Time Warner Cable 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

Gross versus Net Revenue Recognition

In the normal course of business, the Company acts as or uses an intermediary or agent in executing

transactions with third parties. In connection with these arrangements, the Company must determine whether to

report revenue based on the gross amount billed to the ultimate customer or on the net amount received from the

customer after commissions and other payments to third parties. To the extent revenues are recorded on a gross

basis, any commissions or other payments to third parties are recorded as expense so that the net amount (gross

revenues less expense) is reflected in Operating Income. Accordingly, the impact on Operating Income is the

same whether the Company records revenue on a gross or net basis.

The determination of whether revenue should be reported on a gross or net basis is based on an assessment of

whether the Company is acting as the principal or an agent in the transaction. If the Company is acting as a

principal in a transaction, the Company reports revenue on a gross basis. If the Company is acting as an agent in

a transaction, the Company reports revenue on a net basis. The determination of whether the Company is acting

as a principal or an agent in a transaction involves judgment and is based on an evaluation of the terms of an

arrangement. The Company serves as the principal in transactions in which it has substantial risks and rewards of

ownership.

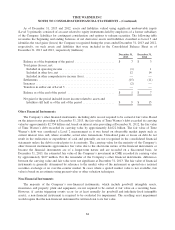

The following are examples of arrangements where the Company is an intermediary or uses an intermediary:

•Warner Bros. provides distribution services to third-party companies. Warner Bros. may provide

distribution services for an independent third-party company for the worldwide distribution of theatrical

films, home video, television programs and/or videogames. The independent third-party company may

retain final approval over the distribution, marketing, advertising and publicity for each film or

videogame in all media, including the timing and extent of the releases, the pricing and packaging of

packaged goods units and approval of all television licenses. Warner Bros. records revenue generated in

these distribution arrangements on a gross basis when it (i) is the merchant of record for the licensing

arrangements, (ii) is the licensor/contracting party, (iii) provides the materials to licensees, (iv) handles

the billing and collection of all amounts due under such arrangements and (v) bears the risk of loss

related to distribution advances and/or the packaged goods inventory. If Warner Bros. does not bear the

risk of loss as described in the previous sentence, the arrangements are accounted for on a net basis.

•Turner provides advertising sales services to third-party companies. From time to time, Turner

contracts with third parties, or in certain instances a related party such as a joint venture, to perform

television or website advertising sales services. While terms of these agreements can vary, Turner

generally records advertising revenue on a gross basis when it acts as the primary obligor in the

arrangement because in those cases it is the face to the advertiser and is responsible for fulfillment of the

advertising sold.

•Time Inc. utilizes marketing partners to generate magazine subscribers. As a way to generate

magazine subscribers, Time Inc. sometimes uses third-party marketing partners to secure subscribers

and, in exchange, the marketing partners receive a percentage of the Subscription revenues generated.

Time Inc. records revenues from subscriptions generated by the marketing partner, net of the fees paid to

the marketing partner, primarily because the marketing partner (i) has the primary contact with the

customer, (ii) performs all of the billing and collection activities, and (iii) passes the proceeds from the

subscription to Time Inc. after deducting the marketing partner’s commission.

Accounting for Collaborative Arrangements

The Company’s collaborative arrangements primarily relate to co-financing arrangements to jointly finance

and distribute theatrical productions and an arrangement entered into with CBS Broadcasting, Inc. (“CBS”) and

the NCAA that provides Turner and CBS with exclusive television, Internet and wireless rights to the NCAA

Tournament in the U.S. and its territories and possessions from 2011 through 2024.

74