Progressive 2011 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2011 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Letter to Shareholders

“I’m a good driver why don’t I get credit for that?” “What

does my age or occupation tell you about my driving?”

...and the list goes on as consumers struggle with group

statistics of correlation versus their sense of controllable

causes. Snapshot, and what is sure to follow in its evolution,

is a meaningful

start toward personalized insurance pricing

based on real-time measurement of your driving behavior

—

the statistics of one.

The power of participation and personalization has strong

appeal, no better demonstrated than when we asked cus-

tomers, employees, shareholders, and directors to contribute

art work for this Annual eport. A simple request to draw

online a car facing to the right resulted in tens of thousands

of responses

—

no two the same. Objective curation of the

responses has selected a sample to highlight this report

—

sadly mine is absent, but the point is not diminished. The

num erosity of responses provides a visual clue as to the

expansive power that personalization provides to segmen-

tation in insurance pricing.

As exciting as Snapshot is, and I’ll discuss it in more detail

later, there is much more to reflect on for Progressive in 2011.

For the first time in Progressive’s history net premiums

written topped $15 billion, surpassing that mark in the closing

days of the year. Earned premiums, recognized on a lag to

written, finished around $14.9 billion.

Our combined ratio of 93 was an equally satisfying result,

and while three points better than the objective we commu-

nicate to shareholders, it benefited from what I would classify

as generally higher-than-expected favorable development

from prior year loss reserves, as those estimates were refined

based on actual payment patterns. However, net of any favor-

able development, we outperformed our target 96 combined

ratio and comfortably handled an active catastrophe year.

Net premiums written growth for the year was 5%, or alter-

natively about $670 million, not yet numbers that come

close to taxing our ability or desire to manage growth, but a

strong growth quarter to end the year was encouraging.

eporting last year

I commented that,

“The closing years of

the decade appear to

be the approximate

time frame during

which in

dustrywide

profitability

will once

again be mod erated

and sustained indus

-

try premium declines will turn positive.” This appears to have

some continued veracity and for Progressive the combination

of growth and margin in the last few years supports our turn.

It’s not always apparent when meaningful business history is being made and in auto insurance

that’s not very often, but in 2 011, Progressive’s introduction of Snapshot® just might qualify.

9

Kombi (Leonardo, age 27) Eco (Mary Anne, age 42)

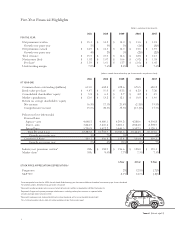

Industrywide

Premium Growth Combined Ratio

2006 0.4% 94.2

2007 (0.7)% 97.7

2008 (0.7)% 99.8

2009 (0.9)% 100.8

2010 1.5% 100.4

Note: Represents A.M. Best Private Passenger Auto Data.