Olympus 2005 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2005 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

O LYMPUS 20 05 5

A MESSAGE

FRO M THE PRESIDEN T

In fiscal 2005, ended M arch 31, 2005, Olympus

recorded a net loss, its first since the introduction of

consolidated financial accounting. From the start of

the in-house company structure in 2001 until the split-

off of the Imaging Systems Business and the M edical

Systems Business in 2004, Olympus has followed a

smooth growth curve while implementing various

reforms. As a result, I believe O lympus has gained

market recognition as a winning company. For this

reason, I deeply regret having to report to our share-

holders and other stakeholders that O lympus posted a

net loss in fiscal 2005. In this annual report, we will

discuss the digital camera business and the issues

relating to its decline in profits, and how we plan to

rebuild our earnings foundation.

> O verview of Fiscal

2005

Thousands of

Millions of yen U.S. dollars

2005 2004 200 3 2005

Net sales .......................................................................... ¥813,538 ¥633,622 ¥564,343 $ 7 ,3 9 5 ,800

Net income (loss)................................................................ (11,827) 33,564 24,348 (107,518)

Earnings per share—Basic net income (loss) ............................ (44.98) 126.96 91.88 (0.409)

Total assets ....................................................................... 858,083 682,673 605,768 7,800,755

Shareholders’ equity ........................................................... 240,837 252,179 222,432 2,189,428

N otes: 1. Earnings per share is shown in yen and U.S. dollars.

2. The U.S. dollar amounts have been translated from yen, for the convenience of the reader, at the rate of ¥ 110=US$ 1.0 0

3. The above figures are based on accounting principles generally accepted in Japan.

4. Diluted net income per share is not presented due to the fact that there were no potentially dilutive common shares.

During fiscal 2005, consolidated net sales totaled ¥ 813.5 billion,

an increase of 28.4% compared with the previous fiscal year.

However, ¥170.4 billion of these sales are attributable to consoli-

dated sales at ITX Corporation, which became a consolidated sub-

sidiary in the second half of the fiscal year under review. Excluding

this factor, consolidated net sales would have increased 1.5%,

marking our 11th co nsecutive fiscal year of growth in net sales.

Nevertheless, O lympus recorded a net loss o f ¥11.8 billion in fis-

cal 2005, compared with net income of ¥33.6 billion in the previ-

ous fiscal year, owing to extraordinary losses on restructuring in

the Imaging Systems Business and the partial reversal of deferred

tax assets. Despite these consolidated results, O lympus has decid-

ed to maintain annual cash dividends o f ¥15 per share, the same

as in the previous fiscal year, in consideration of various factors

such as the future operating environment.

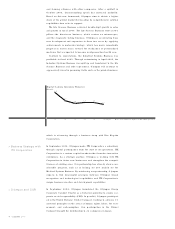

Poor performance in the digital camera business was the lone

cause of earnings deterioratio n in fiscal 2005. In four of our busi-

nesses, with the exception o f the Imaging Systems Business, we

achieved growth in both sales and profits in the Medical Systems

Business, Life Science Business, and Industrial Systems Business.

Despite concerns to the contrary, the Industrial Systems Business

was profitable and contributed to overall earnings. In the Medical