Regions Bank 2015 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2015 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Among our franchise’s positive attributes: 41percent

of all new jobs created in the U.S. since 2009 were

within our footprint, and the region is a strong

performer in automotive and non-durable goods

manufacturing and in overseas trade. Many of our

metropolitan areas have population growth rates

well above the national average. We are committed

to providing great customer service and being a

strong community partner wherever we operate.

But we have also placed special emphasis on select

markets with strong, attractive growth profiles, and

we are devoting talent and resources to strengthen

our presence there.

In Atlanta, GA, Regions executive vice president and

commercial banking executive David Smith leverages

more than 25 years of banking experience on behalf

of middle-market clients in, and near, America’s

ninth-largest metropolitan area. He sees a host of

compelling qualities in Atlanta, which Regions has

identified as a priority market. Economic growth is

underpinned by the world’s busiest airport, the port

of Savannah which is America’s second-busiest U.S.

container exporter, and a diverse, entrepreneurial

business culture. David sees manufacturing on the

upswing, which, he notes, “is a positive for us, since

manufacturing companies tend to be asset-intensive

and need access to capital.”

David and the team in Atlanta meet the needs of

clients across an array of sectors, from healthcare,

insurance and major restaurant chains to poultry

processing and recreation services. He describes the

Atlanta team as “a collaborative, high-performing

team that executes well year in and year out. We

focus on having skilled bankers that bring added

value to the table. We are fortunate to have a lot

of continuity with the bankers on our team. Our

approach to earning new business is it’s a marathon,

not a sprint. You hardly ever win something quickly,

so it takes a lot of tenacity, staying in front of prospects

quarterly, bringing ideas to the table, and thinking

outside the normal bounds of what a bank offers.”

David is selective when recruiting new bankers and

has implemented innovative programs to develop

those who join the group. Several have been selected to

undergo a management consulting program designed

by Vanderbilt University that teaches bankers to think

like a CEO, honing skills to develop a keener under-

standing of the challenges these clients face running

their companies.

While he expects Atlanta’s overall economic growth

to be muted, David sees significant opportunity for

Regions associated with Mergers and acquisitions

(M&A) activity in the middle-market sector. “There

is a lot of money in motion – companies buying other

companies – and that is facilitating future growth.

With the experienced team we have in place, and our

Regions360SM strategy to match solutions with client

needs, we’re well-positioned for the future.”

Some 250 miles Northeast up I-85 in Charlotte, Regions

Corporate Banker Juan Cazorla has a front-row seat

to the dynamic opportunities in that city and across

North Carolina. “There is a tremendous pool of human

capital here, with a well-educated workforce, excellent

colleges and universities, as well as a great quality of

life,” notes Juan. “What we have seen post-recession is

the economy is much more diverse. There have been

a significant number of corporate headquarters that

have relocated here from the Northeast, and that’s

been exciting to witness.” The market is attracting a

growing number of businesses in which intellectual

capital is at a premium, including legal and consulting

services, biotechnology and healthcare.

Charlotte is also the nation’s second-

largest banking center outside New

York, and that makes the competitive

landscape fiercely competitive. For

Juan, the key to Regions’ success is

found in leveraging the advantages

of Regions360SM, creating a holistic

solution that aligns with unique

customer needs. Another differen-

tiator: offering a level of customer

responsiveness that is unmatched by

competitors. “In Charlotte and the

mid-Atlantic we are often not the best

known bank, so it’s fun to tell the

Right Time, Right Place (continued)

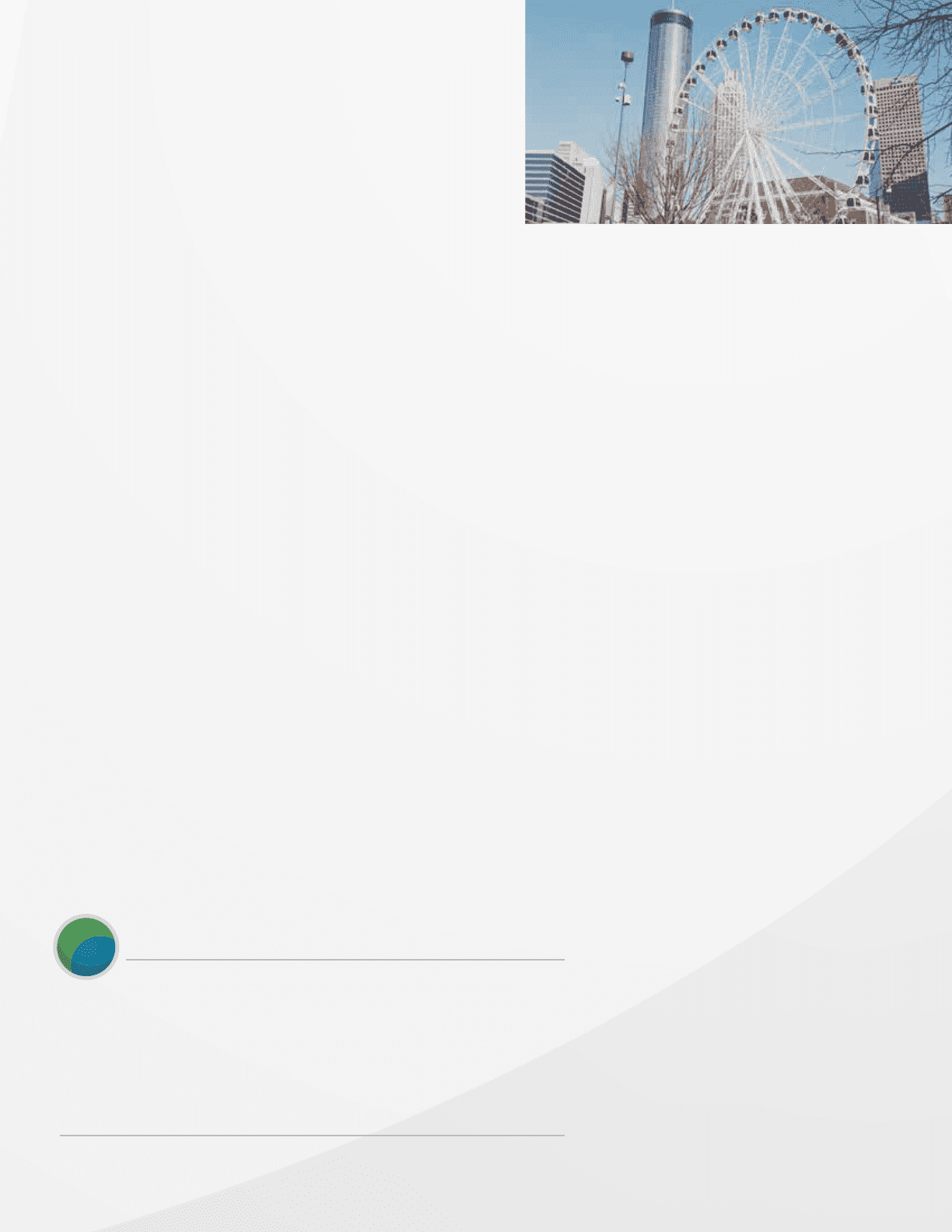

Skyview Ferris Wheel, Atlanta, GA

Regions 2015 Annual Review12 Perspective Regions

We bring the same capabilities that a lot of our

larger competitors can bring, but we bring it in

a manner that’s congruent with our culture and

it’s resonating with customers.”

“