Public Storage 1997 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 1997 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Public Storage, Inc. 1997 Annual Report

6

6

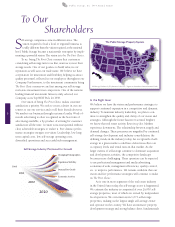

Future Opportunities

Community commitment

We recognize the importance of community relations. Our efforts

to give back to the communities that support us is good for those

communities, our operations and our employees. It is important

to the quality of life in communities supporting our operations.

For example, PSPUD helped the Marine Corps’ Toys for Tots

program celebrate its 50th anniversary during the 1997 holiday

season. PSPUD provided modified Pak & Store™ self-storage

containers for holiday toy collection at select Public Storage

facilities in Southern California. PSPUD also arranged to display

self-storage containers outside 30 Target Stores throughout the

Southern California region to collect toys. PSPUD provided the

self-storage containers for charitable events ranging from celebrity

basketball games to fun runs to parades. These efforts raised

PSPUD’s visibility in the communities served and helped brighten

the holidays for deserving young people.

Joint venture

In April 1997, we formed a joint venture partnership with a state

pension fund to develop up to $220 million of self-storage facil-

ities. The partnership is funded solely with equity capital pro-

vided 30 percent by the Company and 70 percent by the state

pension fund. Initially, we contributed eight facilities which

were under development to the joint venture partnership. We

had invested approximately $32 million in the joint venture as

of December 31, 1997.

Self-storage property acquisitions and development

During 1997, we purchased four self-storage facilities containing

approximately 241,000 net rentable square feet of storage space

for an aggregate cost of approximately $18.1 million. In addition,

an affiliate of the Company acquired 10 commercial properties

with approximately 2.7 million net rentable square feet, for an

aggregate acquisition cost of approximately $166.4 million.

The Company and the construction joint venture partnership

also opened nine new self-storage facilities during 1997 that we

had developed. Collectively, these facilities encompass 530,000

net rentable square feet. As of December 31, 1997, the Company

and the construction joint venture partnership had 21 self-storage

facilities (1,442,000 net rentable square feet) in various stages of

development and had identified 17 additional facilities (1,031,000

net rentable square feet) which we expect to begin constructing

during 1998.

Telecommunications

On December 31, 1996, our national reservation center consisted of

87 representatives. One year later, there were 249 individuals on

staff. The national reservation center has evolved into an important

linchpin in our marketing strategies. The center helps us raise

occupancy and increase market share. We are realizing the benefits

of marketing and inventory management techniques with our

national reservation center at the hub. We are properly staffed to

receive an anticipated 250,000 calls per month during the peak

spring and summer periods. In addition to self-storage, the center

markets portable self-storage, truck rentals and retail stores. We are

aggressively responding to the customer demand we are generating

through various media, enabling us to support favorable occu-

pancy trends and rental rates.

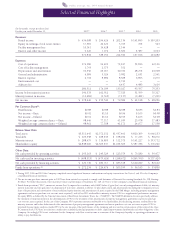

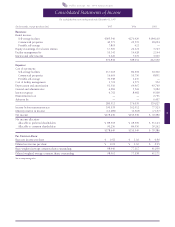

Revenues for 1997 increased to $470,844,000 compared to

$338,951,000 in 1996, representing an increase of $131,893,000

or 38.9 percent. Net income for 1997 was $178,649,000 com-

pared to $153,549,000 in 1996, representing an increase of

$25,100,000 or 16.4 percent. The increase in net income for 1997

compared to 1996 was primarily the result of improved property

operations, the acquisition of additional real estate facilities during

1997 and 1996, and the acquisition of additional partnership

interests during 1997 and 1996, offset partially by start-up oper-

ating losses in PSPUD’s portable self-storage business.

Net income allocable to common shareholders was

$90,256,000 or $.91 per common share on a diluted basis

(based on 98,961,000 weighted average shares) for 1997 com-

pared to $84,950,000 or $1.10 per common share on a diluted

basis (based on 77,358,000 weighted average shares) for 1996.

In computing net income per common share, dividends to the

Company’s preferred shareholders ($88,393,000 and $68,599,000

for 1997 and 1996, respectively) have been deducted from net

income in determining net income allocable to the Company’s

common shareholders. Net income allocable to common share-

holders has been negatively impacted by losses generated from

PSPUD’s portable self-storage business which generated operating

losses of $31,665,000 or approximately $.32 per common share

on a diluted basis in 1997 ($826,000, or approximately $.01 per

common share on a diluted basis in 1996).

In addition, net income allocable to the common share-

holders for 1997 was negatively affected by a special dividend

totaling $13,412,000 paid to the Company’s Series CC Convertible

Preferred Stock during the first quarter of 1997. As a result of the

special dividend, the Company would not have to pay another

dividend on this stock until the quarter ended March 31, 1999.

During the second quarter of 1997, the Series CC Convertible

Preferred Stock converted into common stock of the Company.

Accordingly, all of the $13,412,000 ($.14 per common share on

a diluted basis) of dividends were treated during 1997 as an

allocation of net income to the preferred shareholders in deter-

mining the allocation of net income to the common shareholders.

The special dividend eliminated the quarterly dividend of

$1.9 million and annual fixed charges of $7.6 million.

Funds from operations per common share on a fully-

diluted basis for 1997 were $1.97, compared to $1.98 for 1996,

decreasing $.01 per common share. Funds from operations per

common share on a fully-diluted basis for 1997 were negatively

impacted by the dilutive effects of start-up losses from PSPUD’s

portable self-storage operations which resulted in a reduction

of $.32 per common share for 1997. In addition, funds from

operations for 1996 were negatively impacted by the effect of

the Company’s Series CC Convertible Preferred Stock.

Same Stores

For 1997, occupancy at the self-storage properties on a Same Store

basis averaged 91.8 percent, compared to 91.2 percent during

1996. Same Store average annual realized rents were $9.24 per

square foot for 1997, a 5.5 percent increase compared to

Financial Review