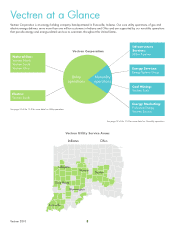

Vectren 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 Vectren annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Achieving Consistent

Earnings Growth

For our utilities, our goal is to continue

to enhance productivity, improve

on customer service and help our

customers focus on energy efficiency.

Likewise, we must work diligently to

minimize pressure on rates and achieve

steady growth. Under the pressures of

rising operating costs, limited growth

in the number of utility customers

and the ever-present need to invest

capital dollars in utility infrastructure,

the question quickly arises: how do

we continue to meet shareholder

expectations regarding earnings while

holding down customer rates? Chief in

the plan is to continue to better manage

resources and earn our allowed returns

provided in rate cases. On the nonutility

side, we will focus less of our future

investments on commodity-driven

businesses that often come with greater

risk and less predictable earnings

based on economic conditions and

changes in market dynamics.

To help with this endeavor of consistent

earnings growth for the utility, we

have assembled an internal group

to institutionalize performance

management principles and have

strengthened our emphasis on

effective strategic sourcing. The

performance management team,

which was put in place in late 2010,

will take actions needed to achieve

performance targets at the business

unit level. Ultimately, this will allow

employees to be better engaged in

using problem-solving and process-

improvement tools to find efficiencies

and eliminate redundancies. A focus

on strategic sourcing accompanies

the performance management push

by enhancing contracts with vendors

and in facilitating more in-depth

bidding processes. These collective

efforts will ensure we’ll be able to even

more effectively manage and reduce

operating and capital costs to achieve

significant savings over the next five

years.

Although we don’t expect the capital

needs of our utility infrastructure

system to decrease, we do believe

there are opportunities for better

resource allocation and to manage

our gas and electric businesses to a

cash flow neutral position. We can do

so by better managing major capital

projects and our operating expenses

with the intent to reduce the need for

incremental external financing and base

rate increases, which benefits customers

and shareholders.

Growing Our Existing

Nonutility Businesses

The intent of future investments in our

nonutility portfolio is to reduce exposure

to volatile energy commodity prices and

the financial risk that comes with them.

As such, our nonutility companies that

fall in our Infrastructure Services and

Energy Services segments provide better

opportunity for consistent growth. For

Infrastructure Services, which houses

Miller Pipeline (Miller), a number of key

drivers suggest demand will continue

growing in areas such as:

• the replacement of bare steel and

cast iron natural gas distribution

systems;

• infrastructure needed for production

and pipeline expansion given the

development of shale gas reserves;

• potential safety legislation

surrounding natural gas infrastructure

stemming from recent, highly

publicized pipeline incidents; and

• aging infrastructure and

environmental issues surrounding

water and waste water.

Miller’s 2010 annual earnings were

$3.1 million compared to $2.4 million in

2009. The increase resulted from higher

net revenues, which were $197 million

compared to $174 million in 2009, and

an increase in hours worked, which were

up 4 percent. With the proven experience

and expertise of Miller, we’re poised to

be an even larger national player in the

infrastructure services market.

To position ourselves for additional

opportunities in the energy services

market, we created a new nonutility

segment, Energy Services, to house

Energy Systems Group (ESG). ESG

competes in a business segment that

is ripe for further, significant growth.

Specializing in performance contracting,

renewable energy and energy center

management, 2010 proved to be a

productive year for ESG with earnings

of $6.4 million compared to $8.4

million in 2009. The lower results

in 2010 principally stem from lower

earnings from renewable energy

activities, partially offset by continued

growth in performance contracting

operations. ESG’s backlog of contracted

work in 2010 reached a record $118

million, compared to $70 million in

2009, indicating substantial work in the

near term. More importantly, several

factors indicate further growth is likely,

including the potential for energy

efficiency measures and retrofits to

significantly reduce energy consumption

and an increased national focus on cost

reductions stemming from the economic

downturn, particularly for hospitals,

universities, governments and schools,

which are ESG’s target markets.

The development and operation

of renewable energy projects also

represents a prime opportunity for

Vectren 2010

3

$300

250

200

150

100

Utility O&M*

In Millions

‘06 ‘07 ‘08 ‘09 ‘10

*Excluding pass-through costs