Visa 2007 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2007 Visa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236

|

|

Table of Contents

We believe that the shift to electronic payment forms is a worldwide phenomenon; however, in many developing countries, it is at an early stage and

will be accelerated by rising incomes, globalization of commerce and increased travel. Recent innovations such as contactless cards and mobile payments are

also increasing the attractiveness of electronic payments. We believe these trends create a substantial growth opportunity for the global payments industry.

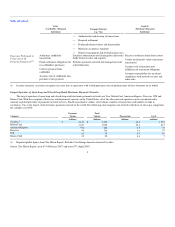

According to The Nilson Report, global card purchase transactions grew at a CAGR of 14% over the period from 2000 to 2006. The Nilson Report forecasts

global card purchase transactions to increase at a CAGR of 11% from 2006 to 2012, with particularly strong growth in Asia/Pacific, Latin America and the

Middle East/Africa:

Source: The Nilson Report, issue 866 (October 2006) and issue 885 (August 2007).

The most common card-based forms of payment are general-purpose cards, which are payment cards that permit widespread usage. General purpose

cards are typically categorized as:

• "pay now" cards, such as debit cards, which enable the cardholder to purchase goods and services by an automatic debit to a checking, demand

deposit or other current account;

• "pay later" cards, which typically permit a cardholder to carry a balance in a revolving credit account (a credit card or deferred debit card) or

require payment of the full balance within a specified period (a charge card); and

• "pay before" cards, such as prepaid cards, which are prefunded up to a certain monetary value.

The primary global general purpose card brands include Visa, MasterCard, American Express, Discover, JCB and Diners Club. While these brands—

including Visa—were historically associated primarily with credit or charge cards in the United States and other major international markets, Visa and others

have over time broadened their offerings to include debit, ATM, prepaid and commercial cards.

In addition to general purpose cards, a number of retailers and other entities issue limited-purpose credit, charge and prepaid cards that can be used for

payment only at the issuing entity. These cards are generally referred to as private label cards. Private label cards are sometimes issued by a financial

institution under a contractual agreement with the retailer.

7