Medtronic 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

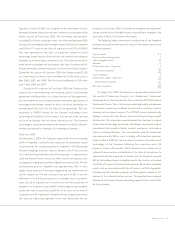

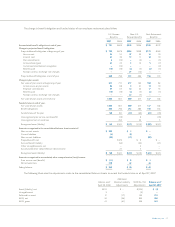

:hi^bViZYV\\gZ\ViZVbdgi^oVi^dcZmeZchZWVhZYdci]ZXjggZciXVggn^c\kVajZd[Vbdgi^oVWaZ^ciVc\^WaZVhhZih^hVh[daadlh/

Fiscal Year

Amortization

Expense

2008 $ 172

2009 164

2010 158

2011 145

2012 120

Thereafter 674

$ 1,433

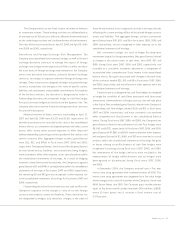

,#;^cVcX^c\6ggVc\ZbZcih

9ZWiXdch^hiZYd[i]Z[daadl^c\/

April 27, 2007 April 28, 2006

Maturity by

Fiscal Year

Payable

Average

Interest Rate Payable

Average

Interest Rate

Short-Term Borrowings:

Contingent convertible debentures 2008Ð2022 $ Ñ Ñ $ 1,971 1.25%

Bank borrowings 2008 255 0.83270 0.31%

Commercial paper 2008 249 5.29190 4.67%

Current portion of capital lease obligations 2008 5 5.196 5.20%

Total Short-Term Borrowings $ 509 $ 2,437

Long-Term Debt:

Contingent convertible debentures 2008Ð2022 $ 94 1.25$ Ñ Ñ

2011 senior convertible notes 2011 2,200 1.502,200 1.50%

2010 senior notes 2011 400 4.38400 4.38%

2013 senior convertible notes 2013 2,200 1.632,200 1.63%

2015 senior notes 2016 600 4.75600 4.75%

Other 2008Ð2013 84 5.3886 5.38%

Total Long-Te rm Debt $ 5,578 $ 5,486

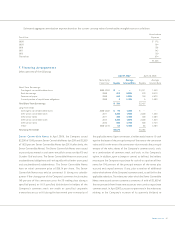

HZc^dg 8dckZgi^WaZCdiZh >c 6eg^a '%%+! i]Z 8dbeVcn ^hhjZY

'!'%%d[&#*%%eZgXZciHZc^dg8dckZgi^WaZCdiZhYjZ'%&&VcY'!'%%

d[&#+'*eZgXZciHZc^dg8dckZgi^WaZCdiZhYjZ'%&(XdaaZXi^kZan!i]Z

HZc^dg8dckZgi^WaZCdiZh#I]ZHZc^dg8dckZgi^WaZCdiZhlZgZ^hhjZY

VieVgVcYeVn^ciZgZhi^cXVh]hZb^"VccjVaan^cVggZVghdc6eg^a&*VcY

DXidWZg&*d[ZVX]nZVg#I]ZHZc^dg8dckZgi^WaZCdiZhVgZjchZXjgZY

jchjWdgY^cViZYdWa^\Vi^dchVcYgVc`ZfjVaanl^i]Vaadi]ZgjchZXjgZY

VcYjchjWdgY^cViZY^cYZWiZYcZhh#I]ZHZc^dg8dckZgi^WaZCdiZh

]VkZ Vc ^c^i^Va XdckZgh^dc eg^XZ d[ *+#&) eZg h]VgZ# I]Z HZc^dg

8dckZgi^WaZCdiZhbVndcan WZXdckZgiZY/ ^Yjg^c\ VcnXVaZcYVg

fjVgiZg^[i]ZXadh^c\eg^XZd[i]Z8dbeVcnÉhXdbbdchidX`gZVX]Zh

&)% eZgXZcid[i]ZXdckZgh^dc eg^XZ[dg'% igVY^c\ YVnhYjg^c\V

heZX^[^ZYeZg^dY!dg^^^[heZX^[^ZYY^hig^Wji^dchid]daYZghd[i]Z

8dbeVcnÉhXdbbdchidX`VgZbVYZdgheZX^[^ZYXdgedgViZ

igVchVXi^dchdXXjg!dg^^^Yjg^c\i]ZaVhibdci]eg^dgidbVijg^ind[

i]ZVeea^XVWaZcdiZh#JedcXdckZgh^dc!V]daYZgldjaYgZXZ^kZ/^XVh]

ZfjVaidi]ZaZhhZgd[i]Zeg^cX^eVaVbdjcid[i]ZcdiZdgi]ZXdckZgh^dc

kVajZVcY^^idi]ZZmiZcii]ZXdckZgh^dckVajZZmXZZYhi]Zeg^cX^eVa

Vbdjcid[i]ZcdiZ!h]VgZhd[i]Z8dbeVcnÉhXdbbdchidX`!XVh]!

dgVXdbW^cVi^dcd[XdbbdchidX`VcYXVh]!Vii]Z8dbeVcnÉh

dei^dc#>cVYY^i^dc!jedcVX]Vc\Z^cXdcigda!VhYZ[^cZY!i]Z]daYZgh

bVngZfj^gZi]Z8dbeVcnidejgX]VhZ[dgXVh]VaadgVedgi^dcd[i]Z^g

cdiZh[dg&%%eZgXZcid[i]Zeg^cX^eVaVbdjcid[i]ZcdiZheajh

VXXgjZYVcYjceV^Y ^ciZgZhi!^[Vcn! eajh V cjbWZgd[VYY^i^dcVa

bV`Z"l]daZh]VgZhd[i]Z8dbeVcnÉhXdbbdchidX`!VhhZi[dgi]^ci]Z

Veea^XVWaZ^cYZcijgZ#I]Z^cYZcijgZhjcYZgl]^X]i]ZHZc^dg8dckZgi^WaZ

CdiZhlZgZ^hhjZYXdciV^cXjhidbVgnXdkZcVcih#6idiVad['!*%%d[

i]ZcZiegdXZZYh[gdbi]ZhZcdiZ^hhjVcXZhlZgZjhZYidgZejgX]VhZ

XdbbdchidX`#>c6eg^a'%%,!ejghjVciidegdk^h^dch^ci]Z^cYZcijgZh

gZaVi^c\ id i]Z 8dbeVcnÉh ^cXgZVhZ d[ ^ih fjVgiZgan Y^k^YZcY id

BZYigdc^X!>cX#+,