Prudential 2011 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2011 Prudential annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.without the restrictions that might otherwise apply under the Volcker Rule. Such limitation will allow us to deregister as a savings and loan

holding company. See “Business—Regulation” included in Prudential Financial’s 2011 Annual Report on Form 10-K for more information

regarding the potential impact of the Dodd-Frank Act on the Company.

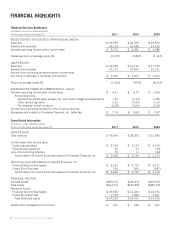

Our financial condition and results of operations for the year ended December 31, 2011 reflect the following:

• Net income of our Financial Services Businesses attributable to Prudential Financial, Inc. for the year ended December 31, 2011

was $3,531 million compared to $2,714 million for 2010.

• Pre-tax net realized investment gains and related charges and adjustments of the Financial Services Businesses were $685 million of

net gains in 2011 primarily reflecting the impact of changes in foreign currency exchange rates on certain assets and liabilities for

which we economically hedge the foreign currency exposure and net increases in the market value of derivatives used to manage

investment portfolio duration. These gains were partially offset by other-than-temporary impairments of fixed maturity and equity

securities and net losses related to the embedded derivatives and related hedge positions associated with certain of our variable

annuity contracts.

• Net unrealized gains on general account fixed maturity investments of the Financial Services Businesses amounted to $10.493

billion as of December 31, 2011, compared to net unrealized gains of $5.726 billion as of December 31, 2010. Gross unrealized

gains increased from $8.826 billion as of December 31, 2010 to $14.749 billion as of December 31, 2011 and gross unrealized

losses increased from $3.100 billion to $4.256 billion for the same periods. Net unrealized gains on general account fixed maturity

investments of the Closed Block Business amounted to $3.876 billion as of December 31, 2011, compared to net unrealized gains of

$1.671 billion as of December 31, 2010.

• Individual Annuity total account values were $113.5 billion as of December 31, 2011. Gross sales were $20.3 billion in 2011

compared to $21.8 billion in 2010, and net sales were $13.1 billion in 2011 compared to $14.6 billion in 2010.

• Full Service Retirement account values were $139.4 billion as of December 31, 2011. Institutional Investment Products account

values reached a record high of $90.1 billion as of December 31, 2011, driven by $21.6 billion of net additions in 2011.

• Asset Management total third party institutional and retail net flows were $20.2 billion in 2011 compared to $35.0 billion in 2010,

contributing to the segment’s assets under management of $619.1 billion as of December 31, 2011.

• International Insurance constant dollar basis annualized new business premiums were a record high of $3,040 million in 2011,

including $728 million from the acquired Star and Edison Businesses, compared to $1,870 million in 2010.

• Individual Life annualized new business premiums were $278 million in 2011, compared to $260 million in 2010.

• Group Insurance annualized new business premiums were a record high of $690 million in 2011, compared to $607 million in 2010.

• As of December 31, 2011, Prudential Financial, the parent holding company, had cash and short-term investments of $4.944 billion.

Outlook

Management expects that results in 2012 will continue to reflect the quality of our individual businesses and their prospects, as well as

our overall business mix and effective capital management. In 2012, we continue to focus on long-term strategic positioning and growth

opportunities, including the following:

•U.S. Retirement and Investment Management Market. We seek to capitalize on the growing need of baby boomers for products

that provide guaranteed income for longer retirement periods. In addition, we continue to focus on our clients’ increasing needs for

retirement income security given volatility in the financial markets. We also seek to provide products that respond to the needs of

plan sponsors to manage risk and control their benefit costs.

•U.S. Insurance Market. We continue to focus on writing high-quality business and expect to continue to benefit from expansion of

our distribution channels and deepening our relationships with third-party distributors. We also seek to capitalize on opportunities

for additional voluntary life purchases in the group insurance market, as institutional clients are focused on controlling their benefit

costs.

•International Markets. We continue to concentrate on deepening our presence in the markets in which we currently operate, such

as Japan, and expanding our distribution capabilities, including through the integration of the acquired Star and Edison Businesses.

We seek to capitalize on opportunities arising in international markets as changing demographics and public policy have resulted in

a growing demand for retirement income products.

Prudential Financial, Inc. 2011 Annual Report 15