Medtronic 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 Annual Report

Innovating for life.

Medtronic 2010 Annual Report Innovating for life.

Table of contents

-

Page 1

Innovating for life. 2010 Annual Report Medtronic 2010 Annual Report Innovating for life. -

Page 2

... the treatment of chronic disease and changing the lives of more than 7 million patients worldwide each year. Medtronic is headquartered in Minneapolis, Minnesota; we serve patients and physicians in 120 countries through 40,000 employees; and we are publicly traded on the New York Stock Exchange... -

Page 3

Therapies that address many of the world's most pressing chronic diseases 18 17 27 25 28 31 26 29 32 34 24 21 23 19 22 15 10 20 7 6 4 1 5 2 3 13 11 8 37 39 14 33 17 12 30 35 38 36 9 16 -

Page 4

... Asymptomatic, Irregular Heart Rates b Parkinson's Disease and Essential Tremor†Dystonia†** Hydrocephalus†Obsessive-Compulsive Disorder** Treatment-Resistant Depression* Severe Spasticity associated with Multiple Sclerosis, Cerebral Palsy, Stroke, and Spinal Cord and Brain Injuries Epilepsy... -

Page 5

..., net, IPR&D and certain acquisition-related costs, non-cash charge to interest expense due to the change in accounting rules governing convertible debt, and certain tax adjustments Dividends per share Return on equity Research and development expense Closing stock price 2006 $11,292 2,519 2007... -

Page 6

..., net, IPR&D and certain acquisition-related costs, non-cash charge to interest expense due to the change in accounting rules governing convertible debt, and certain tax adjustments, adjusted fiscal year 2010 net earnings of $3.577(3) billion and diluted earnings per share of $3.22(3) increased over... -

Page 7

... our consulting payments to doctors transparent. Early in fiscal year 2010, we announced plans to voluntarily disclose all consulting payments to our physician partners on Medtronic's website. I'm pleased to report that as of May 31, 2010, the Physician Collaboration Section of our website went live... -

Page 8

..., our products, and our giving to improve the way people with chronic disease are cared for around the world-no matter where they live or what their economic status. Through the Medtronic Foundation, we invested nearly $30 million worldwide in fiscal year 2010 to educate healthcare professionals... -

Page 9

... time, there were external diagnostic tools being used, like 24-hour Holter monitors, but they can't be worn long enough to capture infrequent syncope. I had the idea to modify a pacemaker, adding self-contained electrodes, and implant it just below the skin. It would be with the patients for a year... -

Page 10

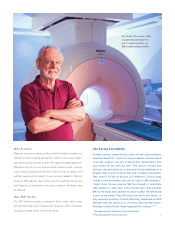

... Rhythm Disease Management business. "According to physicians, MRI safety and accessibility for the millions of people who have pacemakers and other implantable devices is a serious unmet medical need." Not for long. Medtronic introduced the world's first pacing system for use in MRI systems. The... -

Page 11

...with his wife. "The doctors noticed that my heart rate was quite low, so they took me by ambulance to a hospital. After a series of tests, they said I needed a pacemaker. They asked if I'd like to be part of a Medtronic clinical study testing a new pacemaker that can be used in MRI machines.* I didn... -

Page 12

Collaborathng to Develop New DBS Theraphes Medtronic was recently recognized by MIT Technology Review as one of the 50 most innovative companies for our continuing leadership in developing deep brain stimulation (DBS) therapy. The honor should extend to the many physicians who have collaborated with... -

Page 13

...the target area for delivering DBS therapy to treat obsessivemompulsive disorder (OCD). The targets for treating Parkinson's disease, essential tremor, and dystonia are all within mentimeters of the OCD target. team that worked with the pair to fully develop DBS for movement disorders. "However, it... -

Page 14

... a lead wire for a deep brain stimulator in exactly the right spot of the brain to suppress essential tremor. Or avoiding critical anatomy in the spinal cord while removing a tumor. Surgeons can perform these precise tasks with greater accuracy using Medtronic surgical imaging, navigation, and... -

Page 15

... I started using Medtronic surgical navigation tools during spinal fusion surgery, I would close up the patient and then do a CT scan after surgery to see if the screws were placed in the right location," said Dr. Lawrence Lenke, Professor of Orthopaedic Surgery at Washington University School of... -

Page 16

...targeted drug delivery in the brain has so much potential. "In the case of Alzheimer's and other neurodegenerative diseases, deterioration is generally localized within the brain," said Lisa Shafer, Ph.D., Principal Scientist and Research Manager in our Neuromodulation business. "Developing targeted... -

Page 17

... Sciences-Shafer noted that the work is very preliminary. "While we are excited about the results of our preclinical studies, we still have years of research and testing to determine if we are able to develop a therapy that can help treat Alzheimer's disease and other chronic neurological conditions... -

Page 18

... trauma. The greatest benefit to each company is access to new physician and patient populations, because the combined company offers a broader range of products across all economic tiers. These combined product offerings could be used in more than 120,000 surgical cases a year at 750 valuesegment... -

Page 19

...effectively use them. "Professional education is a key component of the joint venture. While physicians at China's academic centers are already well trained on sophisticated spinal products, most rural doctors aren't," Cannon said. For patients, the benefit is access to life-changing therapies that... -

Page 20

... high-quality, coordinated care and ensure appropriate access to devicebased therapies. We're also using economic data to create cost-effectiveness models that reflect local environments. For example, we developed a cost-effectiveness model evaluating spinal cord stimulation (SCS) for the treatment... -

Page 21

... Registered Public Accounting Firm Consolidated Statements of Earnings Consolidated Balance Sheets Consolidated Statements of Shareholders' Equity Consolidated Statements of Cash Flows Notes to Consolidated Financial Statements Selected Financial Data Investor Information Corporate Leadership 18... -

Page 22

... analysis. Net Sales Fiscal Year 2010 $ 5,268 3,500 2,864 1,560 1,237 963 425 $15,817 2009 $ 5,014 3,400 2,437 1,434 1,114 857 343 $14,599 % Change 5% 3 18 9 11 12 24 8% Cardiac Rhythm Disease Management Spinal CardioVascular Neuromodulation Diabetes Surgical Technologies Physio-Control Total Net... -

Page 23

...proceedings, IPR&D, warranty obligations, product liability, self-insurance, pension and post-retirement obligations, sales returns and discounts, stockbased compensation, valuation of equity and debt securities and income tax reserves are updated as appropriate, which in most cases is quarterly. We... -

Page 24

...acquisition-related costs recognized in our operating results, the tax cost or benefit attributable to that item is separately calculated and recorded. Because the effective rate can be significantly impacted by these discrete items that take place in the period, we often refer to our tax rate using... -

Page 25

... 1,292 747 398 2,437 1,434 1,114 857 343 $ 14,599 Defibrillation Systems Pacing Systems Other CARDIAC RHYTHM DISEASE MANAGEMENT Core Spinal Biologics SPINAL Coronary Structural Heart Endovascular CARDIOVASCULAR NEUROMODULATION DIABETES SURGICAL TECHNOLOGIES PHYSIO-CONTROL TOTAL Medtronic, Inc. 21 -

Page 26

...field action that was announced early in fiscal year 2010, as well as continued pricing pressures. The Adapta family of pacemakers incorporates several automatic features to help physicians improve pacing therapy and streamline the patient follow-up process, potentially minimizing the amount of time... -

Page 27

... to address and mitigate interactions between the pacing system and the magnetic resonance environment. • Continued U.S. acceptance of the Reveal XT Insertable Cardiac Monitor (ICM), which offers comprehensive remote monitoring capabilities via the Medtronic CareLink Service and allows physicians... -

Page 28

...' system of ablation catheters and RF generators is dependent on the resolution of our Mounds View FDA warning letter. Spinal Spinal products include thoracolumbar, cervical, neuro monitoring, surgical access, bone graft substitutes and biologic products. Spinal net sales for fiscal year 2010 were... -

Page 29

...consist of coronary and peripheral stents and related delivery systems, endovascular stent graft systems, heart valve replacement technologies, tissue ablation systems and open heart and coronary bypass grafting surgical products. CardioVascular net sales for fiscal year 2010 were $2.864 billion, an... -

Page 30

... patients whose aortas are highly angulated. The Endurant Abdominal Stent Graft System also enables treatment of patients with small or tortuous iliac arteries due to lower crossing profile of the delivery system. Structural Heart net sales for fiscal year 2010 were $880 million, an increase of 18... -

Page 31

...of implantable neurostimulation therapies and drug delivery devices for the treatment of chronic pain, movement disorders, obsessivecompulsive disorder (OCD), overactive bladder and urinary retention, gastroparesis and benign prostatic hyperplasia. Neuromodulation net sales for fiscal year 2010 were... -

Page 32

... Drug Delivery market as we anticipate future competition. Diabetes Diabetes products consist of external insulin pumps and related consumables (together referred to as Durable Pump Systems) and subcutaneous continuous glucose monitoring (CGM) systems. Diabetes net sales for fiscal year 2010... -

Page 33

... defibrillators, including manual defibrillator/monitors used by hospitals and emergency response personnel and automated external defibrillators (AED) used in commercial and public settings for the treatment of sudden cardiac arrest. Physio-Control fiscal year 2010 net sales were $425 million... -

Page 34

... research and development, we continue to access new technologies in areas served by our existing businesses, as well as in new areas, through acquisitions, licensing agreements, alliances and certain strategic equity investments. Selling, General and Administrative Fiscal year 2010 selling, general... -

Page 35

... on the incremental defined benefit pension and post-retirement related expense, see Note 15 to the consolidated financial statements. In the fourth quarter of fiscal year 2010, we recorded a $12 million reversal of excess restructuring reserves related to the fiscal year 2009 initiative. This... -

Page 36

...' existing agreement in order to expand the scope of the definition of the license field from evYsio. The settlement was paid in the second quarter of fiscal year 2010. The Gore settlement related to the resolution of outstanding patent litigation related to selected patents in Medtronic's Jervis... -

Page 37

...2008, we paid substantially all of the settlement for certain lawsuits relating to the Marquis line of ICDs and CRT-Ds. See Note 17 to the consolidated financial statements for additional information. IPR&D and Certain Acquisition-Related Costs During fiscal year 2010, we recorded $23 million of IPR... -

Page 38

...from royalties on the sales of Endeavor products and $92 million of amortization on intangible assets related to the Kyphon acquisition in the current fiscal year compared to $46 million in the prior fiscal year. Interest Expense, Net Interest expense, net includes interest earned on our investments... -

Page 39

...a $16 million operational tax benefit associated with the retroactive renewal and extension of the research and development credit enacted by the Tax Extenders and Alternative Minimum Tax Relief Act of 2008 which related to Medtronic, Inc. 35 Fiscal Year (dollars in millions) 2010 $870 21.9% 2009... -

Page 40

Management's Dismussion and Analysis of Finanmial Condition and Results of Operations (continued) the first seven months of calendar year 2008. The remaining $28 million of operational tax benefit related to the finalization of certain tax returns, changes to uncertain tax position reserves and the... -

Page 41

...For the fiscal year ended April 30, 2010, we have made significant payments related to certain legal proceedings. For information regarding these payments, please see the "Special Charges, Restructuring Charges, Certain Litigation Charges, Net, IPR&D and Certain Acquisition-Related Costs and Certain... -

Page 42

... fiscal year 2010. Our cash returned to shareholders in the form of dividends and the repurchase of common stock was approximately $335 million higher in fiscal year 2010 as compared to fiscal year 2009. Both dividends and share repurchases were up compared to fiscal year 2009. Our net cash used... -

Page 43

... when these payments will be made, the maturity dates included in this table reflect our best estimates. In accordance with new authoritative accounting guidance on business combinations effective in fiscal year 2010, we are required to record the fair value of contingent acquisition considerations... -

Page 44

..., all of which we remain in compliance with as of April 30, 2010. We used the net proceeds from the sale of the 2010 Senior Notes for working capital and general corporate uses, which may include repayment of our indebtedness that matures in fiscal year 2011. This includes the $2.200 billion... -

Page 45

... of the accounting treatment. During the fourth quarter of fiscal year 2010, certain of the holders requested adjustment to the exercise price of the warrants from $75.30 to $74.71 pursuant to the antidilution provisions of the warrants relating to our payment of dividends to common shareholders. In... -

Page 46

... including the assumption and settlement of existing Ablation Frontiers debt and payment of direct acquisition costs. Ablation Frontiers develops radio frequency ablation solutions for treatment of atrial fibrillation. Ablation Frontiers' system of ablation catheters and radio frequency generator... -

Page 47

...family of products. Also, the acquisition of Kyphon in the third quarter of fiscal year 2008 increased the sales growth for Spinal as the comparative period only included six months of Kyphon net sales. Diabetes growth outside the U.S. was led by the continued acceptance of the MiniMed Paradigm REAL... -

Page 48

...in short-term interest rates compared to interest rates at April 30, 2010 indicates that the fair value of these instruments would correspondingly change by $34 million. We have investments in marketable debt securities that are classified and accounted for as available-for-sale. Our debt securities... -

Page 49

..." in our Form 10-K, as well as those related to competition in the medical device industry, reduction or interruption in our supply, quality problems, liquidity, decreasing prices, adverse regulatory action, litigation success, self-insurance, healthcare policy changes and international operations... -

Page 50

...to express an opinion that such financial statements present fairly, in all material respects, our financial position, results of operations and cash flows in accordance with accounting principles generally accepted in the United States. Management's Annual Report on Internal Control over Financial... -

Page 51

... its defined benefit pension and other postretirement plans. As discussed in Note 14 to the consolidated financial statements, in fiscal 2008 the Company changed the manner in which it accounts for uncertain income taxes. A company's internal control over financial reporting is a process designed to... -

Page 52

... Net sales Costs anf expenses: Cost of products sold Research and development expense Selling, general and administrative expense Special charges Restructuring charges Certain litigation charges, net Purchased in-process research and development (IPR&D) and certain acquisition-related costs Other... -

Page 53

...term investments Other assets Total assets Liabilities anf Shareholfers' Equity Current liabilities: Short-term borrowings Accounts payable Accrued compensation Accrued income taxes Other accrued expenses Total current liabilities Long-term febt Long-term accruef compensation anf retirement benefits... -

Page 54

... Dividends to shareholders Issuance of common stock under stock purchase and award plans Adjustment for change in plan measurement date pursuant to the new authoritative guidance for accounting for defined benefit pension and other post-retirement plans Repurchase of common stock Excess tax benefit... -

Page 55

..., net Net cash usef in investing activities Financing Activities: Change in short-term borrowings, net Payments on long-term debt Issuance of long-term debt Dividends to shareholders Issuance of common stock under stock purchase and award plans Excess tax benefit from exercise of stock-based awards... -

Page 56

...change in fair value for available-for-sale securities is recorded, net of taxes, as a component of accumulated other comprehensive loss on the consolidated balance sheets. Investments in securities that are classified and accounted for as trading securities at April 30, 2010 include exchange-traded... -

Page 57

... value over its fair value. Fair value is generally determined using a discounted future cash flows analysis. IPR&D When the Company acquires another entity, the purchase April 30, 2010 $ 896 269 316 $1,481 April 24, 2009 $ 854 251 321 $1,426 Finished goods Work in process Raw materials Total... -

Page 58

... these therapies. Contingent Consideration During fiscal year 2010, as mentioned above, the Company adopted new authoritative guidance related to business combinations. Under this new guidance, the Company must recognize contingent purchase price consideration at fair value at the acquisition date... -

Page 59

...'s compensation programs include share-based payments. All awards under sharebased payment programs are accounted for at fair value and these fair values are generally amortized on a straight-line basis over the vesting terms into cost of products sold, research and development expense and selling... -

Page 60

.... The tax benefit related to the net change in retirement obligations was $112 million, $109 million and $17 million in fiscal years 2010, 2009 and 2008, respectively. The Company adopted new measurement date authoritative guidance for defined benefit plans in the fourth quarter of fiscal year 2009... -

Page 61

... include stock options and other stock-based awards granted under stock-based compensation plans and shares committed to be purchased under the employee stock purchase plan. In June 2008 the FASB issued new authoritative guidance for determining whether instruments granted in share-based payment... -

Page 62

... 7 for additional information on Levels 1, 2 and 3. at a discount) and an equity component. The resulting debt discount is amortized over the period the convertible debt is expected to be outstanding as additional non-cash interest expense. The new guidance changes the accounting treatment for the... -

Page 63

... of the adoption of new authoritative accounting guidance for convertible debt and the new share-based payment authoritative guidance on certain financial statement line items in the consolidated statements of earnings for fiscal years 2010, 2009 and 2008: Fiscal Year 2010 (in millions, except per... -

Page 64

...' existing agreement in order to expand the scope of the definition of the license field from evYsio. The Company paid the settlement in the second quarter of fiscal year 2010. The Gore settlement related to the resolution of outstanding patent litigation related to selected patents in Medtronic... -

Page 65

...recognized in fiscal year 2009 related to litigation that originated in May 2006 with Fastenetix LLC (Fastenetix), a patent holding company. The litigation related to an alleged breach of a royalty agreement in the Spinal business. The agreement reached with Fastenetix required a total cash payment... -

Page 66

... are accounted for under the pension and post-retirement rules. For further discussion on the incremental defined benefit pension and post-retirement related expenses, see Note 15. In the fourth quarter of fiscal year 2010, the Company recorded a $12 million reversal of excess restructuring reserves... -

Page 67

...the new guidance incorporates a number of changes. These changes include the capitalization of IPR&D, expensing of acquisition related costs and the recognition of contingent purchase price consideration at fair value at the acquisition date. In addition, changes in accounting for deferred tax asset... -

Page 68

... life of five years. Fiscal Year 2009 CoreValve, Inc. In April 2009, the Company acquired privately held CoreValve Inc. (CoreValve). Under the terms of the agreement announced in February 2009, the transaction included an initial up-front payment, including direct acquisition costs, of $700 million... -

Page 69

... million including the assumption and settlement of existing Ablation Frontiers debt and payment of direct acquisition costs. Ablation Frontiers develops radio frequency (RF) ablation solutions for treatment of atrial fibrillation. Ablation Frontiers' system of ablation catheters and RF generator is... -

Page 70

... $4.203 billion, which includes payments to Kyphon shareholders for the cancellation of outstanding shares, the assumption and settlement of existing Kyphon debt and payment of direct acquisition costs. Total debt assumed relates to Kyphon's obligations under existing credit and term loan facilities... -

Page 71

...defined as the estimated selling price less the sum of (a) cost to complete (b) direct costs to sell and (c) a reasonable profit allowance for the selling effort. The $34 million fair value Cash acquisition of Kyphon outstanding common stock Cash settlement of vested stock-based awards Debt assumed... -

Page 72

... is presented for informational purposes only. Fiscal Year (in millions, except per share data) acquisition will provide the Company with exclusive rights to use and develop Setagon's Controllable Elution Systems technology in the treatment of cardiovascular disease. Total consideration for... -

Page 73

... of $3 million as of the beginning of fiscal year 2010. The carrying amounts of cash and cash equivalents approximate fair value due to their short maturities. Available-for-sale securities: Corporate debt securities $2,130 Auction rate securities 194 Mortgage backed securities 724 U.S. government... -

Page 74

... of charges being recognized in earnings. These charges relate to credit losses on certain mortgage backed securities, other corporate securities and auction rate securities. The amount of credit losses represents the difference between the present value of cash flows expected to be collected... -

Page 75

... price and accounted for using the cost or equity method was $542 million and $515 million, respectively. The total carrying value of these investments is reviewed quarterly for changes in circumstance or the occurrence of events that suggest the Company's investment may not be recoverable. The fair... -

Page 76

... and accounted for as trading, available-for-sale and derivative instruments. Derivatives include cash flow hedges, freestanding derivative forward contracts, net investment hedges and interest rate swaps. These items were previously and will continue to be marked-to-market at each reporting period... -

Page 77

... pricing for these investments. At April 30, 2010, these securities were valued primarily using broker pricing models that incorporate transaction details such as contractual terms, maturity, timing and amount of expected future cash flows, as well as assumptions about liquidity and credit valuation... -

Page 78

.... During fiscal year 2010, the Company determined that the fair values of certain cost method investments were below their carrying values and that the carrying values of these investments were not expected to be recoverable within a reasonable period of time. As a result, the Company recognized $40... -

Page 79

..., is as follows: (in millions) Fiscal Year 2011 2012 2013 2014 2015 Thereafter Amortization Expense $ 317 294 277 267 253 1,033 $2,441 9. Financing Arrangements Debt consisted of the following: April 30, 2010 (in millions, except interest rates) April 24, 2009 Payable $ 385 13 123 - - - $ 522... -

Page 80

.... During the fourth quarter of fiscal year 2010, certain of the holders requested adjustment to the exercise price of the warrants from $75.30 to $74.71 pursuant to the anti-dilution provisions of the warrants relating to the Company's payment of dividends to common shareholders. In June 2008, the... -

Page 81

... of which the Company remains in compliance with as of April 30, 2010. The Company used the net proceeds from the sale of the 2010 Senior Notes for working capital and general corporate uses, which may include repayment of its indebtedness that matures in fiscal year 2011. This includes the $2.200... -

Page 82

... and Moody's Investors Service. Facility fees are payable on the credit facilities and are determined in the same manner as the interest rates. The agreements also contain customary covenants, all of which the Company remains in compliance with as of April 30, 2010. As of April 30, 2010, the Company... -

Page 83

... earnings related to derivative instruments not designated as hedging instruments for the fiscal years ended April 30, 2010 and April 24, 2009 were as follows: April 30, 2010 (in millions) 10. Derivatives anf Foreign Exchange Risk Management The Company uses operational and economic hedges, as well... -

Page 84

... or periods during which the hedged transaction affects earnings. No gains or losses relating to ineffectiveness of cash flow hedges were recognized in earnings during fiscal years 2010, 2009 and 2008. No components of the hedge contracts were excluded in the measurement of hedge ineffectiveness and... -

Page 85

... of these interest rate swap agreements have been reported as operating activities in the consolidated statement of cash flows. As of April 30, 2010, the unamortized gain was $41 million. During fiscal years 2009 and 2008, the Company did not have any ineffective fair value hedging instruments. In... -

Page 86

.... Beginning in fiscal year 2010, the Company entered into collateral credit agreements with its primary derivatives counterparties. Under these agreements either party is required to post eligible collateral when the market value of transactions covered by the agreement exceeds specific thresholds... -

Page 87

... price of $38.10 and $45.94, respectively, during fiscal years 2010 and 2009. As of April 30, 2010, the Company has approximately 50.8 million shares remaining under the buyback authorizations approved by the Under the fair value recognition provision of U.S. GAAP for accounting for stock-based... -

Page 88

... closing stock price on the date of grant. The following table provides the weighted average fair value of options granted to employees and the related assumptions used in the Black-Scholes model: Fiscal Year 2010 Weighted average fair value of options granted Assumptions used: Expected life (years... -

Page 89

... the fiscal year ended April 30, 2010 was $98 million. The Company's tax benefit related to the exercise of stock options for fiscal year 2010 was $6 million. Unrecognized compensation expense related to outstanding stock options as of April 30, 2010 was $144 million and is expected to be recognized... -

Page 90

... compensation expense related to restricted stock awards as of April 30, 2010 was $154 million and is expected to be recognized over a weighted average period of 2.5 years and will be adjusted for any future changes in estimated forfeitures. Deferred taxes arise because of the different treatment... -

Page 91

... Federal statutory tax rate as follows: Fiscal Year 2010 U.S. Federal statutory tax rate Increase (decrease) in tax rate resulting from: U.S. state taxes, net of Federal tax benefit Research and development credit Domestic production activities International Impact of special charges, restructuring... -

Page 92

... all, of the proposed adjustments for fiscal years 2005 and 2006. The significant issues that remain unresolved relate to the allocation of income between Medtronic, Inc. and its wholly owned subsidiaries and the timing of the deductibility of a settlement payment. For the proposed adjustments that... -

Page 93

...substantially all U.S. employees and many employees outside the U.S. The cost of these plans was $237 million, $223 million and $222 million in fiscal years 2010, 2009 and 2008, respectively. The Company adopted the new measurement date authoritative guidance for pension benefits effective April 26... -

Page 94

... of year Change in plan assets: Fair value of plan assets at beginning of year Adjustment due to adoption of new measurement date guidance Actual (loss)/return on plan assets Employer contributions Employee contributions Benefits paid Foreign currency exchange rate changes Fair value of plan assets... -

Page 95

...Fiscal Year 2010 $675 420 2009 $432 258 Projected benefit obligation Plan assets at fair value The net periodic benefit costs of the plans include the following components: U.S. Pension Benefits Fiscal Year (in millions) Non-U.S. Pension Benefits Fiscal Year Post-Retirement Benefits Fiscal Year... -

Page 96

...-net periofic benefit cost: Discount rate Expected return on plan assets Rate of compensation increase Initial healthcare cost trend rate pre-65 Initial healthcare cost trend rate post-65 2009 2008 2010 Non-U.S. Pension Benefits Fiscal Year 2009 2008 2010 Post-Retirement Benefits Fiscal Year 2009... -

Page 97

... used for retirement benefit plan assets measured at fair value. Short-term investments, Medtronic, Inc. common stock and fixed income mutual funds: Valued at the quoted market prices of shares held by the plans at year-end in the active market on which the individual securities are traded... -

Page 98

... under the U.S. Employee Retirement Income Security Act of 1974 and the various guidelines which govern the plans outside the U.S., the majority of anticipated fiscal year 2011 contributions will be discretionary. Retiree benefit payments, which reflect expected future service, are anticipated to... -

Page 99

... pension plan, respectively: the Personal Pension Account (PPA) and the Personal Investment Rent expense for all operating leases was $154 million, $150 million and $135 million in fiscal years 2010, 2009 and 2008, respectively. In April 2006, the Company entered into a sale-leaseback agreement... -

Page 100

... buyout option in fiscal year 2010 which resulted in converting the lease to a term loan. The balance of the related term loan at April 30, 2010 was $46 million. trial, the Court granted summary judgment to Medtronic as to two of the three patents. Trial started on March 23, 2010 on Edwards' claims... -

Page 101

..., 2010, approximately 3,600 lawsuits regarding the Fidelis leads have been filed against the Company, including approximately 47 putative class action suits reflecting a total of approximately 8,000 individual personal injury cases. In general, the suits allege claims of product liability, warranty... -

Page 102

... Act and Rule 10b-5 thereunder. The complaint alleges that the defendants made false and misleading public statements concerning the INFUSE Bone Graft product which artificially inflated Medtronic's stock price during the period. On August 21, 2009, plaintiffs filed a consolidated putative class... -

Page 103

...to the Health Insurance Portability & Accountability Act of 1996 (HIPAA) seeking documents related to a study published in the British volume of the Journal of Bone & Joint Surgery, and contracts, research grants, speaking and education programs and payments for certain named physicians. The Company... -

Page 104

... reports the results of these businesses. As a result, for fiscal year 2010 the Company continued to function in seven operating segments, consisting of Cardiac Rhythm Disease Management, Spinal, CardioVascular, Neuromodulation, Diabetes, Surgical Technologies 19. Segment anf Geographic Information... -

Page 105

... assets for fiscal years 2010, 2009 and 2008 were $53 million, $51 million and $63 million, respectively. Cardiac Rhythm Disease Management Spinal CardioVascular Neuromodulation Diabetes Surgical Technologies Physio-Control Total Net Sales Geographic Information Net sales to external customers... -

Page 106

... Per Share of Common Stock: Basic earnings Diluted earnings Cash dividends declared Financial Position at Fiscal Year-enf: Working capital Current ratio Total assets Long-term debt Shareholders' equity Affitional Information: Full-time employees at year-end Full-time equivalent employees at year-end... -

Page 107

...vestor Information Annual Meeting The annual meeting of Medtronic shareholders will take place on Wednesday, August 25, 2010, beginning at 10:30 a.m. (Central Daylight Time) at Medtronic's world headquarters, 710 Medtronic Parkway, Minneapolis (Fridley), Minnesota. Investor Information Shareholders... -

Page 108

...Chairman, MFS Investment Management Director since 2004 Caroline Stockdale Senior Vice President, Chief Talent Officer Jean-Pierre Rosso Chairman, World Economic Forum USA Director since 1998 Catherine M. Szyman Senior Vice President and President, Diabetes Medtronic Corporate Leadership William... -

Page 109

...• To contribute to human welfare by application of biomedical engineering in the research, design, manufacture, and sale of instruments or appliances that alleviate pain, restore health, and extend life. MISSION • Contribuer au bien-être de l'homme en appliquant les principes de l'ingénierie... -

Page 110

... International Headquarters Medtronic International, Ltd. 49 Changi South Avenue 2 Nasaco Tech Centre Singapore 486056 Singapore Tel: 65.6436.5000 Fax: 65.6776.6335 The Medtronic 2010 Annual Report is printed on paper made with fiber sourced from well-managed forests, other controlled wood sources...