TJ Maxx 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TO OUR FELLOW SHAREHOLDERS:

The year 2006 was pivotal for The TJX Companies. As

both of us came back into the leadership of the busi-

ness in the fall of 2005, we established profitable sales

growth as our top priority. We are pleased with how

our organization responded and the very strong

results we delivered in a relatively short period of time.

With a renewed focus on the fundamentals, and bet-

ter off-price buying being key, we improved execution

across the board. We regained our entrepreneurial

energy and were better risk-takers. We also rein-

forced the meaning of being accountable and results-

driven. We believe that all of these efforts led to our

success in achieving profitable sales growth in 2006.

For the year, net sales grew 9% to $17.4 billion

and consolidated comparable store sales increased

4% over the prior year. Income from continuing

operations reached $777 million and diluted earn-

ings per share from continuing operations were

$1.63, a very strong 26% increase over last year’s

results, on an adjusted basis, excluding items noted

below.*Overall, we grew square footage by 4%, netting

85 stores to end the year with a total of 2,466 stores.

We undertook many initiatives across the

Company in 2006 that worked well in the short term,

and we believe put us in a stronger position for

continued success in the long term. We reinvigorated

The Marmaxx Group, renewing our emphasis on off-

price buying and better brands. We delivered powerful

performance at our Winners and HomeSense,

T.K. Maxx and HomeGoods divisions, and our smaller

businesses made good progress. Across the Company,

we made cost reduction a major focus area, which

contributed to bottom-line improvement. In addition,

it allowed us to increase our marketing spend, which

we believe succeeded in driving customer traffic.

A Reinvigorated Marmaxx

The Marmaxx Group, our largest division, delivered

excellent results in 2006, increasing segment profit

by 10% to $1.1 billion, with a comparable store sales

increase of 2%. We made better off-price buying a

key priority in 2006, shifting approximately 10 percent

of our buying dollars into more true, off-price, close-

out buys. In so doing, we improved the flow of great

brands at compelling values to our stores, every day,

upping the “WOW” factor and increasing the excite-

ment of the treasure hunt, which encourages

customers to shop our stores more frequently. We

also pursued many merchandising initiatives, includ-

ing The Runway at T.J. Maxx designer departments

that we tested in over 40 T.J. Maxx stores. In addition

to bringing newness and excitement to the stores,

these initiatives are one of the many ways in which

we open new vendor doors, giving us the ability to

continue to flow in fresh brands. More effective

marketing was another main goal in 2006, which we

believe we achieved through our increased media

presence and harder-hitting messaging.

It’s important to note that, although Marmaxx

is the oldest and largest of our divisions, we do not

view it as “mature” in the traditional business sense.

We are constantly testing new ways to grow and drive

profitable sales. We have many initiatives underway

for 2007, including our plan to add more than 200

expanded footwear departments at Marshalls. Further,

we plan to be even stronger in our marketing presence

and message. Additionally, we continue to fill in existing

markets with new stores, with a plan to grow our

3

*FY06 adjusted earnings per share from continuing operations exclude the net

benefit of one-time items totaling $.12 per share, detailed in Management's

Discussion and Analysis in FY07 Form 10-K. On a GAAP basis, including these

items, such earnings per share were $1.41.

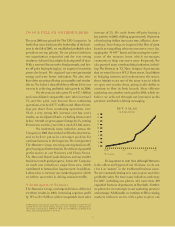

NET SALES

($ BILLIONS)

82*83*91*02*07

* Recessions (FYE)

18

6

4

0

2

8

10

12

16

14