Prudential 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Prudential annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 0 11

PRUDENTIAL FINANCIAL, INC. ANNUAL REPORT

Table of contents

-

Page 1

201 1 PRUDENTIAL FINANCIAL, INC. ANNUAL REPORT -

Page 2

.... We measure our long-term success by our ability to deliver value for shareholders, meet customer needs, attract and develop the best talent in our industry, offer an inclusive work environment where employees can develop to their full potential, and support the communities where we live and... -

Page 3

...markets we serve for the beneï¬t of our customers and our shareholders. Consistent with our commitment to provide long-term shareholder value, our company delivered solid earnings and our highest-ever dividend. Our businesses continued to demonstrate their strength through powerful sales and growth... -

Page 4

... of the ways that we gauge our value to customers is in terms of sales, based on annualized new business premiums, and net ï¬,ows. • International Insurance sales were a record $3.0 billion in 2011 on a constant U.S. dollar basis, including $728 million attributable to the acquired Star and Edison... -

Page 5

... of our long-term strategy. For more than 20 years, Prudential has achieved extensive growth and success in international insurance operations, and we remain committed to achieving growth in both new and existing markets, channels, and products that offer solid returns on our investment. In Japan... -

Page 6

...-study VETalent program to new cities and universities to continue to prepare veterans for new careers. Building on the recognition that we have received in prior years, FORTUNE® magazine named Prudential the world's most admired insurance company in the life and health category for 2012. We have... -

Page 7

... of 4,469 life insurance policyholders who purchased or renewed coverage during the past year. www.jdpower.co.jp. Life insurance and annuities issued by The Prudential Insurance Company of America, Newark, NJ, and its insurance affiliates. Prudential Retirement's group variable annuity contracts are... -

Page 8

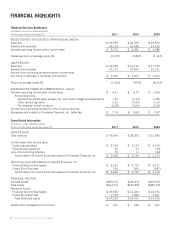

.... Financial Services Businesses Closed Block Business Consolidated net income (loss) attributable to Prudential Financial, Inc. FINANCIAL POSITION Invested assets Total assets Attributed equity: Financial Services Businesses Closed Block Business Total attributed equity Assets under management (in... -

Page 9

...the Financial Services Businesses. Both income amounts above give effect to the direct equity adjustment for earnings per share calculation. Assets Under Management (in billions) Financial Services Businesses Operating Return on Average Equity(B) and Return on Average Equity(B) Operating return on... -

Page 10

FINANCIAL SECTION Some of the statements included in this Annual Report may contain forward-looking statements within the meaning of the U.S. Private Securities Reform Act of 1995. Please see page 276 for a description of certain risks and uncertain ties that could cause actual results to differ, ... -

Page 11

... consists of our Individual Life and Group Insurance segments. The International Insurance division consists of our International Insurance segment. The Common Stock reflects the performance of the Financial Services Businesses, but there can be no assurance that the market value of the Common Stock... -

Page 12

... account assets ...Total assets ...Future policy benefits and policyholders' account balances ...Separate account liabilities ...Short-term debt ...Long-term debt ...Total liabilities ...Prudential Financial, Inc. equity ...Noncontrolling interests ...Total equity ... As of December 31, 2010 2009... -

Page 13

...for $72 million used to purchase a guaranteed investment contract to fund a portion of the bond insurance cost associated with that debt, were allocated to the Financial Services Businesses. However, we expect that the IHC debt will be serviced by the net cash flows of the Closed Block Business over... -

Page 14

... of financial products and services, including life insurance, annuities, retirement-related services, mutual funds, and investment management. We offer these products and services to individual and institutional customers through one of the largest distribution networks in the financial services... -

Page 15

..., including the investment-only stable value market. The recovery of the equity, fixed income, and commercial real estate markets has positively impacted asset managers by increasing assets under management and corresponding fee levels. In addition, institutional fixed income managers have generally... -

Page 16

... international businesses. The Financial Services Agency, the insurance regulator in Japan, has implemented revisions to the solvency margin requirements that will revise risk charges for certain assets and change the manner in which an insurance company's core capital is calculated. These changes... -

Page 17

... in 2010. • Group Insurance annualized new business premiums were a record high of $690 million in 2011, compared to $607 million in 2010. • As of December 31, 2011, Prudential Financial, the parent holding company, had cash and short-term investments of $4.944 billion. Outlook Management... -

Page 18

..., 2011 2010 2009 (in millions) Adjusted operating income before income taxes for segments of the Financial Services Businesses: Individual Annuities ...Retirement ...Asset Management ...Total U.S. Retirement Solutions and Investment Management Division ...Individual Life ...Group Insurance ...Total... -

Page 19

..., related to Executive Life Insurance Company of New York. • Income from continuing operations before income taxes in the Closed Block Business decreased $528 million in 2011 compared to 2010, primarily reflecting an increase in the policyholder dividend obligation expense. Accounting Policies... -

Page 20

...present value of estimated gross profits. In calculating gross profits, we consider mortality, persistency, and other elements as well as rates of return on investments associated with these contracts and the costs related to our guaranteed minimum death and guaranteed minimum income benefits. Total... -

Page 21

... of return on assets held in separate account investment options. This rate of return influences the fees we earn, costs we incur associated with the guaranteed minimum death and guaranteed minimum income benefit features related to our variable annuity contracts, as well as other sources of profit... -

Page 22

...ended December 31, 2011, 2010 and 2009, see "-Results of Operations for Financial Services Businesses by Segment-U.S. Individual Life and Group Insurance Division- Individual Life." For variable annuity contracts, DAC and DSI are more sensitive to changes in our future rate of return assumptions due... -

Page 23

...method for estimating an equity investor's return requirement, and hence a company's cost of equity capital. CAPM is determined by beginning with the long-term risk-free rate of return then applying adjustments that consider the equity risk premium required for large company common stock investments... -

Page 24

... reserves relate primarily to the traditional participating whole life policies of our Closed Block Business and the non-participating whole life, term life, and life contingent structured settlement and group annuity products of our Financial Services Businesses. The future policy benefit reserves... -

Page 25

... policy benefits as of December 31, 2011 represented reserves for the guaranteed minimum death benefit ("GMDB") and optional living benefit features of the variable annuity products in our Individual Annuities segment, and group life and disability and long-term care benefits in our Group Insurance... -

Page 26

... costs associated with these plans. We determine our expected rate of return on plan assets based upon a building block approach that considers inflation, real return, term premium, credit spreads, equity risk premium and capital appreciation as well as expenses, expected asset manager performance... -

Page 27

... discount rate by 100 basis points. For a discussion of our expected rate of return on plan assets and discount rate for our qualified pension plan in 2011, see "-Results of Operations for Financial Services Businesses by Segment-Corporate and Other." For purposes of calculating pension income... -

Page 28

... December 31, 2011, retrospective adoption would reduce deferred policy acquisition costs by approximately $3.6 billion to $4.4 billion for the Financial Services Businesses and by approximately $0.2 billion for the Closed Block Business, increase policy reserves for certain limited pay contracts by... -

Page 29

... Block Business for the periods presented. Year ended December 31, 2011 2010 2009 (in millions) Financial Services Businesses by segment: Individual Annuities ...Retirement ...Asset Management ...Total U.S. Retirement Solutions and Investment Management Division ...Individual Life ...Group Insurance... -

Page 30

...from use of new Social Security Master Death File matching criteria to identify deceased policy and contract holders. On a diluted per share basis, income from continuing operations attributable to the Financial Services Businesses for 2011 of $7.14 per share of Common Stock increased from $5.68 per... -

Page 31

... of Realized investment gains (losses), net, on changes in reserves and the amortization of deferred policy acquisition costs, deferred sales inducements and value of business acquired. Adjusted Operating Income 2011 to 2010 Annual Comparison. Adjusted operating income decreased $333 million, from... -

Page 32

...adjusted operating income was primarily due to an increase in fee income, net of higher distribution costs, driven by higher average variable annuity account values invested in separate accounts due to positive net flows and net market appreciation. 30 Prudential Financial, Inc. 2011 Annual Report -

Page 33

... on gross profits of market value increases in the underlying assets associated with our variable annuity products, reflecting financial market conditions during the period. The benefit in 2009 is higher than that in 2010 due to a greater difference in 2009 between the actual rates of return and the... -

Page 34

... by higher fee income. Interest expense also increased $46 million driven by higher borrowings to fund costs related to new business sales. Interest credited to policyholders' account balances decreased $107 million primarily due to lower average annuity account values in the fixed-rate account of... -

Page 35

... of business activity. Year ended December 31, 2011 2010 2009 (in millions) Variable Annuities(1): Beginning total account value ...Sales ...Surrenders and withdrawals ...Net sales ...Benefit payments ...Net flows ...Change in market value, interest credited and other activity(2) ...Policy charges... -

Page 36

... growth in our variable annuity business and account value performance during 2011. Our GMDBs guarantee a minimum return on the contract value or an enhanced value, if applicable, to be used solely for purposes of determining benefits payable in the event of death. The net amount at risk associated... -

Page 37

...capital markets valuation framework but incorporates two modifications to the U.S. GAAP valuation assumptions. We add a credit spread to the U.S. GAAP risk-free rate of return assumption used to estimate future growth of bond investments in the customer separate account funds to account for the fact... -

Page 38

... rates. For a further discussion of the assumptions used in estimating total gross profits used as the basis for amortizing DAC and other costs, see "-Accounting Policies and Pronouncements-Application of Critical Accounting Estimates." The net benefit of $33 million in 2010 included a net benefit... -

Page 39

... contracts. See "-Experience-Rated Contractholder Liabilities, Trading Account Assets Supporting Insurance Liabilities and Other Related Investments." Adjusted Operating Income 2011 to 2010 Annual Comparison. Adjusted operating income increased $26 million, from $572 million in 2010 to $598 million... -

Page 40

...in 2009 related to updates of client census data on our group annuity blocks of business. Results for both 2010 and 2009 also include the impact of annual reviews of the assumptions used in our estimate of total gross profits used as a basis for amortizing deferred policy acquisition costs and value... -

Page 41

... net of capitalization, higher asset management costs due to an increase in average full service fee-based retirement account values, and expenses incurred in 2010 related to certain cost reduction initiatives. These increases were partially offset by a decrease in interest credited to policyholders... -

Page 42

... billion in 2011 primarily reflecting higher sales of our fee-based investment-only stable value and longevity reinsurance products, and lower general account guaranteed investment product scheduled withdrawals. 2010 to 2009 Annual Comparison. Account values in our full service business amounted to... -

Page 43

... sale of a real estate seed investment in 2011. These increases were partially offset by increased operating expenses, primarily related to compensation as well as other costs supporting the business. 2010 to 2009 Annual Comparison. Adjusted operating income increased $432 million, from $55 million... -

Page 44

...and retail customer assets as a result of higher asset values from market appreciation and positive net asset flows. Commercial mortgage revenues increased $181 million primarily reflecting lower net credit and valuation-related charges on interim loans, as discussed above. Service, distribution and... -

Page 45

... are fees based on assets under management. December 31, 2010 2009 (in billions) 2011 Assets Under Management (at fair market value): Institutional customers: Equity ...Fixed income ...Real estate ...Institutional customers(1)(2) ...Retail customers: Equity ...Fixed income ...Real estate ...Retail... -

Page 46

... the dates indicated. December 31, 2011 2010 (in millions) Co-Investments: Real Estate ...Fixed Income ...Seed Investments: Real Estate ...Public Equity ...Fixed Income ...Loans Secured by Investor Equity Commitments or Fund Assets: Real Estate secured by Investor Equity ...Private Equity secured by... -

Page 47

... and long-term projected rates of return, used in estimating total gross profits used as the basis for amortizing deferred policy acquisition costs and unearned revenue reserves, see "-Accounting Policies & Pronouncements-Application of Critical Accounting Estimates." 2010 to 2009 Annual Comparison... -

Page 48

... policyholder deposits, as well as gains in 2010 on investments in real property separate account funds compared to losses in 2009. Premiums increased $28 million, primarily due to growth of our in force block of term insurance. Policy charges and fees and asset management fees and other income... -

Page 49

...business with us, a driver of future profitability. Generally, our term life insurance products do not provide for cash surrender values. Year ended December 31, 2011 2010 2009 ($ in millions) $778 $697 $855 3.3% 3.0% 4.2% Cash value of surrenders ...Cash value of surrenders as a percentage of mean... -

Page 50

...Group disability premiums and policy charges and fee income, which include long-term care and dental products, increased by $25 million, from $1,121 million in 2009 to $1,146 million in 2010. This increase primarily reflects higher premiums due to growth of business in force resulting from new sales... -

Page 51

... contract and from excess premiums on group universal life insurance that build cash value but do not purchase face amounts, and include premiums from the takeover of claim liabilities. (2) Includes long-term care and dental products. 2011 to 2010 Annual Comparison. Total annualized new business... -

Page 52

... present value of future cash flows, on a U.S. dollar-denominated basis. (3) Excludes $24.5 billion and $10.2 billion as of December 31, 2011 and 2010, respectively, of U.S. dollar assets supporting U.S. dollar liabilities related to U.S. dollar-denominated products issued by our Japanese insurance... -

Page 53

... income. Our Japanese insurance operations, excluding Star and Edison, also hold yen-denominated investments that have been coupled with cross-currency coupon swap agreements, creating synthetic dual currency investments. The yen/ U.S. dollar exchange rate is effectively fixed, as we are obligated... -

Page 54

... "Asset management fees and other income." Due to this non-economic volatility that is reflected in U.S. GAAP, the change in value due to changes in foreign currency exchange rate movements, or remeasurement, of these non-yen denominated assets and related liabilities associated with these products... -

Page 55

... income hedging program discussed above. In addition, for constant dollar information discussed below, activity denominated in U.S. dollars is reported based on the amounts as transacted in U.S. dollars. Annualized new business premiums presented on a constant exchange rate basis in the "Sales... -

Page 56

... International Group, Inc., or AIG, of AIG Star Life Insurance Co., Ltd., or Star, AIG Edison Life Insurance Company, or Edison, and certain other AIG subsidiaries (collectively, the "Star and Edison Businesses") pursuant to the stock purchase agreement dated September 30, 2010 between Prudential... -

Page 57

... costs supporting bank and agency distribution channel growth and unfavorable results from our insurance joint venture in India and our asset management-related joint venture in China. 2010 to 2009 Annual Comparison. Adjusted operating income from our Life Planner operations increased $48 million... -

Page 58

...bank distribution channel including $1,062 million higher sales of single premium whole life. Also contributing to the increase in revenues is favorable investment income primarily reflecting $816 million of income on the acquired assets from Star and Edison and continued growth of our fixed annuity... -

Page 59

... of annualized new business premiums for the Star and Edison Businesses, acquired February 1, 2011. With a diversified product mix supporting the growing demand for retirement and savings products, our international insurance operations offer various traditional whole life, term, endowment policies... -

Page 60

... bank distribution channel annualized new business premiums, excluding annuity products, for the year ended December 31, 2010. 2011 to 2010 Annual Comparison. On a constant exchange rate basis, annualized new business premiums increased $1,170 million, from $1,870 million in 2010 to $3,040 million... -

Page 61

... sales of retirement income and cancer whole life products in Japan. Annualized new business premiums, on a constant exchange rate basis, from our Gibraltar Life operation increased $285 million, primarily due to higher sales of protection products in our bank distribution channels and sales related... -

Page 62

... to address our cash needs in view of changing financial market conditions. On February 1, 2011, we used a portion of cash and short-term investments in Corporate and Other operations to partially fund the purchase price related to our recent acquisition of the Star and Edison Businesses. Also... -

Page 63

... as of the date of demutualization. The Closed Block Business includes our in force traditional domestic participating life insurance and annuity products and assets that are used for the payment of benefits and policyholder dividends on these policies, as well as other assets and equity and related... -

Page 64

... earnings policyholder dividend obligation. Results also included a $40 million increase in reserves for estimated payments arising from use of new Social Security Master Death File matching criteria to identify deceased policy and contract holders. See Note 23 to the Notes to Consolidated Financial... -

Page 65

...and contract holders, as discussed above. Also, amortization of deferred policy acquisition costs decreased $13 million reflecting the impact of lower investment gains in the calculation of actual gross profits for the period compared to the prior period. 2010 to 2009 Annual Comparison. Benefits and... -

Page 66

... In our International Insurance segment, the experience-rated products are fully participating. As a result, the entire return on the underlying investments is passed back to policyholders through a corresponding adjustment to the related liability. 64 Prudential Financial, Inc. 2011 Annual Report -

Page 67

... income also excludes the change in contractholder liabilities due to asset value changes in the pool of investments (including changes in the fair value of commercial mortgage and other loans) supporting these experience-rated contracts, which are reflected in "Interest credited to policyholders... -

Page 68

... ...Equity securities, available-for-sale Commercial mortgage and other loans ...Other long-term investments ...Short-term investments ...Cash equivalents ...Other assets ...Subtotal excluding separate account assets ...Separate account assets(4) ...Total assets ...Future policy benefits ...Other... -

Page 69

... ...Equity securities, available-for-sale ...Commercial mortgage and other loans ...Other long-term investments ...Short-term investments ...Cash equivalents ...Other assets ...Subtotal excluding separate account assets ...Separate account assets(4) ...Total assets ...Future policy benefits ...Other... -

Page 70

... ...Equity securities, available-for-sale ...Commercial mortgage and other loans ...Other long-term investments ...Short-term investments ...Cash equivalents ...Other assets ...Subtotal excluding separate account assets ...Separate account assets(4) ...Total assets ...Future policy benefits ...Other... -

Page 71

... ...Equity securities, available-for-sale ...Commercial mortgage and other loans ...Other long-term investments ...Short-term investments ...Cash equivalents ...Other assets ...Subtotal excluding separate account assets ...Separate account assets(4) ...Total assets ...Future policy benefits ...Other... -

Page 72

... market data providers. Our policy is to use mid-market pricing consistent with our best estimate of fair value. Derivatives classified as Level 3 include first-to-default credit basket swaps, look-back equity options and other structured products. These derivatives are valued based upon models... -

Page 73

...interest rate related losses and credit related losses on sales (other than those related to certain of our businesses which primarily originate investments for sale or syndication to unrelated investors) are excluded from adjusted operating income. Prudential Financial, Inc. 2011 Annual Report 71 -

Page 74

... 31, 2011 2010 2009 (in millions) Realized investment gains (losses), net: Financial Services Businesses ...Closed Block Business ...Consolidated realized investment gains (losses), net ...Financial Services Businesses: Realized investment gains (losses), net: Fixed maturity securities ...Equity... -

Page 75

... $1,375 million related to product embedded derivatives and related hedge positions primarily associated with certain variable annuity contracts. See "-Results of Operations for Financial Services Businesses by Segment-U.S. Retirement Solutions and Investment Management Division-Individual Annuities... -

Page 76

... the Financial Services Businesses by asset type, and for fixed maturity securities, by reason. Year Ended December 31, 2011 2010 (in millions) Other-than-temporary impairments recorded in earnings-Financial Services Businesses(1) Public fixed maturity securities ...Private fixed maturity securities... -

Page 77

... Ended December 31, 2011 2010 (in millions) Realized investment gains (losses), net-Fixed Maturity Securities-Closed Block Business Gross realized investment gains: Gross gains on sales and maturities(1) ...Private bond prepayment premiums ...Total gross realized investment gains ...Gross realized... -

Page 78

... the Closed Block Business by asset type, and for fixed maturity securities, by reason. Year Ended December 31, 2011 2010 (in millions) Other-than-temporary impairments recorded in earnings-Closed Block Business(1) Public fixed maturity securities ...Private fixed maturity securities ...Total fixed... -

Page 79

... in 2009 were $517 million primarily related to a net increase in the loan loss reserve of $317 million and mark-to-market losses on mortgage loans within our Asset Management business. For additional information regarding our commercial mortgage and other loan loss reserves see "-General Account... -

Page 80

... the Financial Services Businesses by asset type, and for fixed maturity securities, by reason. Year Ended December 31, 2010 2009 (in millions) Other-than-temporary impairments recorded in earnings-Financial Services Businesses(1) Public fixed maturity securities ...Private fixed maturity securities... -

Page 81

... Ended December 31, 2010 2009 (in millions) Realized investment gains (losses), net-Fixed Maturity Securities-Closed Block Business Gross realized investment gains: Gross gains on sales and maturities(1) ...Private bond prepayment premiums ...Total gross realized investment gains ...Gross realized... -

Page 82

... the Closed Block Business by asset type, and for fixed maturity securities, by reason. Year Ended December 31, 2010 2009 (in millions) Other-than-temporary impairments recorded in earnings-Closed Block Business(1) Public fixed maturity securities ...Private fixed maturity securities ...Total fixed... -

Page 83

... in our insurance companies to support our liabilities to customers in our Financial Services Businesses and the Closed Block Business, as well as our other general liabilities. Our general account does not include: (1) assets of our trading and banking operations; (2) assets of our asset management... -

Page 84

... the Star and Edison Businesses, which consists of $40,257 million of fixed maturity securities, $1,526 million of other long-term investments, $938 million of equity securities, $790 million of commercial mortgage and other loans, $570 million of policy loans, $542 million of trading account assets... -

Page 85

...value ...Private, held-to-maturity, at amortized cost ...Trading account assets supporting insurance liabilities, at fair value ...Other trading account assets, at fair value ...Equity securities, available-for-sale, at fair value ...Commercial mortgage and other loans, at book value ...Policy loans... -

Page 86

...Financial Services Businesses by Segment-International Insurance Division." As of December 31, 2011, our Japanese insurance operations had $6.4 billion, at fair value, of investments denominated in Australian dollars that support liabilities denominated in Australian dollars. As of December 31, 2010... -

Page 87

...For the Financial Services Businesses, of the $13,273 million of amortized cost represented above, 86% is related to fixed maturities, 7% is related to trading account assets supporting insurance liabilities, and the remaining 7% is related to all other asset types. For the Closed Block Business, of... -

Page 88

...trading and banking operations, real estate and relocation services and asset management operations. See below for a discussion of the change in the Financial Services Businesses' yields. The decrease in net investment income yield attributable to the Closed Block Business for 2011 compared to 2010... -

Page 89

... Fixed maturities ...Trading account assets supporting insurance liabilities ...Equity securities ...Commercial mortgage and other loans ...Policy loans ...Short-term investments and cash equivalents ...Other investments ...Gross investment income before investment expenses ...Investment expenses... -

Page 90

... structures. Fixed Maturity Securities by Contractual Maturity Date The following table sets forth the breakdown of the amortized cost of our fixed maturity securities portfolio in total by contractual maturity as of December 31, 2011. December 31, 2011 Financial Services Businesses Closed Block... -

Page 91

..., 2010 to December 31, 2011, was primarily due to a decrease in interest rates in both the U.S. and Japan. The following table sets forth the composition of the portion of our fixed maturity securities portfolio by industry category attributable to the Closed Block Business as of the dates indicated... -

Page 92

.... See "-Trading Account Assets Supporting Insurance Liabilities" and "-Other Trading Account Assets" for additional information regarding these securities. Asset-Backed Securities at Fair Value-Financial Services Businesses December 31, 2011 Lowest Rating Agency Rating BB and BBB below (in millions... -

Page 93

... Business as of the dates indicated, by credit quality, and for asset-backed securities collateralized by sub-prime mortgages, by year of issuance (vintage). Asset-Backed Securities at Amortized Cost-Closed Block Business December 31, 2011 Lowest Rating Agency Rating BB and BBB below (in millions... -

Page 94

...-prime mortgages attributable to the Closed Block Business as of December 31, 2011, were $545 million of securities, on an amortized cost basis, that represent front pay or second pay securities, depending on the overall structure of the securities. 92 Prudential Financial, Inc. 2011 Annual Report -

Page 95

... Services Businesses and Closed Block Business as of the dates indicated. Residential Mortgage-Backed Securities at Amortized Cost December 31, 2011 Financial Services Businesses Closed Block Business Amortized Amortized Cost % of Total Cost % of Total ($ in millions) By security type: Agency... -

Page 96

...in the table above as of December 31, 2011 are agency commercial mortgage-backed securities with amortized cost of $256 million all rated AA. Commercial Mortgage-Backed Securities at Fair Value-Financial Services Businesses December 31, 2011 Lowest Rating Agency Rating(1) BB and Total BBB below Fair... -

Page 97

...cumulative net loss threshold. The following table sets forth the amortized cost of our AAA commercial mortgage-backed securities attributable to the Financial Services Businesses as of the dates indicated, by type and by year of issuance (vintage). Prudential Financial, Inc. 2011 Annual Report 95 -

Page 98

... to the Closed Block Business as of the dates indicated, by credit quality and by year of issuance (vintage). Commercial Mortgage-Backed Securities at Amortized Cost-Closed Block Business December 31, 2011 Lowest Rating Agency Rating(1) Total BB and Amortized BBB below Cost (in millions) $0 $0 $ 53... -

Page 99

...class benefit from the prioritization of principal cash flows. The following table sets forth the amortized cost our AAA commercial mortgage-backed securities attributable to the Closed Block Business as of the dates indicated, by type and by year of issuance (vintage). AAA Rated Commercial Mortgage... -

Page 100

... Total Public Fixed Maturities ...$174,153 $183,013 $123,918 (1) Reflects equivalent ratings for investments of the international insurance operations. (2) Includes, as of December 31, 2011 and 2010, 10 securities with amortized cost of $2 million (fair value, $12 million) and 17 securities with... -

Page 101

... receipt of SVO ratings. (2) On an amortized cost basis, as of December 31, 2011, includes $290 million in securitized bank loans and $182 million in emerging markets securities. Private Fixed Maturities-Credit Quality The following table sets forth our private fixed maturity portfolios by NAIC... -

Page 102

... of SVO ratings. (2) On an amortized cost basis, as of December 31, 2011, includes $290 million in securitized bank loans and $272 million in commercial asset finance securities. Corporate Securities-Credit Quality The following table sets forth both our public and private corporate securities by... -

Page 103

... credit exposures in our investment portfolio, including exposures relating to certain guarantees from monoline bond insurers. As of December 31, 2011 and 2010, the Financial Services Businesses had $1.598 billion and $1.785 billion of outstanding notional amounts, reported at fair value as an asset... -

Page 104

... billion as of December 31, 2011, include $847 million relating to asset-backed securities collateralized by sub-prime mortgages. Gross unrealized losses attributable to the Financial Services Businesses where the estimated fair value had declined and remained below amortized cost by 20% or more as... -

Page 105

... asset managers formally review all public fixed maturity holdings on a quarterly basis and more frequently when necessary to identify potential credit deterioration whether due to ratings downgrades, unexpected price variances, and/or company or industry specific concerns. For private placements... -

Page 106

... government authorities and agencies and obligations of U.S. states ...Total fixed maturities ...Equity securities ...Total trading account assets supporting insurance liabilities ... As a percentage of amortized cost, 75% and 76% of the portfolio was publicly traded as of December 31, 2011 and 2010... -

Page 107

... portfolio as of the dates indicated, by credit quality and by year of issuance (vintage). Commercial Mortgage-Backed Securities at Amortized Cost-Trading Account Assets Supporting Insurance Liabilities December 31, 2011 Lowest Rating Agency Rating Total BB and Amortized BBB below Cost (in millions... -

Page 108

...reported in "Asset management fees and other income." The following table sets forth our private fixed maturities included in our trading account assets supporting insurance liabilities portfolio by NAIC designation as of the dates indicated. Private Fixed Maturity Securities-Trading Account Assets... -

Page 109

... December 31, 2011, on an amortized cost basis 75% of asset-backed securities classified as "Other trading account assets" attributable to the Closed Block Business have credit ratings of A or above and the remaining 25% have BBB credit ratings. Commercial Mortgage and Other Loans Investment Mix As... -

Page 110

...'s current debt payments. A larger debt service coverage ratio indicates a greater excess of net operating income over the debt service payments. As of December 31, 2011, our general account investments in commercial and agricultural mortgage loans attributable to the Financial Services Businesses... -

Page 111

...and agricultural mortgage loans attributable to the Financial Services Businesses were fixed rate loans. As of December 31, 2011, our general account investments in commercial and agricultural mortgage loans attributable to the Closed Block Business had a weighted average debt service coverage ratio... -

Page 112

... our general account investments in commercial mortgage and other loans, based upon the recorded investment gross of allowance for credit losses, attributable to the Financial Services Businesses and Closed Block Business as of the dates indicated. 110 Prudential Financial, Inc. 2011 Annual Report -

Page 113

... Other Loans-Closed Block Business December 31, 2011 Greater Greater Than 90 Than 90 DaysDays-Not Accruing Accruing (in millions) $0 0 0 0 0 0 0 0 0 0 0 $0 $0 0 0 0 0 0 0 0 0 0 0 $0 Total Commercial Mortgage and Other Loans Current Commercial mortgage loans: Industrial ...Retail ...Office ...Multi... -

Page 114

... the Closed Block Business primarily reflects positive credit migration for certain mortgages. Equity Securities Investment Mix The equity securities attributable to the Financial Services Businesses consist principally of investments in common and preferred stock of publicly traded companies, as... -

Page 115

...the dates indicated. Equity Securities-Closed Block Business December 31, 2011 Gross Gross Unrealized Unrealized Gains Losses December 31, 2010 Gross Gross Unrealized Unrealized Gains Losses Cost Public Equity Perpetual preferred stocks(1) ...Non-redeemable preferred stocks ...Common stock ...Total... -

Page 116

... December 31, 2010. During 2011, perpetual preferred stocks were reclassified to "Other trading account assets." Prior periods were not restated. The following table sets forth the cost and gross unrealized losses of our equity securities attributable to the Financial Services Businesses where the... -

Page 117

... services, manufacturing, and finance sectors. Gross unrealized losses attributable to the Closed Block Business where the estimated fair value had declined and remained below cost by 20% or more of $105 million as of December 31, 2011 does not include any gross unrealized losses on securities where... -

Page 118

... long-term investments" are comprised as follows: December 31, 2010 December 31, 2011 Financial Closed Financial Closed Services Block Services Block Businesses Business Businesses Business (in millions) Joint ventures and limited partnerships: Real estate-related ...Non-real estate-related ...Real... -

Page 119

...value and projected net operating income are used in the calculation of the loan-to-value and debt service coverage ratios. As of December 31, 2011, we also hold $44 million of commercial real estate held for sale related to foreclosed interim loans, which is reported in "Other long-term investments... -

Page 120

... received cash proceeds of $422 million, which includes a final purchase price true-up of $2 million received post-closing on October 21, 2011. Of the total sale proceeds, $415 million was received by Prudential Securities Group LLC, a subsidiary of Prudential Insurance and the former parent company... -

Page 121

...optimize the use of cash by facilitating the lending and borrowing of funds between Prudential Financial and its subsidiaries on a daily basis. Also included are short-term investments of $1,098 million, consisting primarily of government agency securities and money market funds. The following table... -

Page 122

...investment gains and losses, for the year ended December 31, 2011 was $584 million. In addition to the regulatory limitations, the terms of the IHC debt contain restrictions potentially limiting dividends by Prudential Insurance applicable to the Financial Services Businesses in the event the Closed... -

Page 123

...facilitating the lending and borrowing of funds between Prudential Financial and its affiliates on a daily basis. Depending on the overall availability of cash, Prudential Financial invests excess cash on a short-term basis or borrows funds in the capital markets. Additional longer term liquidity is... -

Page 124

... $274 million were used to purchase investments, including the FHLBNY activity-based stock. The funding agreements issued to the FHLBNY, which are reflected in "Policyholders' account balances," have priority claim status above debt holders of Prudential Insurance. These funding agreements currently... -

Page 125

... to these cash flows are the risk of default by debtors or bond insurers, our counterparties' willingness to extend repurchase and/or securities lending arrangements, commitments to invest and market volatility. We closely manage these risks through our credit risk management process and regular... -

Page 126

...on our evaluation of the Company's risk position or other factors. In addition to hedging equity market exposure, we also manage certain risks associated with our variable annuity products through our hedging programs. In our living benefits hedging program, we purchase interest rate derivatives and... -

Page 127

... income (loss)." International Insurance and Investments Subsidiaries On February 1, 2011, we completed our acquisition of the Star and Edison Businesses. Gibraltar Life and Prudential of Japan each contributed $400 million to payment of the acquisition purchase price, with the remaining funding... -

Page 128

... rating as of the dates indicated. December 31, 2011 Star and Gibraltar Edison All Life Businesses Other(1) (in billions) $ 2.4 $ 1.7 $0.2 43.3 0.8 44.1 $46.5 39.5 0.8 40.3 $42.0 8.4 0.1 8.5 $8.7 Prudential of Japan Cash and short-term investments ...Fixed maturity investments: High or highest... -

Page 129

The Financial Services Agency, the insurance regulator in Japan, has implemented revisions to the solvency margin requirements that will revise risk charges for certain assets and change the manner in which an insurance company's core capital is calculated. These changes will be effective for the ... -

Page 130

... distribution of dividends and returns of capital to Prudential Financial. The primary liquidity risks for our fee-based asset management businesses relate to their profitability, which is impacted by market conditions and our investment management performance. We believe the cash flows from our fee... -

Page 131

...2011 and 2010, total short- and long-term debt of the Company on a consolidated basis was $27.0 billion and $25.6 billion, respectively, which as shown below, includes $18.6 billion and $17.6 billion, respectively, related to the parent company, Prudential Financial. Prudential Financial Borrowings... -

Page 132

... Home Loan Bank of New York, which are discussed in more detail in "-Alternative Sources of Liquidity-Federal Home Loan Bank of New York." (5) As of both December 31, 2011 and 2010, the $1.75 billion of limited and non-recourse long-term debt outstanding was attributable to the Closed Block Business... -

Page 133

... of our broker-dealers and our capital markets and other securities business-related operations. Debt related to specified other businesses consists of borrowings associated with our individual annuities business, real estate franchises, and relocation services. Those borrowings where the holder is... -

Page 134

... guidance regarding the deferral of costs relating to the acquisition of new or renewal insurance contracts. As of December 31, 2011, the consolidated net worth of the Company's Financial Services Businesses exceeded the minimum amount required to borrow under the credit facilities. We also use... -

Page 135

... of New Jersey ...Prudential Annuities Life Assurance Corporation ...Prudential Retirement Insurance and Annuity Company ...The Prudential Life Insurance Company Ltd. (Prudential of Japan) ...Gibraltar Life Insurance Company, Ltd...Credit Ratings: Prudential Financial, Inc.: Short-term borrowings... -

Page 136

... Company, Ltd. On January 5, 2012, S&P withdrew the financial strength and long-term counterparty ratings of AIG Edison Life Insurance Company due to its merger with Gibraltar Life Insurance Company, Ltd. Contractual Obligations The table below summarizes the future estimated cash payments related... -

Page 137

...to repurchase, cash collateral for loaned securities, liabilities for unrecognized tax benefits, bank customer liabilities, and other miscellaneous liabilities. We also enter into agreements to purchase goods and services in the normal course of business; however, these purchase obligations are not... -

Page 138

.... Changes to these ratings could impact our borrowing costs, our ability to access alternative sources of liquidity, and our ability to market certain products. For additional information regarding our liquidity and capital resources see "Management's Discussion and Analysis of Financial Condition... -

Page 139

... or adjust portfolio management strategies. Market Risk Related to Interest Rates Our "other than trading" assets that subject us to interest rate risk primarily include fixed maturity securities, commercial mortgage and other loans and policy loans. In the aggregate, the carrying value of these... -

Page 140

... associated with products for which investment risk is borne primarily by the separate account contractholders rather than by us. Market Risk Related to Equity Prices We actively manage investment equity price risk against benchmarks in respective markets. We benchmark our return on equity holdings... -

Page 141

... investment funds underlying the variable annuity products relative to the market indices we use as a basis for developing our hedging strategy. The impact of basis risk could result in larger differences between the change in fair value of the equity-based derivatives and the related living benefit... -

Page 142

... exchange rate risk, and commodities price risk, expressed in terms of adverse changes to fair value with a 95% confidence level over a one-day time horizon, was $1 million during both 2011 and 2010. Limitations of VaR Models Although VaR models are a recognized tool for risk management, they... -

Page 143

...policies or procedures may deteriorate. The effectiveness of the Company's internal control over financial reporting as of December 31, 2011 has been audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, as stated in their report appearing herein. February 24, 2012... -

Page 144

... of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was... -

Page 145

... account assets(1) ...TOTAL ASSETS ...LIABILITIES AND EQUITY LIABILITIES Future policy benefits ...Policyholders' account balances ...Policyholders' dividends ...Securities sold under agreements to repurchase ...Cash collateral for loaned securities ...Income taxes ...Short-term debt ...Long-term... -

Page 146

..., 2011, 2010 and 2009 (in millions, except per share amounts) 2011 REVENUES Premiums ...Policy charges and fee income ...Net investment income ...Asset management fees and other income ...Realized investment gains (losses), net: Other-than-temporary impairments on fixed maturity securities ...Other... -

Page 147

... Years Ended December 31, 2011, 2010 and 2009 (in millions) Common Accumulated Total Additional Stock Other Prudential Common Paid-in Retained Held in Comprehensive Financial, Inc. Noncontrolling Total Stock Capital Earnings Treasury Income (loss) Equity Interests Equity Balance, December 31, 2008... -

Page 148

... ...Trading account assets supporting insurance liabilities and other trading account assets ...Equity securities, available-for-sale ...Commercial mortgage and other loans ...Policy loans ...Other long-term investments ...Short-term investments ...Payments for the purchase/origination of: Fixed... -

Page 149

...is managed separately from the Financial Services Businesses. The Closed Block Business was established on the date of demutualization and includes the Company's in force participating insurance and annuity products and assets that are used for the payment of benefits and policyholders' dividends on... -

Page 150

...Investment-Related Liabilities The Company's principal investments are fixed maturities; equity securities; commercial mortgage and other loans; policy loans; other long-term investments, including joint ventures (other than operating joint ventures), limited partnerships, and real estate; and short... -

Page 151

..., loan term, estimated market value growth rate and volatility for the property type and region. See Note 4 for additional information related to the loan-to-value ratios and debt service coverage ratios related to the Company's commercial mortgage and agricultural loan portfolios. Loans backed... -

Page 152

... net investment income at the contract interest rate when earned. Policy loans are fully collateralized by the cash surrender value of the associated insurance policies. Securities repurchase and resale agreements and securities loaned transactions are used to earn spread income, to borrow funds, or... -

Page 153

... cost basis of investments for net other-than-temporary impairments recognized in earnings. Realized investment gains and losses are also generated from prepayment premiums received on private fixed maturity securities, allowance for losses on commercial mortgage and other loans, fair value changes... -

Page 154

... less when purchased, other than cash equivalents that are included in "Trading account assets supporting insurance liabilities, at fair value." Deferred Policy Acquisition Costs Costs that vary with and that are related primarily to the production of new insurance and annuity business are deferred... -

Page 155

...-related investments, real estate mortgage loans, short-term investments and derivative instruments. The assets of each account are legally segregated and are generally not subject to claims that arise out of any other business of the Company. Investment risks associated with market value changes... -

Page 156

... future cash flows expected from the guaranteed minimum death and income benefit provisions. For acquired defined contribution and defined benefits businesses, contract balances are projected using assumptions for add-on deposits, participant withdrawals, contract surrenders, and investment returns... -

Page 157

... participating life insurance products, the mortality and interest rate assumptions applied are those used to calculate the policies' guaranteed cash surrender values. For life insurance, other than individual traditional participating life insurance, and annuity and disability products, expected... -

Page 158

... life contracts, deferred fixed annuities, structured settlements and other contracts without life contingencies, and participating group annuities are reported as deposits to "Policyholders' account balances." Revenues from these contracts are reflected in "Policy charges and fee income" consisting... -

Page 159

...or contracted in the over-the-counter market. Derivative positions are carried at fair value, generally by obtaining quoted market prices or through the use of valuation models. Derivatives are used in a non-broker-dealer capacity to manage the interest rate and currency characteristics of assets or... -

Page 160

... on a long-term basis in the near term. See Note 14 for additional information regarding short-term and long-term debt. Income Taxes The Company and its eligible domestic subsidiaries file a consolidated federal income tax return that includes both life insurance companies and non-life insurance... -

Page 161

... by subordination) and provides new guidance on how the evaluation of embedded credit derivatives is to be performed. This new guidance is effective for the first interim reporting period beginning after June 15, 2010. The Company's adoption of Prudential Financial, Inc. 2011 Annual Report 159 -

Page 162

...financial asset as a sale. The Company's adoption of this guidance effective January 1, 2010 did not have a material effect on the Company's consolidated financial position, results of operations, and financial statement disclosures. Future Adoption of New Accounting Pronouncements In December 2011... -

Page 163

...Life Insurance Company ("Edison"), AIG Financial Assurance Japan K.K., and AIG Edison Service Co., Ltd. (collectively, the "Star and Edison Businesses") pursuant to the stock purchase agreement dated September 30, 2010 between Prudential Financial and AIG. The total purchase price was $4,709 million... -

Page 164

... millions) Total invested assets at fair value(1) ...Cash and cash equivalents ...Accrued investment income ...Value of business acquired ("VOBA")(2) ...Goodwill(2) ...Other assets(1)(2) ...Total assets acquired ...Future policy benefits(2)(3) ...Policyholders' account balances(2)(3)(4) ...Long-term... -

Page 165

... 6, 2011, the Company sold its real estate brokerage franchise and relocation services business ("PRERS") to Brookfield Asset Management, Inc. The Prudential Real Estate Financial Services Company of America Inc. ("PREFSA"), a finance subsidiary of the Company with investments in a limited number of... -

Page 166

... $18 million and income tax benefit of $1 million. (2) In the first quarter of 2010, the Company signed a definitive agreement to sell Prudential Investment & Securities Co. Ltd. and Prudential Asset Management Co. Ltd., which together comprised the Company's Korean asset management operations. This... -

Page 167

... amortized cost of $500 million (fair value, $519 million) which have been offset with the associated payables under a netting agreement. (2) Includes credit tranched securities collateralized by auto loans, credit cards, education loans, and other asset types. (3) Includes publicly traded agency... -

Page 168

...prime mortgages, auto loans, credit cards, education loans, and other asset types. (2) Includes publicly traded agency pass-through securities and collateralized mortgage obligations. (3) Represents the amount of other-than-temporary impairment losses in "Accumulated other comprehensive income (loss... -

Page 169

... comprehensive income (loss)" ("OCI"). For these securities, the net amount recognized in earnings ("credit loss impairments") represents the difference between the amortized cost of the security and the net present value of its projected future cash flows discounted at the effective interest rate... -

Page 170

... of "Trading account assets supporting insurance liabilities, at fair value" at December 31: December 31, 2011 Amortized Cost Short-term investments and cash equivalents ...Fixed maturities: Corporate securities ...Commercial mortgage-backed securities ...Residential mortgage-backed securities... -

Page 171

... 31, 2011 December 31, 2010 Amortized Fair Amortized Fair Cost Value Cost Value (in millions) Investments in South Korean government and government agency securities: Fixed maturities, available-for-sale ...Fixed maturities, held-to-maturity ...Trading account assets supporting insurance liabilities... -

Page 172

... Financial Statements 4. INVESTMENTS (continued) The commercial mortgage and agricultural property loans are geographically dispersed throughout the United States, Canada and Asia with the largest concentrations in California (27%), New York (11%) and Texas (8%) at December 31, 2011. Activity... -

Page 173

...323 (1) Recorded investment reflects the balance sheet carrying value gross of related allowance. 2010 Residential Other Property Collateralized Loans Loans (in millions) $ 0 17 0 $ 17 $ 20 0 0 $ 20 $ Commercial Mortgage Loans Allowance for Credit Losses: Ending balance: individually evaluated for... -

Page 174

... contractual terms of the loan agreement will not all be collected. Impaired commercial mortgage and other loans identified in management's specific review of probable loan losses and the related allowance for losses for the years ended December 31, are as follows: 2011 Average Recorded Investment... -

Page 175

... an investor. As of December 31, 2011 and 2010, all of the Company's commercial and other loans held for sale were collateralized, with collateral primarily consisting of office buildings, retail properties, apartment complexes and industrial buildings. Prudential Financial, Inc. 2011 Annual Report... -

Page 176

... upon the recorded investment gross of allowance for credit losses. Commercial mortgage loans-Industrial buildings Debt Service Coverage Ratio-December 31, 2011 Greater than Less than 2.0X 1.8X to 2.0X 1.5X to -

Page 177

..., INC. Notes to Consolidated Financial Statements 4. INVESTMENTS (continued) Commercial mortgage loans-Hospitality Debt Service Coverage Ratio-December 31, 2011 Greater than Less than 2.0X 1.8X to 2.0X 1.5X to -

Page 178

... upon the recorded investment gross of allowance for credit losses. Commercial mortgage loans-Industrial buildings Debt Service Coverage Ratio-December 31, 2010 Greater than Less than 2.0X 1.8X to 2.0X 1.5X to -

Page 179

..., INC. Notes to Consolidated Financial Statements 4. INVESTMENTS (continued) Commercial mortgage loans-Hospitality Debt Service Coverage Ratio-December 31, 2010 Greater than Less than 2.0X 1.8X to 2.0X 1.5X to -

Page 180

... provide an aging of past due commercial mortgage and other loans as of the dates indicated, based upon the recorded investment gross of allowance for credit losses. As of December 31, 2011 Greater Greater Than 90 Than 90 Day Day - Not Accruing Accruing (in millions) $0 0 0 0 0 0 0 1 0 0 0 $1 $ 0 15... -

Page 181

...and limited partnerships ...Real estate held through direct ownership ...Other ...Total other long-term investments ...$1,182 3,304 4,486 2,460 874 $7,820 $1,058 2,477 3,535 1,659 977 $6,171 In certain investment structures, the Company's asset management business invests with other co-investors in... -

Page 182

...Fixed maturities, held-to-maturity ...Equity securities, available-for-sale ...Trading account assets ...Commercial mortgage and other loans ...Policy loans ...Broker-dealer related receivables ...Short-term investments and cash equivalents ...Other long-term investments ...Gross investment income... -

Page 183

...Policy Acquisition Costs, Accumulated Deferred Other Sales Comprehensive Inducements, Deferred Income (Loss) and Income Related To Net Net Unrealized Value of Future Tax Unrealized Gains (Losses) Business Policy Policyholders' (Liability) Investment on Investments Acquired Benefits Dividends Benefit... -

Page 184

... Acquisition Costs, Accumulated Deferred Other Sales Comprehensive Inducements, Deferred Income (Loss) and Income Related To Net Net Unrealized Value of Future Tax Unrealized Gains (Losses) Business Policy Policyholders' (Liability) Investment on Investments(1) Acquired Benefits Dividends Benefit... -

Page 185

...Value Losses Fixed maturities(1) U.S. Treasury securities and obligations of U.S. government authorities and agencies ...Obligations of U.S. states and their political subdivisions ...Foreign government bonds ...Corporate securities ...Commercial mortgage-backed securities ...Asset-backed securities... -

Page 186

... discounts. At December 31, 2011, the Company does not intend to sell the securities and it is not more likely than not that the Company will be required to sell the securities before the anticipated recovery of its remaining amortized cost basis. 184 Prudential Financial, Inc. 2011 Annual Report -

Page 187

... of Financial Position included the following: 2010 2011 (in millions) $13,070 $11,610 738 276 46 355 4,073 4,082 276 334 $18,203 $16,657 Fixed maturities(1) ...Trading account assets supporting insurance liabilities ...Other trading account assets ...Separate account assets ...Equity securities... -

Page 188

... certain employee benefits. Securities restricted as to sale amounted to $191 million and $638 million at December 31, 2011 and 2010, respectively. These amounts include member and activity-based stock associated with memberships in the Federal Home Loan Bank of New York and Boston. Restricted cash... -

Page 189

...2010 (in millions) $ 83 $ 49 271 0 154 341 19 17 275 84 1 1 17 3 0 4 $820 $723 0 $723 $499 $379 4 $383 Fixed maturities, available-for-sale ...Other trading account assets ...Commercial mortgage and other loans ...Other long-term investments ...Cash and cash equivalents ...Accrued investment income... -

Page 190

... investment manager is limited to its investment in the VIEs, which was $534 million and $506 million at December 31, 2011 and 2010, respectively. These investments are reflected in "Fixed maturities, available-for-sale," "Other trading account assets, at fair value" and "Other long-term investments... -

Page 191

...comprehensive income and relate to the market price of China Pacific Group's publicly traded shares, which began trading on the Shanghai Exchange in 2007 and since the fourth quarter of 2009 are trading on the Hong Kong exchange. In December 2010, a consortium of investors including the Company sold... -

Page 192

..., $1,981 million, and $76 million related to the insurance transactions associated with the CIGNA, Prudential Annuities Holding Co., Edison Inc., Star Inc., and Aoba Life Insurance Company, LTD. ("Aoba Life"), respectively. The weighted average remaining expected life of VOBA varies by product. The... -

Page 193

... to Consolidated Financial Statements 9. GOODWILL AND OTHER INTANGIBLES The changes in the book value of goodwill by area are as follows: Real Estate and Individual Asset International International Relocation Annuities Management Retirement Insurance Investments Services Total (in millions) Balance... -

Page 194

...%, 24% and 28% of direct individual life insurance premiums for 2011, 2010 and 2009, respectively. Future policy benefits for individual non-participating traditional life insurance policies, group and individual long-term care policies and individual health insurance policies are generally equal to... -

Page 195

...not yet reported as of the balance sheet dates related to group disability products. Unpaid claim liabilities are discounted using interest rates ranging from 0% to 6.4%. Policyholders' Account Balances Policyholders' account balances at December 31, are as follows: 2010 2011 (in millions) $ 41,717... -

Page 196

... Account balances of variable annuity contracts with guarantees were invested in separate account investment options as follows: December 31, 2011 2010 (in millions) $49,110 $54,775 42,791 28,064 377 314 7,134 7,932 $99,412 $91,085 Equity funds ...Bond funds ...Balanced funds ...Money market funds... -

Page 197

... for guarantees on variable contracts. The liabilities for guaranteed minimum death benefits ("GMDB") and guaranteed minimum income benefits ("GMIB") are included in "Future policy benefits" and the related changes in the liabilities are included in "Policyholders' benefits." Guaranteed minimum... -

Page 198

... of the customer's initial deposit, (2) additional credits after a certain number of years a contract is held and (3) enhanced interest crediting rates that are higher than the normal general account interest rate credited in certain product lines. Changes in deferred sales inducements, reported as... -

Page 199

... in the Closed Block are specified individual life insurance policies and individual annuity contracts that were in force on the effective date of the Plan of Reorganization and for which Prudential Insurance is currently paying or expects to pay experience-based policy dividends. Assets have been... -

Page 200

...-sale, at fair value ...Commercial mortgage and other loans ...Policy loans ...Other long-term investments ...Short-term investments ...Total investments ...Cash and cash equivalents ...Accrued investment income ...Other Closed Block assets ...Total Closed Block Assets ...Excess of reported Closed... -

Page 201

... obligations to the Company under the terms of the reinsurance agreements. Reinsurance premiums, commissions, expense reimbursements, benefits and reserves related to reinsured longduration contracts are accounted for over the life of the underlying reinsured contracts using assumptions consistent... -

Page 202

... $725 million is in "Long-term debt" and matures in December 2015. The funding agreements issued to the FHLBNY, which are reflected in "Policyholders' account balances," have priority claim status above debt holders of Prudential Insurance. 200 Prudential Financial, Inc. 2011 Annual Report -

Page 203

... of new or renewal insurance contracts. As of December 31, 2011, the consolidated net worth of the Company's Financial Services Businesses exceeded the minimum amount required to borrow under the credit facilities. In addition to the above credit facilities, the Company had access to $860 million of... -

Page 204

...the Company's total consolidated borrowings on a net basis. Prudential Financial has agreed to make capital contributions to the subsidiary issuer in order to reimburse it for investment losses in excess of specified amounts. In September 2009, Prudential Insurance issued in a private placement $500... -

Page 205

... the prior approval of the Arizona Department of Insurance. As of December 31, 2011 and 2010, these derivative instruments had no material value. Junior Subordinated Notes In June and July 2008, Prudential Financial issued $600 million of 8.875% fixed-to-floating rate junior subordinated notes to... -

Page 206

...218 million was distributed to Prudential Financial through a dividend on the date of demutualization for use in the Financial Services Businesses. In addition, $72 million was used to purchase a guaranteed investment contract to fund a portion of the financial guarantee insurance premium related to... -

Page 207

... shares of Common Stock the Company distributed to policyholders as part of the demutualization. The Common Stock is traded on the New York Stock Exchange under the symbol "PRU." Also on the date of demutualization, Prudential Financial completed the sale, through a private placement, of 2.0 million... -

Page 208

... B Stock. Dividends The principal sources of funds available to Prudential Financial, the parent holding company, are dividends, returns of capital and interest income from its subsidiaries, and cash and short-term investments. The primary uses of funds at Prudential Financial include servicing its... -

Page 209

... outstanding share of Common Stock was coupled with a shareholder right. The rights plan was not applicable to any Class B Stock. Each right initially entitled the holder to purchase one one-thousandth of a share of a series of Prudential Financial preferred stock upon payment of the exercise price... -

Page 210

... Diluted earnings per share Income from continuing operations attributable to the Financial Services Businesses available to holders of Common Stock after direct equity adjustment ...$3,491 488.7 $7.14 $2,700 475.4 $5.68 $3,439 448.2 $7.67 208 Prudential Financial, Inc. 2011 Annual Report -

Page 211

... attributable to the Closed Block Business available to holders of Class B Stock after direct equity adjustment ... $135 24 $480 36 $(287) 43 $111 2.0 $55.50 $444 2.0 $222.00 $(330) 2.0 $(165.00) 17. SHARE-BASED PAYMENTS Omnibus Incentive Plan In March 2003, the Company's Board of... -

Page 212

... plans capitalized in deferred acquisition costs for the years ended December 31, 2011, 2010 and 2009 were de minimis. Stock Options Each stock option granted has an exercise price no less than the fair market value of the Company's Common Stock on the date of grant and has a maximum term... -

Page 213

... and releases to date. The actual number of units to be awarded at the end of each performance period will range between 0% and 150% of the target for awards granted in 2010 and 2011, based upon a measure of the reported performance for the Company's Financial Services Businesses relative... -

Page 214

... Consolidated Financial Statements 17. SHARE-BASED PAYMENTS (continued) The fair market value of employee restricted stock, restricted units and performance share and unit awards released for the years ended December 31, 2011, 2010 and 2009 was $75 million, $56 million and $34 million, respectively... -

Page 215

... on an account balance that takes into consideration age, service and earnings during their career. The Company provides certain health care and life insurance benefits for its retired employees, their beneficiaries and covered dependents ("other postretirement benefits"). The health care plan is... -

Page 216

...Benefit obligation at end of period ...Change in plan assets Fair value of plan assets at beginning of period ...Actual return on plan assets ...Employer contributions ...Plan participants' contributions ...Early retirement reinsurance program receipts...Disbursement for settlements ...Benefits paid... -

Page 217

...accumulated benefit obligation in excess of plan assets 2011 2010 (in millions) $2,582 $1,951 77 196 Accumulated benefit obligation ...Fair value of plan assets ... There were no purchases of annuity contracts in 2011 and 2010 from Prudential Insurance. The approximate future annual benefit payment... -

Page 218

... period) ...Rate of increase in compensation levels (end of period) ...Expected return on plan assets (beginning of period) ...Health care cost trend rates (beginning of period) ...Health care cost trend rates (end of period) ...For 2011, 2010 and 2009, the ultimate health care cost trend rate after... -

Page 219

... fixed maturity returns include inflation, real return, a term premium, credit spread, capital appreciation, effect of active management, expenses and the effect of rebalancing. The Company applied the same approach to the determination of the expected long-term rate of return on plan assets in 2012... -

Page 220

.... Guaranteed Investment Contract-The value is based on contract cash flows and available market rates for similar investments. Registered Investment Companies (Mutual Funds)-Securities are priced at the net asset value ("NAV") of shares. Unrealized Gain (Loss) on Investment of Securities Lending... -

Page 221

...Interest rate swaps (Notional amount: $559) ...Guaranteed investment contract ...Other(10) ...Unrealized gain (loss) on investment of securities lending collateral(11) ...Subtotal ...Short-term Investments: Pooled separate accounts ...United Kingdom insurance pooled funds ...Subtotal ...Real Estate... -

Page 222

... corporate securities. (9) This category invests in highly rated Collateralized Mortgage Obligations. (10) Primarily cash and cash equivalents, short term investments, payables and receivables, and open future contract positions (including fixed income collateral). (11) The contractual net value... -

Page 223

..., INC. Notes to Consolidated Financial Statements 18. EMPLOYEE BENEFIT PLANS (continued) Changes in Fair Value of Level 3 Pension Assets Year Ended December 31, 2011 Fixed Maturities- Corporate Debt- Fixed Corporate Maturities- Bonds Other (in millions) $ 10 $ (8) 0 0 (1) 3 $ 12 0 0 70 0 $ 62... -

Page 224

...Collateralized Mortgage Obligations (CMO)(7) ...Interest rate swaps (Notional amount: $560) ...Other(8) ...Unrealized gain (loss) on investment of securities lending collateral(9) ...Subtotal ...Short-term Investments: Variable Life Insurance Policies ...Registered investment companies ...Subtotal... -

Page 225

... category invests in highly rated Collateralized Mortgage Obligations. (8) Cash and cash equivalents, short term investments, payables and receivables and open future contract positions (including fixed income collateral). (9) In 2011 the contractual net value of the investment of securities lending... -

Page 226

... U.S. Equities ...International Equities ...Fixed Maturities ...Short-term Investments ...Real Estate ...Other ...Total ...8% 2 73 2 4 11 100% 9% 3 72 0 2 14 100% Postretirement Percentage of Plan Assets 2011 2010 46% 4 48 2 0 0 100% 43% 4 52 1 0 0 100% The expected benefit payments for the Company... -

Page 227

... ...Income tax expense (benefit) reported in equity related to: Other comprehensive income ...Impact on Company's investment in Wachovia Securities due to addition of A.G. Edwards business ...Stock-based compensation programs ...Cumulative effect of changes in accounting principles ...Total income... -

Page 228

...) Total income tax expense includes additional tax expense related to the utilization of deferred tax assets recorded in the Statement of Financial Position as of the acquisition date for Prudential Gibraltar Financial Life Insurance Company, Ltd. ("PGFL") and the Star and Edison Businesses. The... -

Page 229

...and the Company recognized an income tax expense of $6 million related to the sale in "Income from discontinued operations, net of taxes." In addition, in 2009, the Company determined, due to the then pending sale, that the earnings from certain of its Korean investment management subsidiaries would... -

Page 230

... as, but not limited to, changes in the amount of dividends received that are eligible for the DRD, changes in the amount of distributions received from mutual fund investments, changes in the account balances of variable life and annuity contracts, and the Company's taxable income before the DRD... -

Page 231

...: fixed maturities (corporate public and private bonds, most government securities, certain asset-backed and mortgage-backed securities, etc.), certain equity securities (mutual funds, which do not actively trade and are priced based on a net asset value) and commercial mortgage loans, short-term... -

Page 232

... ...Equity securities, available for sale ...Commercial mortgage and other loans ...Other long-term investments ...Short-term investments ...Cash equivalents ...Other assets ...Subtotal excluding separate account assets ...Separate account assets(3) ...Total assets ...Future policy benefits ...Other... -

Page 233

... ...Equity securities, available-for-sale ...Commercial mortgage and other loans ...Other long-term investments ...Short-term investments ...Cash equivalents ...Other assets ...Subtotal excluding separate account assets ...Separate account assets(3) ...Total assets ...Future policy benefits ...Other... -

Page 234

... related to the security. Pricing service over-rides, internally-developed valuations and non-binding broker quotes are generally included in Level 3 in the fair value hierarchy. The fair value of private fixed maturities, which are primarily comprised of investments in private placement securities... -

Page 235

... commodity swaps, commodity forward contracts, single name credit default swaps, loan commitments held for sale and to-be-announced (or TBA) forward contracts on highly rated mortgage-backed securities issued by U.S. government sponsored entities are determined using discounted cash flow models. The... -

Page 236

...'s fair values to broker-dealer values. Cash Equivalents and Short-Term Investments-Cash equivalents and short-term investments include money market instruments, commercial paper and other highly liquid debt instruments. Money market instruments are generally valued using unadjusted quoted prices in... -

Page 237

... Significant declines in risk-free interest rates and the impact of account value performance in 2011 drove an increase in the embedded derivative liability associated with the optional living benefit features of the Company's variable annuity products as of December 31, 2011. These factors, as well... -

Page 238

... net ...Asset management fees and other income ...$ 4 Year Ended December 31, 2011 Other Trading Other Other Account Trading Trading AssetsAccount Account Commercial AssetsAssetsMortgageCorporate Asset-Backed Backed Securities Securities Securities (in millions) $35 $ 54 $ 19 Other Trading Account... -

Page 239

... net ...Asset management fees and other income ...Included in other comprehensive income (loss) ...$ 26 Year Ended December 31, 2011 Other Trading Account Equity Commercial AssetsSecurities Mortgage All Other Availableand Other Activity For-Sale Loans (in millions) $134 $ 355 $ 212 Other Long-term... -

Page 240

... against directly observable market information. Consequently, perpetual preferred stocks were transferred into Level 3 within the fair value hierarchy. This represents the majority of the transfers into Level 3 for Equity Securities Available-for-Sale, Trading Account Assets Supporting Insurance... -

Page 241

...the end of the period(3): Included in earnings: Realized investment gains (losses), net ...Asset management fees and other income ... $ 0 $ (3) $ $ 0 1 $ 0 $ 5 $ 0 $ 1 Trading Account Assets Supporting Insurance LiabilitiesEquity Securities Fair Value, beginning of period ...Total gains (losses... -

Page 242

...Included in earnings: Realized investment gains (losses), net ...Asset management fees and other income ...Interest credited to policyholders' account balances ...(1) (2) (3) (4) $ 27 Year Ended December 31, 2010 Separate Future Account Policy Long-term Other Assets(4) Benefits Debt Liabilities (in... -

Page 243

... for Fixed Maturities Available-for-Sale-Asset-Backed Securities and Trading Account Assets Supporting Insurance Liabilities-Asset-Backed Securities include $4,974 million and $222 million, respectively, for the year ended December 31, 2010 resulting from the Company's conclusion that the market for... -

Page 244

... MortgageBacked Securities $28 Trading Account Assets Supporting Insurance LiabilitiesForeign Government Bonds Fair Value, beginning of period ...Total gains (losses) (realized/unrealized): Included in earnings: Realized investment gains (losses), net ...Asset management fees and other income... -

Page 245

... in earnings: Realized investment gains (losses), net ...Asset management fees and other income ...Interest credited to policyholders' account balances ...(1) (2) (3) (4) $26 Year Ended December 31, 2009 Separate Future Account Policy Long-term Assets(4) Benefits Debt (in millions) $19,780 $(3,229... -

Page 246