Napa Auto Parts 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

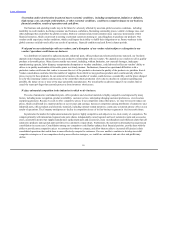

SELECTED FINANCIAL DATA.

The following table sets forth certain selected historical financial and operating data of the Company as of the dates and for the

periods indicated. The following selected financial data are qualified by reference to, and should be read in conjunction with, the

consolidated financial statements, related notes and other financial information set forth beginning on page F-1, as well as in “Item 7.

Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this report.

Net sales $10,057,512 $11,015,263 $10,843,195 $10,457,942

Cost of goods sold 7,047,750 7,742,773 7,625,972 7,353,447

Operating and non-operating expenses, net 2,365,597 2,504,022 2,400,478 2,333,579

Income before taxes 644,165 768,468 816,745 770,916

Income taxes 244,590 293,051 310,406 295,511

Net income $ 399,575 $ 475,417 $ 506,339 $ 475,405

Weighted average common shares

outstanding during year — assuming

dilution 159,707 162,986 170,135 172,486

Per common share:

Diluted net income $ 2.50 $ 2.92 $ 2.98 $ 2.76

Dividends declared 1.60 1.56 1.46 1.35

December 31 closing stock price 37.96 37.86 46.30 47.43

Long-term debt, less current maturities 500,000 500,000 250,000 500,000

Total equity 2,629,372 2,393,378 2,782,946 2,610,707

Total assets $ 5,004,689 $ 4,786,350 $4,774,069 $ 4,496,984

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS.

Genuine Parts Company is a service organization engaged in the distribution of automotive replacement parts, industrial replacement

parts, office products and electrical/electronic materials. The Company has a long tradition of growth dating back to 1928, the year we

were founded in Atlanta, Georgia. In 2010, the Company conducted business throughout the United States, Canada, Mexico and Puerto

Rico from approximately 2,000 locations.

We recorded consolidated net sales of $11.2 billion for the year ended December 31, 2010, an increase of 11% compared to

$10.1 billion in 2009. Consolidated net income for the year ended December 31, 2010 was $476 million, up 19% from $400 million in

2009. The improving market conditions in the industries that we serve combined with our internal growth initiatives drove the

Company’s strong performance in 2010.

The 11% sales growth in 2010 follows a 9% decrease in revenues in 2009 and a 2% increase in revenues in 2008. Our 19% increase

in net income follows a 16% and 6% decrease in net income in 2009 and 2008, respectively. Throughout this three year period, the

Company has implemented a variety of initiatives in each of our four business segments to grow sales and earnings, including the

introduction of new and expanded product lines, geographic expansion (including acquisitions), sales to new markets, enhanced customer

marketing programs and a variety of gross margin and cost savings initiatives. The effects of the economic slowdown, which we began to

experience in the final quarter of 2008, adversely impacted the benefit of these initiatives through 2009. In 2010, however, the recovering

economy served to further support the benefits of our internal growth initiatives.

With regard to the December 31, 2010 consolidated balance sheet, the Company’s cash balance of $530 million was up

$193 million or 57% from $337 million at December 31, 2009. This increase marks the second consecutive year the Company has

significantly improved its cash position and relates to the increase in net income in 2010 and an improved working capital position for

both years. Accounts receivable increased by approximately 15%,

16