Vtech 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Letter to Shareholders

2VTech Holdings Ltd Annual Report 2012

Dear Shareholders,

I am pleased to report that in our 35th anniversary year, VTech

delivered record revenue for the second straight year amid

macro-economic uncertainties.

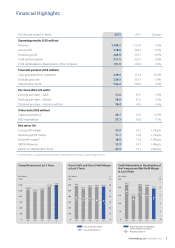

Results and Dividend

Group revenue for the year ended 31 March 2012 increased

by 4.2% over the previous financial year to US$1,784.5 million.

This was mainly due to higher revenue in North America and

Europe, as both Electronic Learning Products (ELPs) and Contract

Manufacturing Services (CMS) recorded growth in these two

regions. Profit attributable to shareholders of the Company

declined by 5.0% to US$191.9 million. The decrease in profit was

mainly attributable to higher input costs as well as lower revenue

from Telecommunication (TEL) products. Basic earnings per share

consequently decreased by 5.5% to US77.0 cents, compared to

US81.5 cents in the financial year 2011.

The Board has proposed a final dividend of US60.0 cents per

ordinary share. Together with the interim dividend of US16.0 cents

per ordinary share, this gives a total dividend for the year of

US76.0 cents per ordinary share. It represents a decrease of 2.6%

over the previous financial year.

Operations

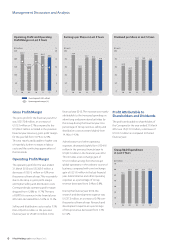

In the financial year 2012, rising input costs posed the biggest

challenge to the Group. Raw material prices increased substantially,

compounded by rising labour costs and Renminbi appreciation

in China. To cope with this, we have raised prices, stepped up cost

reduction and improved efficiency through increased automation

and product optimisation. Although we were unable to offset the

entire cost pressure during the year, we managed to mitigate it to

a great extent. This will improve the Group’s ability to achieve

future growth.

Segment Results

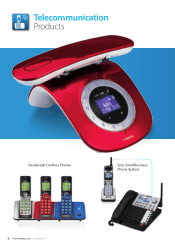

North America remains the largest market of the Group. In the

financial year 2012, we achieved higher sales in ELPs and CMS in

this region, offsetting slightly lower revenue from TEL products.

Sales of small to medium sized business (SMB) phones increased

and compensated for part of the sales decline in residential

phones. Hotel phones began to contribute to the top line

following the first shipment in the second half of the financial year.

ELP revenue in North America was higher and sales via online

retailers showed strong growth. Higher sales were attributable to

the successful launch of the new platform product, InnoTab®, while

sales of standalone products were essentially flat. CMS revenue

saw good growth in North America, driven by higher sales of

professional audio equipment and internet phones for office use.

In Europe, revenue from TEL products was lower, as customers

delayed orders in the second half. However, this was more than

compensated by higher sales of ELPs and CMS. Both platform and

standalone products delivered solid results for ELPs. In the platform

area, InnoTab was launched in the UK, while Storio® and MobiGo®

were rolled out in the other European markets. CMS saw higher

sales, led by wireless headsets and professional audio equipment.

Revenue in Asia Pacific and other regions declined overall, mainly

due to lower sales of TEL products. Our ELP sales in China grew

strongly, albeit from a low base. CMS revenue in Asia Pacific was

broadly flat, as higher sales of medical and wireless products

were offset by significantly lower orders for LED light bulbs, as our

Japanese customer faced very keen competition.

Outlook

Although the macro-economic environment remains challenging,

we are seeing a slow but continuous recovery in the US. In Europe,

consumer demand is affected by austerity measures and the

economic uncertainty.

Despite all these challenges, we are planning for overall top line

growth in the financial year 2013. Sales of our TEL products will

rebound, driven by additional placement in retail channels in

the US, increasing sales of SMB and hotel phones and restocking

in Europe. ELPs are expected to grow, led by the launch of

new platform and standalone products. CMS will continue to

outperform the global electronic manufacturing services (EMS)

industry and expand further.

With the anticipated growth in our top line, we are cautiously

optimistic that profitability will improve. Lower prices of raw

materials are beginning to feed into margin. Profitability will also

be supported by the efficiency enhancement measures that we

pushed hard in the last financial year, including higher automation

and product design optimisation. However, we expect the labour

cost in China will continue to rise. As always, we will continue to

manage our expenses very tightly.

We foresee a rebound for our TEL products in the financial year

2013. As the world’s number one manufacturer of cordless

phones1, our strong design capabilities, economies of scale and

brand reputation will further strengthen our leadership position.

In North America, we expect the good momentum of SMB and

hotel phones to continue. In the first half of the financial year 2013,

we plan to launch a new micro business phone system that will

add further impetus. Sales of our residential phones are expected

to recover, as we gain market share via new product line ups. These

include a new Connect to Cell™ system with high definition voice

quality, user-friendly cell phone registration as well as smartphone

1 The Global Telecommunications Market Report 2011 Edition published by MZA Ltd