Panasonic 2014 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2014 Panasonic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

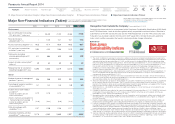

FY2014 FY2015 FY2016

Improve profitability towards 5% operating profit ratio

in each business division

Eliminate unprofitable businesses

Restructuring

Complete

in

2

years

FCF

≥

600.0 billion yen (cumulative total in FY14-16)

Mid-Term Management Plan Roadmap

Business transfers associated with reorganization of the Appliances Company

Operating

profit

Net income*

Operating profit

≥

350.0 bil. yen

Operating profit

ratio

≥

5%

Resumption of

dividend payment

Cold chain/air-conditioner

equipment sales companies (Japan)

Eco Solutions

AVC Networks Appliances

Other/Corporate

Consumer electronics businesses

(TVs, BD Recorders, etc.)

SANYO TV business

Air-conditioner sales divisions (Europe & US)

Changes in Segments 50.0 bil. yen

250.0 bil. yen

Since its establishment, the Panasonic

Group has managed its business under

the concept that returning prots to

shareholders is one of the most important

policies. Under this basic concept, the

Panasonic Group continues to distribute

prots to shareholders from the

perspective of the return on the capital

investment made by them. The basis for

Resumption of Dividend Payments

On April 1, 2014, Panasonic changed its

segment breakdown. Business transfers

associated with the reorganization of the

Appliances Company and other factors

have been reected as appropriate.

Please refer to pages 35–36 “Overview

of Business Divisions” for details.

Changes in Segments

The rst year of the “Cross-Value Innovation

2015” (CV2015) mid-term management

plan, scal 2014 had as its nancial targets

operating prot of more than 250.0 billion

yen, net income attributable to Panasonic

Corporation of more than 50.0 billion yen,

and the resumption of dividend payments.

We achieved all these targets.

Of the four major measures, we had the

denite prospect arise in the rst scal year

of achieving the following: (1) eliminating

unprotable businesses, (2) improving

the Company’s nancial position, and

(3) expanding business and improving

efciency by shifting from an in-house

approach.

Fiscal 2014 Achievements and

Current Issues

We outlined major decisions and

directions on ve major challenging

businesses, including TV set/panels,

assessing their future, shifting into new

business areas, reducing assets, and

reorganizing facilities. We also worked on

the air conditioner and DSC businesses,

Progress of Four Major Measures

1. Eliminate Unprofitable Businesses

Progress with

Mid-Term

Management Plan

Cross-Value Innovation 2015

the distribution of prots is, in principle,

the consolidated business performance

of the Panasonic Group, which aims for

stable and continuous growth in dividends

as well as a dividend payout ratio of

between 30% and 40% with respect to

consolidated net income attributable to

Panasonic Corporation.

Due to the steady improvement in its

business results and nancial position in

scal 2014, the Company resumed dividend

payments with an annual cash dividend

of 13 yen per share, comprising an interim

dividend of 5 yen and a year-end dividend

of 8 yen.

Pre-tax income improved signicantly to

206.2 billion yen from a loss of 398.4

billion yen, and net income attributable to

Panasonic Corporation improved to 120.4

billion yen from a loss of 754.3 billion yen,

respectively. Return on equity (ROE) was

thus a positive 8.6%, compared with a

negative 47.2% in the previous scal year.

Free cash ow amounted to 594.1 billion

yen, an increase of 238.9 billion yen from

a year ago and greatly exceeding the “more

than 200.0 billion yen” target announced

at the start of scal 2014, due primarily to

Group-wide efforts to generate cash.

* Net income attributable to Panasonic Corporation

▶▶

To Our Stakeholders ▶

President’s Message Performance in FY2014 / Progress with Mid-Term Management Plan / FY2015 Initiatives

About Panasonic Top Message Message

from the CFO Business Overview Corporate

Governance

Management

Topics

Panasonic Annual Report 2014 Search Contents Return NextPAGE

10

Highlights

Financial and

Corporate Information