Vonage 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

F-36 VONAGE ANNUAL REPORT 2014

accelerated, such that they are fully vested and exercisable as of the

Effective Time.

We acquired Vocalocity for $134,167, including 7,983 shares

of Vonage common stock (which shares had an aggregate value of

approximately $26,186 based upon the closing stock price on November

15, 2013) and cash consideration of $107,981 including payment of

$2,869 for excess cash as of closing date, subject to adjustments for

closing cash and working capital of Vocalocity, reductions for

indebtedness and transaction expenses of Vocalocity that remained

unpaid as of closing, and deposits into the escrow funds, pursuant to

the Merger Agreement. We financed the transaction with $32,981 of

cash and $75,000 from our revolving credit facility. The aggregate

consideration will be allocated among holders of: (i) Vocalocity preferred

stock, (ii) Vocalocity common stock, (iii) vested options to purchase

Vocalocity common stock, and (iv) warrants to purchase Vocalocity

preferred stock.

During 2013, we incurred $2,768 in acquisition related

transaction and integration costs, which were recorded in selling,

general and administrative expense in the accompanying Consolidated

Statements of Operations.

The Acquisition was accounted for using the acquisition

method of accounting under which assets and liabilities of Vocalocity

were recorded at their respective fair values including an amount for

goodwill representing the difference between the acquisition

consideration and the fair value of the identifiable net assets.

The acquisition price was allocated to the tangible and

identified intangible assets acquired and liabilities assumed as of the

closing date of the Acquisition. Subsequent to the acquisition date, we

decreased the deferred tax liabilities, net, non-current by $3,393 based

upon updated information with respect to NOL utilization.

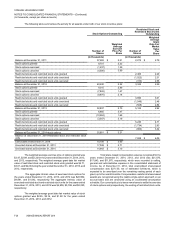

The table below summarizes the assets acquired and liabilities assumed as of November 15, 2013 as follows:

Estimated Fair Value

Assets

Current assets:

Cash and cash equivalents $ 7,924

Accounts receivable 275

Prepaid expenses and other current assets 787

Total current assets 8,986

Property and equipment 1,777

Intangible assets 75,000

Other assets 53

Total assets acquired 85,816

Liabilities

Current liabilities:

Accounts payable 2,226

Accrued expenses 7,064

Deferred revenue, current portion 1,986

Total current liabilities 11,276

Deferred tax liabilities, net, non-current 24,000

Total liabilities assumed 35,276

Net identifiable assets acquired 50,540

Goodwill 83,627

Total purchase price $ 134,167

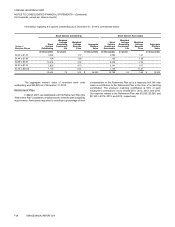

The intangible assets as of the closing date of the Acquisition included:

Amount

Customer relationships $ 39,100

Developed technologies 35,200

Trade names 500

Non-compete agreements 200

$75,000

Indications of fair value of the intangible assets acquired in

connection with the Acquisition were determined using either the

income, market or replacement cost methodologies. The intangible

assets are being amortized over periods which reflect the pattern in

which economic benefits of the assets are expected to be realized. The

customer relationships and developed technology are being amortized

on an accelerated basis over an estimated useful life of ten years; trade

names are being amortized on a straight-line basis over five years; and

the non-compete agreements are being amortized on a straight-line

basis over two years.

The excess of purchase price over the fair value amounts

assigned to the assets acquired and liabilities assumed represents the

amount of goodwill resulting from the Acquisition. We do not expect any

portion of this goodwill to be deductible for tax purposes. The goodwill