Redbox 2001 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2001 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

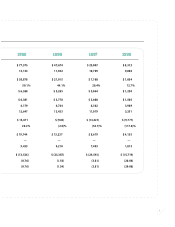

9,327

1996 1997 1998 1999 2000 2001

$15.7

$22.5

$37.3

-$13.4

-$9.8 -$0.9

-15

-10

-5

0

5

10

15

20

25

30

35

40

1996 1997 1998 1999 2000 2001

EBITDA (dollars in millions)

1,501

3,204

4,813

6,943

8,482

0

2,000

4,000

6,000

8,000

10,000

Installed Units

$25.0

$8.3

$47.7

$77.6

$102.2

$127.8

0

20

40

60

80

100

120

140

1996 1997 1998 1999 2000 2001

Revenue (dollars in millions)

0

10

20

30

40

50

60

70

80

*Revenue less direct expenses

Direct Contribution* (dollars in millions)Direct Contribution* (dollars in millions)

$1.1 $7.1

$21.0

$38.9

$54.3

$71.2

1996 1997 1998 1999 2000 2001

* EBITDA - capex - net interest expense

-$26.1

-$33.3

-$50.7

-$32.4 -$6.2

$15.3

-50

-40

-30

-20

-10

0

10

20

1996 1997 1998 1999 2000 2001

Free Cash Flow* (dollars in millions)

Net Income (dollars in millions)

-$13.5

-$23.4

-$29.6

-$15.7 -$8.1

$4.2

-30

-20

-10

0

10

1996 1997 1998 1999 2000 2001

1

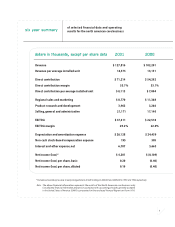

financial highlights

North American Core Business

The following financial information

represents the results of the North

American core business only.

Consolidated financial information

prepared in accordance with

accounting principles generally

accepted in the United States of

America (GAAP) is presented in the

enclosed Annual Report on Form 10-K.

2001 2000 2001/2000

Percent Change

(dollars in millions, except per share data)

$127.8 $102.2 25.1%

71.2 54.3 31.2

37.3 22.5 65.7

11.0 (2.4)

—

4.2 (8.1)

—

—

$0.19 $(0.40)

21,844 20,271 7.8

Revenue

Direct contribution

EBITDA*

Operating income (loss)

Net income (loss)

Net income (loss) per diluted share

Weighted shares outstanding (000)

*Earnings before interest, taxes, depreciation and amortization, and non-cash stock-based compensation