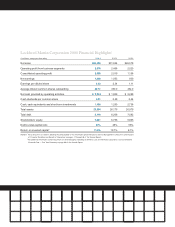

Lockheed Martin 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 Lockheed Martin annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dear Fellow Shareholders,

With pride, I am able to report to you the remarkable accomplishments of the 130,000 men and women of Lockheed

Martin over the past year. In extending the fundamentally sound strategy of disciplined growth, this management

team has aligned our core strengths with specifi cally targeted markets. This approach to managing our business has

resulted in solid sales growth, improved profi tability and consistent cash generation.

Lockheed Martin is an extraordinarily innovative enterprise with all the qualities of a premier advanced technology

leader, and we will continue to drive this competitive distinction in the years ahead.

For 2004, we established and met ambitious goals; it was our fourth consecutive year of operating margin

improvement. We increased sales to a record $35.5 billion, a 12 percent increase over 2003, and we can report a

backlog of $74 billion. In 2004, Lockheed Martin also generated a record $2.9 billion in operating cash. Effective

cash deployment remains a priority. Since January 2000, we have reduced our debt from $12 billion to $5 billion,

adding to fi nancial fl exibility and strength.

In 2004, we repurchased 14.7 million shares of our common stock, and we have repurchased 26.4 million

shares since late 2002. We also delivered on our commitment to shareholders in 2004 by increasing the

dividend by 14 percent. We view dividends as an important component of shareholder value, and will review

the dividend annually.

Although fi nancial results for the year have well met our expectations, we are far from complacent. In fact,

during 2004, we continued using Return on Invested Capital (ROIC) as one of our key metrics for measuring

fi nancial performance, showing an improvement to 11.9 percent. In 2005, the ROIC performance metric will be

a signifi cant part of the evaluation measures for executive incentive compensation.

Our industry and customers’ environments are constantly changing. We face challenges in 2005 and the years

ahead as defense budgets are adjusted and spending priorities are reconsidered. We are determined to stay ahead of

those changes by continued focus on the performance excellence and technology leadership our customers deserve

and expect.

Over the past year, we have talked about our adherence to an operating principle we call Horizontal Integration —

the practice of making Lockheed Martin truly one company and one team with a unifi ed vision supported by coherent

and aligned business processes. Horizontal Integration means reaching across the breadth of this Corporation to

develop the very best forward-looking solutions for our customers’ needs. In 2004, we applied the experience and

leadership we have resident throughout this Corporation to deliver truly transformational technologies.

From left to right: Christopher E. Kubasik,

Executive Vice President and Chief

Financial Offi cer; Maryanne R. Lavan,

Vice President, Ethics and Business

Conduct; Arthur E. Johnson, Senior

Vice President, Strategic Development.

From left to right: Linda R. Gooden, President,

Lockheed Martin Information Technology;

Michael F. Camardo, Executive Vice President,

Information & Technology Services.

2 – 3