Restoration Hardware 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 Restoration Hardware annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.3

Sales Channels

We distribute our products through a fully integrated sales platform comprised of our stores, catalogs and websites. We believe

the level of integration among all of our channels and our approach to the market distinguishes us from most other retailers. For fiscal

2015, sales of products originating in our stores represented 51% of our net revenues, while sales from our direct business represented

49% of our net revenues. We believe our channels complement each other and our customers’ buying decisions are influenced by their

experiences across more than one of our sales channels. We encourage our customers to shop across our channels and have aligned

our business and internal organization to be channel agnostic. Our integrated distribution and product delivery network serves all of

our channels. We believe the key advantage of our multiple sales channels is our ability to leverage the unique attributes of each

channel in our approach to the market.

Stores

Retail Galleries

Our retail galleries are located primarily in upscale malls and street locations, as well as in iconic locations. We believe situating

our galleries in desirable locations with high visibility is critical to the success of our business, and we identify gallery locations based

on several store specific aspects including geographic location, demographics, and proximity to other high-end specialty retail stores.

We pursue a market-based sales strategy, whereby we assess each market’s overall sales potential and how best to approach the

market across all of our channels. We customize square footage and catalog circulation to maximize each market’s sales potential and

increase our return on invested capital.

Our retail galleries reinforce our luxury brand aesthetic and are highly differentiated from other home furnishings retailers. We

have revolutionized the customer experience by showcasing products in a sophisticated lifestyle setting that we believe is on par with

world-class interior designers, consistent with the imagery and product presentation featured in our catalogs and on our websites.

Products in our galleries are presented in fully appointed rooms, emphasizing collections over individual pieces. This presentation

encourages a higher average order value as customers are inspired to consider purchasing a full collection of products to replicate the

design aesthetic experienced in our galleries. In addition, because less than 10% of our merchandise assortment is displayed in our

legacy Galleries, our store associates use iPads and other devices to allow customers to shop our entire merchandise assortment while

in the gallery.

During fiscal 2015, we opened RH Chicago, The Gallery at the Three Arts Club in Chicago’s Gold Coast. This first-of-its-kind

retail concept represents our initial foray into hospitality with a seamlessly integrated culinary offering, which includes the 3 Arts Club

Café, the 3 Arts Club Wine Vault & Tasting Room, and the 3 Arts Club Pantry & Espresso Bar.

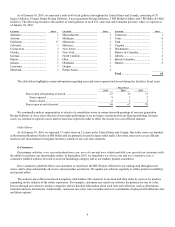

We define leased selling square footage as retail space at our stores used to sell our products. Leased selling square footage

excludes backrooms used for storage, office space or similar purpose, as well as exterior sales space located outside a store, such as

courtyards, gardens and rooftops. We currently operate five distinct store types with the following average leased selling square

footage as of January 30, 2016:

1) Next generation Design Galleries; which include our Galleries in Atlanta, Chicago, Denver and Tampa, and which

average approximately 43,000 leased selling square feet;

2) Initial larger format Design Galleries; which include our Galleries in Houston, Scottsdale, Boston, Indianapolis,

Greenwich, and Los Angeles, and which average approximately 19,000 leased selling square feet;

3) Legacy Galleries, which average approximately 8,000 leased selling square feet;

4) The RH Modern Gallery, which is located in Los Angeles and is approximately 13,000 leased selling square feet; and

5) RH Baby & Child Galleries, which average approximately 4,000 leased selling square feet.

We continue to evaluate potential opportunities for stand-alone RH Baby & Child, RH Teen and RH Modern Galleries in key

markets.