Ross 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 Ross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.— 12 —

Our buying offices are located in New York City and Los Angeles, the nation’s two largest apparel markets. These strategic

locations allow our buyers to be in the market on a daily basis, sourcing opportunities and negotiating purchases with vendors

and manufacturers. These locations also enable our buyers to strengthen vendor relationships — a key element to the success

of our off-price buying strategies.

Over the past year, we continued to make strategic investments in our merchandise organization to further enhance our ability

to deliver name brand bargains to our customers. At the end of fiscal 2009, we had a total of approximately 410 merchants for

Ross and dd’s DISCOUNTS combined, up from 360 in the prior year. The Ross and dd’s buying organizations are separate and

distinct. These buying resources include merchandise management, buyers, and assistant buyers. Ross and dd’s DISCOUNTS

buyers have an average of about 12 years of experience, including merchandising positions with other retailers such as

Ann Taylor, Bloomingdale’s, Burlington Coat Factory, Foot Locker, HomeGoods, Kohl’s, Loehmann’s, Lord & Taylor, Macy’s,

Marshalls, Nordstrom, Saks, and T.J. Maxx. We expect to continue to make additional targeted investments in new merchants

to further develop our relationships with an expanding number of manufacturers and vendors. Our ongoing objective is to

strengthen our ability to procure the most desirable brands and fashions at competitive discounts.

The off-price buying strategies utilized by our experienced team of merchants enable us to purchase Ross merchandise at net

prices that are lower than prices paid by department and specialty stores and to purchase dd’s DISCOUNTS merchandise at

net prices that are lower than prices paid by moderate department and discount stores.

Pricing. Our policy is to sell brand-name merchandise at Ross that is priced 20 to 60 percent below most department and

specialty store regular prices. At dd’s DISCOUNTS, we sell more moderate brand-name product and fashions that are priced

20 to 70 percent below most moderate department and discount store regular prices. Our pricing policy is reflected on the price

tag displaying our selling price as well as the comparable selling price for that item in department and specialty stores for Ross

merchandise, or in more moderate department and discount stores for dd’s DISCOUNTS merchandise.

Our pricing strategy at Ross differs from that of a department or specialty store. We purchase our merchandise at lower prices

and mark it up less than a department or specialty store. This strategy enables us to offer customers consistently low prices.

On a weekly basis our buyers review specified departments in our stores for possible markdowns based on the rate of sale as

well as at the end of fashion seasons to promote faster turnover of merchandise inventory and to accelerate the flow of fresh

product. A similar pricing strategy is in place at dd’s DISCOUNTS where prices are compared to those in moderate department

and discount stores.

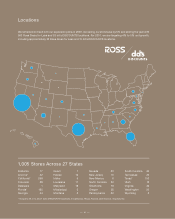

Stores

At January 30, 2010, we operated a total of 1,005 stores comprised of 953 Ross stores and 52 dd’s DISCOUNTS stores. Our

stores are conveniently located in predominantly community and neighborhood shopping centers in heavily populated urban

and suburban areas. Where the size of the market permits, we cluster stores to benefit from economies of scale in advertising,

distribution, and field management.

We believe a key element of our success is our organized, attractive, easy-to-shop, in-store environments at both Ross and

dd’s DISCOUNTS, which allow customers to shop at their own pace. While our stores promote a self-service, treasure hunt

shopping experience, the layouts are designed to promote customer convenience in their merchandise presentation, dressing

rooms, checkout, and merchandise return areas. Each store’s sales area is based on a prototype single floor design with a

racetrack aisle layout. A customer can locate desired departments by signs displayed just below the ceiling of each department.

We enable our customers to select among sizes and prices through prominent category and sizing markers, promoting a

self-service atmosphere. At most stores, shopping carts are available at the entrance for customer convenience. All cash

registers are centrally located at store exits for customer ease and efficient staffing.