Sonic 2009 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2009 Sonic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview

Description of the Business.

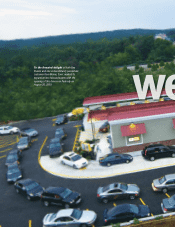

Sonic operates and franchises the largest chain of drive-in restaurants in the United States. As of

August 31, 2009, the Sonic system was comprised of 3,544 drive-ins, of which 13% were Partner Drive-Ins and 87% were Franchise Drive-

Ins. Sonic Drive-Ins feature signature menu items such as specialty drinks and frozen desserts, made-to-order sandwiches and a unique

breakfast menu. The company derives revenues primarily from Partner Drive-In sales and royalties from franchisees. The company also

receives revenues from initial franchise fees and, to a lesser extent, from the selling and leasing of signs and real estate.

Costs of Partner Drive-In sales, including minority interest in earnings of drive-ins, relate directly to Partner Drive-In sales. Other

expenses, such as depreciation, amortization, and general and administrative expenses, relate to the company’s franchising operations,

as well as Partner Drive-In operations. Our revenues and expenses are directly affected by the number and sales volumes of Partner Drive-

Ins. Our revenues and, to a lesser extent, expenses also are affected by the number and sales volumes of Franchise Drive-Ins. Initial

franchise fees and franchise royalties are directly affected by the number of Franchise Drive-In openings.

Overview of Business Performance.

Fiscal year 2009 was a challenging year marked by economic disruptions and constrained

consumer discretionary spending. In response to these and other challenges, we made progress against a number of initiatives during

the year. In January 2009, we introduced the Sonic Everyday Value Menu featuring 11 items for $1. We also made significant progress

against our refranchising initiative evidenced by the sale of 205 Partner Drive-Ins to franchisees during the year. Partner Drive-Ins now

comprise 13% of the entire system, down from 20% at the beginning of the fiscal year.

Investments by franchisees in new and existing development remained solid throughout the year, with the opening of 130 new drive-

ins, the relocation or rebuilding of 46 existing drive-ins, and the completion of 337 retrofits for the fiscal year. We also opened the first

Sonic Drive-Ins in several new markets and new states with very strong opening results.

The growth and success of our business is built around implementation of our multi-layered growth strategy, which features the

following components:

• Same-store sales growth fueled by increased media expenditures, new product news, improved sales performance of Partner

Drive-Ins and product and service differentiation initiatives;

• Expansion of the Sonic brand through new unit growth, particularly by franchisees;

• Increased franchising income stemming from franchisee new unit growth, same-store sales growth and our unique ascending

royalty rate; and

• The use of excess cash for shareholder value-enhancing initiatives.

The following table provides information regarding the number of Partner Drive-Ins and Franchise Drive-Ins in operation as of the

end of the years indicated as well as the system-wide growth in sales and average unit volume. System-wide information includes both

Partner Drive-In and Franchise Drive-In information, which we believe is useful in analyzing the growth of the brand as well as the

company’s revenues since franchisees pay royalties based on a percentage of sales.

System-wide Performance

Year Ended August 31,

($ in thousands)

2009 2008 2007

Percentage increase in sales 0.7% 5.6% 8.6%

System-wide drive-ins in operation

(1)

:

Total at beginning of period 3,475 3,343 3,188

Opened 141 169 175

Closed (net of re-openings) (72) (37) (20)

Total at end of period 3,544 3,475 3,343

Average sales per drive-in: $ 1,093 $ 1,125 $ 1,109

Change in same-store sales

(2)

: (4.3%) 0.9% 3.1%

(1)

Drive-ins that are temporarily closed for various reasons (repairs, remodeling, relocations, etc.) are not considered closed unless the

company determines that they are unlikely to reopen within a reasonable time.

(2)

Represents percentage change for drive-ins open for a minimum of 15 months.

Management's Discussion and Analysis of Financial Condition and Results of Operations

15