Napa Auto Parts 2014 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2014 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

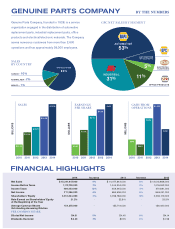

Segment Data. In the years ended December 31, 2014 and 2013, sales from the Company’s Industrial Parts

Group approximated 31% of the Company’s net sales, as compared to 34% in 2012. For additional segment

information, see Note 10 of Notes to Consolidated Financial Statements beginning on page F-1.

Competition. The industrial parts distribution business is highly competitive. The Industrial Parts Group

competes with other distributors specializing in the distribution of such items, general line distributors and others

who provide similar services. To a lesser extent, the Industrial Parts Group competes with manufacturers that sell

directly to the customer. The Industrial Parts Group competes primarily on the breadth of product offerings, service

and price. Further information regarding competition in the industry is set forth in “Item 1A. Risk Factors — We

Face Substantial Competition in the Industries in Which We Do Business.”

OFFICE PRODUCTS GROUP

The Office Products Group, operated through S. P. Richards Company (“S. P. Richards”), a wholly-owned

subsidiary of the Company, is headquartered in Atlanta, Georgia. S. P. Richards is engaged in the wholesale dis-

tribution of a broad line of office and other business related products through a diverse customer base of

resellers. These products are used in homes, businesses, schools, offices, and other institutions. Office products

fall into the general categories of office furniture, technology products, general office and school supplies, clean-

ing, janitorial, and breakroom supplies, safety and security items, healthcare products and disposable food service

products.

The Office Products Group is represented in Canada through S. P. Richards Canada, a wholly-owned sub-

sidiary of the Company headquartered near Toronto, Ontario. S. P. Richards Canada services office product

resellers throughout Canada from locations in Vancouver, Toronto, Calgary, Edmonton and Winnipeg.

Effective February 1, 2014, S. P. Richards acquired the assets of Garland C. Norris Company, Inc. (“GCN”),

headquartered in Apex, North Carolina. GCN is a regional wholesale distributor of food service disposables and

janitorial and cleaning supplies, with annual revenues of approximately $35 million.

Effective July 1, 2014, S. P. Richards acquired Impact Products, LLC (“Impact”), headquartered in Toledo,

Ohio. Impact is a leading value-added provider of facility, janitorial and safety supplies, with annual revenues of

approximately $85 million. Its broad customer base is served from distribution centers in Toledo and Walnut,

California.

Effective January 2, 2015, S. P. Richards acquired JAL Associates Inc (“JAL”). JAL is a regional whole-

saler of office furniture with locations in Landover, Maryland and Philadelphia, Pennsylvania, and expected

annual revenues of approximately $12 million.

Distribution System. The Office Products Group distributes more than 61,000 items to over 5,200 resellers

and distributors throughout the United States and Canada from a network of 44 distribution centers. This group’s

network of strategically located distribution centers provides overnight delivery of the Company’s compre-

hensive product offering. In September of 2014, the Company relocated its Sacramento, California distribution

center to a larger, state of the art facility. Approximately 41% of the Company’s 2014 total office products pur-

chases were made from 10 major suppliers.

The Office Products Group sells to a wide variety of resellers. These resellers include independently owned

office product dealers, national office product superstores and mass merchants, large contract stationers, mail

order companies, Internet resellers, college bookstores, military base stores, office furniture dealers, value-added

technology resellers, business machine dealers, janitorial and sanitation supply distributors, safety product

resellers and food service distributors. Resellers are offered comprehensive marketing programs, which include

print and electronic catalogs and flyers, digital content and email campaigns for reseller websites, and education

and training resources. In addition, world class market analytics programs are made available to qualified

resellers.

Products. The Office Products Group distributes technology products and consumer electronics including

storage media, printer supplies, iPad, iPhone and computer accessories, calculators, shredders, laminators, cop-

iers, printers, fitness bracelets and digital cameras; office furniture including desks, credenzas, chairs, chair mats,

7