McKesson 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 McKesson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

McKESSON CORPORATION

12

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters, Issuer Purchases of

Equity Securities and Stock Price Performance Graph

(a) Market Information: The principal market on which the Company’s common stock is traded is the New York

Stock Exchange (“NYSE”). High and low prices for the common stock by quarter are included in Financial

Note 23, “Quarterly Financial Information (Unaudited),” to the consolidated financial statements appearing in

this Annual Report on Form 10-K.

(b) Holders: The number of record holders of the Company’s common stock at March 31, 2009 was approximately

9,200.

(c) Dividends: Dividend information is included in Financial Note 23, “Quarterly Financial Information

(Unaudited),” to the consolidated financial statements appearing in this Annual Report on Form 10-K.

In April 2008, the Company’s Board of Directors (“Board”) approved a change in the Company’s dividend

policy by increasing the amount of the Company’s quarterly dividend from six cents to twelve cents per share,

applicable to ensuing quarterly dividend declarations until further action by the Board. The Company

anticipates that it will continue to pay quarterly cash dividends in the future. However, the payment and amount

of future dividends remain within the discretion of the Board and will depend upon the Company’s future

earnings, financial condition, capital requirements and other factors.

(d) Securities Authorized for Issuance under Equity Compensation Plans: Information relating to this item is

provided under Part III, Item 12, to this Annual Report on Form 10-K.

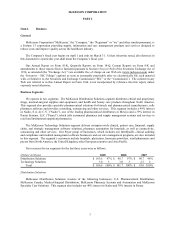

(e) Share Repurchase Plans: The following table provides information on the Company’s share repurchases during

the fourth quarter of 2009:

Share Repurchases (1)

(In millions, except price per share)

Total

Number of Shares

Purchased (2) (3)

Average Price Paid

Per Share

Total Number of

Shares Purchased

As Part of Publicly

Announced

Program

Approximate

Dollar Value of

Shares that May

Yet Be Purchased

Under the

Programs

January 1, 2009 – January 31, 2009 - $ - - $ 980

February 1, 2009 – February 28, 2009 1 44.66 1 944

March 1, 2009 – March 31, 2009 3 39.25 3 830

Total 4 40.41 4 830

(1) This table does not include shares tendered to satisfy the exercise price in connection with cashless exercises of employee

stock options or shares tendered to satisfy tax withholding obligations in connection with employee equity awards.

(2) All of the shares purchases were part of the publicly announced programs.

(3) The number of shares purchased reflects rounding adjustments.

In April 2008, the Board approved a plan to repurchase $1.0 billion of the Company’s common stock of which

$830 million remained available as of March 31, 2009. Stock repurchases may be made from time to time in open

market or private transactions.

In July 2008, the Board authorized the retirement of shares of the Company’s common stock that may be

repurchased from time to time pursuant to its stock repurchase program. During the second quarter of 2009, we

repurchased 4 million shares for $204 million and all of these shares were formally retired by the Company. The

retired shares constitute authorized but unissued shares.