Stein Mart 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 Stein Mart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

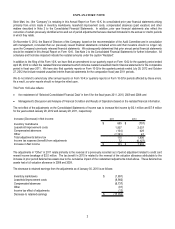

EXPLANATORY NOTE

Stein Mart, Inc. (the “Company”) is restating in this Annual Report on Form 10-K, its consolidated prior year financial statements arising

primarily from errors made in inventory markdowns, leasehold improvement costs, compensated absences (paid vacation) and other

matters described in Note 2 to the Consolidated Financial Statements. In addition, prior year financial statements also reflect the

correction of certain previously identified errors and out of period adjustments that were deemed immaterial to the annual or interim periods

in which they relate.

On November 6, 2012, the Board of Directors of the Company, based on the recommendation of the Audit Committee and in consultation

with management, concluded that our previously issued financial statements contained errors and that investors should no longer rely

upon the Company’s previously released financial statements. We subsequently determined that prior annual period financial statements

should be restated in this Annual Report on Form 10-K. See Note 2 to the Consolidated Financial Statements for further information. All

schedules and footnotes impacted indicate the restated amounts under the caption “Restated”.

In addition to the filing of this Form 10-K, we have filed an amendment to our quarterly report on Form 10-Q for the quarterly period ended

April 28, 2012 to reflect the restated financial statements which includes restated unaudited interim financial statements for the comparable

period in fiscal year 2011. We have also filed quarterly reports on Form 10-Q for the quarterly periods ended July 28, 2012 and October

27, 2012 that include restated unaudited interim financial statements for the comparative fiscal year 2011 periods.

We do not intend to amend any other annual reports on Form 10-K or quarterly reports on Form 10-Q for periods affected by these errors.

As a result, our prior reports should no longer be relied upon.

This Form 10-K also reflects:

x the restatement of “Selected Consolidated Financial Data” in Item 6 for the fiscal years 2011, 2010, 2009 and 2008; and

x Management’s Discussion and Analysis of Financial Condition and Results of Operations based on the restated financial information.

The net effect of the adjustments on the Consolidated Statements of Income was to increase Net income by $0.1 million and $7.9 million

for the years ended January 28, 2012 and January 29, 2011, respectively.

Increase (Decrease) in Net income:

2011 2010

Inventory markdowns 655$ (707)$

Leasehold improvement costs 1,937 2,037

Compensated absences

(

134

)

429

Othe

r

(

2,283

)

47

Total adjustments before tax 175 1,806

Income tax expense (benefit) from adjustments 72

(

6,127

)

Increase in Net income 103$ 7,933$

The adjustments in “Other” in 2011 relate primarily to the reversal of a previously recorded out of period adjustment related to credit card

reward income breakage of $2.0 million. The tax benefit in 2010 is related to the reversal of the valuation allowance attributable to the

increase in prior period deferred tax assets due to the cumulative impact of the restatement adjustments noted above. These deferred tax

assets had a full valuation allowance in 2008 and 2009.

The decrease to retained earnings from the adjustments as of January 30, 2010 is as follows:

Inventor

y

markdowns

(

1,891

)

$

Leasehold improvement costs

(

8,982

)

Compensated absences

(

6,737

)

Othe

r

(

81

)

Income tax effect of ad

j

ustments

(

12

)

Decrease to retained earnin

g

s

(

17,703

)

$