Macy's 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DEAR FELLOW SHAREHOLDER:

While our company again produced strong financial results in fiscal 2004,

perhaps our most remarkable achievement was the significant positive

change we have initiated to fortify the very foundations of our business for

the long run.

• We made the landmark decision to convert our regional store

nameplates to the Macy’s brand. As of March 6, 2005, all of our stores,

catalogs and e-commerce sites operate as either Bloomingdale’s or

Macy’s. This allows us to focus on the two strongest brands in American

department store retailing – both deeply rooted in fashion, service and

community involvement – and to drive sales and profitability by serving

a well-defined core customer with a unified message. Our five regionally

based Macy’s divisions ensure our decision-making stays close to the

customer and that our stores and assortments reflect local tastes

and preferences.

• We drove significant progress in each of the four strategic priorities

that guide our business decisions. The four priorities – Assortments,

Price Simplification, Improving the Shopping Experience and Marketing

– are described below. They have helped sharpen our discipline and

creativity, while providing Macy’s a well-defined roadmap for continuous

improvement in the most crucial aspects of daily operations.

• We launched Macy’s Home Store as a consolidated central organization

for merchandising and marketing home-related merchandise for all

Macy’s stores nationwide. Going forward, this best-in-class organization

will provide our core customer with a fashion-driven home assortment

that is uniquely Macy’s.

• In February 2005, we entered into an agreement to acquire The May

Department Stores Company. The acquisition would create a stronger,

more resourceful company with more than 950 department stores

operating in 64 of the nation’s top 65 markets. Pending regulatory

review and shareholder approval, the transaction is expected to be

completed in the third quarter this year. Meanwhile, we are working

to finalize plans for the combined company.

DIFFERENTIATED AND EDITED ASSORTMENTS

Recognizing that great product assortments and brands in our stores

create customer excitement and build loyalty among shoppers, we are

implementing programs to ensure our assortments are fresh, new and

fashion-right so Macy’s is differentiated in the marketplace. Concurrently,

we are pursuing a good-better-best merchandising strategy that aligns

our assortments with our core customer’s expectation for price

and quality. And we are more tightly editing assortments to

reduce duplication and clutter on the selling floor.

The company’s private brands continue to grow at

a faster pace than overall sales trends, providing

differentiation and value to customers. In 2004,

Federated’s private brands – such as I·N·C, Charter Club/

Clubroom, Alfani, Style & Co., Hotel Collection and

Tools of the Trade – represented about 17.4 percent

of total sales toward our ultimate goal of 20 percent.

LETTER TO

SHAREHOLDERS

POSITIVE CHANGE

CREATES BENEFITS

FOR CUSTOMERS AND

SHAREHOLDERS.

P A G E T W O

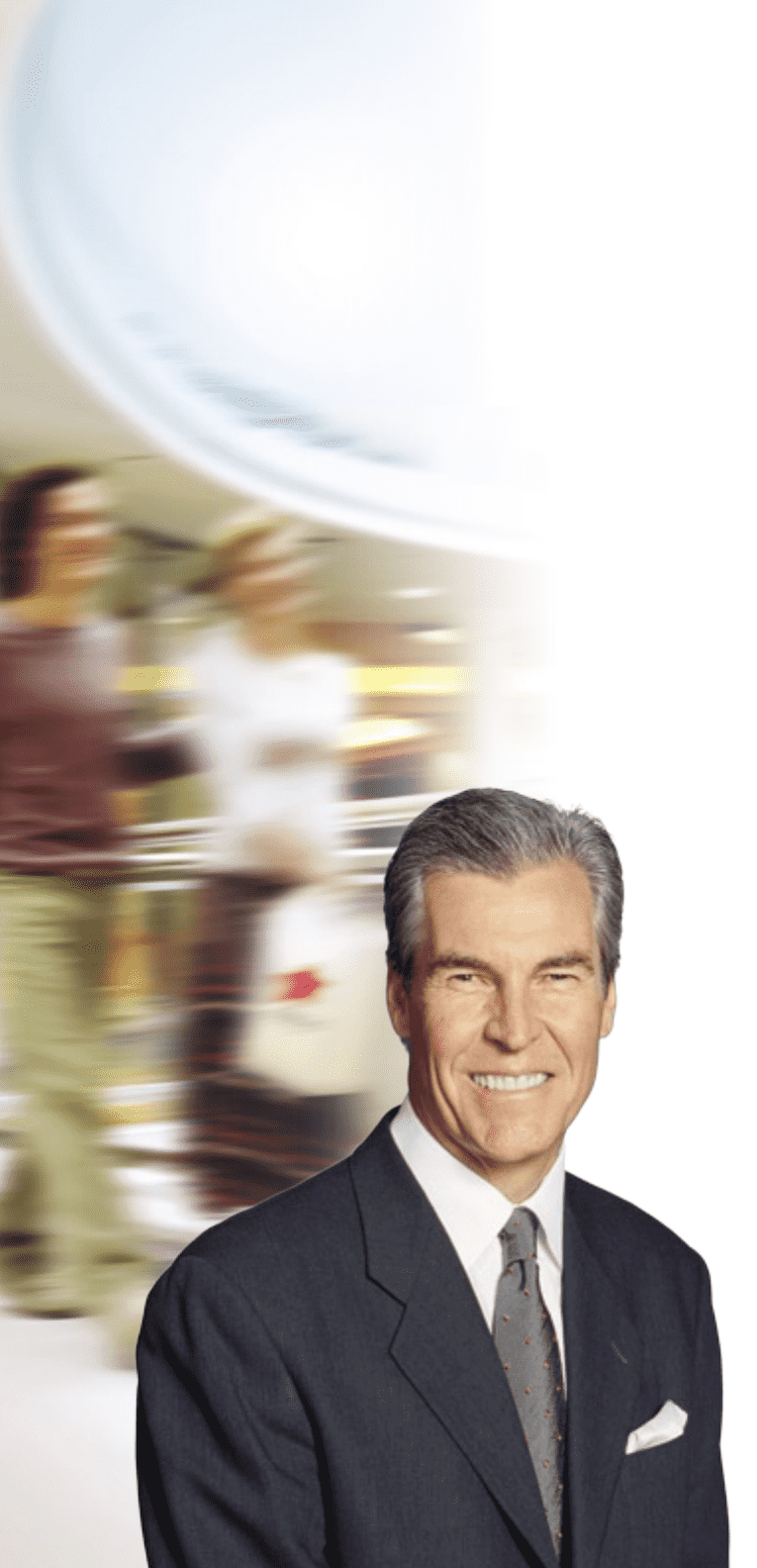

TERRY J. LUNDGREN

CHAIRMAN, PRESIDENT &

CHIEF EXECUTIVE OFFICER