Microsoft 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS (CONTINUED)

PAGE 28

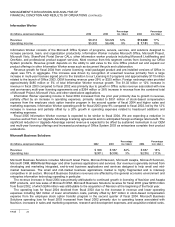

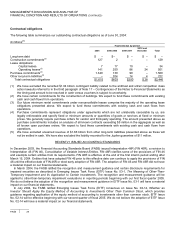

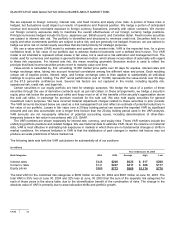

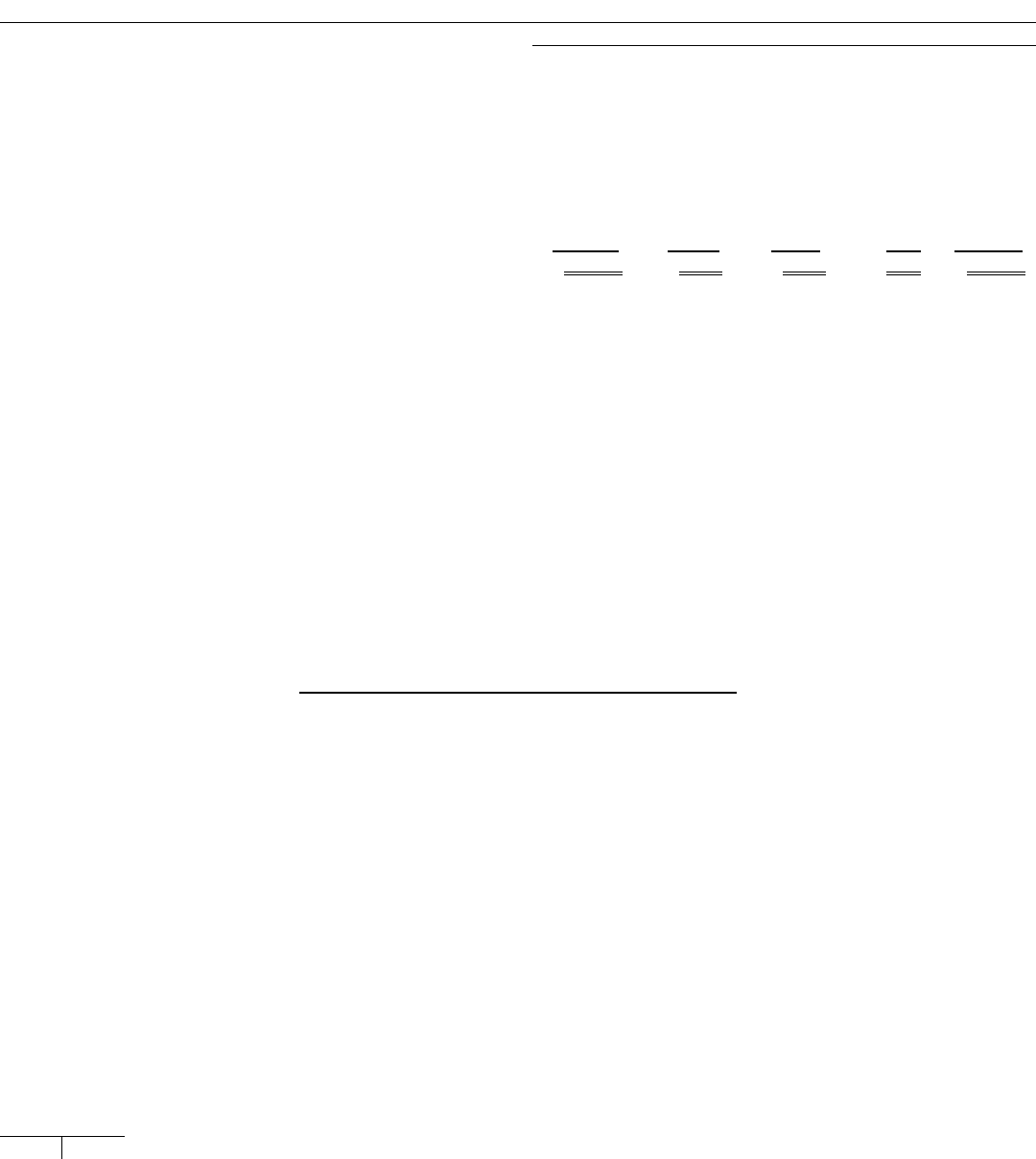

Contractual obligations

The following table summarizes our outstanding contractual obligations as of June 30, 2004:

(In millions)

(1)

Payments due by period

2005 2006-2008 2009-2011

2012 and

thereafter Total

Long-term debt $ – $ – $ – $ – $ –

Construction commitments

(2)

127 2 – – 129

Lease obligations:

Capital leases 7 17 10 – 34

Operating leases

(3)

141 250 86 24 501

Purchase commitments

(4)

1,340 130 90 – 1,560

Other long-term liabilities

(5)

– 204 14 4 222

Total contractual obligations $1,615 $603 $200 $ 28 $2,446

(1) We have excluded the recorded $1.04 billion contingent liability related to the antitrust and unfair competition class

action lawsuits referred to in the third paragraph of Note 17 – Contingencies of the Notes to Financial Statements as

the timing and amount to be resolved in cash versus vouchers is subject to uncertainty.

(2) We have certain commitments for the construction of buildings. We expect to fund these commitments with existing

cash and cash flows from operations.

(3) Our future minimum rental commitments under noncancellable leases comprise the majority of the operating lease

obligations presented above. We expect to fund these commitments with existing cash and cash flows from

operations.

(4) Purchase commitments represent obligations under agreements which are not unilaterally cancelable by us, are

legally enforceable and specify fixed or minimum amounts or quantities of goods or services at fixed or minimum

prices. We generally require purchase orders for vendor and third-party spending. The amount presented above as

purchase commitments includes an analysis of all known contracts exceeding $5 million in the aggregate as well as

all known open purchase orders. We expect to fund these commitments with existing cash and cash flows from

operations.

(5) We have excluded unearned revenue of $1.66 billion from other long-term liabilities presented above as these will

not be settled in cash. We have also excluded the liability recorded for the Jupiter guarantee of $11 million.

RECENTLY ISSUED ACCOUNTING STANDARDS

In December 2003, the Financial Accounting Standards Board (FASB) issued Interpretation 46R (FIN 46R), a revision to

Interpretation 46 (FIN 46), Consolidation of Variable Interest Entities. FIN 46R clarifies some of the provisions of FIN 46

and exempts certain entities from its requirements. FIN 46R is effective at the end of the first interim period ending after

March 15, 2004. Entities that have adopted FIN 46 prior to this effective date can continue to apply the provisions of FIN

46 until the effective date of FIN 46R or elect early adoption of FIN 46R. The adoption of FIN 46 and FIN 46R did not have

a material impact on our financial statements.

In March 2004, the FASB ratified the recognition and measurement guidance and certain disclosure requirements for

impaired securities as described in Emerging Issues Task Force (EITF) Issue No. 03-1, The Meaning of Other-Than-

Temporary Impairment and Its Application to Certain Investments. The recognition and measurement guidance will be

applied to other-than-temporary impairment evaluations in reporting periods beginning with our first fiscal quarter 2005.

We do not believe the adoption of the recognition and measurement guidance in EITF Issue No. 03-1 will have a material

impact on our financial statements.

In July 2004, the FASB ratified Emerging Issues Task Force (EITF) consensus on Issue No. 02-14, Whether an

Investor Should Apply the Equity Method of Accounting to Investments Other Than Common Stock, which provides

guidance regarding application of the equity method of accounting to investments other than common stock. EITF Issue

No. 02-14 will be effective beginning with our second quarter of fiscal 2005. We do not believe the adoption of EITF Issue

No. 02-14 will have a material impact on our financial statements.