Valero 2005 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2005 Valero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VA L E R O E N E R G Y C O R P O R AT I O N 3

It was 25 years ago this month that

the first Valero Energy Corporation annual

report rolled off the presses. The report’s stark

cover didn’t feature a photo, a graphic or even

a logo.

It simply said: “Valero Energy Corporation had

a record year which exceeded all expectations. The

company moved significantly nearer a major goal:

sustained earnings growth from an expanding

operating base.” – 1980 Annual Report

After six tough years of litigation, which led

to the $1.6 billion settlement of 400 lawsuits

against Coastal subsidiary LoVaca Gathering

Company, Valero spun off as a separate pub-

licly traded company from Coastal on Jan. 1,

1980. At the time, it was the largest spin-off

in the history of Corporate America. While we

had great plans and high hopes for the fledgling

company, none of us could ever have envi-

sioned the tremendous growth and success that

Valero would achieve over the next 25 years!

Since the spin-off, our revenues have climbed

from $1.3 billion to $82 billion. Total assets

have jumped from $649 million to $33 billion.

And, along with the growth in our asset base,

our employee count has swelled from 1,594

employees in 1980 to 21,923 today.

Not surprisingly, the company’s business has

changed just as dramatically. Valero has grown

from a regional energy company in the natural

gas industry to become the largest refiner in

North America. Today, our operations have

expanded to include 18 refineries stretching

from the U.S. West Coast to the East Coast

and from Canada to the Caribbean.

Valero has also added 5,000 retail and branded

wholesale sites in 34 U.S. states. And, this

was a big year because Valero signs began dot-

ting the landscape throughout the U.S. as we

launched our nationwide roll-out of the Valero

retail brand!

With our record growth has come record

earnings. Valero has achieved 10 consecutive

quarters of record earnings. 2005 was the best

year in history with net income of $3.6 billion

versus $64 million 25 years ago. What a differ-

ence a quarter-of-a-century can make!

Of course, I am proud to say that our share-

holders have shared in our success. In fact,

total shareholder return is up 480 percent over

the past five years, which compares to a 3 per-

cent increase for the S&P 500 Index for that

same period! And, in 2005 alone, shareholder

value has increased 128 percent compared to

the S&P’s 5 percent increase.

From these record results, it is obvious that

we have had the right strategy. In 1996, we

believed that we were at the bottom of the

refining cycle and that we could purchase refin-

ing assets for pennies-on-the-dollar of replace-

ment costs. We also believed that historically

low refining margins would improve as global

demand continued to grow and as the world-

wide movement toward cleaner fuels tightened

refined product supplies. And, we further

believed that the future would belong to the

refiners that could process low-cost, heavy sour

crude and residual oils that sell at a big dis-

count to easier-to-refine, sweet crude oil.

And, we were right on all counts! In 1997, we

sold our natural gas liquids and pipelines busi-

ness for a record $1.5 billion to PG&E, and

spun off our single refinery in Corpus Christi,

Texas, to our shareholders as the new Valero.

It was a bold move, but one that has paid big

dividends for all our stakeholders -- employees,

communities and shareholders!

We began a series of refinery acquisitions,

many of which were purchased for just 10 to

20 percent of replacement cost. This string of

successful acquisitions culminated in 2005 with

our purchase of Premcor Inc. for $7 billion.

The four Premcor refineries added approxi-

mately 800,000 barrels per day (BPD) of refin-

ing capacity and brought our total throughput

to 3.3 million BPD - making Valero the largest

refining company in North America!

This acquisition not only made us bigger; it

made us better! In 2006, we estimate that we

THE BUSINESS AT HAND

A LETTER TO OUR SHAREHOLDERS

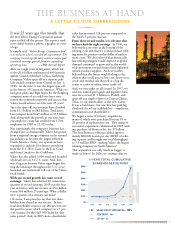

12/00 12/04 12/05

VALERO ENERGY CORPORATION – 480%

PEER GROUP – 66%

S&P 500 – 3%

$0

$100

$200

$300

$400

$500

$600

12/01 12/02 12/03

5-YEAR TOTAL CUMULATIVE

SHAREHOLDER RETURN