Toro 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Toro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Toro Company

2011 Annual Report

Table of contents

-

Page 1

The Toro Company 2011 Annual Report -

Page 2

... features Quad-Steerâ„¢ all-wheel steering to maximize productivity and deliver unprecedented versatility unlike any other rotary mower. We thrive on developing innovative irrigation technologies that help customers maximize water efï¬ciency while enhancing the health of turf and landscapes. This... -

Page 3

...of our competitive advantage. In fact, new products - those introduced the current and previous two years - accounted for over 50 percent of total sales in 2011, marking the highest level in recent history. These new product offerings played a signiï¬cant role in helping us increase market share by... -

Page 4

... expand our offerings to existing customers. Earlier this year, we acquired Unique Lighting Systems, Inc., a leading manufacturer of professionally installed landscape lighting for residential and commercial use. Additionally, we purchased Lawn Solutions Commercial Products, Inc., a provider of turf... -

Page 5

... California Municipal Utilities Association. Our micro irrigation business achieved strong growth in 2011 with sales particularly strong in North America, Europe and Central Asia. Growers are becoming more aware of this efï¬cient new method of irrigating crops. We have a great slate of products led... -

Page 6

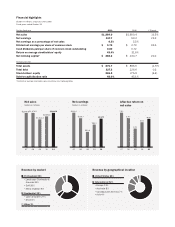

Financial highlights (Dollars in millions, except per share data) Fiscal years ended October 31 For the ï¬scal year 2011 2010 % Change Net sales Net earnings Net earnings as a percentage of net sales Diluted net earnings per share of common stock Cash dividends paid per share of common stock ... -

Page 7

..., based on the closing price of the common stock on April 29, 2011, the last business day of the registrant's most recently completed second fiscal quarter, as reported by the New York Stock Exchange, was approximately $2.1 billion. The number of shares of common stock outstanding as of December 14... -

Page 8

... Disclosures about Market Risk ...Financial Statements and Supplementary Data Management's Report on Internal Control over Financial Reporting ...Report of Independent Registered Public Accounting Firm ...Consolidated Statements of Earnings for the fiscal years ended October 31, 2011, 2010, and... -

Page 9

...this report. We design, manufacture, and market professional turf maintenance equipment and services, turf irrigation systems, agricultural micro-irrigation systems, landscaping equipment and lighting, and residential yard and snow removal products. We produced our first mower for golf course use in... -

Page 10

... innovative new attachments designed to improve efficiency. We also manufacture and market underground irrigation systems, including sprinkler heads, controllers, turf sensors, and electric, battery-operated, and hydraulic valves. Our golf course irrigation systems are designed to use computerized... -

Page 11

... control technology. Financial Information about Foreign Operations and Business Segments We currently manufacture our products in the United States, Mexico, Australia, the United Kingdom, and Italy for sale throughout the world and, in late fiscal 2011, we completed the construction of our new... -

Page 12

...demand for our products, taking into account production capacity, timing of shipments, and field inventory levels. In fiscal 2011, we continued to roll-out a pull-based production system at some of our manufacturing facilities to better align the production of our products to meet customer demand at... -

Page 13

... foreign distributors, as well as a large number of outdoor power equipment dealers, hardware retailers, home centers, and mass retailers in more than 90 countries worldwide. Residential products, such as walk power mowers, riding products, and snow throwers, are mainly sold directly to home centers... -

Page 14

...contractors, government customers, rental stores, and golf courses. We also sell some professional segment products directly to government customers and rental companies, as well as directly to end-users in certain international markets. Select residential/commercial irrigation and lighting products... -

Page 15

... the financing is for a distributor or dealer. Rates may also vary based on the product that is financed. Toro continues to provide financing in the form of open account terms directly to home centers and mass retailers; general line irrigation dealers; international distributors and dealers, other... -

Page 16

... in the U.S. and Canada. These programs, offered primarily to Toro and Exmark dealers, provide end-user customers revolving and installment lines of credit for Toro and Exmark products, parts, and services. Distributor Financing. Occasionally, we enter into long-term loan agreements with some... -

Page 17

... adverse effect on sales of our irrigation products, and lower snow fall accumulations in key markets have had an adverse effect on sales of our snow thrower products. Similarly, adverse weather conditions in one season may adversely affect customer purchasing patterns and our net sales for some of... -

Page 18

...international economic, political, legal, accounting, and business factors, and may not be successful or produce desired levels of net sales. We currently manufacture our products in the United States, Mexico, Australia, the United Kingdom, and Italy for sale throughout the world and, in late fiscal... -

Page 19

... party customers, purchases from suppliers, and bank lines of credit with creditors denominated in foreign currencies. Our reported net sales and net earnings are subject to fluctuations in foreign currency exchange rates. Because our products are manufactured or sourced primarily from the United... -

Page 20

... market demand for our products and/or our profit margins, which may adversely affect our financial results. If our customers' buying patterns change to purchasing our products in advance of price increases on compliant products, we may experience abnormal fluctuation in sales and our financial... -

Page 21

...significant research, planning, design, development, engineering, and testing at the technological, product, and manufacturing process levels and we may not be able to timely develop and introduce product improvements or new products. Our competitors' new products may beat our products to market, be... -

Page 22

... our internal controls; to manage our manufacturing and supply chain processes; and to maintain our research and development data. The failure of our management information systems to perform properly could disrupt our business and product development, which may result in decreased sales, increased... -

Page 23

... to new or emerging technologies and changes in customer preferences, or devote greater resources to the development, promotion, and sale of their products than we can. In addition, competition could increase if new companies enter the market or if existing competitors expand their product lines or... -

Page 24

products in Canada to support their businesses and increase our net sales, as well as to free up our working capital for our other strategic purposes. As a result, we are dependent upon the joint venture for our inventory financing programs, including floor plan and open account receivable financing... -

Page 25

..., and increase in insurance premiums; • financial viability of distributors and dealers, changes in distributor ownership, changes in channel distribution of our products, relationships with our distribution channel partners, our success in partnering with new dealers, and our customers' ability... -

Page 26

... each of our current facilities in use to be in good operating condition. Management believes we have sufficient manufacturing capacity for fiscal 2012. Our significant facilities are listed below by location, ownership, and function as of October 31, 2011: Location Bloomington, MN El Paso, TX... -

Page 27

..., Irrigation Business Timothy P. Dordell 49, Vice President, Secretary and General Counsel Michael D. Drazan 54, Vice President, Contractor Business and Chief Information Officer Blake M. Grams 44, Vice President, Corporate Controller Michael J. Happe 40, Vice President, Residential and Landscape... -

Page 28

... - The following table sets forth information with respect to shares of our common stock purchased by the company during each of the three fiscal months in our fourth quarter ended October 31, 2011. Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs 14,059 689,347... -

Page 29

... Alpine Group, Briggs & Stratton Corporation, Caterpillar Inc., Crane Co., Cummins Engine Company, Inc., Deere & Company, Dover Corporation, Flowserve Corporation, General Cable Corporation, Harsco Corporation, Illinois Tool Works Inc., International Game Technology, ITT Industries, Inc., Kennametal... -

Page 30

... equipment and services, turf irrigation systems, agricultural micro- irrigation systems, landscaping equipment and lighting, and residential yard and snow removal products worldwide. We sell our products worldwide through a network of distributors, dealers, hardware retailers, home centers... -

Page 31

... in the rental market. • Our residential segment net sales were up by 5.8 percent in fiscal 2011 compared to fiscal 2010 primarily from strong demand for our new line of zero-turn radius riding mowers. Shipments of snow thrower products also increased as our channel partners purchased products to... -

Page 32

...consumers, we expect our residential segment net sales to slightly increase compared to fiscal 2011. We anticipate that our new walk power mower product offering will be well received by customers in fiscal 2012 and expect continued growth in demand for our new line of zero-turn radius riding mowers... -

Page 33

... sales from heavy snow falls during the 2010-2011 snow season, as well as additional product placement. In addition, riding product sales increased primarily from positive customer acceptance for our new line of zero-turn radius riding mowers. However, sales of walk power mowers and electric blowers... -

Page 34

... of snow thrower products that shipped to customers in the first quarter of fiscal 2010 instead of the fourth quarter of fiscal 2009. • International net sales were also up for both our professional and residential segments due also to increased demand primarily from improved market conditions in... -

Page 35

...equipment and irrigation systems due to new golf development projects in key international markets, particularly in Asia, and domestic renovation projects, as well as positive customer response for new products we introduced. • Increased sales of landscape contractor equipment and grounds products... -

Page 36

... we transact business. Somewhat offsetting those increases was a decline in sales of walk power mowers and electric blowers due mainly to unfavorable weather conditions. Our domestic field inventory levels of our residential segment products were slightly up as of the end of fiscal 2011 as compared... -

Page 37

... inventory levels and production, as well as our supply chain initiatives. As a result of the combination of these increases, our average net working capital (accounts receivable plus inventory less trade payables) as a percentage of net sales was 15.0 percent as of the end of fiscal 2011 compared... -

Page 38

... to enable sales growth in new markets and expand existing markets, help us to meet product demand, and increase our manufacturing efficiencies and capacity. Cash used in investing activities was up 13.9 percent in fiscal 2011 compared to fiscal 2010 due mainly to an increase in purchases of 32 -

Page 39

... rating for long-term unsecured senior, non-credit enhanced debt was unchanged during fiscal 2011 by Standard and Poor's Ratings Group at BBB- and by Moody's Investors Service at Baa3. Share Repurchase Plan During fiscal 2011, we continued repurchasing shares of our common stock in the open market... -

Page 40

...form of open account terms to home centers and mass retailers; general line irrigation dealers; international distributors and dealers other than the Canadian distributors and dealers to whom Red Iron provides financing arrangements; government customers; and rental companies. End-User Financing. We... -

Page 41

... the landscape, rental, municipal, and golf markets. This acquisition broadens and strengthens our product offering line of turf renovation equipment solutions. On January 17, 2011, we completed the acquisition of certain assets of, and assumed certain liabilities from, Unique Lighting Systems, Inc... -

Page 42

... accounts. Each fiscal quarter, we prepare an analysis of our ability to collect outstanding receivables that provides a basis for an allowance estimate for doubtful accounts. In doing so, we evaluate the age of our receivables, past collection history, current financial conditions of key customers... -

Page 43

... exchange rate changes and not for trading purposes. We are exposed to foreign currency exchange rate risk arising from transactions in the normal course of business, such as sales to third party customers, sales and loans to wholly owned foreign subsidiaries, foreign plant operations, and purchases... -

Page 44

... based upon market prices that are established with the vendor as part of the purchase process. We generally attempt to obtain firm pricing from most of our suppliers for volumes consistent with planned production. To the extent that commodity prices increase and we do not have firm pricing from our... -

Page 45

...establishing and maintaining an adequate system of internal control over financial reporting as defined in Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934, as amended, for The Toro Company and its subsidiaries. This system is designed to provide reasonable assurance regarding... -

Page 46

... on these consolidated financial statements and financial statement schedule and an opinion on the Company's internal control over financial reporting based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those... -

Page 47

... 35,788 36,240 Net sales Cost of sales Gross profit Selling, general, and administrative expense Operating earnings Interest expense Other income (expense), net Earnings before income taxes Provision for income taxes Net earnings Basic net earnings per share of common stock Diluted net earnings per... -

Page 48

... taxes Total current assets Property, plant, and equipment, net Other assets Goodwill Other intangible assets, net Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current portion of long-term debt Short-term debt Accounts payable Accrued liabilities: Warranty Advertising and marketing programs... -

Page 49

... Purchases of Toro common stock Dividends paid on Toro common stock Net cash used in financing activities Effect of exchange rates on cash Net (decrease) increase in cash and cash equivalents Cash and cash equivalents as of the beginning of the fiscal year Cash and cash equivalents as of the end... -

Page 50

...common stock - $0.60 per share Issuance of 1,201,256 shares under stock-based compensation plans Contribution of stock to a deferred compensation trust Purchase of 3,316,536 shares of common stock Excess tax benefits from stock-based awards Retirement benefits adjustment, net of tax Foreign currency... -

Page 51

...'' of this report, which include, among others, economic conditions, including consumer spending and confidence levels; foreign currency exchange rate impact; commodity costs; and credit conditions, all of which may increase the uncertainty Allowance for Doubtful Accounts The company estimates the... -

Page 52

... over 10 to 45 years, and equipment over two to seven years. Tooling costs are generally depreciated over three to five years using the straight-line method. Software and web site development costs are generally amortized over two to five years utilizing the straight-line method. Expenditures for... -

Page 53

... that have been financed by suppliers. As of October 31, 2011 and 2010, $14,643 and $7,312, respectively, of the company's outstanding payment obligations had been placed on the accounts payable tracking system. The changes in accrued warranties were as follows: Fiscal years ended October 31... -

Page 54

... operating costs of distribution and corporate facilities, warranty expense, depreciation and amortization expense on non-manufacturing assets, advertising and marketing expenses, selling expenses, engineering and research costs, information systems costs, incentive and profit sharing expense, and... -

Page 55

purchases. These financing arrangements are used by the company as a marketing tool to assist customers to buy inventory. The financing costs for distributor and dealer inventories were $16,394, $14,490, and $9,452 for the fiscal years ended October 31, 2011, 2010, and 2009, respectively. upon ... -

Page 56

... certain liabilities from, Lawn Solutions Commercial Products, Inc. (''Lawn Solutions''), a manufacturer of turf renovation equipment, including aerators, seeders, power rakes, and brush cutters, for the landscape, rental, municipal, and golf markets. On January 17, 2011, the company completed the... -

Page 57

...previously provided floor plan financing to dealers of the company's products in the U.S. and Canada. During the first quarter of fiscal 2010, Red Iron began financing open account receivables, as well as floor plan receivables previously financed by such third party financing company. Red Iron also... -

Page 58

... and stock repurchases. Interest expense on this credit line is determined based on a LIBOR rate (or other rates quoted by the Administrative Agent, Bank of America, N.A.) plus a basis point spread defined in the credit agreement. The company had no outstanding short-term debt as of October 31, 2011... -

Page 59

...date on a semi-annual basis at the treasury rate plus 30 basis points, plus, in both cases, accrued and unpaid interest. In the event of the occurrence of both (i) a change of control of the company, and (ii) a downgrade of the notes below an investment grade rating by both Moody's Investors Service... -

Page 60

...,431 $95,788 During the fiscal years ended October 31, 2011, 2010, and 2009, respectively, $2,988, $3,396, and $7,403 was added to stockholders' equity reflecting the permanent book to tax difference in accounting for tax benefits related to employee stock-based award transactions. The tax effects... -

Page 61

... closing price of the company's common stock on the date of grant, as reported by the New York Stock Exchange. Options are generally granted to officers, other employees, and non-employee members of the company's Board of Directors on an annual basis in the first quarter of the company's fiscal year... -

Page 62

... company's then Vice President, Finance and Chief Financial Officer. On August 22, 2011, the company also granted a restricted stock award as part of the offer to the new Vice President, Finance and Chief Financial Officer. Restricted stock awards generally vest one-third each year over a three-year... -

Page 63

... and commercial landscapes, as well as directly to government customers, rental companies, and large retailers. The Residential business segment consists of walk power mowers, riding mowers, snow throwers, replacement parts, and home solutions products, including trimmers, blowers, blower-vacuums... -

Page 64

... include general corporate expenses, interest expense, and income taxes. The company accounts for intersegment gross sales at current market prices. The following table shows summarized financial information concerning the company's reportable segments: Fiscal years ended October 31 2011 Net sales... -

Page 65

.... See Note 3 for additional information related to Red Iron. Some products sold to independent dealers in Australia finance their products with a third party finance company. This third party financing company purchased $21,146 of receivables from the company during fiscal 2011. As of October 31... -

Page 66

...transactions in the normal course of business, such as sales to third party customers, sales and loans to wholly owned foreign subsidiaries, foreign plant operations, and purchases from suppliers. The company actively manages the exposure of its foreign currency exchange rate market risk by entering... -

Page 67

... of earnings for the company's derivatives not designated as hedging instruments. Gain (Loss) Recognized in Net Earnings Fiscal Year Ended Location of Gain (Loss) Recognized in Net Earnings Foreign exchange contracts Other income (expense), net October 31, October 31, 2011 2010 $(6,867) $1,619... -

Page 68

... related to the company's acquisitions of Lawn Solutions and Unique Lighting, as of October 31, 2011, are summarized below: Fair Value Assets: Trade name Patents Non-compete agreements Customer list Developed technology Total assets $ 1,500 700 3,100 713 11,250 $17,263 Level 1 - - - - - - Level... -

Page 69

...EVENTS The company evaluated all subsequent events and concluded that no subsequent events have occurred that would require recognition in the financial statements or disclosure in the notes to the financial statements. Fiscal year ended October 31, 2011 Quarter Net sales Gross profit Net earnings... -

Page 70

...this report in Part II, Item 8, ''Financial Statements and Supplementary Data'' under the caption ''Report of Independent Registered Public Accounting Firm.'' There was no change in the company's internal control over financial reporting that occurred during the company's fourth fiscal quarter ended... -

Page 71

... in Part II, Item 8, ''Financial Statements and Supplementary Data'' of this report: • Management's Report on Internal Control over Financial Reporting. • Report of Independent Registered Public Accounting Firm. • Consolidated Statements of Earnings for the fiscal years ended October 31, 2011... -

Page 72

...).* 10.11 Form of Nonqualified Stock Option Agreement between The Toro Company and its Non-Employee Directors under The Toro Company 2000 Directors Stock Plan (incorporated by reference to Exhibit 10.20 to Registrant's Annual Report on Form 10-K for the fiscal year ended October 31, 2008, Commission... -

Page 73

...'s Annual Report on Form 10-K for the fiscal year ended October 31, 2009, Commission File No. 1-8649).* 10.21 The Toro Company Change in Control Severance Compensation Policy and attached Form of Release (incorporated by reference to Exhibit 10.1 to Registrant's Current Report on Form 8-K dated... -

Page 74

... following financial information from The Toro Company's Annual Report on Form 10-K for the fiscal year ended October 31, 2011, filed with the SEC on December 21, 2011, formatted in eXtensible Business Reporting Language (XBRL): (i) Consolidated Statements of Earnings for each of the fiscal years in... -

Page 75

...II THE TORO COMPANY AND SUBSIDIARIES Valuation and Qualifying Accounts Balance as of the beginning of the fiscal year $3,904 4,151 2,726 Charged to costs and expenses1 $ 6 666 1,811 Balance as of the end of the fiscal year $2,040 3,904 4,151 (Dollars in thousands) Fiscal year ended October 31, 2011... -

Page 76

..., Finance and Chief Financial Officer (principal financial officer) Vice President, Corporate Controller (principal accounting officer) Director Director Director Director Director Director Director Director Director December 21, 2011 December 21, 2011 December 21, 2011 December 21, 2011 December... -

Page 77

This page is intentionally blank. -

Page 78

... Vice President and Chief Operating Ofï¬cer 3M Company Timothy P. Dordell Vice President, Secretary and General Counsel Peter M. Ramstad Vice President, Human Resources and Business Development Michael D. Drazan Vice President, Contractor Business and Chief Information Ofï¬cer Katherine... -

Page 79

... year, Toro was honored to partner with our distributor Turf Equipment and Supply Company in supporting the grounds crew at Congressional Country Club in Bethesda, Maryland, as they prepared the course for the 2011 U.S. Open. With growing concerns around water availability and cost, drip irrigation... -

Page 80

The Toro Company 8111 Lyndale Avenue South Bloomington, MN 55420-1196 952-888-8801 www.thetorocompany.com