Vectren 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 Vectren annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Letter To Shareholders:

Live Smart. Simple words that have endless meaning.

For Vectren, it’s the philosophy we have adopted in our

partnership with customers that promotes using energy

wisely in the uncertain times ahead. In 2008, we modied

our mission statement and expanded our energy efciency

programs and sustainability efforts to reect this new

cooperative environment. In addition, we ofcially changed

our brand to Live Smart.

This concept is spreading throughout both our utility and

nonutility businesses. Whether we’re providing an incentive

for a residential customer to purchase a high-efciency water

heater, tapping an Indiana landll to harvest bio-fuel or

transitioning our energy delivery eet to hybrid vehicles, our

goal is to become an industry leader in helping customers

manage their energy usage as well as our own. This new

customer relationship will help us adapt to the ever-changing

energy business through innovative regulatory solutions and

an evolving business model that has helped us align our

interests with those of all our stakeholders.

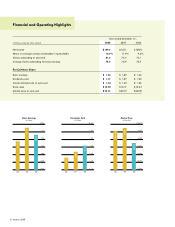

2008 Financial Results

2008 was certainly a break-through year from a customer

focus standpoint; however, from a nancial perspective, we

encountered some challenges. Reported 2008 net income

was $129.0 million, or $1.65 per share, compared to 2007

results of $143.1 million, or $1.89 per share.

Vectren’s 2008 utility earnings were $111.1 million,

compared to $106.5 million in 2007. The $4.6 million

increase was primarily due to a full year of base rate

changes in the Indiana service territories and increased

earnings from wholesale power operations. Increases were

partially offset by increased operating costs associated with

maintenance and reliability programs contemplated in the

base rate cases and less favorable weather in 2008. Over

the last 18 months, Vectren has brought to conclusion base

rate adjustments in all of our service territories, the most

recent being the Ohio rate order approved in January 2009.

Included in our natural gas rate orders are mechanisms that

allow Vectren to promote customer conservation efforts while

maintaining and improving system reliability. These orders

also include new rate designs that provide a more stable

recovery of our xed operating costs.

Vectren’s 2008 nonutility earnings were $18.9 million,

compared to $37.0 million in 2007. Earnings from our

primary nonutility operations, Energy Marketing and Services,

Coal Mining and Energy Infrastructure Services in 2008

were $24.8 million, compared to $33.7 million in 2007. Coal

Mining operated at a loss, and results were approximately

$6.6 million lower than the prior year due primarily to

lower production and increased roong structure costs as

a result of revised Mine Safety and Health Administration

regulatory guidelines that necessitated changes to the mining

plan. ProLiance Energy’s (ProLiance) earnings were $3.6

million lower than the prior year due to lower operating

results as well as a reserve for a Federal Energy Regulatory

Commission matter pertaining to pipeline capacity release

policies. ProLiance has taken the corrective actions needed to

assure that current and future transactions are in compliance.

The results from the other primary nonutility operations

reect record earnings from the performance contracting

and renewable energy construction operations of Energy

Systems Group (ESG) and the retail gas marketing

operations of Vectren Source. Miller Pipeline’s (Miller)

results were comparable to the prior year, which was a

record year for Miller.

Other nonutility businesses are comprised of legacy

investments, including investments in commercial real

estate. As a result of the economy impacting commercial

real estate values during 2008, the company recorded an

after-tax impairment charge of $5.9 million associated

with these investments.

Vectren 2008 3