Rayovac 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Rayovac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SPECTRUM BRANDS HOLDINGS

2010 Annual Report

Providing Quality and Value to Consumers Worldwide

™

Table of contents

-

Page 1

SPECTRUM BRANDS HOLDINGS 2010 Annual Report Providing Quality and Value to Consumers Worldwide â„¢ -

Page 2

..., including alkaline, zinc carbon, hearing aid, rechargeable batteries and chargers. Rayovac® and VARTA® also market portable lighting products. PERSONAL CARE Our Remington® brand is a leading name in electric shaving and grooming and personal care products, including men's and women's shavers... -

Page 3

...scal 2010 achievement was our acquisition of the Russell Hobbs small appliances business, with its widely respected brands and leading market positions. Upon completion of this acquisition, our Company became Spectrum Brands Holdings from Spectrum Brands, Inc. As part of the Russell Hobbs merger, we... -

Page 4

... our corporate headquarters from Atlanta back to Madison, Wisconsin. In short, Spectrum Brands now has a streamlined organization aligned along global business units, and connected through a shared services platform. In addition to organic growth in our business segments, and a focus on driving more... -

Page 5

..., always looking to accelerate the pace when and where we can. Spectrum Brands has the vision, the mission, the strategy, the ï¬nancial and human resources, the business models, and the market and product opportunities needed to drive a prosperous and rewarding future and even greater value for our... -

Page 6

...cer and President - Global Batteries and Personal Care and Home and Garden Spectrum Brands Holdings, Inc. Age 56; Director since 2010 Norman S. Matthews ³ Independent Business Consultant Age 78; Director since 2009 Terry L. Polistina President, Small Appliances, Spectrum Brands Holdings, Inc. Age... -

Page 7

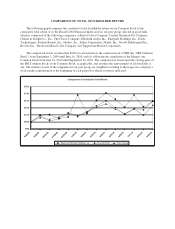

...September 30, 2010. The comparison is based upon the closing price of the SBI Common Stock or our Common Stock, as applicable, and assumes the reinvestment of all dividends, if any. The returns of each of the companies in our peer group are weighted according to the respective company's stock market... -

Page 8

-

Page 9

...001-34757 SPECTRUM BRANDS HOLDINGS, INC. (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 27-2166630 (I.R.S. Employer Identification Number) 601 Rayovac Drive, Madison, Wisconsin (Address of principal executive offices... -

Page 10

... AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS ... 37 39 42 84 85 85 85 86 ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK ...ITEM 8. ITEM 9. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA ...CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL... -

Page 11

... home product categories ("Small Appliances"). We manufacture and market alkaline, zinc carbon and hearing aid batteries, herbicides, insecticides and repellants and specialty pet supplies. We design, market and distribute rechargeable batteries, battery-powered lighting products, electric shavers... -

Page 12

... development facilities are located in the U.S., Europe, Latin America and Asia. Substantially all of our rechargeable batteries and chargers, shaving and grooming products, small household appliances, personal care products and portable lighting products are manufactured by third-party suppliers... -

Page 13

...; electric personal care products; home and garden control products; small appliances and portable lighting. Our broad line of products includes consumer batteries, including alkaline and zinc carbon batteries, rechargeable batteries and chargers and hearing aid batteries and other specialty... -

Page 14

... names and private labels, including Beltone, Miracle Ear and Starkey. We also sell Nickel Metal Hydride (NiMH) rechargeable batteries and a variety of battery chargers under the Rayovac and VARTA brands. Our other specialty battery products include camera batteries, lithium batteries, silver oxide... -

Page 15

... the Rayovac and VARTA brand names, under other proprietary brand names and pursuant to licensing arrangements with third parties. Sales and Distribution We sell our products through a variety of trade channels, including retailers, wholesalers and distributors, hearing aid professionals, industrial... -

Page 16

...home improvement centers, mass merchandisers, hardware stores, lawn and garden distributors, and food and drug retailers in the U.S. Small Appliances In the small appliances category, Russell Hobbs' products are sold principally by internal sales staff located in North America, Latin America, Europe... -

Page 17

.... Substantially all of our rechargeable batteries and chargers, portable lighting products, hair care and other personal care products and our electric shaving and grooming products and small appliances are manufactured by third party suppliers that are primarily located in the Asia/Pacific region... -

Page 18

... as a value brand, which is typically defined as a product that offers comparable performance at a lower price. In Europe, the VARTA brand is competitively priced with other premium brands. In Latin America, where zinc carbon batteries outsell alkaline batteries, the Rayovac brand is competitively... -

Page 19

...who use their own private label brands for household appliances (for example, Wal-Mart). Our major competitors in the electric personal care product category are Conair Corporation, Wahl Clipper Corporation and Helen of Troy Limited ("Helen of Troy"). Our primary competitors in the portable lighting... -

Page 20

...should not be material to our business or financial condition. Electronic and electrical products that we sell in Europe, particularly products sold under the Remington brand name, VARTA battery chargers, certain portable lighting and all of our batteries, are subject to regulation in European Union... -

Page 21

... of particular classes of electrical goods financially responsible for specified collection, recycling, treatment and disposal of past and future covered products. WEEE assigns levels of responsibility to companies doing business in EU markets based on their relative market share. WEEE calls... -

Page 22

...Vice President, Investor Relations & Corporate Communications, Spectrum Brands Holdings, Inc. at 601 Rayovac Drive, Madison, Wisconsin 53711 or via electronic mail at [email protected], or by contacting the Vice President, Investor Relations & Corporate Communications by telephone... -

Page 23

...our business strategy, future operations, financial condition, estimated revenues, projected costs, projected synergies, prospects, plans and objectives of management, as well as information concerning expected actions of third parties, are forward-looking statements. When used in this Annual Report... -

Page 24

... Annual Report on Form 10-K is accurate only as of September 30, 2010 or as otherwise specified, as our business, financial condition, results of operations and prospects may have changed since that date. Except as required by applicable law, including the securities laws of the U.S. and the rules... -

Page 25

... with integrating the operations, products and personnel of Spectrum Brands and Russell Hobbs into a combined company, in addition to costs related directly to completing the Merger described below. These costs may include costs for employee redeployment, relocation or severance; integration of... -

Page 26

... 30, 2009 will not be comparable to our financial information from prior periods. All conditions required for the adoption of fresh-start reporting were met upon emergence from Chapter 11 of the Bankruptcy Code on the Effective Date. However, in light of the proximity of that date to our accounting... -

Page 27

... Harbinger Group, Inc. ("HRG") would acquire a majority of the outstanding shares of our common stock, any sale or other disposition by HRG to non-affiliates of a sufficient amount of the common stock of SB Holdings would constitute a change of control under the agreements governing Spectrum Brands... -

Page 28

... each of the Spectrum Brands Term Loan and the ABL Revolving Credit Facility. In addition, under the indentures governing the 9.5% Notes and the 12% Notes, upon a change of control of SB Holdings, Spectrum Brands is required to offer to repurchase such notes from the holders at a price equal to 101... -

Page 29

... may acquire rights to market and distribute particular products or lines of products. The acquisition of a business or of the rights to market specific products or use specific product names may involve a financial commitment by us, either in the form of cash or equity consideration. In the case of... -

Page 30

... the foreign exchange rate of the Euro; changes in the economic conditions or consumer preferences or demand for our products in these markets; the risk that because our brand names may not be locally recognized, we must spend significant amounts of time and money to build brand recognition without... -

Page 31

... materials; any increase in the price of, or change in supply and demand for, these raw materials could have a material and adverse effect on our business, financial condition and profits. The principal raw materials used to produce our products-including zinc powder, electrolytic manganese dioxide... -

Page 32

... may relate to inventory practices, logistics, or other aspects of the customer-supplier relationship. Because of the importance of these key customers, demands for price reductions or promotions, reductions in their purchases, changes in their financial condition or loss of their accounts could... -

Page 33

... label products, which we do not produce on their behalf and which directly compete with our products, could have a material adverse effect on our business, financial condition and results of operations. As a result of our international operations, we face a number of risks related to exchange... -

Page 34

... also claimed by us, or a trademark application claiming a trademark, service mark or trade dress also used by us, in order to protect our rights, we may have to participate in expensive and time consuming opposition or interference proceedings before the U.S. Patent and Trademark Office or... -

Page 35

... business, financial condition and results of operations. In our Small Appliances segment, we license the use of the Black & Decker brand for marketing in certain small household appliances in North America, South America (excluding Brazil) and the Caribbean. Sales of Black & Decker branded products... -

Page 36

... in turn harm our business, financial condition and results of operations. We face risks related to our sales of products obtained from third-party suppliers. We sell a significant number of products that are manufactured by third party suppliers over which we have no direct control. While we have... -

Page 37

... in which certain of our products are made. We may incur some of these costs directly and others may be passed on to us from our third-party suppliers. Although we believe that we are substantially in compliance with applicable environmental laws and regulations at our facilities, we may not always... -

Page 38

...have a material adverse effect on our business, financial condition and results of operations. Compliance with various public health, consumer protection and other regulations applicable to our products and facilities could increase our cost of doing business and expose us to additional requirements... -

Page 39

... the safety of consumer products. Our products may not meet the specifications required by these authorities. A determination that any of our products are not in compliance with these rules and regulations could result in the imposition of fines or an award of damages to private litigants. Public... -

Page 40

... assets or other long-term assets is determined. Any such impairment charges could have a material adverse effect on our business, financial condition and operating results. Risks Related to SB Holdings' Common Stock The Harbinger Parties and, following the Share Exchange, HRG, will exercise... -

Page 41

... of the common stock of SB Holdings would constitute a change of control under the agreements governing Spectrum Brands' debt." In addition, because, as of the date hereof the Harbinger Parties owned, and, assuming the consummation of the Share Exchange, HRG and the Harbinger Parties will own more... -

Page 42

... the 2011 Plan for shareholder approval in connection with our next Annual Meeting. Upon such shareholder approval, no further awards will be granted under the 2009 Plan and the 2007 RH Plan. 4,625,676 shares of our common stock of the Company, net of cancellations, may be issued under the 2011 Plan... -

Page 43

... a change of control. Under our certificate of incorporation, holders of 5% or more of the outstanding common stock or capital stock into which any shares of common stock may be converted have certain rights to purchase their pro rata share of certain future issuances of securities. Spectrum Brands... -

Page 44

..., and distribution facilities at September 30, 2010: Facility Function Global Batteries & Personal Care Fennimore, Wisconsin(1) ...Portage, Wisconsin(1) ...Dischingen, Germany(1) ...Washington, UK(2) ...Guatemala City, Guatemala(1) ...Jaboatao, Brazil(1) ...Manizales, Colombia(1) ...Dixon, Illinois... -

Page 45

... Annual Report on Form 10-K, cannot estimate any possible losses. In May 2010, Herengrucht Group, LLC ("Herengrucht") filed an action in the U.S. District Court for the Southern District of California against the Company claiming that the Company had falsely marked patents on certain of its products... -

Page 46

... generally arising out of the ordinary course of business. Environmental We are subject to various federal, state and local environmental laws and regulations. We believe we are in substantial compliance with all such environmental laws that are applicable to our operations. See also the discussion... -

Page 47

...consumer products company and was created in connection with the combination of Spectrum Brands and Russell Hobbs to form a new combined company, on June 16, 2010. SB Holdings' common stock (the "SBH Common Stock") is traded on the NYSE under the symbol "SPB." Prior to June 16, 2010, Spectrum Brands... -

Page 48

... table reflects open market purchases of our common stock made by the Harbinger Parties, who may be considered "affiliated purchasers" (as defined in Rule 10b-18(a)(3) of the Securities Exchange Act of 1934, as amended). Total Number of Shares Purchased Total Number of Shares Purchased as Part of... -

Page 49

... that of Russell Hobbs since the Merger on June 16, 2010. On November 5, 2008, Spectrum Brands' board of directors committed to the shutdown of the growing products portion of the Home and Garden Business, which includes the manufacturing and marketing of fertilizers, enriched soils, mulch and... -

Page 50

...'s Discussion and Analysis of Financial Condition and Results of Operations as well as Note 3(i), Significant Accounting Policies-Intangible Assets, of Notes to Consolidated Financial Statements included in this Annual Report on Form 10-K for further details on these impairment charges. 40 -

Page 51

... and Related Charges, of Notes to Consolidated Financial Statements included in this Annual Report on Form 10-K for further discussion. (9) Fiscal 2006 includes a $8 million net gain on the sale of our Bridgeport, CT manufacturing facility, acquired as part of the Remington Products Company... -

Page 52

... primarily in the kitchen and home product categories ("Small Appliances"). We manufacture and market alkaline, zinc carbon and hearing aid batteries, herbicides, insecticides and repellants and specialty pet supplies. We design and market rechargeable batteries, battery-powered lighting 42 -

Page 53

... facilities are located in the United States, Europe, Latin America and Asia. Substantially all of our rechargeable batteries and chargers, shaving and grooming products, small household appliances, personal care products and portable lighting products are manufactured by third-party suppliers... -

Page 54

...Plan, on the Effective Date, reorganized Spectrum Brands, Inc. issued a total of 27,030,000 shares of common stock and approximately $218 million in aggregate principal amount of 12% Senior Subordinated Toggle Notes due 2019 (the "12% Notes") to holders of allowed claims with respect to Old Spectrum... -

Page 55

... we adopted fresh-start reporting upon emergence from Chapter 11 of the Bankruptcy Code as of our monthly period ended August 30, 2009 as is reflected in this Annual Report on Form 10-K. Since the reorganization value of the assets of Old Spectrum immediately before the date of confirmation of the... -

Page 56

..., Germany battery plant, transferring private label battery production at our Dischingen, Germany battery plant to our manufacturing facility in China and restructuring the sales, marketing and support functions. As a result, we have reduced headcount in Europe by approximately 350 employees or... -

Page 57

...carbon batteries in cell sizes of AA, AAA, C, D and 9-volt, and specialty batteries, which include rechargeable batteries, hearing aid batteries, photo batteries and watch/calculator batteries. Most consumer batteries are marketed under one of the following brands: Rayovac/VARTA, Duracell, Energizer... -

Page 58

... our overall market penetration and promote sales. Expansive Distribution Network. We distribute our products in approximately 120 countries through a variety of trade channels, including retailers, wholesalers and distributors, hearing aid professionals, industrial distributors and OEMs. Innovative... -

Page 59

...to Consolidated Financial Statements, included in this Annual Report on Form 10-K for additional information regarding the shutdown of the growing products portion of the Home and Garden Business. As a result, and unless specifically stated, all discussions regarding Fiscal 2010 and Fiscal 2009 only... -

Page 60

... coupled with favorable foreign exchange translation of $2 million. Sales of portable lighting products also increased modestly in both Europe and Latin America. Small appliances contributed $238 million or 9% of total net sales for Fiscal 2010. This represents sales related to Russell Hobbs from... -

Page 61

... and integration related charges incurred in Fiscal 2010 related to the Merger. Segment Results. As discussed above in Item 1, Business, we manage our business in four reportable segments: (i) Global Batteries & Personal Care, (ii) Global Pet Supplies; (iii) Home and Garden Business; and (iv) Small... -

Page 62

... Financial Statements included in this Annual Report on Form 10-K. Below is a reconciliation of GAAP Net Income (Loss) from Continuing Operations to Adjusted EBITDA by segment for Fiscal 2010 and Fiscal 2009: Fiscal 2010 Global Home and Corporate / Batteries & Global Pet Garden Small Unallocated... -

Page 63

...as this amount is included within Restructuring and related charges, this adjustment negates the impact of reflecting the add-back of depreciation and amortization. Global Batteries & Personal Care 2010 2009 (in millions) Net sales to external customers ...Segment profit ...Segment profit as a % of... -

Page 64

...Latin America driven by the successfully leveraging our value proposition, that is, products that work as well as or better than our competitors, at a lower price. The $6 million increase in alkaline sales is driven by the increased sales in North America, attributable to an increase in market share... -

Page 65

...Related Charges, to our Consolidated Financial Statements included in this Annual Report on Form 10-K for additional information regarding our restructuring and related charges. Segment Adjusted EBITDA in Fiscal 2010 was $98 million compared to $93 million in Fiscal 2009. Despite decreased net sales... -

Page 66

.... See "Restructuring and Related Charges" below, as well as Note 14, Restructuring and Related Charges, to our Consolidated Financial Statements included in this Annual Report on Form 10-K, for further detail on our Fiscal 2009 initiatives. Segment assets as of September 30, 2010 decreased to $826... -

Page 67

... of $17 million in Fiscal 2010 compared to $3 million of stock compensation expense in Fiscal 2009. Restructuring and Related Charges. See Note 14, Restructuring and Related Charges, of Notes to Consolidated Financial Statements, included in this Annual Report on Form 10-K for additional information... -

Page 68

... summarizes all restructuring and related charges we incurred in Fiscal 2010 and Fiscal 2009 (in millions): 2010 2009 Costs included in cost of goods sold: Latin America Initiatives: Termination benefits ...Global Realignment Initiatives: Termination benefits ...Other associated costs ...Ningbo... -

Page 69

...$15 million related to the Global Batteries and Personal Care segment; and $1 million related to the Home and Garden Business. See Note 3(i), Significant Accounting Policies and Practices-Intangible Assets, of Notes to Consolidated Financial Statements included in this Annual Report on Form 10-K for... -

Page 70

... indefinite carryforward periods. We are subject to an annual limitation on the use of our U.S. net operating losses that arose prior to our emergence from bankruptcy. We have had multiple changes of ownership, as defined under Internal Revenue Code ("IRC") Section 382, that subject our U.S. federal... -

Page 71

...in this Annual Report on Form 10-K for additional information. Discontinued Operations. On November 5, 2008, the board of directors of Old Spectrum committed to the shutdown of the growing products portion of the Home and Garden Business, which included the manufacturing and marketing of fertilizers... -

Page 72

... with new distribution. The decreased consumer battery sales in Latin America continues to be a result of a slowdown in economic conditions in all countries and inventory de-stocking at retailers mainly in Brazil. Zinc carbon batteries decreased $35 million while alkaline battery sales are down... -

Page 73

... the first quarter sales of Fiscal 2010 to be positively impacted versus our historical results due to this delay. The increases within Europe and Latin America were driven by new product launches, pricing and promotions. Electric personal care product sales during Fiscal 2009 decreased $20 million... -

Page 74

... Consolidated Financial Statements included in this Annual Report on Form 10-K for additional information regarding the reclassification of the Home and Garden Business. Tempering the decrease in operating expenses from Fiscal 2008 to Fiscal 2009 was an increase in restructuring and related charges... -

Page 75

... product lines within that segment. Financial information pertaining to our reportable segments is contained in Note 12, Segment Information, of Notes to Consolidated Financial Statements included in this Annual Report on Form 10-K. Global Batteries & Personal Care 2009 2008 (in millions) Net sales... -

Page 76

... 2009 of $15 million. See Note 3(i), Significant Accounting Policies and Practices-Intangible Assets, of Notes to Consolidated Financial Statements included in this Annual Report on Form 10-K for additional information regarding this impairment charge and the amount attributable to Global Batteries... -

Page 77

... Statements included in this Annual Report on Form 10-K for more information related to fresh-start reporting. Partially offsetting this increase in assets was a non-cash impairment charge of certain intangible assets in Fiscal 2009 of $19 million. See Note 3(i), Significant Accounting Policies... -

Page 78

... Reorganization Under Chapter 11, of Notes to Consolidated Financial Statements included in this Annual Report on Form 10-K for more information related to fresh-start reporting. Goodwill and intangible assets as of September 30, 2009 total approximately $419 million and are directly a result of... -

Page 79

... included: integrating all of United's home and garden administrative services, sales and customer service functions into our operations in Madison, Wisconsin; converting all information systems to SAP; consolidating United's home and garden manufacturing and distribution locations in North America... -

Page 80

... label battery production at our Dischingen, Germany battery plant to our manufacturing facility in China and restructuring Europe's sales, marketing and support functions. In connection with the European Initiatives, we recorded de minimis pretax restructuring and related charges in Fiscal 2009... -

Page 81

..., of Notes to Consolidated Financial Statements included in this Annual Report on Form 10-K for more information related to our reorganization under Chapter 11 of the Bankruptcy Code. Income Taxes. Our effective tax rate on losses from continuing operations is approximately 2.0% for Old Spectrum and... -

Page 82

...were scheduled to expire between 2009 and 2028. Certain of the foreign net operating losses have indefinite carryforward periods. We are subject to an annual limitation on the use of our net operating losses that arose prior to its emergence from bankruptcy. We have had multiple changes of ownership... -

Page 83

...in this Annual Report on Form 10-K for additional information. Discontinued Operations. On November 5, 2008, the board of directors of Old Spectrum committed to the shutdown of the growing products portion of the Home and Garden Business, which includes the manufacturing and marketing of fertilizers... -

Page 84

... of discontinued operations were related to the growing products portion of the Home and Garden Business. See "Discontinued Operations," above, as well as Note 9, Discontinued Operations, of Notes to Consolidated Financial Statements included in this Annual Report on Form 10-K for further details... -

Page 85

...facility, to pay fees and expenses in connection with the refinancing and for general corporate purposes. The 9.5% Notes and 12% Notes were issued by Spectrum Brands. SB/RH...a corresponding charge to interest expense over the remaining life of the Senior Credit Agreement. During Fiscal 2010, we ... -

Page 86

..., to repurchase all or a portion of the applicable outstanding notes for a specified redemption price, including a redemption premium, upon the occurrence of a change of control, as defined in such indenture. At September 30, 2010 and September 30, 2009, we had outstanding principal of $245 million... -

Page 87

... Fixed Charge Coverage Ratio test to impair our ability to provide adequate liquidity to meet the short-term and long-term liquidity requirements of our existing businesses, although no assurance can be given in this regard. In connection with the Merger, we obtained the consent of the note holders... -

Page 88

... the Merger and are time-based and vest over a one year period. The remaining 0.6 million shares are restricted stock grants primarily vest over a two year period. The total market value of the restricted shares on the date of the grant was approximately $23 million. During Fiscal 2009, Old Spectrum... -

Page 89

...Annual Report on Form 10-K. Other Commercial Commitments The following table summarizes our other commercial commitments as of September 30, 2010, consisting entirely of standby letters of credit that back the performance of certain of our entities under various credit facilities, insurance policies... -

Page 90

... in circumstances in the business or external factors warrants a review. Circumstances such as the discontinuation of a product or product line, a sudden or consistent decline in the sales forecast for a product, changes in technology or in the way an asset is being used, a history of operating or... -

Page 91

... for, and our general policy is not to accept, product returns for battery sales. We do accept returns in specific instances related to our electric shaving and grooming, electric personal care, home and garden, small appliances and pet supply products. The provision for customer returns is based on... -

Page 92

... Customers and Employees, of Notes to Consolidated Financial Statements included in this Annual Report on Form 10-K for more information about our revenue recognition and credit policies. Pensions Our accounting for pension benefits is primarily based on a discount rate, expected and actual return... -

Page 93

... employees of the acquired company that do not meet the conditions prescribed in ASC 805 are treated as restructuring and related charges and expensed as incurred. See Note 14, Restructuring and Related Charges, of Notes to the Consolidated Financial Statements included in this Annual Report on Form... -

Page 94

... and foreign exchange options. The related amounts payable to, or receivable from, the contract counter-parties are included in accounts payable or accounts receivable. Commodity Price Risk We are exposed to fluctuations in market prices for purchases of zinc used in the manufacturing process. We... -

Page 95

... cost of one year's purchases of the related commodities due to the same change in commodity prices, would be a net gain of $0.8 million. ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA The information required for this Item is included in this Annual Report on Form 10-K on pages 70 through 133... -

Page 96

statements of the Company as of and for the year ended September 30, 2010. The Company's independent registered public accounting firm, KPMG LLP, has issued an audit report on the Company's internal control over financial reporting, which is included herein. Changes in Internal Control Over ... -

Page 97

... Spectrum Brands Code of Business Conduct and Ethics, a code of ethics that applies to all of our directors, officers and employees. The Spectrum Brands Code of Business Conduct and Ethics is publicly available on our website at www.spectrumbrands.com under "Investor Relations-Corporate Governance... -

Page 98

... Committee Interlocks and Insider Participation" in SB Holdings Definitive Proxy Statement. ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS Ownership of Common Shares of Spectrum Brands Holdings, Inc. The information required by Item 403 of... -

Page 99

...Index to Consolidated Financial Statements and Financial Statement Schedule, filed as part of this Annual Report on Form 10-K. 2. The financial statement schedule listed in the Index to Consolidated Financial Statements and Financial Statement Schedule, filed as part of this Annual Report on Form 10... -

Page 100

SPECTRUM BRANDS, INC. AND SUBSIDIARIES INDEX TO CONSOLIDATED FINANCIAL STATEMENTS AND FINANCIAL STATEMENT SCHEDULE Page Reports of Independent Registered Public Accounting Firm ...Consolidated Statements of Financial Position ...Consolidated Statements of Operations ...Consolidated Statements of ... -

Page 101

... statements, effective September 30, 2009, the Successor Company adopted the measurement date provision of ASC 715, "Compensation-Retirement Benefits" formerly FAS 158, "Employers' Accounting for Defined Benefit Pension and other Postretirement Plans". /s/ KPMG LLP Atlanta, Georgia December 14, 2010... -

Page 102

... of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. In our opinion, Spectrum Brands Holdings, Inc. and subsidiaries maintained, in all material respects, effective internal control over financial reporting as of September 30, 2010, based... -

Page 103

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES Consolidated Statements of Financial Position September 30, 2010 and 2009 (In thousands, except per share amounts) Successor Company 2010 2009 Assets Current assets: Cash and cash equivalents ...Receivables: Trade accounts receivable, net of ... -

Page 104

...share amounts) Successor Company Predecessor Company Period from Period from August 31, 2009 October 1, 2008 Year Ended through through Year Ended September 30, September 30, August 30, September 30, 2010 2009 2009 2008 Net sales ...Cost of goods sold ...Restructuring and related charges... (benefit) ... -

Page 105

... ...- Cancellation of Predecessor Company common stock ...(52,738) Elimination of Predecessor Company accumulated deficit and accumulated other comprehensive income ...- Issuance of new common stock in connection with emergence from Chapter 11 of the Bankruptcy Code ...30,000 (1) - - - (691... -

Page 106

... Comprehensive Shareholders' Accumulated Income (Loss), Treasury Equity Deficit net of tax Stock (Deficit) Common Stock Shares Amount Additional Paid-In Capital Balances at August 30, 2009, Successor Company ...30,000 Net loss ...- Adjustment of additional minimum pension liability ...- Valuation... -

Page 107

... proceeds on supplemental loan ...Treasury stock purchases ...Net cash (used) provided by financing activities ...Effect of exchange rate changes on cash and cash equivalents due to Venezuela hyperinflation ...Effect of exchange rate changes on cash and cash equivalents ...Net increase (decrease) in... -

Page 108

... HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (In thousands, except per share amounts) (1) Description of Business Spectrum Brands Holdings, Inc., a Delaware corporation ("SB Holdings" or the "Company"), is a global branded consumer products company and was created in... -

Page 109

... product development facilities located in the U.S., Europe, Asia and Latin America. The Company sells its products in approximately 120 countries through a variety of trade channels, including retailers, wholesalers and distributors, hearing aid professionals, industrial distributors and original... -

Page 110

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) Successor Company issued a total of 2,970 shares of common stock to supplemental and sub-supplemental debtor-in-possession facility participants in respect ... -

Page 111

... and allowed claims, and the holders of the Predecessor Company's voting shares immediately before confirmation of the Plan received less than 50 percent of the voting shares of the emerging entity. The four-column consolidated statement of financial position as of August 30, 2009, included herein... -

Page 112

...segment were as follows: (i) Global Batteries and Personal Care used a range of 7.0x-8.0x for Fiscal 2009 and 6.5x-7.5x for Fiscal 2010; (ii) Global Pet Supplies used a range of 7.5x-8.5x for Fiscal 2009 and 7.0x-8.0x for Fiscal 2010; and (iii) the Home and Garden Business used a range of 9.0x-10.0x... -

Page 113

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) The recent transactions of companies in similar industries analysis identified transactions of similar companies giving consideration to lines of business, ... -

Page 114

...Current maturities of long-term debt ...Accounts payable ...Accrued liabilities: Wages and benefits ...Income taxes payable ...Restructuring and related charges ...Accrued interest ...Other ...Total current liabilities ...Long-term debt, net of current maturities ...Employee benefit obligations, net... -

Page 115

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) Effects of Plan Adjustments (a) The Plan's impact resulted in a net decrease of $25,551 on cash and cash equivalents. The significant sources and uses of ... -

Page 116

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) (g) The adjustment to long-term debt represents the issuance of the 12% Notes at a fair value of $218,731 (face value of $218,076) used, in part, to ... -

Page 117

... market prices of certain debt instruments as of the Effective Date, offset by an increase of $4,343 related to debt instruments not traded which was calculated giving consideration to the terms of the underlying agreements, using a risk adjusted interest rate of 12%. Employee benefit obligations... -

Page 118

... goodwill and other intangible assets). The Successor Company's August 30, 2009 statement of financial position reflects the allocation of the business enterprise value to assets and liabilities immediately following emergence as follows: Business enterprise value ...Add: Fair value of non-interest... -

Page 119

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) • The Company valued technology using the income approach, specifically the relief from royalty method. Under this method, the asset value was determined ... -

Page 120

..., and the Company's general policy is not to accept, product returns associated with battery sales. The Company does accept returns in specific instances related to its shaving, grooming, personal care, home and garden, small appliances and pet products. The provision for customer returns is based... -

Page 121

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) credit and financial condition based on changing economic conditions and will make adjustments to credit policies as required. Provision for losses on ... -

Page 122

... impairment testing on the Company's goodwill. To determine fair value during Fiscal 2010, the period from October 1, 2008 through August 30, 2009 and Fiscal 2008 the Company used the discounted estimated future cash flows methodology, third party valuations and negotiated sales prices. Assumptions... -

Page 123

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) In connection with the Company's annual goodwill impairment testing performed during Fiscal 2010 the first step of such testing indicated that the fair ... -

Page 124

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) fertilizer and growing media products manufactured by the Company at that time as well as more conservative growth rates to reflect the current and expected... -

Page 125

... in circumstances in the business or external factors warrants a review. Circumstances such as the discontinuation of a product or product line, a sudden or consistent decline in the sales forecast for a product, changes in technology or in the way an asset is being used, a history of operating or... -

Page 126

... of employee stock options awards. As discussed in Note 2, Voluntary Reorganization under Chapter 11, the Predecessor Company common stock was cancelled as a result of the Company's emergence from Chapter 11 of the Bankruptcy Code on the Effective Date. The Successor Company common stock began... -

Page 127

... equivalents as the impact would be antidilutive. On June 16, 2010, the Company issued 20,433 shares of its common stock in conjunction with the Merger. Additionally, all shares of its wholly owned subsidiary Spectrum Brands, were converted to shares of SB Holdings on June 16, 2010. (See also, Note... -

Page 128

...the accompanying Consolidated Statements of Financial Position were as follows: Asset Derivatives September 30, 2010 September 30, 2009 Derivatives designated as hedging instruments under ASC 815: Commodity contracts ...Commodity contracts ...Foreign exchange contracts ...Foreign exchange contracts... -

Page 129

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) The following table summarizes the impact of derivative instruments on the accompanying Consolidated Statements of Operations for Fiscal 2010 (Successor ... -

Page 130

...8,925 $(11,846) Cost of goods sold Interest expense Net sales Cost of goods sold Discontinued operations $(433) - - - (177) $(610) Derivative Contracts For derivative instruments that are used to economically hedge the fair value of the Company's third party and intercompany payments and interest... -

Page 131

..., at September 30, 2010 and September 30, 2009. Additionally, the Company does not require collateral or other security to support financial instruments subject to credit risk. The Company's standard contracts do not contain credit risk related contingencies whereby the Company would be required to... -

Page 132

... the related hedge is reclassified as an adjustment to Net sales or purchase price variance in Cost of goods sold. At September 30, 2010 the Successor Company had a series of foreign exchange derivative contracts outstanding through June 2012 with a contract value of $299,993. At September 30, 2009... -

Page 133

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) The Company is exposed to risk from fluctuating prices for raw materials, specifically zinc used in its manufacturing processes. The Company hedges a ... -

Page 134

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) the underlying transactions did not occur as originally forecasted. As a result, the Predecessor Company reclassified approximately $(6,191), pretax, of (... -

Page 135

...any impairment charges related to goodwill, intangible assets or other long-lived assets during Fiscal 2010. (See also Note 3(i), Significant Accounting Policies-Intangible Assets, for further details on impairment testing.) The carrying amounts and fair values of the Company's financial instruments... -

Page 136

...acquire up to 2,318 shares of common stock, in the aggregate, could be granted to select employees and non-employee directors of the Predecessor Company under either or both a time-vesting or a performance-vesting formula at an exercise price equal to the market price of the common stock on the date... -

Page 137

... CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) non-employee directors stock options, SARs, restricted stock, and other stock-based awards, as well as cashbased annual and long-term incentive awards. Accelerated vesting would occur in the event of a change in... -

Page 138

... Company's non-vested restricted stock as of September 30, 2010 is as follows: Weighted Average Grant Date Fair Value Restricted Stock Shares Fair Value Restricted stock at September 30, 2009 ...Granted ...Vested ...Restricted stock at September 30, 2010 ...(x) Restructuring and Related Charges... -

Page 139

... and certain other employees, integration related professional fees and other post business combination related expenses associated with the Merger of Russell Hobbs. The following table summarizes acquisition and integration related charges incurred by the Company during Fiscal 2010: 2010 Legal and... -

Page 140

... the date and time the Company's financial statements are issued. The Company has evaluated subsequent events through December 14, 2010, which is the date these financial statements were issued. (4) Inventory Inventories consist of the following: September 30, 2010 2009 Raw materials ...Work-in... -

Page 141

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) (6) Goodwill and Intangible Assets Intangible assets consist of the following: Global Batteries & Home and Garden Global Pet Small Personal Care Business ... -

Page 142

... and $259,300 related to impaired trade name intangible assets. (See also Note 3(i), Significant Accounting Policies-Intangible Assets, for further details on the impairment charges). The Company has designated the growing products portion of the Home and Garden Business and the Canadian division... -

Page 143

... related to the Home and Garden Business). The Company estimates annual amortization expense for the next five fiscal years will approximate $55,630 per year. (7) Debt Debt consists of the following: September 30, 2010 Amount Rate September 30, 2009 Amount Rate Term Loan, U.S. Dollar, expiring... -

Page 144

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) The Successor Company's aggregate scheduled maturities of debt as of September 30, 2010 are as follows: 2011 ...2012 ...2013 ...2014 ...2015 ...Thereafter ... -

Page 145

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) and merge or acquire or sell assets. Pursuant to a guarantee and collateral agreement, the Company and its domestic subsidiaries have guaranteed their ... -

Page 146

... all or a portion of the applicable outstanding notes for a specified redemption price, including a redemption premium, upon the occurrence of a change of control of the Company, as defined in such indenture. At September 30, 2010 and September 30, 2009, the Company had outstanding principal of $245... -

Page 147

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) In connection with the Merger, the Company obtained the consent of the note holders to certain amendments to the 2019 Indenture (the "Supplemental Indenture... -

Page 148

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) At September 30, 2009, the Company had an aggregate amount outstanding under its then-existing asset based revolving loan facility of $84,225 which included... -

Page 149

... NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) The following reconciles the Federal statutory income tax rate with the Company's effective tax rate: Successor Company Period from August 31, 2009 through September 30, 2010 2009 Predecessor Company... -

Page 150

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) ...Company September 30, 2010 2009 Current deferred tax assets: Employee benefits ...Restructuring ...Inventories and receivables ...Marketing and promotional... -

Page 151

... $103,790 related to acquired net deferred tax assets as part of purchase accounting. This amount is included in the $198,248 above. The total amount of unrecognized tax benefits on the Successor Company's Consolidated Statements of Financial Position at September 30, 2010 and September 30, 2009 are... -

Page 152

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) tax positions in income tax expense. The Successor Company as of September 30, 2009 and September 30, 2010 had approximately $3,021 and $5,860, respectively... -

Page 153

...contractual working capital adjustments the Predecessor Company recorded a loss on disposal of $1,087, net of tax benefit. On November 11, 2008, the Predecessor Board approved the shutdown of the growing products portion of the Home and Garden Business, which included the manufacturing and marketing... -

Page 154

... charge of $5,700 in discontinued operations to reduce the carrying value of intangible assets related to the growing products portion of the Home and Garden Business in order to reflect such intangible assets at their estimated fair value. (10) Employee Benefit Plans Pension Benefits The Company... -

Page 155

... on the Company's pension and other postretirement benefit plans: Pension and Deferred Compensation Benefits 2010 2009 Other Benefits 2010 2009 Change in benefit obligation Benefit obligation, beginning of year ...$ Obligations assumed from Merger with Russell Hobbs ...Service cost ...Interest... -

Page 156

...$54,407, respectively, is recognized in the accompanying Consolidated Statements of Financial Position within Employee benefit obligations, net of current portion. Included in the Successor Company's AOCI as of September 30, 2010 and September 30, 2009 are unrecognized net (losses) gains of $(17,197... -

Page 157

... CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) Below is a summary allocation of all pension plan assets along with expected long-term rates of return by asset category as of the measurement date. Weighted Average Allocation Target Actual 2010 2010 2009 Asset... -

Page 158

... Information The Company manages its business in four vertically integrated, product-focused reporting segments; (i) Global Batteries & Personal Care; (ii) Global Pet Supplies; (iii) the Home and Garden Business; and (iv) Small Appliances. On June 16, 2010, the Company completed the Merger with... -

Page 159

... from August 31, 2009 through September 30, 2010 2009 Predecessor Company Period from October 1, 2008 through August 30, 2009 2008 Global Batteries & Personal Care ...Global Pet Supplies ...Home and Garden Business(A) ...Small Appliances ...Total segments ...Corporate ...Total Depreciation and... -

Page 160

... Company Period from October 1, 2008 through August 30, 2009 2008 2010 Global Batteries & Personal Care ...$ 152,757 Global Pet Supplies ...55,646 Home and Garden Business(A) ...50,881 Small Appliances ...13,081 Total segments ...Corporate expenses ...Acquisition and integration related charges... -

Page 161

... 2010. The Company also reported a foreign exchange loss in Other expense (income), net, of $10,102 during Fiscal 2010. Segment total assets September 30, 2010 2009 Global Batteries & Personal Care ...Global Pet Supplies ...Home and Garden Business ...Small Appliances ...Total segments ...Corporate... -

Page 162

... Period from August 31, 2009 through September 30, 2010 2009 Predecessor Company Period from October 1, 2008 through August 30, 2009 2008 Global Batteries & Personal Care ...Global Pet Supplies ...Home and Garden Business ...Russell Hobbs ...Total segments ...Corporate ...Total Capital expenditures... -

Page 163

... Consumer Products, Inc., a subsidiary of the Company is a defendant in NACCO Industries, Inc. et al. v. Applica Incorporated et al., Case No. C.A. 2541-VCL, which was filed in the Court of Chancery of the State of Delaware in November 2006. The original complaint in this action alleged a claim... -

Page 164

... Predecessor Company's total rent expense was $22,132 and $37,068 for the period from October 1, 2008 through August 30, 2009 and Fiscal 2008, respectively. (13) Related Party Transactions Merger Agreement and Exchange Agreement On June 16, 2010 (the "Closing Date"), SB Holdings completed a business... -

Page 165

... of the Share Exchange, HRG will become a party to the SB Holdings Registration Rights Agreement, entitled to the rights and subject to the obligations of a holder thereunder. Other Agreements On August 28, 2009, in connection with Spectrum Brands' emergence from Chapter 11 reorganization... -

Page 166

... directly related to the restructuring or integration initiatives implemented. The Company reports restructuring and related charges relating to administrative functions in Operating expenses, such as initiatives impacting sales, marketing, distribution, or other non-manufacturing related functions... -

Page 167

... through September 30, 2010 2009 Predecessor Company Period from October 1, 2008 through August 30, 2009 2008 Cost of goods sold: Global Batteries & Personal Care ...Global Pet Supplies ...Home and Garden Business ...Total restructuring and related charges in cost of goods sold ...Operating expense... -

Page 168

...BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) The following table summarizes restructuring and related charges incurred by type of charge: Successor Company Period from August 31, 2009 through September 30, 2010... -

Page 169

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) 2009 Restructuring Initiatives The Company implemented a series of initiatives within the Global Batteries & Personal Care segment, the Global Pet Supplies ... -

Page 170

... STATEMENTS-(Continued) (In thousands, except per share amounts) complete, include the plan to exit the Company's Ningbo battery manufacturing facility in China (the "Ningbo Exit Plan"). The Successor Company recorded $2,162 and $165 of pretax restructuring and related charges during Fiscal 2010... -

Page 171

... private label battery production at the Company's Dischingen, Germany battery plant to the Company's manufacturing facility in China and restructuring its sales, marketing and support functions. The Company recorded $(92) and $7 of pretax restructuring and related charges during Fiscal 2010... -

Page 172

...On June 16, 2010, the Company merged with Russell Hobbs. Headquartered in Miramar, Florida, Russell Hobbs is a designer, marketer and distributor of a broad range of branded small household appliances. Russell Hobbs markets and distributes small kitchen and home appliances, pet and pest products and... -

Page 173

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) (1) Number of shares calculated based upon conversion formula, as defined in the Merger Agreement, using balances as of June 16, 2010. (2) The fair value of... -

Page 174

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) Certain estimated values are not yet finalized and are subject to change, which could be significant. The Company will finalize the amounts recognized as it... -

Page 175

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) were selected based on consideration of several factors, including prior transactions of Russell Hobbs related trademarks and trade names, other similar ... -

Page 176

... exercise of common stock equivalents as the impact would be antidilutive. (16) Quarterly Results (unaudited) Successor Company Quarter Ended July 4, April 4, 2010 2010 September 30, 2010 January 3, 2010 Net sales ...Gross profit ...Net loss ...Basic net loss per common share ...Diluted net loss... -

Page 177

SPECTRUM BRANDS HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except per share amounts) Successor Company Period from August 31, 2009 through September 30, 2009 Predecessor Company Period from June 29, 2009 through August 30, 2009 Quarter Ended... -

Page 178

... Adjustment" in the period from October 1, 2008 through August 30, 2009, represents the elimination of Accounts receivable allowances through fresh-start reporting as a result of the Company's emergence from Chapter 11 of the Bankruptcy Code. See accompanying Report of Independent Registered Public... -

Page 179

...on its behalf by the undersigned thereunto duly authorized. SPECTRUM BRANDS HOLDINGS, INC. By: /s/ David R. Lumley David R. Lumley Chief Executive Officer DATE: December 14, 2010 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following... -

Page 180

...to Exhibit 2.1 to the Current Report on Form 8-K filed with the SEC by Spectrum Brands, Inc. on February 12, 2010). Amendment to Agreement and Plan of Merger dated as of March 1, 2010 by and among SB/RH Holdings, Inc., Battery Merger Corp., Grill Merger Corp., Spectrum Brands, and Russell Hobbs, Inc... -

Page 181

...Notes due 2019, dated as of August 28, 2009, by and among Spectrum Brands, Inc., Battery Merger Corp. and U.S. Bank National Association, as trustee (filed by incorporation by reference to Exhibit 4.4 to the Quarterly Report on Form 10-Q filed with the SEC by Spectrum Brands, Inc. on August 18, 2010... -

Page 182

... agent (filed by incorporation by reference to Exhibit 10.14 to the Annual Report on Form 10-K filed with the SEC by Spectrum Brands, Inc. on December 14, 2010). Guaranty dated as of June 16, 2010, by and among SB/RH Holdings, LLC and Credit Suisse AG, as administrative agent (filed by incorporation... -

Page 183

... of Spectrum Brands, Inc. party to the Loan and Security Agreement as borrowers, SB/RH Holdings, LLC and Bank of America, N.A. (filed by incorporation by reference to Exhibit 10.19 to the Annual Report on Form 10-K filed with the SEC by Spectrum Brands, Inc. on December 14, 2010). Guaranty dated as... -

Page 184

...incorporation by reference to Exhibit 10.21 to the Quarterly Report on Form 10-Q filed with the SEC by Spectrum Brands, Inc. on August 18, 2010). Patent Security Agreement dated as of June 16, 2010, by and among the loan parties party thereto and Wells Fargo Bank, National Association, as collateral... -

Page 185

... Statement on Form S-8 filed with the SEC by Spectrum Brands Holdings, Inc. on June 16, 2010). Subsidiaries of Registrant.* Consent of Independent Registered Public Accounting Firm.* Certification of Chief Executive Officer required by Rule 13a-14(a) or Rule 15d-14(a) of the Securities and Exchange... -

Page 186

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 187

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 188

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 189

... HEADQUARTERS Spectrum Brands Holdings, Inc. 601 Rayovac Drive Madison, WI 53711 608.275.3340 608.288.4518 fax spectrumbrands.com INVESTOR AND SHAREHOLDER CONTACT David A. Prichard Vice President, Investor Relations and Corporate Communications 608.278.6141 [email protected] COMPANY... -

Page 190

601 Rayovac Drive, Madison, WI 53711 608.275.3340 spectrumbrands.com