Lockheed Martin 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Lockheed Martin annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOCKHEED MARTIN CORPORATION

ANNUAL REPORT 2004

Table of contents

-

Page 1

LOCKHEED MARTIN CORPORATION ANNUAL REPORT 2004 -

Page 2

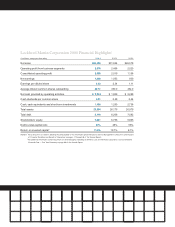

...Earnings per diluted share Average diluted common shares outstanding Net cash provided by operating activities Cash dividends per common share Cash, cash equivalents and short-term investments Total assets Total debt Stockholders' equity Debt-to-total-capital ratio Return on invested capital2 1 $35... -

Page 3

...ï¬cant programs to advance freedom and promote progress for people worldwide. Contents: 2. Letter to Shareholders 6. Narrative Section 16. Financial Section of the 2004 Annual Report 71. Corporate Directory 73. General Information On the Cover: In January 2005, a team led by Lockheed Martin was... -

Page 4

... with speciï¬cally targeted markets. This approach to managing our business has resulted in solid sales growth, improved proï¬tability and consistent cash generation. Lockheed Martin is an extraordinarily innovative enterprise with all the qualities of a premier advanced technology leader, and we... -

Page 5

... the advanced technology solutions of the future. Participants at the Center and at any point in our Global Vision Network will have simultaneous access to data, simulations and rich analytical tools and processes as they work together. The Lockheed Martin Center for Innovation is indicative... -

Page 6

... seven-year contract to provide information technology support to the Social Security Administration, continuing a long-term partnership to help the agency meet its challenges for the future Leadership of a team to provide managed network services - including video, data, voice and wireless - across... -

Page 7

... right: Jim Thomas, Vice President, Operations & Supply Chain Management; Carol Hulgus, Vice President of Programs, Lockheed Martin Maritime Systems & Sensors; Robert B. Coutts, Executive Vice President, Electronic Systems. In a successful company such as ours, every employee shares a vision of how... -

Page 8

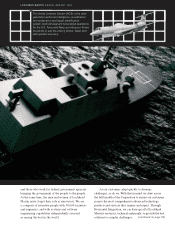

6-7 Lockheed Martin applies inventive technologies to programs across our markets. This is evident in the Littoral Combat Ship (LCS), which will be a key element in the U.S. Navy's Seapower 21 transformational vision. We are partners with our customers sharing a uniï¬ed vision: to deliver the ... -

Page 9

..., we draw across the full breadth of the Corporation to ensure our customers receive the most comprehensive advanced technology products and services they require and expect. Through Horizontal Integration, we can leverage all of Lockheed Martin's resources, technical and people, to provide the best... -

Page 10

8-9 â-² Lockheed Martin's breadth of experience in robotic systems is leading to new and exciting uses of this technology such as robotic manufacturing on the F-35 Joint Strike Fighter. The Warï¬ghter Information Network-Tactical (WIN-T) is the backbone of high-speed voice, data and video ... -

Page 11

LOCKHEED MARTIN ANNUAL REPORT 2004 The U.S. Air Force's 21st century air dominance ï¬ghter, the F/A-22, is unmatched in its combination of stealth, onboard computing, avionics and performance - technologies developed across Lockheed Martin and integrated to create a truly transformational combat ... -

Page 12

..., more mobile force. Lockheed Martin is truly one company, one team with a singular focus - to turn data into knowledge and knowledge into action. Horizontal Integration becomes particularly critical as the U.S. Department of Defense rapidly embraces netenabled operations. Lockheed Martin is at the... -

Page 13

... simultaneous voice, data and video in real time. Lockheed Martin leverages automation, optical scanning technology, systems integration and computing/software innovations resident throughout the Corporation to serve the U.S. Postal Service's Automated Package Processing System. ï¬,exible systems... -

Page 14

..., is an example of the kinds of global partnerships that distinguish Lockheed Martin in the government and commercial marketplace. Aerostats represent an innovative technology that can be applied to a variety of missions: missile defense, homeland security, border protection, and other unmanned... -

Page 15

...ANNUAL REPORT 2004 â-² Net-enabled solutions are vital to protecting the homeland. Lockheed Martin leads an industry team to recapitalize the U.S. Coast Guard with aircraft and ships, as well as communications, logistics, and command and control. We are leading a team to design and install a range... -

Page 16

... community projects. Also in 2004, Lockheed Martin and its employees contributed more than $600,000 to Operation USO Care Package in support of troops serving in Iraq, Afghanistan and worldwide. underscored our commitment to the international space launch market with our Atlas and Proton family of... -

Page 17

... assistance wherever it is needed in response to natural disasters and other emergencies. The C-130J conducting a relief mission (left) is the most advanced of the Hercules airlifters. others, demonstrates Lockheed Martin's leadership as a systems integrator. As a corporate citizen, Lockheed Martin... -

Page 18

... SECTION Lockheed Martin Corporation - 2004 Annual Report 2004 Financial Highlights - Inside Front Cover Management's Discussion and Analysis of Financial Condition and Results of Operations, including Financial Section Roadmap - 17 Management's Report on Financial Statements and Internal Control... -

Page 19

... Lockheed Martin's Business Lockheed Martin Corporation principally researches, designs, develops, manufactures, integrates, operates and sustains advanced technology systems, products and services. We mainly serve customers in domestic and international defense, civil markets, and homeland security... -

Page 20

...: Topic Critical accounting policies: Contract accounting/ revenue recognition Post-retirement benefit plans Environmental matters Discussion of business segments Liquidity and cash flows Capital structure and resources Legal proceedings, commitments and contingencies Stock-based compensation Page... -

Page 21

... the U.S. Social Security Administration, the Environmental Protection Agency, and the DoD. We provide program management, business strategy and consulting, complex systems development and maintenance, complete life-cycle software support, information assurance and enterprise solutions. Consistent... -

Page 22

.... Commercial Atlas and Proton launch services are marketed around the world through International Launch Services (ILS), a joint venture between Lockheed Martin and LKEI. We consolidate the results of operations of LKEI and ILS into our financial statements based on our controlling financial... -

Page 23

.... As a result, setbacks, delays, cost growth and product failures can occur. We provide products and services to government agencies such as the Departments of Energy, Homeland Security, Justice, and Health and Human Services, the U.S. Postal Service, the Social Security Administration, the Federal... -

Page 24

... ACCOUNTING POLICIES Contract Accounting / Revenue Recognition A large part of our business is derived from long-term contracts for development, production and service activities which we account for consistent with the American Institute of Certified Public Accountants' (AICPA) audit and accounting... -

Page 25

...compliance with regulatory standards by our personnel, and are subject to audit by the Defense Contract Audit Agency. Post-Retirement Benefit Plans Most employees are covered by defined benefit pension plans (pension plans), and we provide health care and life insurance benefits to eligible retirees... -

Page 26

Lockheed Martin Corporation MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS December 31, 2004 We account for our pension plans using Statement of Financial Accounting Standards (FAS) 87, Employers' Accounting for Pensions. Those rules require that the amounts ... -

Page 27

... the final regulations related to the Act, we calculated a reduction in our retiree healthcare benefit obligation of $295 million at December 31, 2004. The impact on net earnings of the reduction in the net periodic post-retirement benefits cost for 2005, after application of government contracting... -

Page 28

Lockheed Martin Corporation MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS December 31, 2004 that are probable of future recovery in pricing of our products and services for U.S. Government businesses. The amount that is expected to be allocated to our ... -

Page 29

... in our income tax expense primarily resulting from the closure of an Internal Revenue Service (IRS) examination reduced our 2004 tax rate. A $90 million tax benefit related to settlement of a research and development tax credit claim reduced our tax rate for 2002. Tax benefits related to export... -

Page 30

... profit," the reconciling item "Net unallocated Corporate expense" includes the FAS/CAS pension adjustment (see discussion below), earnings and losses from equity investments, interest income, costs for certain stock-based compensation programs, the effects of items not considered part of management... -

Page 31

Lockheed Martin Corporation This table shows net sales and operating profit of the business segments and reconciles to the consolidated total. (In millions) 2004 2003 2002 NET SALES Aeronautics $11,781 Electronic Systems 9,724 6,357 Space Systems 3,850 Integrated Systems & Solutions Information & ... -

Page 32

Lockheed Martin Corporation MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS December 31, 2004 Operating profit for the segment increased by 30% in 2004 compared to 2003. Combat Aircraft operating profit increased $95 million primarily as a result of higher ... -

Page 33

... as compared to 2003. Launch Services' operating profit increased $65 million. This increase was primarily due to U.S. Government support of the Atlas program and the benefit resulting from the first quarter termination of a launch vehicle contract by a commercial customer, offset by a decline in... -

Page 34

...operating profit increase was mainly due to the higher volume in Information Technology and improved performance across all lines of business. The I&TS segment includes a business unit that provides services to the government of Argentina. At December 31, 2004, we had net investments in and advances... -

Page 35

... payment or advance payment terms in our contracts, inventory management, and billing and collection activities. We continue to leverage the billing and collection processes of our Shared Services centers, including the emphasis on electronic interfaces with our U.S. Government customers. Cash from... -

Page 36

... used $1.1 billion of cash for the early retirement and scheduled repayment of long-term debt. We used $163 million of cash for costs associated with the early retirement of $951 million of debt through our tender offers. In 2003, we issued $1.0 billion of floating rate convertible senior debentures... -

Page 37

... provides investors with greater visibility into how effectively Lockheed Martin uses the capital invested in its operations. We use ROIC to evaluate multi-year investment decisions and as a long-term performance measure. We also plan to use ROIC as a factor in evaluating management performance for... -

Page 38

Lockheed Martin Corporation MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS December 31, 2004 Cash and cash equivalents, short-term investments, cash flow from operations and other available financing resources, are expected to be sufficient to meet ... -

Page 39

... federal subsidy to eligible sponsors of retiree health care benefits provided under this law. Using this guidance, the Corporation calculated a reduction in its accumulated post-retirement benefit obligation at December 31, 2004 of $295 million from the effects of the new law and, after application... -

Page 40

Lockheed Martin Corporation MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS December 31, 2004 safeguarded and transactions are properly executed and recorded. Our disclosure controls and procedures are also designed to ensure that information is accumulated ... -

Page 41

Lockheed Martin Corporation MANAGEMENT'S REPORT ON FINANCIAL STATEMENTS AND INTERNAL CONTROL OVER FINANCIAL REPORTING The management of Lockheed Martin is responsible for the consolidated financial statements and all related financial information contained in this Annual Report. The consolidated ... -

Page 42

... with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of Lockheed Martin Corporation as of December 31, 2004 and 2003, and the related consolidated statements of earnings, stockholders' equity, and cash flows for each of the three... -

Page 43

...FINANCIAL STATEMENTS Board of Directors and Stockholders Lockheed Martin Corporation We have audited the accompanying consolidated balance sheet of Lockheed Martin Corporation as of December 31, 2004 and 2003, and the related consolidated statements of earnings, stockholders' equity, and cash flows... -

Page 44

Lockheed Martin Corporation CONSOLIDATED STATEMENT OF EARNINGS Year ended December 31, (In millions, except per share data) NET SALES 2004 $35,... 500 Cost of sales Other income and expenses, net Operating profit Interest expense Earnings from continuing operations before taxes Income tax expense ... -

Page 45

Lockheed Martin Corporation CONSOLIDATED BALANCE SHEET (In millions) ASSETS December 31, 2004 2003 Current assets: Cash and cash equivalents Short-term investments Receivables Inventories Deferred income taxes Other current assets Total current assets Property, plant and equipment, net ... -

Page 46

...of businesses / investments in affiliated companies Other Net cash used for investing activities FINANCING ACTIVITIES Repayments of long-term debt Issuances of long-term debt Long-term debt repayment and issuance costs Issuances of common stock Repurchases of common stock Common stock dividends Net... -

Page 47

Lockheed Martin Corporation CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY (In millions, except per share data) Additional Common Paid-In Stock Capital Retained Earnings Unearned Compensation Unearned ESOP Shares Accumulated Other Total Comprehensive Stockholders' (Loss) Income Equity ... -

Page 48

... and information systems. The Corporation mainly serves customers in domestic and international defense, civil markets and homeland security, with its principal customers being agencies of the U.S. Government. Basis of consolidation and classifications - The consolidated financial statements include... -

Page 49

Lockheed Martin Corporation Receivables - Receivables consist of amounts billed and currently due from customers, and unbilled costs and accrued profits primarily related to revenues on long-term contracts that have been recognized for accounting purposes but not yet billed to customers. As such ... -

Page 50

...related to government products and services. Except for certain arrangements described below, these costs are generally included as part of the general and administrative costs that are allocated among all contracts and programs in progress under U.S. Government contractual arrangements. Corporation... -

Page 51

... pricing of the Corporation's products and services. Included in other assets in the consolidated balance sheet at December 31, 2004 and 2003 is $95 million and $155 million, respectively, of deferred costs related to various consolidation actions. Impairment of certain long-lived assets - Generally... -

Page 52

... at the date of grant using the Black-Scholes option pricing model with the following weighted average assumptions: 2004 Risk-free interest rate Dividend yield Volatility factors related to expected price of Lockheed Martin stock Expected option life 3.19% 1.50% 0.365 5 years 2003 2.91% 1.00% 0.387... -

Page 53

... federal subsidy to eligible sponsors of retiree health care benefits provided under this law. Using this guidance, the Corporation calculated a reduction in its accumulated post-retirement benefit obligation at December 31, 2004 of $295 million from the effects of the new law and, after application... -

Page 54

Lockheed Martin Corporation NOTES TO CONSOLIDATED FINANCIAL STATEMENTS December 31, 2004 NOTE 4 - RECEIVABLES (In millions) 2004 2003 $1,421 2,351 (470) 335 448 (46) $4,039 U.S. Government: $1,529 Amounts billed Unbilled costs and accrued profits 2,394 Less customer advances and progress ... -

Page 55

Lockheed Martin Corporation NOTE 7 - INVESTMENTS IN EQUITY SECURITIES (In millions) 2004 $703 57 760 2003 $ 729 94 823 133 96 8 237 $1,060 Equity method investments (ownership interest): Intelsat, Ltd. (25%) Other In 2002, the Corporation recorded impairment charges relating to its ... -

Page 56

..., net of state income tax benefits, totaling $154 million in other income and expenses related to the tender offers. The charge reduced 2004 net earnings by $100 million ($0.22 per share). In the third quarter of 2003, the Corporation completed a tender offer to purchase for cash any and all of its... -

Page 57

... FAS 109, Accounting for Income Taxes, and FSP 109-1, Application of FAS 109 to the Tax Deduction on Qualified Production Activities Provided by the American Jobs Creation Act of 2004, the benefit provided by the new tax law constitutes a special deduction, and accordingly the Corporation was not... -

Page 58

... tax cash benefit of $34 million in 2004, $13 million in 2003 and $140 million in 2002 as a result of exercises of employee stock options. This benefit is recorded in stockholders' equity under the caption, "Stock awards and options, and ESOP activity." NOTE 11 - STOCKHOLDERS' EQUITY AND RELATED... -

Page 59

...Lockheed Martin 2003 Incentive Performance Award Plan (the Award Plan). Under the Award Plan, employees of the Corporation may be granted stock-based incentive awards, including options to purchase common stock, stock appreciation rights, restricted stock or stock units. The maximum number of shares... -

Page 60

... of which were funded in Lockheed Martin common stock. The Lockheed Martin Corporation Salaried Savings Plan is a defined contribution plan with a 401(k) feature that includes Approximately 26.4 million, 25.5 million and 19.6 million outstanding options were exercisable by employees at December 31... -

Page 61

... accounts. This ESOP trust held approximately 3.0 million issued and outstanding shares of common stock at December 31, 2004. Defined benefit pension plans, and retiree medical and life insurance plans - Most employees are covered by defined benefit pension plans, and certain health care and life... -

Page 62

Lockheed Martin Corporation NOTES TO CONSOLIDATED FINANCIAL STATEMENTS December 31, 2004 Defined Benefit Pension Plans (In millions) AMOUNTS RECOGNIZED IN THE CONSOLIDATED BALANCE SHEET: Retiree Medical and Life Insurance Plans Post-retirement Benefits Other Than Pensions, related to the ... -

Page 63

...2 100% Lockheed Martin Investment Management Company (LMIMCO), a wholly-owned subsidiary of the Corporation, has the fiduciary responsibility for making investment decisions related to the assets of the Corporation's defined benefit pension plans and retiree medical and life insurance plans. LMIMCO... -

Page 64

Lockheed Martin Corporation NOTES TO CONSOLIDATED FINANCIAL STATEMENTS December 31, 2004 The Corporation generally refers to U.S. Government Cost Accounting Standards (CAS) and Internal Revenue Code rules in determining funding requirements for its pension plans. In September and December 2004, ... -

Page 65

...ex rel John D. Tillson v. Lockheed Martin Energy Systems, Inc., et al. The Department alleges that the Corporation committed violations of the Resource Conservation and Recovery Act at the Paducah Gaseous Diffusion Plant by failing properly to handle, store, and transport hazardous waste and that it... -

Page 66

... contribution to site clean-up costs against other potentially responsible parties (PRPs), including the U.S. Government. 64 At Redlands, California, in response to administrative orders issued by the California Regional Water Quality Control Board, the Corporation is investigating the impact and... -

Page 67

... profit," the reconciling item "Net unallocated Corporate expense" includes the FAS/CAS pension adjustment (see discussion below), earnings and losses from equity investments, interest income, costs for stock-based compensation programs, the effects of items not considered part of management... -

Page 68

...-related, and other technology services to federal agencies and other customers. Major product lines include: information technology integration and management; enterprise solutions, application development, maintenance, and consulting for strategic programs for the DoD and civil government agencies... -

Page 69

Lockheed Martin Corporation (In millions) AMORTIZATION OF PURCHASED INTANGIBLES 2004 2003 2002 (In millions) CUSTOMER ADVANCES AND AMOUNTS IN EXCESS OF 2004 2003 2002 Aeronautics Electronic Systems Space Systems Integrated Systems & Solutions Information & Technology Services Total business... -

Page 70

...Net sales Operating profit Net earnings Earnings per share $7,059 505 250 0.55 $7,709 470 242 0.54 $8,078 428 217 0.48 $8,978 616 344 0.77 COMMERCIAL (b) Aeronautics Electronic Systems Space Systems Integrated Systems & Solutions Information & Technology Services Total business segments Other... -

Page 71

... Goodwill Purchased intangibles, net Other assets Total Current maturities of long-term debt Other current liabilities Long-term debt Other post-retirement benefit liabilities Other liabilities Stockholders' equity Total COMMON SHARES AT YEAR-END RETURN ON INVESTED CASH FLOW DATA CAPITAL(f) $ 8,953... -

Page 72

... provides investors with greater visibility into how effectively Lockheed Martin uses the capital invested in its operations. The Corporation uses ROIC to evaluate multi-year investment decisions and as a long-term performance measure, and also plans to use ROIC as a factor in evaluating management... -

Page 73

... Ford Motor Company Robert J. Stevens President and Chief Executive Officer Lockheed Martin Corporation James R. Ukropina Chief Executive Officer Directions, LLC (A Management and Consulting Firm) Douglas C. Yearley Chairman Emeritus Phelps Dodge Corporation COMMITTEES Audit and Ethics Committee Mr... -

Page 74

Lockheed Martin Corporation CORPORATE DIRECTORY (As of March 11, 2005) OFFICERS Kenneth Asbury Vice President James F. Berry Vice President Dennis R. Boxx Senior Vice President Charles T. Burbage Vice President Michael F. Camardo Executive Vice President Information & Technology Services Joseph R.... -

Page 75

... to purchase Lockheed Martin common stock, increase holdings and manage the investment. For more information about Lockheed Martin Direct Invest, contact our transfer agent, EquiServe Trust Company, N.A. at 1-877-498-8861, or to view plan materials online and enroll electronically, access Internet... -

Page 76

... may impact pension plan assumptions; charges from any future impairment reviews that may result in the recognition of losses and a reduction in the book value of investments, goodwill or other long-term assets; the future impact of legislation or changes in accounting or tax rules or pronouncements... -

Page 77

POWERED BY INNOVATION AND GUIDED BY INTEGRITY, LOCKHEED MARTIN APPLIES ITS VISION, ITS PURPOSE AND ITS VALUES TO CUSTOMER PRIORITIES Our Vision To be the world's best advanced technology systems integrator. Our Purpose To achieve Mission Success by attaining total customer satisfaction and meeting ... -

Page 78

Lockheed Martin Corporation 6801 Rockledge Drive Bethesda, MD 20817 www.lockheedmartin.com