Restoration Hardware 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Restoration Hardware annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

⌧ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the fiscal year ended January 30, 2016

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the transition period from to

Commission file number: 001-35720

RESTORATION HARDWARE HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

Delaware 45-3052669

(State or other jurisdiction of

incorporation or organization) (I.R.S. Employer

Identification Number)

15 Koch Road, Suite K

Corte Madera, CA

(Address of principal executive offices)

94925

(Zip Code)

Registrant’s telephone number, including area code: (415) 924-1005

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, $0.0001 par value New York Stock Exchange, Inc.

(Title of class) (Name of each exchange on which registered)

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ⌧ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No ⌧

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days. Yes ⌧ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for

such shorter period that the registrant was required to submit and post such files). Yes ⌧ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained

herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in

Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

Large accelerated filer ⌧ Accelerated filer

N

on-accelerated filer (Do not check if a smaller reporting company) Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No ⌧

As of July 31, 2015, the last business day of the registrant’s most recently completed second quarter, the approximate market value of the

registrant’s common stock held by non-affiliates was $2,794,100,000. Solely for purposes of this disclosure, shares of common stock held by

executive officers and directors of the registrant as of such date have been excluded because such persons may be deemed to be affiliates.

As of March 25, 2016, 40,583,845 shares of registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for its 2016 Annual Meeting of Stockholders are incorporated by reference in Part III of this

Annual Report on Form 10-K where indicated. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of

the registrant’s fiscal year ended January 30, 2016.

Table of contents

-

Page 1

... year ended January 30, 2016 or TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number: 001-35720 RESTORATION HARDWARE HOLDINGS, INC. (Exact name of registrant as specified in its charter) Delaware (State... -

Page 2

... Disclosures About Market Risk ...Financial Statements and Supplementary Data ...Changes in and Disagreements with Accountants on Accounting and Financial Disclosure ...Controls and Procedures...Other Information...PART III. Directors, Executive Officers and Corporate Governance ...Executive... -

Page 3

... AND MARKET DATA This annual report contains forward-looking statements that are subject to risks and uncertainties. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business... -

Page 4

...of January 30, 2016, we operated a total of 69 retail galleries, consisting of 53 legacy Galleries, 6 larger format Design Galleries, 4 next generation Design Galleries, 1 RH Modern Gallery and 5 RH Baby & Child Galleries, as well as 17 outlet stores, throughout the United States and Canada. We have... -

Page 5

... business into select countries outside of the United States and Canada in the future. We believe that our luxury brand positioning and unique aesthetic will have strong international appeal. Products and Product Development We have positioned RH as a lifestyle brand and design authority by offering... -

Page 6

..., catalogs and websites. We believe the level of integration among all of our channels and our approach to the market distinguishes us from most other retailers. For fiscal 2015, sales of products originating in our stores represented 51% of our net revenues, while sales from our direct business... -

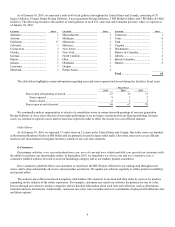

Page 7

... 30, 2016, we operated a total of 69 retail galleries throughout the United States and Canada, consisting of 53 legacy Galleries, 6 larger format Design Galleries, 4 next generation Design Galleries, 1 RH Modern Gallery and 5 RH Baby & Child Galleries. The following list shows the number of retail... -

Page 8

..., to showcase our merchandise assortment. In fiscal 2015, these included our Interiors, Outdoor, RH Modern, RH Teen, RH Baby & Child, Small Spaces, Bath, Linens, Rugs, Lighting and Holiday Source Books. Our Source Books, which showcase nearly our entire product assortment, are one of our primary... -

Page 9

... vehicles for the RH brands. The highly-differentiated design aesthetic and shopping environment of our stores drive customer traffic not only to our stores but also to our direct channels. Our Source Books and targeted emails further reinforce the RH brand image and drive sales across all of... -

Page 10

... custom-designed product offerings at high price points, including antique dealers and home furnishings retailers who market to the interior design community. We also compete with national and regional home furnishings retailers and department stores, as well as with mail order catalogs and online... -

Page 11

... our relations with our employees are good. Intellectual Property The "RH", "Restoration Hardware," "RH Baby & Child," "RH Modern," and "RH Teen" trademarks, among others, are registered or are the subject of pending trademark applications with the United States Patent and Trademark Office and... -

Page 12

...-priced housing, our business would likely be adversely affected. In addition, sales growth may be adversely affected if favorable customer responses to our product offerings and store formats are not sustained. We have introduced new product assortments in recent years, including RH Modern and RH... -

Page 13

... metropolitan markets and we expect to close a number of legacy Galleries and replace them with our next generation Design Gallery format. We also continue to add new product categories and to expand product assortments. For example, last year we introduced our new RH Modern and RH Teen categories... -

Page 14

..., including the health of the high-end housing market, may significantly impact our revenue and results of operations. We target consumers of high-end home furnishings as customers for our products. As a result, we believe that our sales are sensitive to a number of factors that influence consumer... -

Page 15

... financial performance. The home furnishings sector within the retail market is highly competitive. We compete with the interior design trade and specialty stores, as well as antique dealers and other merchants that provide unique items and custom-designed product offerings at higher price points... -

Page 16

... order to sell excess inventory or we may be required to sell such inventory through our outlet stores or warehouse sales. For these reasons, our results of operations in any given quarterly period may be adversely affected. We expect these factors to continue from time to time as we add new product... -

Page 17

... similar products. Our vendors could also initiate or expand sales of their products through vendor-owned stores or through the Internet to the retail market and therefore directly compete with us or sell their products through outlet centers or discount stores, increasing the competitive pricing... -

Page 18

... sales in our stores in Canada as well as sales in some of our U.S. based stores which have a high degree of visitors from other countries who purchase goods from us while visiting the United States. Changes in prices for raw materials and fluctuations in exchange rates are dependent on a number... -

Page 19

... address challenges such as those listed above could adversely affect our ability to successfully open new stores or change our store footprint in a timely and cost-effective manner and could have a material adverse effect on our business, results of operations and financial condition. 16 -

Page 20

...the sales generated by our stores currently located in shopping malls. If we are unable to successfully operate our distribution centers, furniture home delivery hubs and customer service centers, as well as fulfill orders and deliver our merchandise to our customers in a timely manner, our business... -

Page 21

..., to make acquisitions of other businesses or companies or to respond to changing business conditions or unanticipated competitive pressures. Any weakening of, or other adverse developments in, the U.S. or global credit markets could affect our ability to manage our debt obligations and our ability... -

Page 22

... employee costs associated with finding, hiring and training new store employees. If we are unable to hire and retain store personnel capable of consistently providing a high level of customer service, our ability to open new stores may be impaired, the performance of our existing and new stores... -

Page 23

...in our RH Baby & Child division. Certain of the products we sell are subject to the Lacey Act, prohibiting the importation and sale of products containing illegally harvested wood, among other things. Likewise, many of our products are subject to the regulations of the California Air Resources Board... -

Page 24

... of zip code or other information from customers. In addition, from time to time, we are subject to product liability and personal injury claims for the products that we sell and the stores we operate. Subject to certain exceptions, our purchase orders generally require the vendor to indemnify... -

Page 25

... the level of our international sourcing activities in an effort to obtain more of our products directly from vendors located outside the United States. Additionally, we have expanded our business-to-business sales. The foreign and U.S. laws and regulations that are applicable to our operations are... -

Page 26

... costs and longer lead times associated with distributing our products to both our stores and online customers and the inability to process orders in a timely manner or ship goods to our customers. Further, any significant interruption in the operation of our customer service centers could also... -

Page 27

... operations compared to market expectations; changes in preferences of our customers; announcements of new products or significant price reductions by us or our competitors; size of our public float; stock price performance of our competitors; fluctuations in stock market prices and volumes; default... -

Page 28

..., and/or by purchasing or selling shares of our common stock or other securities of the Company in secondary market transactions and/or open market transactions. The effect, if any, of these transactions and activities on the market price of our common stock or the trading prices of the Notes (which... -

Page 29

... materially and adversely affect the market price of our common stock and, in turn, the trading prices of the Notes. In addition, the conversion of some or all of the Notes may dilute the ownership interests of existing holders of our common stock, and any sales in the public market of any shares of... -

Page 30

...for 51 legacy Galleries, 6 larger format Design Galleries, 4 next generation Design Galleries, 1 RH Modern Gallery, 5 RH Baby & Child Galleries and 17 outlet stores that were open as of January 30, 2016. The initial lease term of our retail galleries generally ranges from 10 to 15 years, and certain... -

Page 31

...to be the location of a Design Gallery in the future. We believe that our current offices and facilities are in good condition, are being used productively and are adequate to meet our requirements for the foreseeable future. Item 3. Legal Proceedings From time to time, we and/or our management are... -

Page 32

... Securities Market Information and Dividend Policy Our common stock trades under the symbol "RH" on the NYSE. The following table sets forth the highest and lowest closing prices for our common stock on the NYSE for the periods indicated. Highest Lowest Fiscal 2014 First Quarter ...Second Quarter... -

Page 33

...any filing of Restoration Hardware Holdings, Inc. under the Securities Act of 1933, as amended, or the Exchange Act. The following graph and table compare the cumulative total stockholder return for our common stock during the period from November 2, 2012 (the date our common stock commenced trading... -

Page 34

... and other information herein relating to periods prior to the completion of the Reorganization is that of Restoration Hardware, Inc. The selected consolidated financial data as of January 30, 2016 and January 31, 2015 and for the fiscal years ended January 30, 2016, January 31, 2015, and February... -

Page 35

... 27 % 20% Direct ...10% 28% 33 % 30% Total...13% 20% 30 % 25% Comparable brand revenue growth (4)...11% 20% 31 % 28% Retail (5): Retail stores open at end of period...69 67 70 71 Total leased square footage at end of period (in thousands) (6) ...1,011 861 798 768 Total leased selling square footage... -

Page 36

... Baby & Child and RH Modern Galleries, and direct net revenues. Comparable brand revenue growth excludes retail non-comparable store sales, closed store sales and outlet store net revenues. Comparable store sales have been calculated based upon retail stores, excluding outlet stores, that were open... -

Page 37

...our management services agreement with Home Holdings, as well as fees and expense reimbursements paid to our board of directors prior to the initial public offering. Fiscal 2013 includes a $33.7 million non-cash compensation charge related to the one-time, fully vested option granted to Mr. Friedman... -

Page 38

... by the special committee of the board of directors relating to our Chief Executive Officer, Gary Friedman, and our subsequent remedial actions. Represents costs incurred in connection with our initial public offering, including a fee of $7.0 million to Catterton Management Company, LLC, Tower Three... -

Page 39

... 30, 2016, we operated a total of 69 retail galleries, consisting of 53 legacy Galleries, 6 larger format Design Galleries, 4 next generation Design Galleries, 1 RH Modern Gallery and 5 RH Baby & Child Galleries, as well as 17 outlet stores, throughout the United States and Canada. In order to drive... -

Page 40

... the development of our new larger format Design Galleries, which we refer to as next generation Design Galleries, in a number of new locations, the optimization of our store sizes to better fit anticipated demand in a given market, the expansion of our product categories and services and changes in... -

Page 41

... to match market demand from our customers, leading to higher levels of customer back orders and lost sales. For example, some of our vendors experienced difficulty in producing goods in sufficient quantity to meet initial customer demand in connection with the introduction of our RH Modern product... -

Page 42

... business, the synergies between our retail stores, websites and Source Books, and the fact that customers shop across all of these channels. Comparable brand revenue growth includes retail comparable store sales, including RH Baby & Child and RH Modern Galleries, and direct net revenues. Comparable... -

Page 43

... Baby & Child and RH Modern Galleries, and direct net revenues. Comparable brand revenue growth excludes retail non-comparable store sales, closed store sales and outlet store net revenues. Comparable store sales have been calculated based upon retail stores, excluding outlet stores, that were open... -

Page 44

...shows a summary of our stores net revenues, which include all sales for orders placed in galleries, as well as sales through outlet stores, and our direct net revenues, which include sales through our catalogs and websites. January 30, 2016 Year Ended January 31, 2015 (in thousands) February 1, 2014... -

Page 45

...launch of RH Modern and RH Teen, whereas in fiscal 2014 the majority of our new product introductions coincided with our Spring Source Book mailing. Further, there was a significant reduction in total circulated pages in fiscal 2015 as compared to fiscal 2014. Gross profit Gross profit increased $61... -

Page 46

... in our Galleries and on our websites, and our pricing and promotional strategy in fiscal 2014. We believe our brand awareness has increased and has allowed us to further disrupt the highly fragmented home furnishings landscape and achieve market share gains. Gross profit Gross profit increased $133... -

Page 47

...to Mr. Friedman in connection with the initial public offering, (iii) a $4.9 million charge incurred in connection with a legal claim alleging that the Company violated California's Song-Beverly Credit Card Act of 1971 by requesting and recording ZIP codes from customers paying with credit cards and... -

Page 48

... results. Our management uses this non-GAAP financial measure in order to have comparable financial results to analyze changes in our underlying business from quarter to quarter. The following table presents a reconciliation of net income, the most directly comparable GAAP financial measure, to... -

Page 49

... Baby & Child and RH Modern Galleries, and direct net revenues. Comparable brand revenue growth excludes retail non-comparable store sales, closed store sales and outlet store net revenues. Comparable store sales have been calculated based upon retail stores, excluding outlet stores, that were open... -

Page 50

... revenue and customer deposits of $7.3 million due to the timing of shipments made at fiscal year-end, as well as increases in deferred rent and lease incentives of $7.2 million primarily due to entering into new lease agreements for Galleries and new distribution center locations. Net Cash Used... -

Page 51

For fiscal 2015, net cash used in investing activities was $227.4 million and consisted of investments of $133.5 million related to new galleries, supply chain, renovations to our corporate headquarters, information technology and systems infrastructure. During fiscal 2015, we made payments of $20.0... -

Page 52

... Notes for such trading day was less than 98% of the product of the last reported sale price of our common stock and the applicable conversion rate on such trading day; or (3) upon the occurrence of specified corporate transactions. As of January 30, 2016, none of these conditions have occurred and... -

Page 53

... Notes for such trading day was less than 98% of the product of the last reported sale price of our common stock and the applicable conversion rate on such trading day; or (3) upon the occurrence of specified corporate transactions. As of January 30, 2016, none of these conditions have occurred and... -

Page 54

... in the fourth quarter of fiscal 2014 and $0.9 million related to the previous facility will be amortized over the life of the new revolving line of credit, which has a maturity date of November 24, 2019. On August 12, 2015, Restoration Hardware, Inc. and Restoration Hardware Canada, Inc. entered... -

Page 55

...borrowing base. On June 27, 2014, we paid off the principal balance and related interest under the prior credit agreement of $154.8 million using proceeds from the issuance of the 2019 Notes. As of January 30, 2016, Restoration Hardware, Inc. had no amounts outstanding under the amended and restated... -

Page 56

... accordance with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect amounts reported in our consolidated financial statements and related notes, as well as the related disclosure of contingent assets and liabilities at the... -

Page 57

... related cost of goods sold when merchandise is received by our customers. Revenues from direct-to-customer and home-delivered sales are recognized when the merchandise is delivered to the customer. Revenues from "cashand-carry" store sales are recognized at the point of sale in the store. Discounts... -

Page 58

... in customer demand or business climate that could affect the value of an asset; general economic conditions, such as increasing Treasury rates or unexpected changes in gross domestic product growth; a change in our market share; budget-to-actual performance and consistency of operating margins and... -

Page 59

...carrying amount of an asset may not be recoverable. Conditions that may indicate impairment include, but are not limited to, a significant adverse change in customer demand or business climate that could affect the value of an asset, a product recall or an adverse action or assessment by a regulator... -

Page 60

...line basis, net of forfeitures, over the requisite service period for the fair value of awards that actually vest. Fair value for restricted stock units is valued using the closing price of our stock...recent financial reporting losses. United States GAAP states that cumulative losses in recent years ... -

Page 61

.... The core principle of the revenue model is that revenue is recognized when a customer obtains control of a good or service. A customer obtains control when it has the ability to direct the use of and obtain the benefits from the good or service. Under the new guidance, transfer of control is... -

Page 62

... under ASC 405-20-Liabilities-Extinguishments of Liabilities, to derecognize financial liabilities related to certain prepaid stored-value products using a revenue-like breakage model. The new guidance is effective in fiscal years beginning after December 15, 2017, and interim periods within those... -

Page 63

...significant and a 1% movement in market interest rates would not have a significant impact on the total value of our portfolio. We actively monitor changes in interest rates. We are subject to interest rate risk in connection with borrowings under our revolving line of credit which bears interest at... -

Page 64

Impact of Inflation Our results of operations and financial condition are presented based on historical cost. While it is difficult to accurately measure the impact...we believe the effects of inflation, if any, on our consolidated results of operations and financial condition have been immaterial. 61 -

Page 65

Item 8. Financial Statements and Supplementary Data RESTORATION HARDWARE HOLDINGS, INC. CONSOLIDATED BALANCE SHEETS (In thousands, except share amounts) January 30, 2016 January 31, 2015 ASSETS Current assets: Cash and cash equivalents ...Short-term investments ...Accounts receivable-net ...... -

Page 66

RESTORATION HARDWARE HOLDINGS, INC. CONSOLIDATED STATEMENTS OF INCOME (In thousands, except share and per share amounts) January 30, 2016 Year Ended January 31, 2015 February 1, 2014 Net revenues...Cost of goods sold ...Gross profit ...Selling, general and administrative expenses ...Income from ... -

Page 67

RESTORATION HARDWARE HOLDINGS, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In thousands) January 30, 2016 Year Ended January 31, 2015 February 1, 2014 Net income ...$ Net losses from foreign currency translation ...Net unrealized holding gains (losses) on available-for-sale investments ... -

Page 68

RESTORATION HARDWARE HOLDINGS, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (In thousands, except share amounts) Accumulated Retained Additional Other Earnings Common Stock Paid-In Comprehensive (Accumulated Shares Amount Capital Income (Loss) Deficit) Total Treasury Stock Stockholders' ... -

Page 69

RESTORATION HARDWARE HOLDINGS, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) January 30, 2016 CASH FLOWS FROM OPERATING ACTIVITIES Net income ...Adjustments to reconcile net income to net cash provided by operating activities: Year Ended January 31, 2015 $ 91,002 34,463 - - 7,969 (16,... -

Page 70

...a luxury home furnishings retailer that offers a growing number of categories, including furniture, lighting, textiles, bathware, décor, outdoor and garden, tableware, and child and teen furnishings. These products are sold through the Company's stores, catalogs and websites. As of January 30, 2016... -

Page 71

...weeks. The fiscal years ended January 30, 2016 ("fiscal 2015"), January 31, 2015 ("fiscal 2014") and February 1, 2014 ("fiscal 2013") each consisted of 52 weeks. Use of Accounting Estimates The preparation of the Company's consolidated financial statements in conformity with GAAP requires management... -

Page 72

... to certain Source Books and merchandise assortment offered. If actual revenues associated with the Company's Source Books differ from its original estimates, the Company adjusts its catalog amortization schedules accordingly. Management does not believe that changes in the assumptions used in these... -

Page 73

...lease term. The Company expenses all internal-use software costs incurred in the preliminary project stage and capitalizes certain direct costs associated with the development and purchase of internal-use software, including external costs of materials and services and internal payroll costs related... -

Page 74

... adverse change in customer demand or business climate that could affect the value of an asset; general economic conditions, such as increasing Treasury rates or unexpected changes in gross domestic product growth; a change in the Company's market share; budget-to-actual performance and consistency... -

Page 75

... do not occur or if events change requiring the Company to revise its estimates. The Company recorded an impairment charge in fiscal 2013 of $1.4 million related to the underperformance of a stand-alone RH Baby & Child Gallery, which is included in selling, general and administrative expenses on the... -

Page 76

... to the revolving line of credit are amortized utilizing the straight-line method. Revenue Recognition The Company recognizes revenues and the related cost of goods sold when merchandise is received by its customers. Revenues from direct-to-customer and home-delivered sales are recognized when... -

Page 77

... and Merchandise Credits The Company sells gift cards, gift certificates and issues merchandise credits to its customers in its stores and through its websites and product catalogs. Such gift cards, gift certificates and merchandise credits do not have expiration dates. Revenue associated with gift... -

Page 78

...related to many of the Company's operations at its corporate headquarters, including utilities, depreciation and amortization, credit card fees and marketing expense, which primarily includes catalog production, mailing and print advertising costs. All store pre-opening costs are included in selling... -

Page 79

.... The core principle of the revenue model is that revenue is recognized when a customer obtains control of a good or service. A customer obtains control when it has the ability to direct the use of and obtain the benefits from the good or service. Under the new guidance, transfer of control is... -

Page 80

... amendments in ASU 2015-03 require that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts. Costs associated with line-of-credit arrangements may continue... -

Page 81

...30, 2016. This is a change from the Company's ...term, on a generally straight-line basis. The ASU is effective for public companies for fiscal years...financial liabilities related to certain prepaid stored-value products using a revenue-like breakage model. The new guidance is effective in fiscal years... -

Page 82

... 2014, the Company concluded that it was the deemed owner for accounting purposes for a new distribution center located in California during the construction... During the fourth quarter of fiscal 2015, upon the completion of the construction period, the Company performed a sale-leaseback analysis and ... -

Page 83

... of the following (in thousands): January 30, 2016 January 31, 2015 Federal and state tax payable ...$ Unredeemed gift card and merchandise credit liability...Allowance for sales returns ...Capital lease obligations-current ...Other liabilities ...Total other current liabilities ...$ 27,838 $ 24... -

Page 84

... for such trading day was less than 98% of the product of the last reported sale price of the Company's common stock and the applicable conversion rate on such trading day; or (3) upon the occurrence of specified corporate transactions. As of January 30, 2016, none of these conditions have occurred... -

Page 85

... the offering of the 2020 Notes in June 2015 and the exercise in full of the overallotment option in July 2015, the Company entered into convertible note hedge transactions whereby the Company has the option to purchase a total of approximately 5.1 million shares of its common stock at a price of... -

Page 86

... for such trading day was less than 98% of the product of the last reported sale price of the Company's common stock and the applicable conversion rate on such trading day; or (3) upon the occurrence of specified corporate transactions. As of January 30, 2016, none of these conditions have occurred... -

Page 87

... of the new revolving line of credit, which has a maturity date of November 24, 2019. On August 12, 2015, Restoration Hardware, Inc. and Restoration Hardware Canada, Inc. entered into a First Amendment (the "Amendment") to the amended and restated credit agreement. The Amendment changes the amended... -

Page 88

... (or the BA Rate or the Canadian Prime Rate, as such terms are defined in the credit agreement, for Canadian borrowings denominated in Canadian dollars or the United States Index Rate or LIBOR for Canadian borrowings denominated in United States dollars) plus an applicable margin rate, in each case... -

Page 89

...-for-sale securities within the Company's investment portfolio based on stated maturities, which are recorded within cash and cash equivalents, short-term investments and long-term investments on the consolidated balance sheets (in thousands): January 30, 2016 Cost Fair Value January 31, 2015 Cost... -

Page 90

...including the trading price of the Company's convertible notes, when available, the Company's stock price and interest rates based on similar debt issued by parties with credit ratings similar to the Company (Level 2). As the Company's debt obligations under the revolving line of credit are variable... -

Page 91

... of the federal statutory tax rate to the Company's effective tax rate is as follows: Year Ended January 31, 2015 January 30, 2016 February 1, 2014 Provision at federal statutory tax rate ...State income taxes-net of federal tax impact ...Stock-based compensation...Valuation allowance ...Foreign... -

Page 92

... accruals of $0.2 million associated with exposures as of both January 30, 2016, and January 31, 2015. This Company is subject to tax in the United States, Canada, Shanghai and Hong Kong. The Company could be subject to United States federal and state tax examinations for years 2002 and forward by... -

Page 93

... is paid annually. The Company's repurchase and promissory note issuance activity is as follows: January 30, 2016 Year Ended January 31, 2015 February 1, 2014 Shares repurchased ...Fair value at purchase price (in thousands) ...$ Weighted-average interest rate ...Weighted-average term... 2,625 238... -

Page 94

....09 62.96 55.71 The fair value of stock options issued was estimated on the date of grant using the following assumptions: January 30, 2016 Year Ended January 31, 2015 February 1, 2014 Expected volatility ...Expected life (years) ...Risk-free interest rate...Dividend yield ... 37.7% 6.5 1.8% - 39... -

Page 95

... a straight-line basis over a weighted-average period of 3.59 years. 2012 Stock Incentive Plan-Restricted Stock Awards The Company grants restricted stock awards, which include restricted stock and restricted stock units, to its employees and members and advisor of its Board of Directors. A summary... -

Page 96

... of their performance-based units, such shares began to vest during the period following the initial public offering when the 10-day average closing price of the Company's common stock exceeded the initial public offering price of $24.00 per share for at least 10 consecutive trading days, and such... -

Page 97

... Agreement") with Gary Friedman, its Chief Executive Officer. The Time Sharing Agreement governs use of any of the Company's aircraft ("Corporate Aircraft") by Mr. Friedman for personal trips and provides that Mr. Friedman will lease such Corporate Aircraft and pay Restoration Hardware, Inc. an... -

Page 98

...the Company is obligated are excluded from minimum lease payments. Minimum and contingent rent under lease agreements accounted for as operating leases and lease agreements accounted for as build-to-suit lease transactions are as follows (in thousands): January 30, 2016 Year Ended January 31, 2015... -

Page 99

... Company's customers, including sales through catalogs, sales through the Company's website and sales through the Company's stores. The Company classifies its sales into furniture and non-furniture product lines. Furniture includes both indoor and outdoor furniture. Non-furniture includes lighting... -

Page 100

... claim alleging that the Company violated California's Song-Beverly Credit Card Act of 1971 by requesting and recording ZIP codes from customers paying with credit cards. The three months ended January 31, 2015 included a reversal of estimated expenses of $1.5 million associated with this matter... -

Page 101

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders Restoration Hardware Holdings, Inc. In our opinion, the consolidated financial statements listed in the index appearing under Item 15(a)(1) present fairly, in all material respects, the financial ... -

Page 102

... of the Company's internal control over financial reporting as of January 30, 2016 has been audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, as stated in their report which is included herein. Changes in Internal Control Over Financial Reporting There was... -

Page 103

...Directors, Executive Officers and Corporate Governance The information required by this item will be contained in our definitive Proxy Statement for the 2016 Annual... Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters The information required by this item will... -

Page 104

... documents are filed as part of this Annual Report on Form 10-K: Consolidated Financial Statements The following financial statements are included in Part II, Item 8 of this Annual Report on Form 10-K 2. Consolidated Balance Sheets as of January 30, 2016 and January 31, 2015 Consolidated Statements... -

Page 105

...of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. RESTORATION HARDWARE HOLDINGS, INC. By: /s/ Gary Friedman Gary Friedman Chairman and Chief Executive Officer Date: March 30, 2016 POWER OF ATTORNEY Know all persons by these... -

Page 106

..., by and between Restoration Hardware, Inc. and Gary Friedman. Employment Agreement dated as of November 1, 2012, by and between Restoration Hardware, Inc. and Karen Boone. 2012 Equity Replacement Plan and related documents. 2012 Stock Incentive Plan and related documents. 2012 Stock Option Plan and... -

Page 107

... the Counterparties. Amended and Restated Aircraft Time Sharing Agreement entered into on March 29, 2016 by and between Restoration Hardware, Inc. and Gary G. Friedman. Form of Base Convertible Bond Hedge Confirmation, dated June 18, 2015, between Restoration Hardware Holdings, Inc. and each of the... -

Page 108

...File Number First Filing Exhibit Number Filed Herewith 31.2 Certification of Chief Financial and Administrative Officer pursuant to Rule 13a-14(a) of the Securities Exchange...- - - - - - - - - - - - - - - - - - X X X X X X Indicates management contract or compensatory plan or arrangement. 105