth vehicle; however, consideration is given to retail and other acquisitions that

provide unique opportunities and fit our business strategies, such as the acquisitions

of select locations of Drug Fair to our drugstore operations and McKesson Specialty

and IVPCARE to our specialty pharmacy operations.

Page 18 2009 Walgreens Annual Report