Ross 2015 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2015 Ross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.17

ITEM 1A. RISK FACTORS

Our Annual Report on Form 10-K for fiscal 2015, and information we provide in our Annual Report to Stockholders, press

releases, and other investor communications, including those on our corporate website, may contain forward-looking

statements with respect to anticipated future events and our projected growth, financial performance, operations, and

competitive position that are subject to risks and uncertainties that could cause our actual results to differ materially from

those forward-looking statements and our prior expectations and projections. Refer to Management’s Discussion and

Analysis for a more complete identification and discussion of “Forward-Looking Statements.”

Our financial condition, results of operations, cash flows, and the performance of our common stock may be adversely

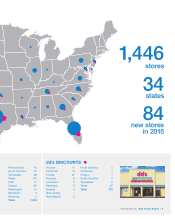

affected by a number of risk factors. Risks and uncertainties that apply to both Ross and dd's DISCOUNTS include, without

limitation, the following:

Competitive pressures in the apparel and home-related merchandise retailing industry are high.

The retail industry is highly competitive and the marketplace is highly fragmented, as many different retailers compete for

market share by utilizing a variety of store formats and merchandising strategies. We expect competition to increase in the

future. There are no significant economic barriers for others to enter our retail sector. We compete with many other local,

regional, and national retailers, traditional department stores, upscale mass merchandisers, other off-price retailers, specialty

stores, internet and catalog businesses, and other forms of retail commerce, for customers, associates, store locations, and

merchandise. Our retail competitors constantly adjust their pricing, business strategies and promotional activity (particularly

during holiday periods) in response to changing conditions. The substantial sales growth in the e-commerce industry within

the last decade has also encouraged the entry of many new competitors, new business models, and an increase in

competition from established companies looking for ways to create successful online off-price shopping alternatives. Intense

pressures from our competitors, our inability to adapt effectively and quickly to a changing competitive landscape, or a failure

to effectively execute our off-price model, could reduce demand for our merchandise, decrease our inventory turnover, cause

greater markdowns, and negatively affect our sales and margins.

Unexpected changes in the level of consumer spending on or preferences for apparel and home-related

merchandise.

Our success depends on our ability to effectively buy and resell merchandise that meets customer demand. We work on an

ongoing basis to identify customer trends and preferences, and to obtain merchandise inventory to meet anticipated

customer needs. It is very challenging to successfully do this well and consistently across our diverse merchandise

categories and in the multiple markets in which we operate throughout the United States. Although our off-price business

model provides us certain advantages and could allow us greater flexibility than traditional retailers in adjusting our

merchandise mix to ever-changing consumer tastes, our merchandising decisions may still fail to correctly anticipate and

match consumer trends and preferences, particularly in our newer geographic markets. Failure to correctly anticipate and

match the trends, preferences, and demands of our customers could adversely affect our business, financial condition, and

operating results.

Unseasonable weather may affect shopping patterns and consumer demand for seasonal apparel and other

merchandise.

Unseasonable weather and prolonged, extreme temperatures, and events such as storms, affect consumers’ buying patterns

and willingness to shop, and could adversely affect the demand for merchandise in our stores, particularly in apparel and

seasonal merchandise. Among other things, weather conditions may also affect our ability to deliver our products to our

stores or require us to close certain stores temporarily, thereby reducing store traffic. Even if stores are not closed, many

customers may decide to avoid going to stores in bad weather. As a result, unseasonable weather in any of our markets

could lead to disappointing sales and increase our markdowns, which may negatively affect our sales and margins.