Polaris 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Polaris Industries Inc. is headquartered in Medina, Minnesota, and

designs, manufactures and markets innovative, high-quality, high-performance

motorized products for recreation and utility use. • Our product lines consist of all-

terrain recreational and utility vehicles (ATVs), snowmobiles, motorcycles and related

parts, garments and accessories (PG&A). Polaris engineering, manufacturing and

distribution facilities are located in Roseau, Minnesota; Osceola, Wisconsin; Spirit Lake,

Iowa; Vermillion, South Dakota; Passy, France; Ballarat, Victoria, Australia; Winnipeg,

Manitoba; Gloucester, United Kingdom; Askim, Norway; Östersund, Sweden; and

Hudson, Wisconsin (joint venture with Fuji Heavy Industries, Ltd.). • Our wholesale

finance company, Polaris Acceptance, is a 50/50 joint venture. Polaris products are

sold through a network of nearly 2,000 dealers in North America, five subsidiaries

and 40 distributors in 126 countries outside North America. • Polaris common stock

trades on the New York Stock Exchange and Pacific Stock Exchange under the

symbol PII, and the Company is included in the S&P SmallCap 600 stock price index.

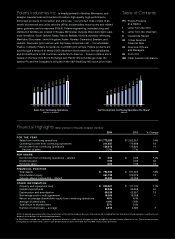

Financial Highlights (dollars and shares in thousands, except per share data)

2004 2003 % Change

FOR THE YEAR

Sales from continuing operations $ 1,773,206 $ 1,552,351 14%

Operating income from continuing operations 211,637 179,898 18

Net income from continuing operations 136,813 119,823 14

Percent of sales 7.7% 7.7%

PER SHARE

Net income from continuing operations – diluted $ 3.04 $ 2.66 14%

Dividends paid 0.92 0.62 48

Net book value 8.03 7.09 13

FINANCIAL POSITION

Total assets $ 792,925 $ 671,352 18%

Stockholders’ equity 361,732 319,378 13

Average shares outstanding – diluted 45,035 45,056 —

OTHER INFORMATION

Property and equipment (net) $ 200,901 $ 171,744 17%

Capital expenditures 88,836 59,209 50

Depreciation and amortization 59,339 52,657 13

Borrowings under credit agreement 18,000 18,008 —

Return on average shareholder equity from continuing operations 40% 40%

Average dividend yield 1.6% 1.8%

Total return to shareholders 57% 54%

Number of employees – average 3,616 3,380 7

NOTE: All periods presented reflect the classification of the marine products division’s financial results, including the loss from discontinued operations and the loss on

disposal of the division, as discontinued operations.

Table of Contents

IFC Polaris Products

at a Glance

1Letter from the CEO

5Letter from the Chairman

6Operations Review

22 11-Year Selected

Financial Data

24 Directors, Officers

and Managers

25 Form 10-K

IBC Other Investor Information

$1.89

01

$1.70

00

$1.53

99

$1.42

98

$1.27

97

$1.17

96

$3.04

95 02 04

$2.07

$2.66

03

$2.36

$1,327

01

$1,245

00

$1,106

99

$948

98

$985

97

$909

96

$1,773

95 02 04

$1,427

$1,552

03

$1,468

Sales from Continuing Operations

(dollars in millions) Net Income from Continuing Operations Per Share*

(dollars)

* In 1998, Polaris entered into a settlement agreement related to a trade secret infringement claim brought by Injection Research Specialists, Inc. The one-time provision

for litigation loss of $61.4 million, or $0.77 per diluted share, has been excluded from the 1998 financial data presented.