North Face 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 29

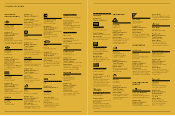

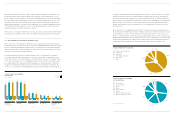

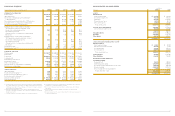

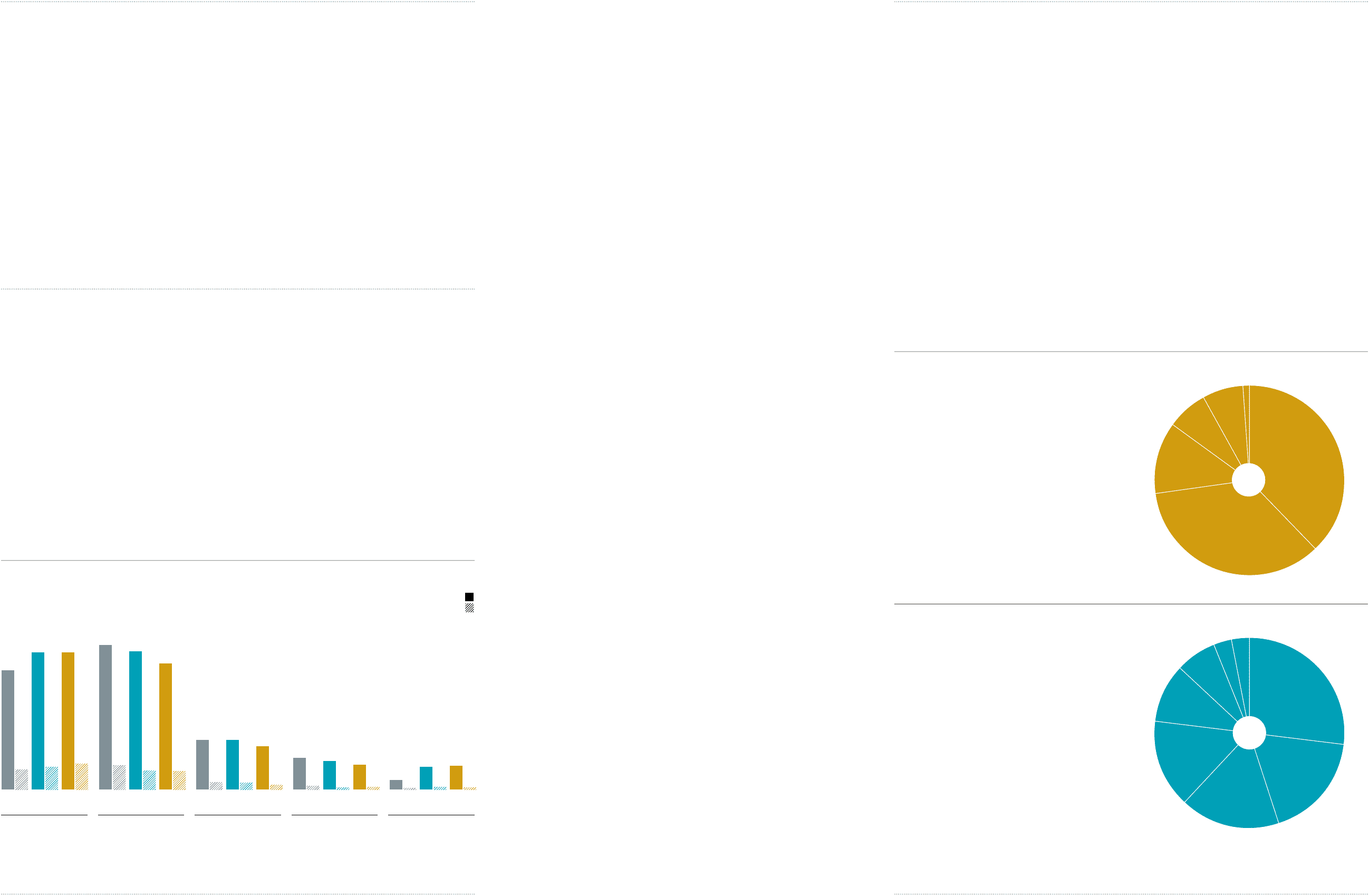

090807 090807 090807 090807 090807*

RE VE NUE

PR OF IT

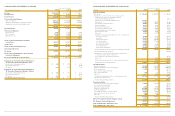

2,387

2,742

2,752

2,897

2,765

2,522

370

988

142

132

87

631

571

42

498

52

195

24

451

52

472

37

67

991

865

379

479

393

454

508

TOTA L R E V E N U E S B Y C H A N N E L

OF DISTRIBUTION

27% International

18% Specialty Stores

17% Retail*

15% Mass

10% Royalties/Other

7% Chains

3% Upscale Department Stores

3% Mainline Department Stores

* Includes international retail

* Brands acquired in mid-2007

TOTA L R E V E N U E S B Y C O A L I T I O N

38% Outdoor & Action Sports

35% Jeanswear

12% Imagewear

7% Contemporary Brands

7% Sportswear

1% Other

3-YEAR COALITION REVENUES

AND PROFITS

(Dollars in Millions)

Revenues in 2009 were down 6%, with foreign currency translation accounting for two

percentage points of the decline. Despite lower revenues, gross margins rose to record

levels, underscoring the strength of our brands. Earnings per share were $5.16 excluding a

$1.03 per share noncash impairment charge for goodwill and intangible assets. Our earn-

ings in both 2009 and 2008 included unusual items. In 2009, earnings were impacted by

higher pension expenses, foreign currency translation effects, and the impairment charge.

2008 earnings included expenses to reduce costs. Excluding these items in both years,

earnings per share would have risen by 2% in 2009.

We’re proud of our long dividend history, but I’m particularly proud that despite the challeng-

ing environment, 2009 marked the 37th year of higher dividend payments to shareholders.

2009: THE STRENGTH TO CHANGE IN CHANGING TIMES

We took decisive action in 2009 to ensure that our company remained strong and well

positioned for future growth. We reduced costs by more than $100 million and cut inventories

by 17%, all while maintaining the highest levels of customer service. We further strength-

ened our balance sheet, nearly doubling our cash position by year-end. We reported record

cash flow from operations of nearly $1 billion.

Focused investments drove solid results in many areas of our business. For example,

we continued the global momentum in our Outdoor & Action Sports businesses, with

revenue growth in our two largest brands — The North Face® was up 6%, and Vans® grew

by 5%. We gained share in our core Wrangler® and Lee® brands in the United States with

successful new product innovations and compelling in-store presentations. Conditions

in upper-tier department and specialty stores have been very difficult, but international

revenues of our premium 7 For All Mankind® brand increased in 2009. Our growth in Asia

continued, with 2009 revenues increasing by 28%. Finally, we grew our direct-to-consumer

business, with a 6% increase in revenues and the opening of 90 new stores. Acquisitions

are always an important component of our long-term growth plans. In 2009 we completed

the acquisition of the Splendid® and Ella Moss® brands, further expanding our Contemporary

Brands coalition. We continue to seek acquisitions of high growth, high-margin lifestyle

brands, particularly activity-based brands that could complement our Outdoor & Action

Sports portfolio.

We’re proud of our accomplishments in 2009, but we also had our share of challenges. Our

European jeans business had a much more difficult year than we had envisioned, particularly

in Eastern Europe, where we had experienced significant growth in recent years. Our

Image (or uniform) business was hurt disproportionately during the economic downturn by

higher than anticipated levels of unemployment in key sectors. And while we are encouraged

by improving profitability in our Sportswear coalition, where operating margins returned to

double-digit levels, the Sportswear revenue trend is still not where we want it to be.

Outdoor &

Action Sports

Jeanswear Imagewear Sportswear Contemporary

Brands

38%

35%

27%

18%

17%

15%

10%

7%

3% 3%

12%

7%

7% 1%