Vectren 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Vectren annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

live smart

using energy wisely

2008 Annual Report and Form 10-K

Contains 10% post-consumer recycled ber

You can make a difference by agreeing to receive future annual meeting material

This report is printed on FSC-certied paper made with 10% post-consumer waste. The FSC sets standards to ensure

The inks used in the printing of this report contain an average of 25%-35% vegetable oils from plant derivatives, a

renewable resource. They replace petroleum inks as an effort also to reduce volatile organic compounds (VOC’s).

investors a powerful and unied voice with the single mission of making permanent the

current 15 percent dividend tax rate beyond 2010. The campaign is sponsored by

various associations, organizations and companies with the support of their members,

organization focused on state and national issues that specically impact utility shareholder

value. The IUSA will be holding meetings throughout the state, including the opportunity to

Table of contents

-

Page 1

2008 Annual Report and Form 10-K live smart using energy wisely -

Page 2

...of gas and electric services. uTILITY OPEraTIOnS naTuraL GaS: Vectren North Vectren South Vectren Energy Delivery of Ohio ELECTrIC: Vectren South Vectren Energy Delivery's natural gas distribution businesses provide natural gas service to nearly one million customers in adjoining service territories... -

Page 3

... inefficient gas appliances and home weatherization to our nonutility businesses providing commercial clients with the means to reduce their energy needs. For our own part, we are purchasing power from Indiana wind farms and investing in hybrid utility vehicles. We look to these efforts as a way to... -

Page 4

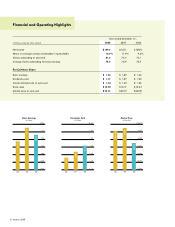

... 2006 $108.8 9.4% 76.1 75.7 Net income Return on average common shareholders' equity (ROE) Shares outstanding at year-end Average shares outstanding for basic earnings Per Common Share Basic earnings Dividends paid Annual dividend rate at year-end Book value Market price at year-end $ 1.65 $ 1.31... -

Page 5

... base rate changes in the Indiana service territories and increased earnings from wholesale power operations. Increases were partially offset by increased operating costs associated with maintenance and reliability programs contemplated in the base rate cases and less favorable weather in 2008. Over... -

Page 6

... Indiana efforts. Included in our recent Ohio rate order was the approval for the expenditure of up to $5 million annually for customer energy efficiency programs. The programs, which will debut in April, include rebate offerings on high-efficiency natural gas appliances for residential customers... -

Page 7

... to our efforts to promote efficient use of electricity, we have begun utilizing local sources of renewable power. This past summer Vectren purchased 30 megawatts (MW) of generation from a Benton County, Indiana, wind farm; and in early 2009, we filed for regulatory approval to add another 50 MW... -

Page 8

.... On the renewable energy front, ESG has constructed and is operating the first bio-fuel generated power source in southwestern Indiana, which is being sold to Vectren's utility. Located at the Veolia Environmental Services landfill in Pike County, this 3.2 MW sustainability project will power up to... -

Page 9

... increase capital expenditures when current credit markets begin to correct. Looking Forward It goes without saying that 2009 will be a challenging year for our customers given the economic downturn that has left no one's life untouched. Although natural gas prices have N A ignment Vectren 2008... -

Page 10

.... 2008 marked the 49th consecutive year annual dividends paid have increased, and in December, the dividend rate was increased 3.1 percent. For many utility shareholders, reliable dividends, such as Vectren's, provide a much needed source of income to pay everyday bills. Regrettably, the current 15... -

Page 11

...to _____ Commission file number: 1-15467 VECTREN CORPORATION (Exact name of registrant as specified in its charter) INDIANA (State or other jurisdiction of incorporation or organization) One Vectren Square (Address of principal executive offices) Registrant's telephone number, including area code... -

Page 12

... (gigawatt hours) OCC: Ohio Office of the Consumer Counselor OUCC: Indiana Office of the Utility Consumer Counselor PUCO: Public Utilities Commission of Ohio SFAS: Statement of Financial Accounting Standards USEPA: United States Environmental Protection Agency Throughput: combined gas sales and gas... -

Page 13

...electronically filing or furnishing the reports to the SEC, or by request, directed to Investor Relations at the mailing address, phone number, or email address that follows: Mailing Address: One Vectren Square Evansville, Indiana 47708 Phone Number: (812) 491-4000 Investor Relations Contact: Steven... -

Page 14

... Indiana. The Ohio operations provide energy delivery services to approximately 317,000 natural gas customers located near Dayton in west central Ohio. The Ohio operations are owned as a tenancy in common by Vectren Energy Delivery of Ohio, Inc. (VEDO), a wholly owned subsidiary of Utility Holdings... -

Page 15

... Indiana, and the Company's power generating and wholesale power operations. In total, these regulated operations supply natural gas and/or electricity to over one million customers. The Utility Group's other operations are not significant. Gas Utility Services At December 31, 2008, the Company... -

Page 16

...an annual bidding process for VEDO's gas supply and portfolio administration services. From November 1, 2005 through September 30, 2008, the Company used a third party provider for these services. Prior to October 31, 2005, ProLiance also supplied natural gas to Utility Holdings' Ohio operations. On... -

Page 17

.... New pricing reflects current Illinois Basin market prices and will result in substantially higher costs in 2009, compared to prior years. Firm Purchase Supply The Company maintains a 1.5 percent interest in the Ohio Valley Electric Corporation (OVEC). OVEC is comprised of several electric utility... -

Page 18

...the present time, Indiana has not adopted such legislation. Ohio regulation allows gas customers to choose their commodity supplier. The Company implemented a choice program for its gas customers in Ohio in January 2003. At December 31, 2008, over 80,000 customers in Vectren's Ohio service territory... -

Page 19

... 2008, 2007, and 2006, are included as Exhibit 99.1 to this Form 10-K. Vectren Source Vectren Retail, LLC (d/b/a Vectren Source) provides natural gas and other related products and services in the Midwest and Northeast United States to over 170,000 residential and commercial customers. This customer... -

Page 20

.... Coal is also transported via truck to its customers, which include Vectren's power supply operations and other third party utilities. The mine opened in 2001, and the total plant and development costs to date are $152 million. Through December 31, 2008, approximately 4,000 acres of coal have been... -

Page 21

...through Miller Pipeline Corporation (Miller) and energy performance contracting and renewable energy services through Energy Systems Group, LLC (ESG). Miller's customers include Vectren's utilities. Miller Pipeline Effective July 1, 2006, the Company purchased the remaining 50 percent of Miller from... -

Page 22

...which 1,600 are employees of Miller and 2,200 are subject to collective bargaining arrangements. Utility Holdings In December 2008, the Company reached a three-year labor agreement, ending December 1, 2011 with Local 1393 of the International Brotherhood of Electrical Workers and United Steelworkers... -

Page 23

... estate and other legacy investments. Vectren's gas and electric utility sales are concentrated in the Midwest. The operations of the Company's regulated utilities are concentrated in central and southern Indiana and west central Ohio and are therefore impacted by changes in the Midwest economy in... -

Page 24

... will significantly mitigate weather risk related to Ohio residential gas sales. Risks related to the regulation of Vectren's utility businesses, including environmental regulation, could affect the rates the Company charges its customers, its costs and its profitability. Vectren's businesses are... -

Page 25

... or regulatory actions taken to address global climate change or mandate renewable energy sources could substantially affect both the costs and operating characteristics of the Company's fossil fuel generating plants and possibly natural gas distribution businesses. Further, any legislation would... -

Page 26

... of electric generating capacity or purchased power available, beyond that needed to meet firm service requirements. If Vectren does not accurately forecast future commodities prices or if its hedging procedures do not operate as planned in certain nonutility businesses, the Company's net income... -

Page 27

... a number of factors. The market for Illinois Basin coal reflects limited supply and increased demand, which has resulted in substantially higher coal prices. Contracts reflecting these higher prices are in place on 70 percent of 2009 and 2010 planned production. As a result, coal mining operations... -

Page 28

... supplying the Ohio operations with natural gas, and those suppliers are responsible for the demand charges. The Ohio operations' gas delivery system includes 5,500 miles of distribution and transmission mains, all of which are located in Ohio. Electric Utility Services SIGECO's installed generating... -

Page 29

... The Company's common stock trades on the New York Stock Exchange under the symbol ''VVC.'' For each quarter in 2008 and 2007, the high and low sales prices for the Company's common stock as reported on the New York Stock Exchange and dividends paid are presented below. Cash Dividend 2008 First... -

Page 30

... chart contains information regarding open market purchases made by the Company to satisfy those plans during the quarter ended December 31, 2008. Period October 1-31 November 1-30 December 1-31 Number of Shares Purchased 33,841 - Average Price Paid Per Share $ 27.24 - Total Number of Shares... -

Page 31

... changes. The Utility Group generates revenue primarily from the delivery of natural gas and electric service to its customers. The primary source of cash flow for the Utility Group results from the collection of customer bills and the payment for goods and services procured for the delivery of gas... -

Page 32

...other primary nonutility operations also reflect increased earnings from performance contracting and renewable energy construction operations performed through Energy Systems Group and retail gas marketing operations performed through Vectren Source. Miller Pipeline's (Miller) results were generally... -

Page 33

... ice storm in the Company's southern Indiana territory resulted in an extended disruption of electricity to approximately 75,000 of the Company's 141,000 electric customers. Electricity was restored to substantially all customers within one week. Management estimates the total cost of restoration... -

Page 34

...distribution business, which provides electric distribution services primarily to southwestern Indiana, and the Company's power generating and wholesale power operations. In total, these regulated operations supply natural gas and/or electricity to over one million customers. Utility Group operating... -

Page 35

... with gas and fuel costs, as well as other tracked expenses. Expenses subject to tracking mechanisms include Ohio bad debts and percent of income payment plan expenses, Indiana gas pipeline integrity management costs, and costs to fund Indiana energy efficiency programs. Certain operating costs... -

Page 36

... Company resolved all remaining issues related to a 2005 disallowance by the PUCO of gas costs incurred by the Ohio utility operations, resulting in an additional charge of $1.1 million. Electric Utility Margin (Electric Utility revenues less Cost of fuel and purchased power) Electric Utility margin... -

Page 37

...in June 2008, the Company began earning a return on electric transmission projects constructed by the Company in its service territory that benefit reliability throughout the region. These returns primarily account for the year over year increase of $4.8 million in transmission system sales. For the... -

Page 38

... million in debt-related proceeds were received and used to retire short-term borrowings and other long-term debt. Utility Group Income Taxes Federal and state income taxes increased $0.9 million in 2008 compared to 2007 and $19.0 million in 2007 compared to 2006. The changes are impacted primarily... -

Page 39

... use of renewable energy sources as a supplement to base load coal generation including effective energy conservation, demand side management and generation efficiency measures; A flexible market-based cap and trade approach with zero cost allowance allocations to coal-fired electric generators. The... -

Page 40

... Company's Indiana and Ohio gas utility service territories; ï,· Participation in an electric conservation and demand side management collaborative with the OUCC and other customer advocate groups; ï,· Evaluating potential carbon requirements with regard to new generation, other fuel supply sources... -

Page 41

... allowance prices. Costs to purchase allowances that cap greenhouse gas emissions should be considered a cost of providing electricity, and as such, the Company believes recovery should be timely reflected in rates charged to customers. Approximately 22 percent of electric volumes sold in 2008 were... -

Page 42

... Indiana customers are regulated by the IURC. The retail gas operations of the Ohio operations are subject to regulation by the PUCO. Gas rates in Indiana contain a gas cost adjustment (GCA) clause. The GCA clause allows the Company to charge for changes in the cost of purchased gas. Electric rates... -

Page 43

... of pipeline integrity management expense; timely recovery of costs associated with the accelerated replacement of bare steel and cast iron pipes, as well as certain service risers; and expanded conservation programs now totaling up to $5 million in annual expenditures. Vectren Energy Delivery Ohio... -

Page 44

... in the MISO energy markets, bidding its owned generation into the Day Ahead and Real Time markets and procuring power for its retail customers at Locational Marginal Pricing (LMP) as determined by the MISO market. The Company is typically in a net sales position with MISO as generation capacity is... -

Page 45

... system, both to SIGECO's facilities as well as to those facilities of adjacent utilities, over the next several years is expected to be significant. The Company timely recovers its investment in certain new electric transmission projects that benefit the MISO infrastructure at a FERC approved rate... -

Page 46

Energy Marketing & Services Energy Marketing and Services is comprised of the Company's gas marketing operations, energy management services, and retail gas supply operations. Results, inclusive of holding company costs, from Energy Marketing and Services for the year ended December 31, 2008, were ... -

Page 47

... the needs of its customers. Vectren Source Vectren Retail, LLC (d/b/a Vectren Source), a wholly owned subsidiary, provides natural gas and other related products and services to customers opting for choice among energy providers. Vectren Source earned approximately $1.9 million in 2008, compared to... -

Page 48

... in Other operating expense totaling $90.9 million in 2007 compared to 2006. During 2006, the Company exited the meter reading and line locating businesses, which it had previously provided through Reliant Services, LLC. Energy Systems Group ESG's earnings were $6.7 million in 2008, compared to... -

Page 49

...included in Other-net and $4.8 million is included in Other operating expenses. Sale of Interest in SIGECOM SIGECOM provided broadband services, such as cable television, high-speed internet, and advanced local and long distance phone services, to the greater Evansville, Indiana area. In August 2006... -

Page 50

... pension plans and postretirement plans. SFAS 158 requires, among other things, an employer to measure the funded status of a plan as of the date of its year-end balance sheet and requires disclosure in the notes to financial statements certain additional information related to net periodic benefit... -

Page 51

... the sources of accounting principles and the framework for selecting principles used in the preparation of financial statements. SFAS No. 162 is effective 60 days following the SEC's approval of the Public Company Accounting Oversight Board amendments to AU Section 411, "The Meaning of Present... -

Page 52

...were holding periods, net operating income and capitalization rates, which have increased in the current economic and credit constrained environment. Related to capitalization rates, the Company used a 9.75 cap rate to value a suburban Chicago commercial real estate holding owned by the Company that... -

Page 53

... units by customer class. Those allocated units are multiplied by rates in effect during the month to calculate unbilled revenue at balance sheet dates. Regulation At each reporting date, the Company reviews current regulatory trends in the markets in which it operates. This review involves judgment... -

Page 54

... debt of Utility Holdings and Indiana Gas, at December 31, 2008, are A/Baa1 as rated by Standard and Poor's Ratings Services (Standard and Poor's) and Moody's Investors Service (Moody's), respectively. The credit ratings on SIGECO's secured debt are A/A3. Utility Holdings' commercial paper has... -

Page 55

...of the current credit line given the recent decline in natural gas prices. The current facility is not guaranteed by Vectren or Citizens. New Share Issues The Company may periodically issue new common shares to satisfy the dividend reinvestment plan, stock option plan and other employee benefit plan... -

Page 56

... tax benefits totaling $3 million. Based on the nature of these items their expected settlement dates cannot be estimated. The Company's regulated utilities have both firm and non-firm commitments to purchase natural gas and electricity as well as certain transportation and storage rights. Costs... -

Page 57

... rate plus 0.65 percent. Vectren Common Stock Issuance In February 2007, the Company sold 4.6 million authorized but previously unissued shares of its common stock to a group of underwriters in an SEC-registered primary offering at a price of $28.33 per share. The transaction generated proceeds, net... -

Page 58

... Holdings' three public utilities: SIGECO, Indiana Gas, and VEDO. These guarantees are full and unconditional and joint and several. These notes, as well as the timely payment of principal and interest, are insured by a financial guaranty insurance policy by Financial Guaranty Insurance Company... -

Page 59

... in 2008 include minor acquisitions by Miller, among other items. The year ended December 31, 2007 also includes expenditures for environmental compliance equipment as well as increased spending for electric transmission, a new gas line serving a Honda plant in the Vectren North service territory... -

Page 60

... pipeline incidents; transmission or distribution incidents; unanticipated changes to electric energy supply costs, or availability due to demand, shortages, transmission problems or other developments; or electric transmission or gas pipeline system constraints. Increased competition in the energy... -

Page 61

.... Commodity Price Risk Regulated Operations The Company's regulated operations have limited exposure to commodity price risk for transactions involving purchases and sales of natural gas, coal and purchased power for the benefit of retail customers due to current Indiana and Ohio regulations... -

Page 62

... risk that may be undertaken. The Company's customer receivables from gas and electric sales and gas transportation services are primarily derived from residential, commercial, and industrial customers located in Indiana and west central Ohio. The Company manages credit risk associated with its... -

Page 63

... Vectren Corporation's management is responsible for establishing and maintaining adequate internal control over financial reporting. Those control procedures underlie the preparation of the consolidated balance sheets, statements of income, cash flows, and common shareholders' equity, and related... -

Page 64

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Vectren Corporation: We have audited the accompanying consolidated balance sheets of Vectren Corporation and subsidiaries (the "Company") as of December 31, 2008 and 2007, and the related ... -

Page 65

... PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Vectren Corporation: We have audited the internal control over financial reporting of Vectren Corporation and subsidiaries (the "Company") as of December 31, 2008, based on criteria established in Internal Control - Integrated... -

Page 66

VECTREN CORPORATION AND SUBSIDIARY COMPANIES CONSOLIDATED BALANCE SHEETS (In millions) 2008 ASSETS Current Assets Cash & cash equivalents Accounts receivable - less reserves of $5.6 & $3.7, respectively Accrued unbilled revenues Inventories Recoverable fuel & natural gas costs Prepayments & other ... -

Page 67

VECTREN CORPORATION AND SUBSIDIARY COMPANIES CONSOLIDATED BALANCE SHEETS (In millions) At December 31, 2008 2007 LIABILITIES & SHAREHOLDERS' EQUITY Current Liabilities Accounts payable Accounts payable to affiliated companies Refundable fuel & natural gas costs Accrued liabilities Short-term ... -

Page 68

VECTREN CORPORATION AND SUBSIDIARY COMPANIES CONSOLIDATED STATEMENTS OF INCOME (In millions, except per share amounts) 2008 OPERATING REVENUES Gas utility Electric utility Nonutility revenues Total operating revenues OPERATING EXPENSES Cost of gas sold Cost of fuel & purchased power Cost of ... -

Page 69

...of pension & postretirement benefit cost Other non-cash charges - net Changes in working capital accounts: Accounts receivable & accrued unbilled revenue Inventories Recoverable/refundable fuel & natural gas costs Prepayments & other current assets Accounts payable, including to affiliated companies... -

Page 70

VECTREN CORPORATION AND SUBSIDIARY COMPANIES CONSOLIDATED STATEMENTS OF COMMON SHAREHOLDERS' EQUITY (In millions, except per share amounts) Accumulated Common Stock Other Retained Comprehensive Shares Amount Earnings Income (Loss) Total Balance at January 1, 2006 76.0 $ 528.1 $ 628.8 $ (13.6) $ 1,... -

Page 71

... Indiana. The Ohio operations provide energy delivery services to approximately 317,000 natural gas customers located near Dayton in west central Ohio. The Ohio operations are owned as a tenancy in common by Vectren Energy Delivery of Ohio, Inc. (VEDO), a wholly owned subsidiary of Utility Holdings... -

Page 72

... in-service utility plant. The original cost of utility plant, together with depreciation rates expressed as a percentage of original cost, follows: (In millions) Gas utility plant Electric utility plant Common utility plant Construction work in progress Total original cost At December 31, 2008... -

Page 73

... in Other - net in the Consolidated Statements of Income. The total AFUDC capitalized into utility plant and the portion of which was computed on borrowed and equity funds for all periods reported follows: (In millions) AFUDC - borrowed funds AFUDC - equity funds Total AFUDC 2008 $ $ Year Ended... -

Page 74

... changes in the cost of purchased gas. Metered electric rates contain a fuel adjustment clause that allows for adjustment in charges for electric energy to reflect changes in the cost of fuel. The net energy cost of purchased power, subject to a variable benchmark based on NYMEX natural gas prices... -

Page 75

... & other Amounts currently recovered in customer rates related to: Demand side management programs Unamortized debt issue costs & hedging proceeds Indiana authorized trackers Ohio authorized trackers Premiums paid to reacquire debt & other Total regulatory assets At December 31, 2008 2007 $ 101... -

Page 76

... nonutility gas supply operations as well as Citizens' utilities. ProLiance's primary businesses include gas marketing, gas portfolio optimization, and other portfolio and energy management services. Consistent with its ownership percentage, Vectren is allocated 61 percent of ProLiance's profits and... -

Page 77

... for ProLiance to provide natural gas supply services to the Company's Indiana utilities through March 2011. ProLiance has not provided gas supply/portfolio administration services to VEDO since October 31, 2005. Regulatory Matter ProLiance self reported to the Federal Energy Regulatory Commission... -

Page 78

... settlement related to a dispute over a contractual relationship with Huntsville Utilities during 2000-2002. As an equity investor in ProLiance, Vectren recorded its share of these charges which totaled $6.6 million after tax in 2006. Undistributed Earnings As of December 31, 2008, undistributed... -

Page 79

... develop, own, and operate four projects to produce and sell coal-based synthetic fuel (synfuel) utilizing Covol technology. The Company has an 8.3 percent interest in Pace Carbon which is accounted for using the equity method of accounting. The Internal Revenue Code provided for manufacturers, such... -

Page 80

...Holdings, Inc. (Holdings), which was formed by Utilicom to hold interests in SIGECOM, LLC (SIGECOM). SIGECOM provided broadband services, such as cable television, high-speed internet, and advanced local and long distance phone services, to the greater Evansville, Indiana area. The Company accounted... -

Page 81

... Reliant for locating and meter reading services as well as for Miller's construction-related services totaled $20.6 million. Amounts charged are market based. Amounts owed to Reliant totaled less than $0.1 million at December 31, 2007 and are included in Accounts payable to affiliated companies in... -

Page 82

... income tax rate follows: Statutory rate: State and local taxes-net of federal benefit Amortization of investment tax credit Depletion Other tax credits Synfuel tax credits Tax law change Adjustment of income tax accruals All other-net Effective tax rate Year Ended December 31, 2006 2008 2007 35... -

Page 83

...that such changes would have a significant impact on earnings and would only affect the timing of payments to taxing authorities. 9. Retirement Plans & Other Postretirement Benefits At December 31, 2008, the Company maintains three qualified defined benefit pension plans, a nonqualified supplemental... -

Page 84

...at 6.25 percent. The weighted averages of significant assumptions used to determine net periodic benefit costs follow: (In millions) Discount rate Rate of compensation increase Expected return on plan assets Expected increase in Consumer Price Index Pension Benefits 2008 2007 2006 6.25% 5.85% 5.50... -

Page 85

... 2008 roll forward of the projected benefit obligation includes 15 months of activity. The benefit obligation as of December 31, 2008 and 2007 was calculated using the following assumptions: Discount rate Rate of compensation increase Expected increase in Consumer Price Index Pension Benefits 2008... -

Page 86

... securities Debt securities Real estate and other Total Pension Benefits 2008 2007 58% 64% 37% 31% 5% 5% 100% 100% Other Benefits 2008 2007 72% 74% 25% 26% 3% 100% 100% The Company invests in trusts that benefit its qualified defined benefit plans. The general investment objectives are to invest... -

Page 87

... investments to fund its deferred compensation liabilities that are currently funded primarily through corporate-owned life insurance policies. These investments, which are consolidated, are available to pay plan benefits and are subject to the claims of the Company's creditors. The cash surrender... -

Page 88

... exempt 2025, 1998 Pollution Control Series A, current adjustable rate 1.2%, tax exempt, 2008 weighted average: 2.94% 2030, 1998 Pollution Control Series C, 5.35%, tax exempt 2041, 2007 Pollution Control Series, 5.45%, tax exempt Total SIGECO Indiana Gas Senior Unsecured Notes 2013, Series E, 6.69... -

Page 89

... Holdings' three public utilities: SIGECO, Indiana Gas, and VEDO. These guarantees are full and unconditional and joint and several. These notes, as well as the timely payment of principal and interest, are insured by a financial guaranty insurance policy by Financial Guaranty Insurance Company... -

Page 90

... Corporation guarantees Vectren Capital's long-term and short-term debt, which totaled $183 million and $327 million, respectively, at December 31, 2008. Utility Holdings' currently outstanding long-term and shortterm debt is jointly and severally guaranteed by Indiana Gas, SIGECO, and VEDO. Utility... -

Page 91

..., based on Vectren's current credit rating, would expect to be priced at the appropriate Libor rate plus 0.65 percent. Impacts on Short-Term Borrowings from Recent Events in Credit Markets Historically, the Company has funded the short-term borrowing needs of Utility Holdings' operations through the... -

Page 92

... decreases to the forward sale price that align with expected Company dividend payments. Vectren transferred the proceeds to Utility Holdings, and Utility Holdings used the proceeds to repay short-term debt obligations incurred primarily to fund its capital expenditure program. The proceeds received... -

Page 93

... various share-based compensation programs to encourage executives, key non-officer employees, and non-employee directors to remain with the Company and to more closely align their interests with those of the Company's shareholders. Under these programs, the Company issues stock options, non-vested... -

Page 94

... December 31, 2008. Stock Option Related Matters In the past, option awards were granted to executives and other key employees with an exercise price equal to the market price of the Company's stock at the date of grant; those option awards generally required 3 years of continuous service and have... -

Page 95

... in 2010-2013. Firm purchase commitments for utility and nonutility plant total (in millions) $45.1 in 2009, and zero in 2010-2013. The Company's regulated utilities have both firm and non-firm commitments to purchase natural gas and electricity as well as certain transportation and storage rights... -

Page 96

...legislation mandating a renewable energy portfolio standard is adopted, such regulation could substantially affect both the costs and operating characteristics of the Company's fossil fuel generating plants, nonutility coal mining operations, and possibly natural gas distribution businesses. Further... -

Page 97

...VRP. The remaining site is currently being addressed in the VRP by another Indiana utility. SIGECO added those four sites into the renewal of the global Voluntary Remediation Agreement that Indiana Gas has in place with IDEM for its manufactured gas plant sites. That renewal was approved by the IDEM... -

Page 98

... pipeline integrity management expense; timely recovery of costs associated with the accelerated replacement of bare steel and cast iron pipes, as well as certain service risers; and expanded conservation programs now totaling up to $5 million in annual expenditures. Vectren Energy Delivery of Ohio... -

Page 99

...the Company's electric transmission facilities as well as that of other Midwest utilities. Since April 1, 2005, the Company has been an active participant in the MISO energy markets, bidding its owned generation into the Day Ahead and Real Time markets and procuring power for its retail customers at... -

Page 100

... involve the sale of excess generation into the MISO day ahead and real-time markets. Net revenues from wholesale activities included in Electric Utility revenues totaled $57.6 million in 2008, $39.8 million in 2007 and $29.8 million in 2006. The Company also receives transmission revenue that... -

Page 101

... outstanding as of December 31, 2008. Natural Gas Procurement Activity The Company's regulated operations have limited exposure to commodity price risk for purchases and sales of natural gas and electricity for retail customers due to current Indiana and Ohio regulations which, subject to compliance... -

Page 102

... and other current assets managing synfuel risk totaling $22.8 million and totaling $2.6 million in other derivative instruments. In addition, there was $8.9 million in Accrued liabilities related to derivatives managing interest rate risk. SFAS 159 Also on January 1, 2008, the Company adopted SFAS... -

Page 103

...Ohio. The Electric Utility Services segment provides electric distribution services primarily to southwestern Indiana, and includes the Company's power generating and wholesale power operations. The Company manages its regulated operations as separated between Energy Delivery, which includes the gas... -

Page 104

...(11.8) 246.6 34.8 281.4 (In millions) Assets Utility Group Gas Utility Services Electric Utility Services Other Operations, net of eliminations Total Utility Group Nonutility Group Corporate & Other Eliminations Consolidated Assets 102 At December 31, 2008 2007 $ 2,204.7 1,462.1 171.3 3,838.1 780... -

Page 105

... other current assets in the Consolidated Balance Sheets consist of the following: (In millions) Prepaid gas delivery service Deferred income taxes Synfuels related derivatives Prepaid taxes Other prepayments & current assets Total prepayments & other current assets $ $ At December 31, 2008 2007... -

Page 106

...) AFUDC & capitalized interest Interest income Synfuel-related activity Commercial real estate impairment charge Broadband charges Cash surrender value of life insurance policies All other income Total other - net 20. Impact of Recently Issued Accounting Guidance $ $ Year Ended December 31... -

Page 107

... Information in any one quarterly period is not indicative of annual results due to the seasonal variations common to the Company's utility operations. Summarized quarterly financial data for 2008 and 2007 follows: (In millions, except per share amounts) 2008 Operating revenues Operating income Net... -

Page 108

... Code of Ethics covering the Company's directors, officers and employees are available on the Company's website, www.vectren.com, and a copy will be mailed upon request to Investor Relations, Attention: Steve Schein, One Vectren Square, Evansville, Indiana 47708. The Company intends to disclose any... -

Page 109

...December 31, 2008, and shares available for future issue have been increased by that amount. The SIGCORP stock option plan was approved by SIGCORP common shareholders prior to the merger forming Vectren. The At-Risk Compensation plan was approved by Vectren Corporation common shareholders after the... -

Page 110

... of ProLiance Holdings, LLC are attached as Exhibit 99.1 to this Form 10-K. Supplemental Schedules For the years ended December 31, 2008, 2007, and 2006, the Company's Schedule II -- Valuation and Qualifying Accounts Consolidated Financial Statement Schedules is presented herein. The report of... -

Page 111

... February 27, 2008. (Filed and designated in Current Report on Form 8-K filed February 27, 2008, File No. 1-15467, as Exhibit 3.1.) 3.3 Shareholders Rights Agreement dated as of October 21, 1999 between Vectren Corporation and Equiserve Trust Company, N.A., as Rights Agent. (Filed and designated in... -

Page 112

..., 2000, (Filed and designated in Current Report on Form 8-K filed December 27, 2000, File No. 16494, as Exhibit 4.) Indenture dated October 19, 2001, among Vectren Utility Holdings, Inc., Indiana Gas Company, Inc., Southern Indiana Gas and Electric Company, Vectren Energy Delivery of Ohio, Inc., and... -

Page 113

...10.3.) Coal Supply Agreement for A.B. Brown Generating Station for 1 million tons between Southern Indiana Gas and Electric Company and Vectren Fuels, Inc., effective January 1, 2009. (Filed and designated in Form 8-K dated January 5, 2009, File No. 1-15467, as Exhibit 10.4.) Gas Sales and Portfolio... -

Page 114

...10.23 Revolving Credit Agreement (5 year facility), dated November 10, 2005, among Vectren Utility Holdings, Inc., and each of the purchasers named therein. (Filed and designated in Form 10-K, for the year ended December 31, 2005, File No. 1-15467, as Exhibit 10.24.) 10.24 Revolving Credit Agreement... -

Page 115

... the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. VECTREN CORPORATION Dated February 19, 2009 /s/ Niel C. Ellerbrook Niel C. Ellerbrook, Chairman, Chief Executive Officer, and Director Pursuant to the requirements of the Securities... -

Page 116

... Timothy McGinley /s/ Richard P. Rechter Richard P. Rechter Director February 19, 2009 Director February 19, 2009 /s/ R. Daniel Sadlier R. Daniel Sadlier Director February 19, 2009 /s/ Richard W. Shymanski Richard W. Shymanski Director February 19, 2009 /s/ Michael L Smith Michael L Smith... -

Page 117

... SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 CHIEF EXECUTIVE OFFICER CERTIFICATION I, Niel C. Ellerbrook, certify that: 1. 2. I have reviewed this Annual Report on Form 10-K of Vectren Corporation; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit... -

Page 118

...TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 CHIEF FINANCIAL OFFICER CERTIFICATION I, Jerome A. Benkert, Jr., certify that: 1. 2. I have reviewed this Annual Report on Form 10-K of Vectren Corporation; Based on my knowledge, this report does not contain any untrue statement of a material fact or... -

Page 119

... of 1934 and (ii) the information contained in this report fairly presents, in all material respects, the financial condition and results of operations of Vectren Corporation. Signed this 19th day of February, 2009. /s/ Jerome A. Benkert, Jr. (Signature of Authorized Officer) Jerome A. Benkert, Jr... -

Page 120

...expenditures Utility Nonutility Total Total assets Utility Operating Statistics Gas distribution Operating revenues Margin Average Customers (in thousands) Electric Operating revenues Margin Average Customers (in thousands) Weather as a percent of normal Heating degree days* Cooling degree days 2008... -

Page 121

... Electric, Integrys Energy, Laclede Group, New Jersey Resources, Nicor, NiSource, Northeast Utilities, Northwest Natural Gas, NorthWestern, NSTAR, NV Energy, Pepco Holdings, Piedmont Natural Gas, SCANA, South Jersey Industries, Southwest Gas, TECO Energy, UniSource Energy, Vectren, WGL Holdings... -

Page 122

... The Investor Relations section of Vectren.com provides instant access to the latest news releases and historical archives of annual reports, SEC filings, financial presentations and much more. a paper copy of the Vectren Corporation and/or Vectren utility Holdings, Inc., 2008 annual report on Form... -

Page 123