Time Warner Cable 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2013

Table of contents

-

Page 1

ANNUAL REPORT 2013 -

Page 2

WI NN E R OF 1 0 2 014 AC AD E M Y AWARDS, IN C LU D IN G B E ST D I R E CTO R, ALF ON SO C UA RÃ" N , F OR G R AV IT Y -

Page 3

... Time Warner as the world's leading storytelling company, with an emphasis on video and especially television. Put simply, our goals are to be the preferred home for the best talent and ideas, to create engaging and valuable content that we share with consumers across technological frontiers... -

Page 4

All of our businesses are the LEADERS IN THEIR INDUSTRIES and the home for THE BEST STORYTELLING INVESTED OVER $5 BILLION IN TELE VISION NE T WORKS PROGR AMMING IN 2013 2 TIME WARNER 2013 ANNUAL REPORT -

Page 5

WARNER BROS. PRODUCED MORE THAN 60 TV SHOWS DURING 2013-2014 SEASON WINNER BRANDS REACH OF MORE PRIMETIME EMMY AWARDS THAN ANY NETWORK AND TIED FOR THE MOST GOLDEN GLOBE AWARDS IN 2013 ALMOST HALF OF U.S. ADULTS EACH MONTH CABLE'S #1 AD-SUPPORTED NETWORK IN PRIMETIME AMONG ADULTS 18-49* RANKED... -

Page 6

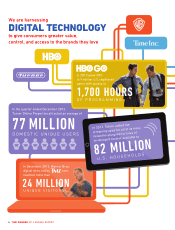

... access to 1,700 HOURS of programming In the quarter ended December 2013, Turner Online Properties attracted an average of 77 MILLION domestic unique users In December 2013, Warner Bros.' digital sites, led by .com, reached more than added live In 2013, Turner main s for all of its streaming app... -

Page 7

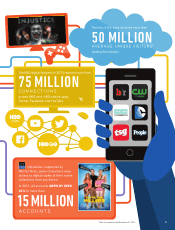

... MILLION across HBO.com, HBO mobile apps, Twitter, Facebook, and YouTube UltraViolet, supported by Warner Bros., gives consumers easy access to digital copies of their movie collections from any device. In 2013, UV accounts GREW BY OVER 65% to more than 15 MILLION accounts *Data for quarter ended... -

Page 8

..., online, and mobile HBO ASIA ORIGINAL SERIES SERANGOON ROAD OVER $3 BILLION in revenue 127+ MILLION worldwide subscribers* and HBO GO WAS AVAILABLE in 22 COUNTRIES outside the U.S. as of December 31, 2013 6 TIME WARNER 2013 ANNUAL REPORT generated by HBO and Turner's international businesses... -

Page 9

...BILLION We've increased local and international television production through KOKOWÄÄH 2, GERMANY INVESTMENTS AND ACQUISITIONS In 2013, Warner Bros. films GROSSED OVER $3 BILLION at t h e i n t e r n at i o n a l b o x o f f i c e , NOSOTROS LOS NOBLES, MEXICO with 10 MOVIES grossing more than... -

Page 10

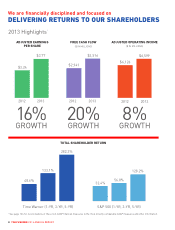

...TOTAL SHAREHOLDER RETURN 8% GROWTH 128.2% 282.3% 32.4% 56.8% Thme Warner (1-YR, 3-YR, 5-YR) 1 S&P 500 (1-YR, 3-YR, 5-YR) See page 124 for reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures and other information. 8 TIME WARNER 2013 ANNUAL REPORT -

Page 11

OVER THE PAST FIVE YEARS, OUR ADJUSTED OPERATING INCOME 1 GREW 57% AND OUR ADJUSTED EARNINGS PER SHARE IS UP 1 OVER 165% CUMULATIVELY 9 -

Page 12

WE ALL SHARE A DEDICATION TO LIGHT UP THE WORLD WITH THE BEST STORYTELLING ACROSS TECHNOLOGICAL FRONTIERS AND GEOGRAPHIC BOUNDARIES. 10 TIME WARNER 2013 ANNUAL REPORT -

Page 13

... accessible to audiences, but has also helped enable an unprecedented era of quality and choice. Warner Bros. has been a leader of the TV renaissance, with more than 60 shows in production across broadcast and cable networks for the 2013-2014 television season 11 T Jeff Bewkes Chairman and CEO -

Page 14

... CBS). TNT continued Diaries. As we've increased our investments in to prove itself the home of ad-supported cable's content over the last several years, we've seen best-loved original dramas with such programs as increasing demand for high-quality programming not Rizzoli & Isles, Falling Skies, and... -

Page 15

... INVESTING TO POSITION OUR COMPANY FOR THE FUTURE. SO FAR BUT HOW WE'VE BEEN TV Everywhere products like HBO GO and Turner's suite of apps that now offer live streaming as well as rich on-demand libraries, popular online brands like TMZ and Turner's Bleacher Report, and video games such as Batman... -

Page 16

... John K. Martin, Jr. Chief Executive Officer, Turner Broadcasting System, Inc. Kevin Tsujihara Chief Executive Officer, Warner Bros. Entertainment Inc. Richard Plepler Chief Executive Officer, Home Box Office, Inc. Joseph A. Ripp Chief Executive Officer, Time Inc. 14 TIME WARNER 2013 ANNUAL REPORT -

Page 17

... Financial Statements ...Management's Report on Internal Control Over Financial Reporting ...Reports of Independent Registered Public Accounting Firm ...Selected Financial Information ...Quarterly Financial Information ...Comparison of Cumulative Total Returns ...2013 Highlights - Reconciliations... -

Page 18

[THIS PAGE INTENTIONALLY LEFT BLANK] 2 -

Page 19

...company. The Company classifies its businesses into the following four reportable segments Turner, consisting principally of cable networks and digital media properties; Home Box Office, consisting principally of premium pay television services domestically and premium pay and basic tier television... -

Page 20

..., Men at Work and King of the Nerds, and its new original series include Deal With It, Ground Floor and Trust Me, I'm a Game Show Host. Syndicated series for the 2013-2014 season include The Big Bang Theory, Family Guy and The Office. TBS is also airing new episodes of Cougar Town for the 2013-2014... -

Page 21

... online and mobile sports property that provides team-specific sports content and real-time event coverage. Its content appears on BleacherReport.com, on CNN and on the Team Stream app, as well as in Bleacher Report's daily sport- and team-specific email newsletters. Cartoon Network offers original... -

Page 22

..., the only sports channel in Brazil nationally available via free-to-air networks and pay television platforms. In addition, Turner provides the advertising sales and network operations services for the WB Channel in Latin America. In Europe, Turner's regional entertainment brands include Cartoonito... -

Page 23

... distributed domestic multi-channel premium pay television service. Both HBO and Cinemax are made available in high definition on a number of multiplex channels. Home Box Office also distributes HBO On Demand and Cinemax On Demand as well as the HBO GO and MAX GO streaming services, products that... -

Page 24

... and television product on DVD, Blu-ray Discs and various digital formats (e.g., EST and VOD). In recent years, home video revenues have declined as a result of several factors, including consumers shifting to subscription rental services and discount rental kiosks; changing retailer initiatives... -

Page 25

... and basic cable networks as well as scripted original programming for U.S. basic cable networks. For the 2013-2014 season, Warner Horizon is producing non-scripted series for broadcast networks, including The Bachelor and The Voice, and the Company's networks, including Deon Cole's Black Box airing... -

Page 26

...Bros.' film and television content as well as acquired content through VOD and EST transactions via cable system operators, satellite distribution services, telecommunications companies, broadband services and mobile platforms for delivery to consumers worldwide. WBDD distributes its motion pictures... -

Page 27

...ray collections and, in 2013, in-home offerings of the service were launched by multiple retailers. WBDD also launched Warner Archive Instant in 2013, a subscription streaming service focused on rare and hard-to-find movies and television shows from the Warner Bros. library. The service is available... -

Page 28

... retail locations. Subscriptions in the U.S. are sold primarily through direct mail solicitation, subscription sales agents, Time Inc.'s owned websites, marketing agreements with other companies, insert cards in Time Inc.'s magazines and other publications, email solicitations and online advertising... -

Page 29

...mornings. Advertising-supported full episodes of The CW's series are also available on cwtv.com. The CW programming is also available for streaming through Netflix and Hulu. Available Information and Website The Company's annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on... -

Page 30

...other information, including feature films, television, premium pay television services, SVOD services, the Internet, home video products, videogames, social networking, print media, pirated content, live sports and other events and radio broadcasts, for consumers' leisure and entertainment time and... -

Page 31

... affect subscription revenues, advertising demand and rates and a network's distribution potential. A decline in the popularity of television programming aired by the Company's premium pay and basic tier television services can negatively affect subscription revenues and content sales as well as... -

Page 32

... video service subscriptions, reduce the number of services they subscribe to or elect to subscribe to a lower-priced tier or offering that may not include all of the Company's cable networks or premium pay or basic tier television services. In addition, technological developments and changes... -

Page 33

... and/or marketing for its cable networks and premium pay and basic tier television services, on commercially reasonable terms, or at all. The ability of the Company's businesses to compete successfully depends on many factors, including their ability to develop, market and distribute high-quality... -

Page 34

... in the Company's cable networks having less inventory available to sell to advertisers or to use to promote their own programming. Time-shifted and on-demand viewing of programming and viewership on new platforms or devices that is not being measured by the television ratings system could have... -

Page 35

... be time-consuming and costly and divert management's attention and resources away from its businesses. The Company's businesses are subject to labor interruption. The Company and certain of its suppliers retain the services of writers, directors, actors, athletes, technicians, trade employees and... -

Page 36

... increase and the Company will need to expend additional resources to protect its technology, information systems and data. Service disruptions or the failure of communication satellites or transmitter facilities used by the Company's cable networks and premium pay and basic tier television services... -

Page 37

...and strategic goals relating to the initiatives. The Company has launched multi-year enterprise efficiency initiatives to deliver certain business support services (e.g., real estate and certain information technology and human resources functions) centrally to the Company's divisions. In connection... -

Page 38

.... The Company could face increased costs and business disruption from changes in postal rates and service. The financial condition of the USPS continues to decline. In 2012 and 2013, the USPS closed numerous mail processing centers and announced plans to close additional processing centers in 2014... -

Page 39

... impact supplier profitability, including increases in operating expenses caused by rising raw material and energy costs. If paper prices increase significantly or the Company experiences significant supply channel disruptions, the Company's magazine publishing business, financial condition... -

Page 40

... complete the Time Separation during the second quarter of 2014. Time Warner Businesses Time Warner classifies its operations into four reportable segments: Turner, Home Box Office, Warner Bros. and Time Inc. In the fourth quarter of 2013, the Company separated its former Networks reportable segment... -

Page 41

... have access to the authenticated HBO GO and MAX GO streaming services, respectively, on various mobile devices and other online platforms, and an authenticated HBO GO streaming service is available to international premium pay television subscribers of HBO in a number of countries. Home Box Office... -

Page 42

... profits. In recent years, home video revenues have declined as a result of several factors, including consumers shifting to subscription rental services and discount rental kiosks, which generate significantly less revenue per transaction for the Company than physical disc sales; changing retailer... -

Page 43

...the lease period. Time Warner also expects to recognize a tax benefit of $50 million to $70 million related to the sale in the first quarter of 2014. In addition, the Company reached preliminary agreement relating to the move of its Corporate headquarters and its New York City-based employees to the... -

Page 44

...South Asia In September 2013, Home Box Office purchased its partner's interests in HBO Asia and HBO South Asia (collectively, "HBO Asia") for $37 million in cash, net of cash acquired. HBO Asia operates HBO- and Cinemax-branded premium pay and basic tier television services serving over 15 countries... -

Page 45

... ...Gain on operating assets, net ...Other ...Impact on Operating Income ...Investment gains (losses), net ...Amounts related to the separation of Time Warner Cable Inc...Amounts related to the disposition of Warner Music Group ...Items affecting comparability relating to equity method investments... -

Page 46

... of the controlling interests in HBO Asia, a $9 million gain at the Home Box Office segment upon the Company's acquisition of the controlling interest in HBO Nordic, a $6 million gain at the Warner Bros. segment related to miscellaneous operating assets, a $13 million gain at the Time Inc. segment... -

Page 47

... certain options to redeem securities. Amounts Related to the Separation of Time Warner Cable Inc. For the years ended December 31, 2013, 2012 and 2011, the Company recognized other income of $10 million, $9 million and $4 million, respectively, related to the expiration, exercise and net change in... -

Page 48

... year ended December 31, 2013 was primarily related to increases at the Warner Bros. and Time Inc. segments. For the year ended December 31, 2012, the increase in Subscription revenues was primarily related to an increase at the Turner and Home Box Office segments. Advertising revenues for the year... -

Page 49

..., the Company incurred Restructuring and severance costs primarily related to employee terminations and other exit activities. Restructuring and severance costs are as follows (millions): Year Ended December 31, 2013 2012 2011 Turner ...Home Box Office ...Warner Bros...Time Inc...Corporate ...Total... -

Page 50

TIME WARNER INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued) The remaining changes in Other loss, net for the year ended December 31, 2013 reflected the absence of the 2012 adjustment to reduce a liability for deferred compensation and higher ... -

Page 51

... increase in Advertising revenues for the year ended December 31, 2013 reflected domestic growth of $219 million driven by an increase at Turner's domestic entertainment networks due to higher pricing and demand, which included higher demand for sports programming, primarily the NBA and the National... -

Page 52

... the second quarter of 2012, partially offset by higher revenues from availabilities to SVOD services. The increase in Costs of revenues for the year ended December 31, 2013 was primarily due to higher originals and sports programming costs, mainly due to higher costs for original series, as well as... -

Page 53

... for the Home Box Office segment are as follows (millions): Year Ended December 31, 2013 2012 2011 % Change 2013 vs. 2012 2012 vs. 2011 Programming costs: Acquired films and syndicated series ...Originals and sports ...Total programming costs ...Other direct operating costs ...Costs of revenues... -

Page 54

... series, as well as higher other direct operating costs due to higher employee-related costs and an increase of a receivable allowance, partially offset by lower acquired films and syndicated series programming costs. For the year ended December 31, 2012, Selling, general and administrative expenses... -

Page 55

...content made available for initial airing on television). The components of Content revenues for the years ended December 31, 2013, 2012 and 2011 are as follows (millions): Year Ended December 31, 2013 2012 2011 % Change 2013 vs. 2012 2012 vs. 2011 Theatrical product: Film rentals ...Home video and... -

Page 56

... television product revenues from home video and electronic delivery for the year ended December 31, 2013 was primarily due to lower revenues from consumer packaged goods, partially offset by higher revenues from availabilities of television product to SVOD services. Other content revenues increased... -

Page 57

... higher fees for certain returning series as well as the timing of network deliveries, partially offset by lower worldwide syndication revenues mainly as a result of the initial off-network availability of The Big Bang Theory in 2011. The increase in television product revenues from home video and... -

Page 58

...December 31, 2013 2012 2011 % Change 2013 vs. 2012 2012 vs. 2011 Revenues: Subscription ...Advertising ...Content ...Other ...Total revenues ...Costs of revenues(a) ...Selling, general and administrative(a) ...Gain (loss) on operating assets ...Asset impairments ...Restructuring and severance costs... -

Page 59

... 31, 2013, the transfer of the management of the SI.com and Golf.com websites to Time Inc. from Turner in the second quarter of 2012 had a positive effect on Advertising revenues of $12 million and a $9 million negative effect on Other revenues. The Company expects the market conditions associated... -

Page 60

... primarily due to the absence of the QSP Business. For the year ended December 31, 2012, the transfer of the management of the SI.com and Golf.com websites to Time Inc. from Turner in the second quarter of 2012 had a positive effect on Advertising revenues of $26 million and a corresponding negative... -

Page 61

...disposal of certain corporate assets. For the year ended December 31, 2012, Operating Loss increased due primarily to higher costs related to investments in enterprise efficiency initiatives, offset in part by a change in estimate associated with the Company's employee benefit plans of approximately... -

Page 62

...the lease period. Time Warner also expects to recognize a tax benefit of $50 million to $70 million related to the sale in the first quarter of 2014. In addition, the Company reached preliminary agreement relating to the move of its Corporate headquarters and its New York City-based employees to the... -

Page 63

... shares of common stock and received $674 million in connection with the exercise of stock options. At December 31, 2013, all of the approximately 27 million exercisable stock options outstanding on such date had exercise prices below the closing price of the Company's common stock on the New York... -

Page 64

... 31, 2012, the Company issued approximately 35 million shares of common stock and received $1.107 billion in connection with the exercise of stock options. Outstanding Debt and Other Financing Arrangements Outstanding Debt and Committed Financial Capacity At December 31, 2013, Time Warner had total... -

Page 65

... $2 billion of debt publicly issued by Time Warner in 2006, which is not guaranteed by Home Box Office). See Note 8, "Long-Term Debt and Other Financing Arrangements," to the accompanying consolidated financial statements for additional information regarding the Company's outstanding debt and other... -

Page 66

..., primarily at the Turner, Home Box Office and Warner Bros. segments; (2) obligations related to the Company's postretirement and unfunded defined benefit pension plans; (3) obligations to purchase information technology licenses and services; (4) obligations related to payments to the NCAA for... -

Page 67

... or unable to meet its agreed upon contractual payment obligations. Credit risk in the Company's businesses originates from sales of various products or services and is dispersed among many different counterparties. At December 31, 2013, no single customer had a receivable balance greater than... -

Page 68

...customer credit risk, refer to Note 1, "Description of Business, Basis of Presentation and Summary of Significant Accounting Policies," to the accompanying consolidated financial statements. MARKET RISK MANAGEMENT Market risk is the potential gain/loss arising from changes in market rates and prices... -

Page 69

... for additional information. Equity Risk The Company is exposed to market risk as it relates to changes in the market value of its investments. The Company invests in equity instruments of public and private companies for operational and strategic business purposes. These securities are subject... -

Page 70

...tax benefit expected to be recognized in the first quarter of 2014 in connection with the sale of the Company's office space in Time Warner Center, (v) the Company's expectation that the soft market conditions that have adversely affected the Time Inc. segment's Subscription and Advertising revenues... -

Page 71

...whose programming is shown on the Company's networks; changes in tax, federal communication and other laws and regulations; changes in foreign exchange rates and in the stability and existence of the Euro; and the other risks and uncertainties detailed in "Risk Factors" in this 2013 Annual Report to... -

Page 72

... issued and 895 million and 932 million shares outstanding ...Paid-in-capital ...Treasury stock, at cost (757 million and 720 million shares) ...Accumulated other comprehensive loss, net ...Accumulated deficit ...Total Time Warner Inc. shareholders' equity ...Noncontrolling interests ...Total equity... -

Page 73

... per share amounts) 2013 2012 2011 Revenues: Subscription ...Advertising ...Content ...Other ...Total revenues ...Costs of revenues ...Selling, general and administrative ...Amortization of intangible assets ...Restructuring and severance costs ...Asset impairments ...Gain on operating assets, net... -

Page 74

...) losses realized in net income ...Change in derivative financial instruments ...Other comprehensive income (loss) ...Comprehensive income ...Less Comprehensive loss attributable to noncontrolling interests ...Comprehensive income attributable to Time Warner Inc. shareholders ... $ 3,691 $ 2,922... -

Page 75

... and television costs ...Asset impairments ...(Gain) loss on investments and other assets, net ...Equity in losses of investee companies, net of cash distributions ...Equity-based compensation ...Deferred income taxes ...Changes in operating assets and liabilities, net of acquisitions: Receivables... -

Page 76

... AT DECEMBER 31, 2012 ...Net income ...Other comprehensive income ...Cash dividends ...Common stock repurchases ...Noncontrolling interests of acquired businesses ...Amounts related primarily to stock options and restricted stock(b) ...BALANCE AT DECEMBER 31, 2013 ...(a) (b) $16 - - - - - 1 $17 17... -

Page 77

... company, whose businesses include television networks, film and TV entertainment and publishing. Time Warner classifies its operations into four reportable segments: Turner: consisting principally of cable networks and digital media properties; Home Box Office: consisting principally of premium pay... -

Page 78

... application. The development and selection of these critical accounting policies have been determined by Time Warner's management and the related disclosures have been reviewed with the Audit and Finance Committee of the Board of Directors of the Company. Due to the significant judgment involved in... -

Page 79

... based on customer payment levels, historical experience and management's views on trends in the overall receivable agings at the Company's divisions. In addition, for larger accounts, the Company performs analyses of risks on a customer-specific basis. At December 31, 2013 and 2012, total reserves... -

Page 80

... rights in this entity are disproportionate. HBO LAG operates multi-channel premium pay and basic tier television services in Latin America and is accounted for using the equity method. See Note 4 for additional information. At December 31, 2012, HBO Asia and HBO South Asia were also considered VIEs... -

Page 81

... model. For more information, see Note 2. Asset Impairments Investments The Company's investments consist of (i) investments carried at fair value, including available-for-sale securities and certain deferred compensation-related investments, (ii) investments accounted for using the cost 65 -

Page 82

...changes in circumstances. Goodwill is tested for impairment at the reporting unit level. A reporting unit is either the "operating segment level," such as Warner Bros. Entertainment Inc. ("Warner Bros."), Home Box Office, Inc. ("Home Box Office"), Turner Broadcasting System, Inc. ("Turner") and Time... -

Page 83

... for years beyond the current long range plan period. Discount rate assumptions are based on an assessment of market rates as well as the risk inherent in the future cash flows included in the budgets and long range plans. In 2013, the Company elected not to perform a qualitative assessment of... -

Page 84

...return on plan assets, the interest factor implied by the discount rate and the rate of compensation increases. Additional information about the determination of pension-related assumptions is presented in Note 13. Equity-Based Compensation The Company measures the cost of employee services received... -

Page 85

... annual dividend by the market price of Time Warner common stock at the date of grant. For more information, see Note 12. Revenues and Costs Turner and Home Box Office Subscription revenues are recognized as programming services are provided to cable system operators, satellite distribution services... -

Page 86

...with which the network expects to use and benefit from providing the sports programming. For premium pay television services that are not advertising-supported, each licensed program's costs are amortized on a straight-line basis over its license period or estimated period of use, beginning with the... -

Page 87

...-demand services, premium cable, basic cable and broadcast networks. Theatrical revenues are recognized as the films are exhibited. Revenues from home video sales are recognized at the later of the delivery date or the date that the DVDs or Blu-ray Discs are made widely available for sale or rental... -

Page 88

... in future subscription sales. Revenues from retail outlet sales are recognized based on gross sales less a provision for estimated returns. Advertising revenues from websites are recognized as impressions are delivered or the services are performed. Film and Television Production Cost Recognition... -

Page 89

... initial weeks of release would have its theatrical, home video and television distribution ultimate revenues adjusted downward. A failure to adjust for a downward change in estimates of ultimate revenues would result in the understatement of production costs amortization for the period. The Company... -

Page 90

... and/or the packaged goods inventory. If Warner Bros. does not bear the risk of loss as described in the previous sentence, the arrangements are accounted for on a net basis. Turner provides advertising sales services to third-party companies. From time to time, Turner contracts with third parties... -

Page 91

... December 31, 2013 and 2012 were not significant. In accounting for this arrangement, the Company records Advertising revenues for the advertisements aired on Turner's networks and amortizes Turner's share of the programming rights fee based on the ratio of current period advertising revenues to its... -

Page 92

..., the Company expects to report the financial position and results of operations of its Time Inc. segment as discontinued operations. For more information on the separation of Time Inc. from Time Warner, see Note 3. During 2013, the Company recognized additional net tax benefits associated with... -

Page 93

... of Bleacher Report (see Note 3 for additional information). The increase in Goodwill for the year ended December 31, 2012 at the Warner Bros. segment is primarily related to contingent consideration earned by the former shareholders of TT Games Limited, which was acquired by the Company in 2007... -

Page 94

... ended December 31, 2013, 2012 and 2011 by reportable segment, as follows (millions): Year Ended December 31, 2013 2012 2011 Turner ...Warner Bros...Time Inc...Time Warner ... $ 18 1 78 $ 97 $ 79 1 - $ 80 $ 5 1 13 $ 19 For the year ended December 31, 2013, the Company recorded an impairment of... -

Page 95

...a publicly-traded broadcasting company operating leading networks in six Central and Eastern European countries. Since the Company's initial investment in CME in May 2009, CME founder and Non-Executive Chairman Ronald S. Lauder had controlled the voting rights associated with the Company's shares in... -

Page 96

...in CME. HBO Asia and HBO South Asia In September 2013, Home Box Office purchased its partner's interests in HBO Asia and HBO South Asia (collectively, "HBO Asia") for $37 million in cash, net of cash acquired. HBO Asia operates HBO- and Cinemax- branded premium pay and basic tier television services... -

Page 97

... 31, 2013, investments accounted for using the equity method primarily included the Company's investments in the Class A common stock and Series A convertible preferred stock of CME (49.9% economic interest), HBO LAG (88% owned) and certain other Turner, Home Box Office and Warner Bros. ventures... -

Page 98

... funds. The Company uses available qualitative and quantitative information to evaluate all cost-method investments for impairment at least quarterly. Gain on Sale of Investments For the years ended December 31, 2013, the Company recognized net gains of $76 million, primarily related to a gain... -

Page 99

... investments related to deferred compensation. The Company primarily applies the market approach for valuing recurring fair value measurements. During the year ended December 31, 2013, approximately $13 million of certain available-for-sale debt securities classified within Level 2 were transferred... -

Page 100

... 31, 2013 and 2012, assets and liabilities valued using significant unobservable inputs (Level 3) primarily consisted of an asset related to equity instruments held by employees of a former subsidiary of the Company, liabilities for contingent consideration and options to redeem securities. The... -

Page 101

... Company employs a DCF methodology that includes cash flow estimates of a film's ultimate revenue and costs as well as a discount rate. The discount rate utilized in the DCF analysis is based on the weighted average cost of capital of the respective business (e.g., Warner Bros.) plus a risk premium... -

Page 102

... during the twelve-month period ending December 31, 2014. 7. DERIVATIVE INSTRUMENTS Time Warner uses derivative instruments, principally forward contracts, to manage the risk associated with the volatility of future cash flows denominated in foreign currencies and changes in fair value resulting... -

Page 103

... OTHER FINANCING ARRANGEMENTS The Company's long-term debt and other financing arrangements consist of revolving bank credit facilities, a commercial paper program, fixed-rate public debt and other obligations. Long-term debt consists of (millions)(a): December 31, 2013 2012 Fixed-rate public debt... -

Page 104

..., which support the commercial paper program. Proceeds from the commercial paper program may be used for general corporate purposes. The obligations of the Company under the commercial paper program are directly or indirectly guaranteed, on an unsecured basis, by Historic TW, Home Box Office and... -

Page 105

... 31, 2013 and 2012, the weighted average interest rate on the Company's outstanding fixed-rate public debt was 6.13% and 6.23%, respectively. At December 31, 2013, the Company's fixed-rate public debt had maturities ranging from 2015 to 2043. Debt Offering On December 16, 2013, Time Warner issued... -

Page 106

... in the profits or losses of these SPEs. The Company accounts for these arrangements based on their substance, and the Company records the costs of producing the films as an asset and records the net benefit received from the investors as a reduction of film and television production costs resulting... -

Page 107

TIME WARNER INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Current and Deferred income taxes (tax benefits) provided on Income from continuing operations are as follows (millions): Year Ended December 31, 2013 2012 2011 Federal: Current ...Deferred ...Foreign: Current(a) ...Deferred ... -

Page 108

... benefit ultimately received. The applicable accounting rules require that the deferred tax asset related to an equity-based compensation award be reduced only at the time the award vests (in the case of a restricted stock unit or performance share unit), is exercised (in the case of a stock option... -

Page 109

...income tax positions as of December 31, 2013 will significantly increase or decrease during the twelve-month period ended December 31, 2014; however, various events could cause the Company's current expectations to change in the future. The Company and its subsidiaries file income tax returns in the... -

Page 110

...privately negotiated transactions. The size and timing of these purchases are based on a number of factors, including price and business and market conditions. Shares Authorized and Outstanding At December 31, 2013, shareholders' equity of Time Warner included 895 million shares of common stock (net... -

Page 111

......Year Ended December 31, 2013 Unrealized losses on foreign currency translation ...Reclassification adjustment for gains on foreign currency translation realized in net income(a) ...Unrealized gains on securities ...Unrealized gains (losses) on benefit obligation ...Reclassification adjustment for... -

Page 112

... 31, 2013 2012 2011 Income from continuing operations attributable to Time Warner Inc. shareholders: ...Income allocated to participating securities ...Income from continuing operations attributable to Time Warner Inc. common shareholders ...Average number of common shares outstanding - basic... -

Page 113

... the number of shares that vest and are paid out. Holders of stock options do not receive dividends or dividend equivalent payments. Upon the (i) exercise of a stock option award, (ii) vesting of an RSU, (iii) vesting of a PSU or (iv) grant of restricted stock, shares of Time Warner common stock may... -

Page 114

... shares of Time Warner common stock were available for future grants of stock options under the Company's equity plan. The following table summarizes information about stock options exercised (millions): 2013 Year Ended December 31, 2012 2011 Total intrinsic value ...Cash received ...Tax benefits... -

Page 115

... continues) and, effective December 31, 2013, pay increases will not be taken into consideration when determining a participating employee's benefits under the plans. In July 2013, the Company's Board of Directors approved amendments to the Time Warner Group Health Plan. Pursuant to the amendments... -

Page 116

...for substantially all of Time Warner's domestic and international defined benefit pension plans is as follows: Benefit Obligation (millions) December 31, 2013 2012 Change in benefit obligation: Projected benefit obligation, beginning of year ...Service cost ...Interest cost ...Actuarial (gain) loss... -

Page 117

...-average assumptions used to determine benefit obligations and net periodic benefit costs for the years ended December 31: Benefit Obligations 2013 2012 2011 Net Periodic Benefit Costs 2013 2012 2011 Discount rate ...Rate of compensation increase ...Expected long-term return on plan assets ... 4.82... -

Page 118

...defined benefit pension plans, including those assets related to The CW sub-plan, as of December 31, 2013 and December 31, 2012 (millions): Asset Category Level 1 December 31, 2013 Level 2 Level 3 Total Level 1 December 31, 2012 Level 2 Level 3 Total Cash and cash equivalents ...Insurance contracts... -

Page 119

..., 2013 and December 31, 2012, the defined benefit pension plans' assets did not include any securities issued by Time Warner. Expected cash flows After considering the funded status of the Company's defined benefit pension plans, movements in the discount rate, investment performance and related tax... -

Page 120

... in 2013, $188 million in 2012 and $184 million in 2011. The Company's contributions to the savings plans are primarily based on a percentage of the employees' elected contributions and are subject to plan provisions. Other Postretirement Benefit Plans Time Warner also sponsors several unfunded... -

Page 121

... the Home Box Office segment, $42 million at the Warner Bros. segment, $69 million at the Time Inc. segment and $5 million at Corporate. 2012 Initiatives For the year ended December 31, 2012, the Company incurred $101 million in Restructuring and severance costs primarily related to various employee... -

Page 122

... INFORMATION Time Warner classifies its operations into four reportable segments: Turner: consisting principally of cable networks and digital media properties; Home Box Office: consisting principally of premium pay television services domestically and premium pay and basic tier television services... -

Page 123

...Time Warner's reportable segments is set forth below (millions): Subscription Year Ended December 31, 2013 Advertising Content Other Total Revenues Turner ...Home Box Office ...Warner Bros...Time... 31, 2013 2012 2011 Intersegment Revenues Turner ...Home Box Office ...Warner Bros...Time Inc...Total... -

Page 124

...066 5,667 2,507 $ 67,994 $ 25,953 13,297 19,853 5,850 3,136 $ 68,089 Year Ended December 31, 2013 2012 2011 Capital Expenditures Turner ...Home Box Office ...Warner Bros...Time Inc...Corporate ...Total capital expenditures ...108 $ 210 45 236 34 77 602 $ 229 65 270 34 45 643 $ 235 95 313 48... -

Page 125

... Time Warner has commitments under certain network programming, film licensing, creative talent, employment and other agreements aggregating $25.113 billion at December 31, 2013. The Company also has commitments for office space, studio facilities and operating equipment. Time Warner's net... -

Page 126

...) The following table summarizes the Company's contingent commitments at December 31, 2013. For put options where payment obligations are outside the Company's control, the timing of amounts presented in the table represents the earliest period in which the payment could be requested. For other... -

Page 127

... fees are collected periodically over the term of the related licensing agreements. Backlog was approximately $5.5 billion and $6.0 billion at December 31, 2013 and 2012, respectively. Included in these amounts is licensing of film product from the Warner Bros. segment to the Home Box Office... -

Page 128

... administrative proceeding relates to CNN America's December 2003 and January 2004 terminations of its contractual relationships with Team Video, under which Team Video had provided electronic newsgathering services in Washington, DC and New York, NY. The National Association of Broadcast Employees... -

Page 129

... business with unconsolidated investees accounted for under the equity method of accounting. These transactions have been executed on terms comparable to the terms of transactions with unrelated third parties and primarily relate to the licensing of television programming to The CW broadcast network... -

Page 130

...the lease period. Time Warner also expects to recognize a tax benefit of $50 million to $70 million related to the sale in the first quarter of 2014. In addition, the Company reached preliminary agreement relating to the move of its Corporate headquarters and its New York City-based employees to the... -

Page 131

TIME WARNER INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) December 31, 2013 December 31, 2012 Accounts Payable and Accrued Liabilities Accounts payable ...Accrued expenses ...Participations payable ...Programming costs payable ...Accrued compensation ...Accrued interest ...Accrued ... -

Page 132

... control over financial reporting was made as of a specific date, and continued effectiveness in future periods is subject to the risks that controls may become inadequate because of changes in conditions or that the degree of compliance with the policies and procedures may decline. Management... -

Page 133

... of the two years in the period ended December 31, 2012. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Time Warner's internal control over financial reporting as of December 31, 2013, based on criteria established in Internal... -

Page 134

...internal control over financial reporting as of December 31, 2013, based on the COSO criteria. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Time Warner as of December 31, 2013 and 2012, and... -

Page 135

... to Time Warner Inc. shareholders: Income from continuing operations ...Discontinued operations, net of tax ...Net income ...Per share information attributable to Time Warner Inc. common shareholders: Basic income per common share from continuing operations ...Discontinued operations ...Basic net... -

Page 136

..., net of tax ...Net income ...Net income attributable to Time Warner Inc. shareholders ...Per share information attributable to Time Warner Inc. common shareholders: Basic income per common share from continuing operations ...Diluted income per common share from continuing operations ...Basic net... -

Page 137

..., net of tax ...Net income ...Net income attributable to Time Warner Inc. shareholders ...Per share information attributable to Time Warner Inc. common shareholders: Basic income per common share from continuing operations ...Diluted income per common share from continuing operations ...Basic net... -

Page 138

...formerly named News Corporation) (Class A), Viacom Inc. (Class B) and The Walt Disney Company. In accordance with SEC rules, the Company constructed the peer group index with which to compare its stock performance because there is not a relevant published industry or line-of-business index. The peer... -

Page 139

... and quarterly market capitalization weighting. The Company's Common Stock performance has been adjusted to take into account the separations of Time Warner Cable Inc. and AOL Inc. from the Company in 2009. From 2009 through 2013, the Company paid a quarterly dividend of (i) $0.1875 per share in... -

Page 140

... Continuing Operations attributable to Time Warner Inc. common shareholders. "Free Cash Flow" is defined as Cash Provided by Operations from Continuing Operations plus payments related to securities litigation and government investigations (net of any insurance recoveries), external costs related to... -

Page 141

... ...Gains on operating assets, net ...Other operating income items ...Gains (losses) on investments ...Other Amounts related to separation of Time Warner Cable Inc...Amounts related to separation of Warner Music Group ...Items affecting comparability relating to equity method investments ...Total... -

Page 142

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 143

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 144

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 145

...request to Time Warner Inc., One Time Warner Center, New York, NY 10019-8016, Attn: Investor Relations; by placing an order online at www.timewarner.com/investors or by calling toll-free 866-INFO-TWX. The Annual Report on Form 10-K and Time Warner's Quarterly Reports on Form 10-Q, as well as certain... -

Page 146

timewarner.com