Oki 2002 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2002 Oki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Oki Electric Industry Co., Ltd. Annual Report 20024

The changes in the industry provide

a great opportunity for Oki. Japan’s

telecommunications market is cur-

rently making the dramatic transition from

voice networks to broadband IP networks.

Although ADSL services were not launched

until late 2001, 10 million users are expected

by the end of 2002. There are also plans for

full-scale introduction of fiber-to-the-home

(FTTH) and IP telephony services.

Oki entered this market fairly early. In fiscal

1998, we used our VoIP and CTI technology

and our alliance with Cisco Systems, Inc., to

enter the market for VoIP systems. We were

able to do this before other domestic manu-

facturers of telecommunications devices and

are currently the top domestic vendor in the

VoIP and CTI market.

Despite these advantages, though, profit-

ability in this segment has been hurt by up-

front investments in IP networks and lower

revenues for existing systems. To combat

these problems, we decided to shift network

engineers from existing systems to broadband

IP networks. If we increase our focus here, we should be able to gain a greater share

of the market and achieve high growth, although competition will also be harsh. The

only way we can keep our leading position is by using our know-how effectively.

Cutting costs by manufacturing hardware and software overseas will also help.

Broadband based on

Internet protocol (IP)

technology is becoming

more popular in the tele-

communications industry.

What are Oki’s strengths

in this area and what are

its future strategies?

QA

Alliances are increasingly

being formed among com-

panies in the global semi-

conductor market. Most

semiconductor manu-

facturers in Japan are

switching from DRAM and

focusing their resources

on system LSI. What are

Oki’s plans?

QWhen I became president of Oki in fiscal

1999, the semiconductor business was

recording significant losses. To turn this

situation around, our Phoenix 21 plan called for with-

drawal from advanced DRAM and concentration of

resources in logic and system LSI. DRAM comprises

less than 20% of our semiconductor business now,

compared with 50% in fiscal 1999, and logic and

system LSI accounts for 60%, up from 30%.

The best strategy is to continue focusing on busi-

ness areas that capitalize on our expertise. For Oki,

that means specializing in system LSI utilizing

A

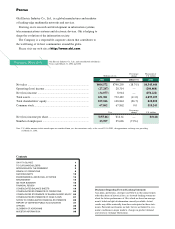

57%

20%

15%

8%

Breakdown of Sales in the

Electronic Devices Segment

Logic and system LSI

Year ended March 31, 2002

System memory

DRAM

Optical components

0

20

40

60

80

(%)

2000 2001 2002

Broadband IP networks

Existing systems

Breakdown of Sales in the

Telecommunications Systems Segment

Years ended March 31

Oki Electric Industry Co., Ltd. Annual Report 20024